- Jo Earlam

- May 28, 2023

- 9:00 pm

- 10 min read

Focus is weather, the roll from old to new crop and what the funds do next?

Look around for something that bothers you and see if you can fix it!

CTN23 83.35 (+3.23)

CTZ23 80.54 (+2.04)

CTH24 80.66 (+2.02)

Zhengzhou WQU23 – 15,865 (+60)

Cotlook “A” Index – 90.65 (-1.30)

Daily volume – 55,262

AWP – 69.08

Open interest – 193,258

Certificated stock – 63

N23/Z23 spread – (+281)

Z23/H24 spread – (-0.12)

H24/K24 – (-0.14)

K24/N24– (-0.05)

July Options Expiry – 9th June 2023

July 1st Notice Day – 26th June 2023

Introduction

– It was an extremely volatile week for July which traded in a 739 point range between 79.86 and 87.25, before closing the week down 337 points at 83.35, after traversing a massive 1229 points over 5 days! Volume was once again good at 44,753 contracts daily with new crop December open interest now about 10k over July, even before the start of the Roger’s roll starting on Tuesday, which lasts for 3 days.

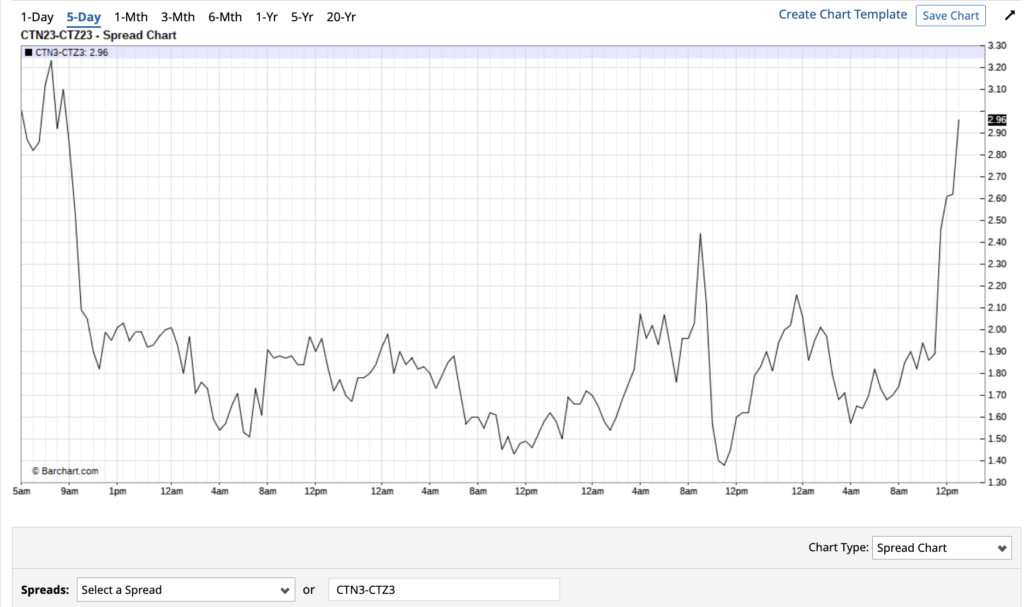

– Z23 was understandably and once again much less volatile, trading in a 555 point range between 78.45 and 84.00 before closing down 335 points at 80.54. The N/Z spread was frankly all over the place and highlighted in the 5 day chart of it detailed below.

