- Jo Earlam

- May 21, 2023

- 5:29 pm

- 10 min read

The 22/23 season is nearly over and focus shifts to new crop Z23

Let the sea set you free!

CTN23 86.72 (+0.06)

CTZ23 83.89 (+0.17)

CTH24 83.62 (+0.18)

Zhengzhou WQU23 – 15,865 (+60)

Cotlook “A” Index – 97.85 (+2.80) – From the 18th May 2023

Daily volume – 43,020

AWP – 68.10

Open interest – 184,988

Certificated stock – 63

N23/Z23 spread – (+283)

Z23/H24 spread – (+0.27)

H24/K24 – (+0.44)

K24/N24– (+0.60)

July Options Expiry – 9th June 2023

July 1st Notice Day – 26th June 2023

Introduction

– CTN23 was firm from the start of the week, trading in a wide 745 point range between 80.53 and 87.98, before closing up 619 points higher at 86.72. Futures volume was high averaging 46,658 contracts and options were also very busy at 12,276 contracts daily being nearly double the previous week, with calls and puts trading about equally!

– New crop Z23 was much less volatile trading in a 407 point range between 80.23 and 84.30 before closing the week up 374 points at 83.89. Open interest between N&Z is down to just 6,457 N over Z and we are over a week before the roll period even begins. The spread between N/Z23 has once again taken centre stage and is known to wily traders in the cotton business as the widow maker for those who get the wrong side of a N/Z spread trade!

– Weather is clearly an area of focus for everyone involved in the Cotton trade with rain in Texas the key to the outcome of the 2023 USA crop and the 23/24 season ahead! A link to the latest weather forecasts for this region is enclosed https://www.wpc.ncep.noaa.gov

– The CFTC COT report showed Managed Money (MM) to be buyers of 1,078 contracts in the week ending last Tuesday, when N23 closed at 83.30 c/lb. This takes MM net short to 12,764 contracts. Between MM, OR and NR their overall net position is 2,679 contracts net long. Price action post Tuesday would probably suggest MM have bought as much as 10k contracts and are probably now close to flat but will not know for sure until next Friday when the next COT report is published!

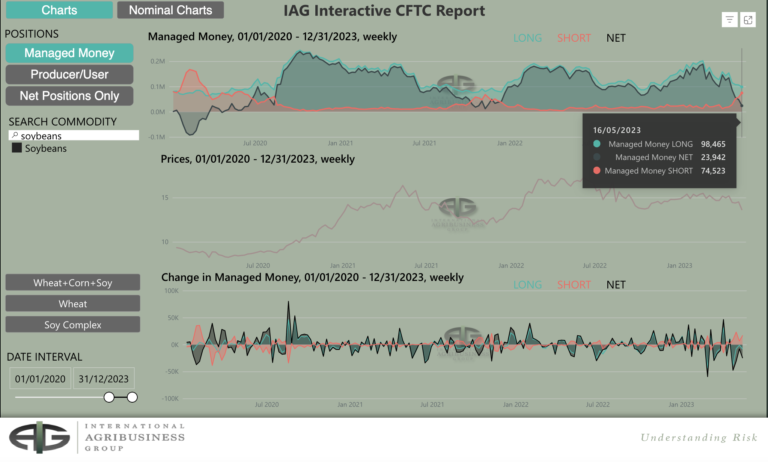

– The position of MM in Soy and Corn shows their position to be short Corn and slightly short Soy and thanks to our friends at IAG for pictorial evidence of the fact! We are of the opinion Commodities are somewhat out of favour as an asset class for funds and if true see them not taking off to the upside anytime soon!

– Brazilian FOB basis Dec 23 came off another 100 points over the past week to 300 ON. As you as can see in graph below, this is the lowest figure since January 2022.

– Brazilian domestic prices, on the other hand, seem to have bottomed, closing the day on 09/05/2023 at US$ 0.7486 cents/ lbs. On Friday the 12th and Monday the 15th, CEPEA prices had very strong movements, finishing the day up 1.93% and 2.40% up, consecutively. CEPEA closed last Friday at US$ 0.7968 cents/ lbs, up 3.44% on the week.

– Old crop N23 is increasingly dangerous in our opinion and a contract we prefer to avoid in preference of concentrating our efforts on new crop Z23.

– Whilst we may not have anticipated the ferocity of last week’s rise for N23 (or predicted it for that matter) we certainly made some right calls over the season just past.

– In our report of the 28th October when Z22 closed at just above 72c we stated the following.. “The big question for so many right now is when is the pain going to stop and to that end we have included a cotton continuation chart below showing prices from 1970 to the present day. Fibonacci levels are identified for this century alone which show the lowest and highest price prints of 28.20 and 227.00 and identifies the 70c/lb level as a major area of support! Catching the falling knife is not a recommended pastime and prices almost always overshoot to the downside and we expect this time to be no different. However, at some point you have to be ready to change the narrative and noting Cotton is very oversold right now the time is fast approaching to no longer be short”

– In the last EAP report of the 2022 calendar year we stated in our conclusion “We see prices in the mid to high 80’s as fully valued and our bearish stance is based on a lack of demand …… we would not want to be short Cotton long term under 70c/lb with a sideways market likely for the rest of the 22/23 season”.

– Looking at the chart of N23 below we believe nothing much has changed to alter any of the aforementioned statements made more than 6 and 4 months ago respectively, all of which we are pleased to report proved correct!

– New crop Z23 is where we feel the focus should now be noting the difference in open interest between the two contracts is down to just 7k contracts in favour of N23, based on Friday’s close! By the end of next week we fully expect Z23 to be the effective front month on account of holding the highest open interest and once again this is even before the Rogers and GSCI roll periods begin!

