CTN23 80.12 (-1.60)

CTZ23 78.50 (-1.78)

CTH24 78.64 (-1.63)

Zhengzhou WQU23 – 15,610 (-395)

Cotlook “A” Index – 94.45 (0.95) – 24th May

Daily volume – 52,297

AWP – 68.10

Open interest – 193,480

Certificated stock – 63

N23 / Z23 spread – (1.62)

Z23/H24 spread – (-0.14)

July Options Expiry – 9th June 2023

July 1st Notice Day – 26th June 2023

December Options Expiry – 10th November 2023

December 1st Notice Day – 24th November 2023

Introduction

– Over the course of the week so far July ’23 has given back all of the gains of last week and a little more, closing today at 80.12, down 160 pts for the day and 41 pts below the close of Friday May 12th when the mini-rally can be said to have begun. Whilst many will still look to July as the front month, Dec ’23 has, in fact, now overtaken it in open interest. Speculative money will always look to the contact with the highest open interest to place new positions and, in this regard, Dec ’23 could be considered the ‘true’ front month right now. Nevertheless, we must also recognise that there are still many market participants (and readers) with hedges and fixations in the July. A word of warning though, now the cross over has begun the July open interest is likely to dwindle fast so we would not advise dawdling over any remaining July positions!

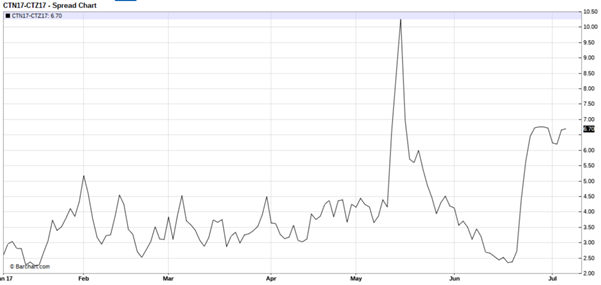

– Regular readers will be accustomed to our frequent comments on the volatility of the N/Z spread. The below charts of N/Z17 and N17 offer a good illustration of this phenomenon. A mid-May spike higher was followed by an abrupt sell off taking both the spread and the outright futures to lower levels, sound familiar?

– With the ongoing negotiations to lift the US debt ceiling seemingly no nearer a conclusion, Fitch have placed the US AAA credit rating on a negative watch, a precursor to a possible downgrade. By way of comparison, in 2011 S&P downgraded the US credit rating to AA plus which led directly to a stock market sell off.

– In India the debate over the true size of the crop (or the crop which will be delivered by the farmers!) continues. Over recent weeks arrivals have picked up whilst the yarn market has struggled, leaving ginners and local merchants with burdensome stocks. This is reflected in the offering prices which have dropped almost 10 cents on a fixed price basis in the last two weeks basis CIF FE.

– Texas has received good rains over recent weeks leading to many in the trade pondering prospects of a higher US crop than current predictions. As can be seen in the pictures below, the US drought monitor looks considerably better in Texas than it has for some time and the forecasts for the Texas cotton areas are to receive very good rains over the coming five days.

– Last week we commented on the CZCE / ICE spread and how it can be seen as an indicator of import demand from the country. It is worth revisiting this as, on the back of ICE’s retreat, the spread is back out at more elevated levels that may attract some import buying.

– The USDA export sales report for the week ending 18th May was expected to show the much talked about sales to China that didn’t show up in last week’s report. On this count, we were left pondering whether the sales actually took place (we believe they did), or why they do not appear to have been reported by the sellers?? Net sales were reported as 131,200 bales with China reporting 64,800 bales. Exports were continued solid at 268,700 bales, whilst new crop sales finally showed some sign of life with 84,300 bales reported.

– The CFTC cotton on call report based on positions as of 19th May consists of only the July contract for this crop year. The net on call sales position stands at 15,287 contracts as just short of 5,000 contracts of on call purchases were fixed over the last week, representing 31% of the total position.

– Looking at new crop, the net position is, had grown to 4,319 contracts, but given that this growth is traditional at this time of year, this remains the smallest ever position on record for this week of the season! In other words, any weakness in new crop futures will meet with very little fixation support!

– Copper, or Dr Copper as its known, has slipped below $7,900 per tonne (3-month LME cash price) reaching its lowest level in 6 months as a result of further short selling by the speculators. Copper is seen as a barometer for the health of the global economy and the short-term outlook has soured as recessionary risks in Europe and the U.S. intensify. A poor start to the Chinese recovery is also negatively impacting commodity demand.

Conclusion

N23 has been trading between 76.25 and 89.59, being a range of 13.34c/lb for over 7 months. Over the past ten days, the market has reached for the top end of the range and has been found wanting. Given the retreat, it would seem entirely plausible to now see a test of the lower end of this range and perhaps even the chart gap down to 74.85 There could still be some wild moves into expiry of the N23 contract within the aforementioned range and should be avoided if at all possible! New crop Z23 has been less volatile, trading between 74.25 and 86.98, being a 1273 point range over the same period. EAP suggest this contract is fully valued in the mid to high 80’s and maintain that end users should only consider a scale down long and/or “on call” fixations from the mid 70’s, to maybe into the 60’s at some point!

Useful links

*Please note that we only share CFTC CTO on weekend reports.

Written by:

Jo Earlam

Copyright statement

No image or information display on this site may be reproduced, transmitted or copied (other than for the purposes of fair dealing, as defined in the Copyright Act 1968) without the express written permission of Earlam & Partners Ltd. Contravention is an infrigement of Copyright Act and its amendments and may be subject to legal action.

Disclaimer

The risk of loss associated with futures and options trading can be substantial. Opinions set forth herein should not be viewed as an offer or solicitation to buy, sell or otherwise trade futures, options or securities. All opinions and information contained in this email constitute EAP’s judgment as of the date of this document and are subject to change without notice. EAP and their respective directors and employees may effect or have effected a transaction for their own account in the investments referred to in the material contained herein before or after the material is published to any customer of a Group Company or may give advice to customers which may differ from or be inconsistent with the information and opinions contained herein. While the information contained herein was obtained from sources believed to be reliable, no Group Company accepts any liability whatsoever for any loss arising from any inaccuracy herein or from any use of this document or its contents. This document may not be reproduced, distributed or published in electronic, paper or other form for any purpose without the prior written consent of EAP. This email has been prepared without regard to the specific investment objectives, financial situation and needs of any particular recipient. For the customers of EAP, this email is produced exclusively for our business and expert clients, it is not for general distribution and our services are not available to private clients. Past performance is not indicative of future results.