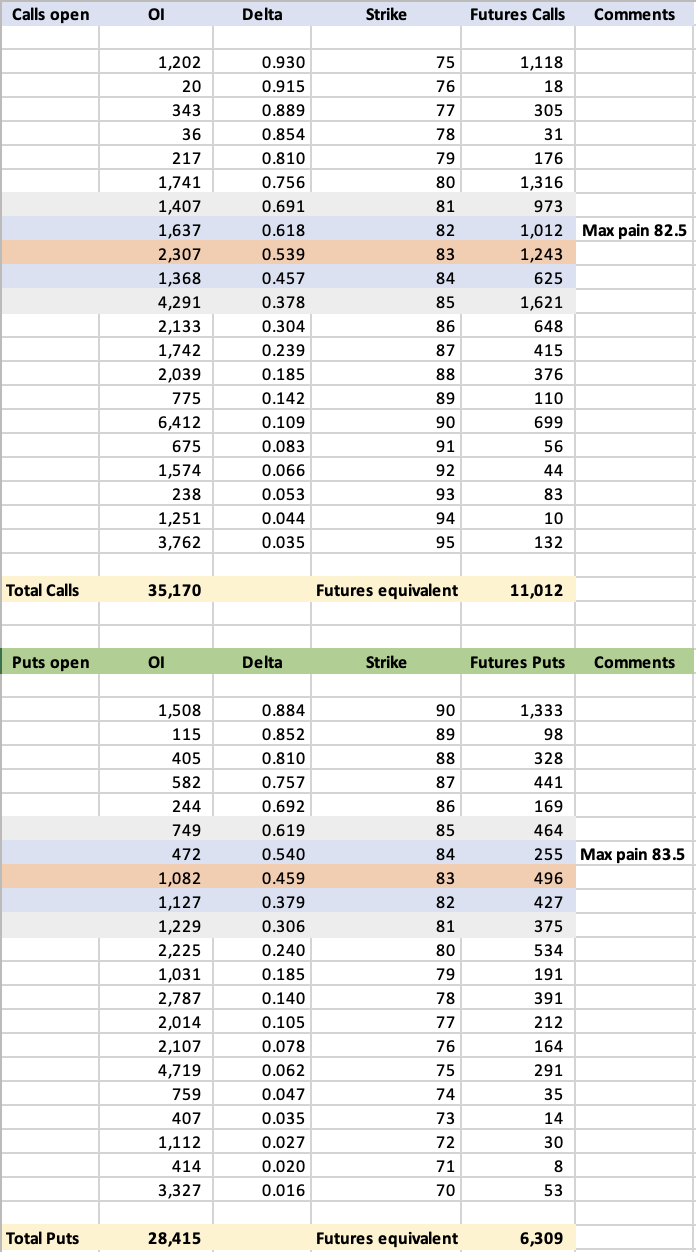

– There are just 9 business days until N23 option expiry, noting that Monday is a Bank holiday and Cotton will not be trading. We also repeat previous comments that the roll from old to new crop is one of the most dangerous and volatile times of the year and have shown “open interest” (read open bets) in both calls and puts to determine what might happen to N23 futures when N23 options expire a week on Friday!

– We have included the open interest from the 70 to 95c/lb strikes for both calls and puts. If prices were to move lower into N23 option expiry as EAP think may occur, those market makers who have to manage their exposure may be forced sellers of futures to manage their position and effectively keep delta neutral (i.e. not be exposed to the market). It certainly promises to be a very interesting old crop expiry!