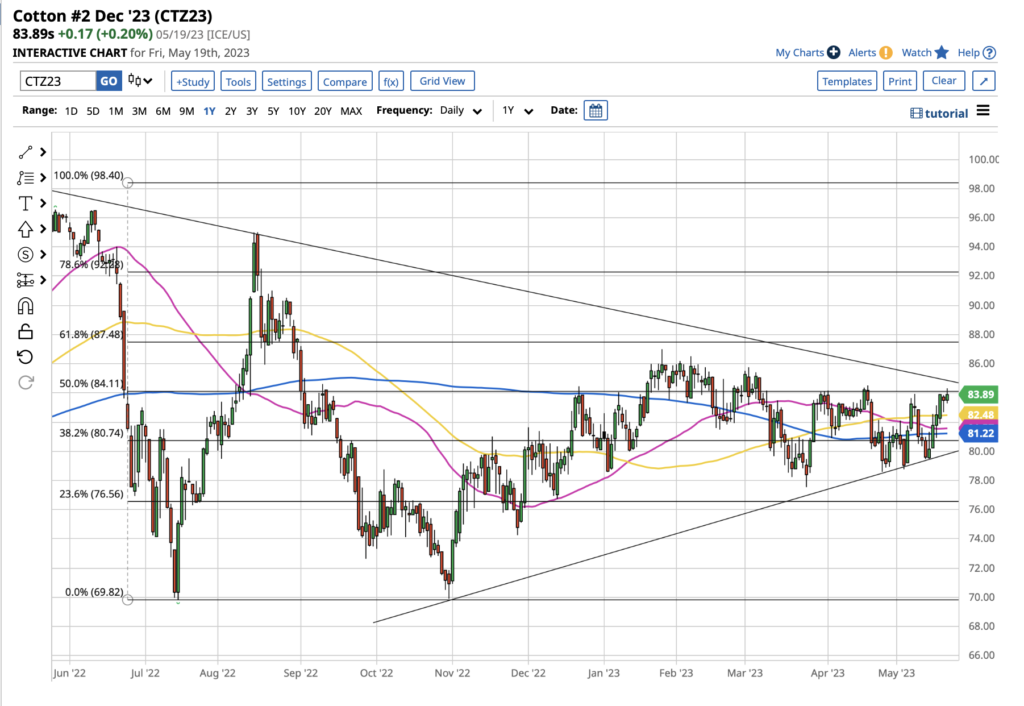

– Z23 is actually trading above its medium (50 day) and longer term (100 & 200 day) moving averages and to some could be deemed to be friendly; but in fairness Z23 has see-sawed above and below these for some time now!

– Looking at the chart of Z23 below it is clearly a sideways chart, trading in a contracting triangle that will at some point break out one way or the other. We believe that move will be to the downside.

– The 22/23 season was an inverse season where highs were seen early and lows later in the season. We are of the opinion such an occurrence could occur this coming season as well. An over supply of Cotton and carryover of outside growths from the previous season can provide a hangover for end users. Stocks of high priced physical Cotton and yarn will likely take time to be consumed, coupled with late and high basis arrivals to come, will likely weigh upon the market for many weeks and months ahead.

– The flat position of funds is a valid and counter argument to EAP’s less than friendly stance and must be watched carefully and we will also be keeping a watchful eye! The lack of forward coverage will also mean spot business will keep the market buoyant too, but overall we feel unprofitable stocks of physical Cotton and Yarn will eventually push the market to lows that few today think possible!

Conclusion

N23 has been trading between 76.25 and 89.59, being a range of 13.34c/lb for over 7 months and we now can’t rule out a test of this higher level before the end of May when the 22/23 season finishes. There could still be some wild moves into expiry of the N23 contract within the aforementioned range and should be avoided if at all possible! New crop Z23 has been less volatile, trading between 74.25 and 86.98, being a 1273 point range over the same period. EAP suggest this contract is fully valued in the mid to high 80’s and maintain that end users should only consider a scale down long and/or “on call” fixations from the mid 70’s, to maybe into the 60’s at some point!

Useful links

*Please note that we only share CFTC CTO on weekend reports.

Written by:

Jo Earlam

Copyright statement

No image or information display on this site may be reproduced, transmitted or copied (other than for the purposes of fair dealing, as defined in the Copyright Act 1968) without the express written permission of Earlam & Partners Ltd. Contravention is an infrigement of Copyright Act and its amendments and may be subject to legal action.

Disclaimer

The risk of loss associated with futures and options trading can be substantial. Opinions set forth herein should not be viewed as an offer or solicitation to buy, sell or otherwise trade futures, options or securities. All opinions and information contained in this email constitute EAP’s judgment as of the date of this document and are subject to change without notice. EAP and their respective directors and employees may effect or have effected a transaction for their own account in the investments referred to in the material contained herein before or after the material is published to any customer of a Group Company or may give advice to customers which may differ from or be inconsistent with the information and opinions contained herein. While the information contained herein was obtained from sources believed to be reliable, no Group Company accepts any liability whatsoever for any loss arising from any inaccuracy herein or from any use of this document or its contents. This document may not be reproduced, distributed or published in electronic, paper or other form for any purpose without the prior written consent of EAP. This email has been prepared without regard to the specific investment objectives, financial situation and needs of any particular recipient. For the customers of EAP, this email is produced exclusively for our business and expert clients, it is not for general distribution and our services are not available to private clients. Past performance is not indicative of future results.