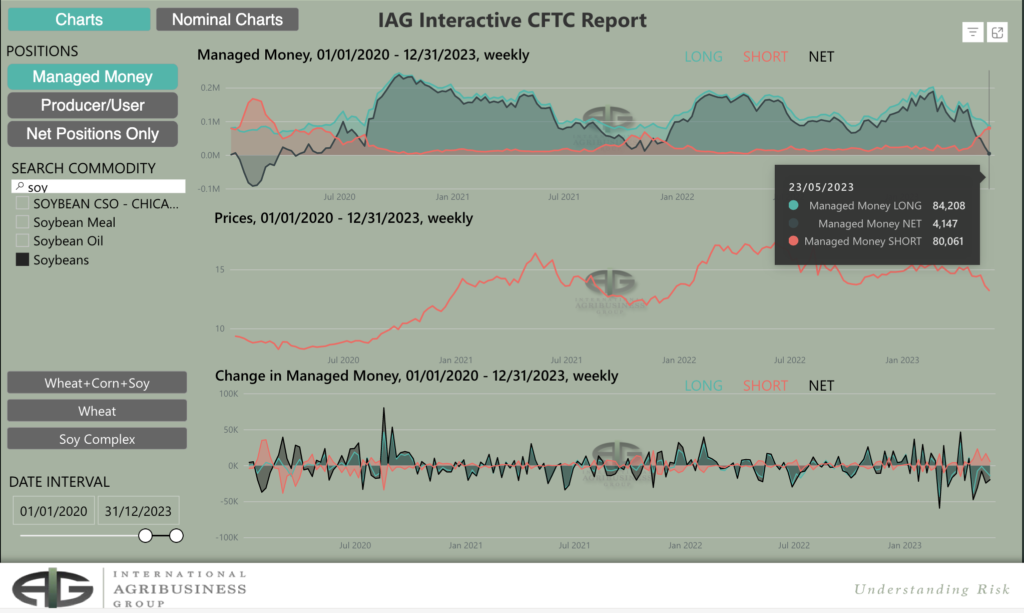

– The CFTC COT report showed Managed Money (MM) to be huge buyers in the week ending last Tuesday, when N23 closed at 84.35 c/lb. Speculators were the largest weekly buyers in nearly 2 years and bought a net 20,744 contracts taking their position to a net long of 7,980 contracts. Other and Non Reportables bought a net 432 and 3,019 each meaning between MM, OR and NR their overall net position is 26,884 contracts net long.

– MM Soy positions are totally flat and for Corn they are short as can be seen by the pictures below courtesy of our friends at IAG for which we are most thankful! The point being that funds are by and large out of positions in the softs and grains…Commodities are not in vogue!

– This is a huge turnaround in a week and looking closer at the report it is interesting to see MM short position in old crop N23 is radically different from the week before, where they were a net circa 19k short, versus about 8k net short as of Tuesday. Between MM, OR and NR their old crop net position is 2,553 net short!

– The Price action since Tuesday was volatile to say the least and we would guesstimate that funds are probably now net flat July (i.e. as of Friday close) but net long new crop Z23 and a figure more than they are reported as of last Tuesday.

– However, Z23 is a sideways chart and we cannot really fathom why they would want to be long Z23 Cotton in the face of continuing rains in Texas with whispers of a USA crop of 16.5 to 17m bales increasingly likely! This means that if prices head South then the long and subsequently losing funds getting out of these longs could exacerbate the move!

– A 17.0m bale new USA crop and overstated world demand by the USDA does not translate to a Z23 price in the 80’s in our opinion…it is statistically and fundamentally overvalued and funds are long! We remain very happy scale up sellers of this contract were the chance present itself in the weeks ahead!

– Old crop N23 has averaged a 619 point weekly range for the last 4 weeks so another range of similar magnitude should not be a surprise. We feel a sell the rallies approach will reward the brave, but maintain that N23 should be avoided if at all possible!

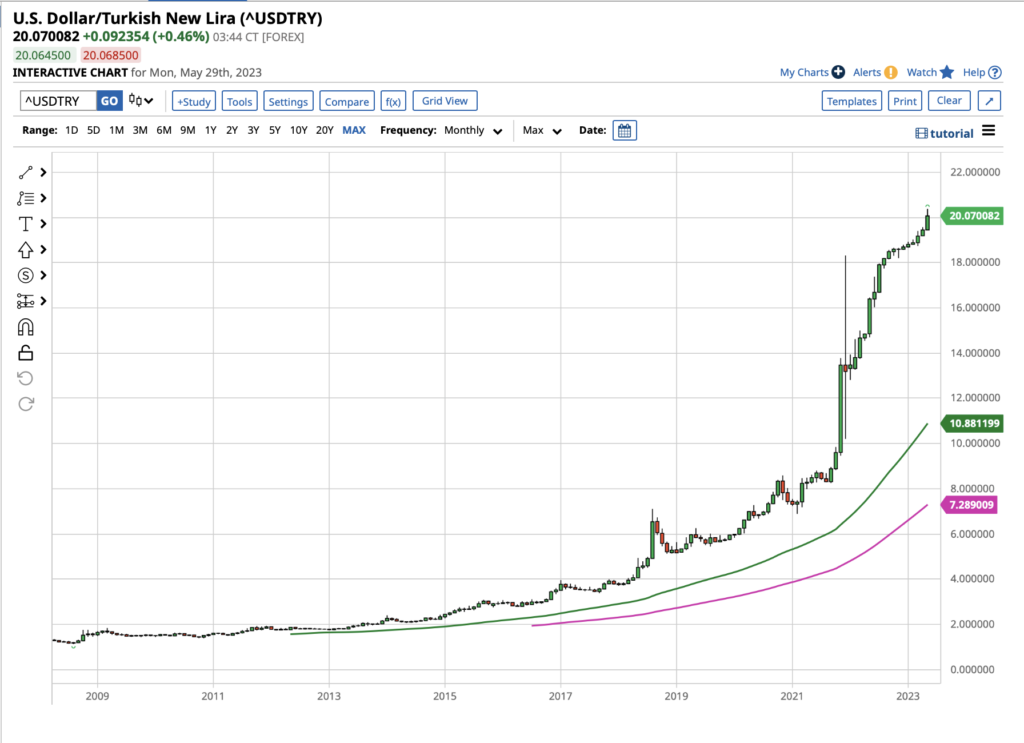

– Turkey announced over the weekend that president Erdogan has just won the latest election, meaning he will extend his 20 year management for another 5 years. The re-election comes in the teeth of a spiralling economy, rampant inflation and in the wake of a horrific natural disaster following seemingly rightful accusations his government was slow to respond!

– For Cotton, our close friend on the ground reports that the largest mill there has 6 months of physical Cotton stock, several months of unsold expensive yarn and their cotton factories are mostly not running. It is a similar situation for the rest of the Turkish mills!

– Following the disaster, 30-50% of mills are working but at very low capacity and workers are hard to find which in turn has meant wages have increased!

– With 400k mt of old crop available and an anticipated new crop of say 700-700k mt, word on the ground is consumption will be between 1.3 to 1.5m mt only and circa 30% less than last year!

– The re-election of Erdogan will not help a collapsing Lira which tells you all you need to know about the real situation in Turkey right now!

Conclusion

N23 has been trading between 76.25 and 89.59, being a range of 13.34c/lb for over 7 months. Over the past ten days, the market has reached for the top end of the range and has been found wanting. Given the retreat, it would seem entirely plausible to now see a test of the lower end of this range and perhaps even the chart gap down to 74.85. There could still be some wild moves into expiry of the N23 contract within the aforementioned range and should be avoided if at all possible! New crop Z23 has been less volatile, trading between 74.25 and 86.98, being a 1273 point range over the same period. EAP suggest this contract is fully valued in the mid to high 80’s and maintain that end users should only consider a scale down long and/or “on call” fixations from the mid 70’s, to maybe into the 60’s at some point!

Useful links

*Please note that we only share CFTC CTO on weekend reports.

Written by:

Jo Earlam

Copyright statement

No image or information display on this site may be reproduced, transmitted or copied (other than for the purposes of fair dealing, as defined in the Copyright Act 1968) without the express written permission of Earlam & Partners Ltd. Contravention is an infrigement of Copyright Act and its amendments and may be subject to legal action.

Disclaimer

The risk of loss associated with futures and options trading can be substantial. Opinions set forth herein should not be viewed as an offer or solicitation to buy, sell or otherwise trade futures, options or securities. All opinions and information contained in this email constitute EAP’s judgment as of the date of this document and are subject to change without notice. EAP and their respective directors and employees may effect or have effected a transaction for their own account in the investments referred to in the material contained herein before or after the material is published to any customer of a Group Company or may give advice to customers which may differ from or be inconsistent with the information and opinions contained herein. While the information contained herein was obtained from sources believed to be reliable, no Group Company accepts any liability whatsoever for any loss arising from any inaccuracy herein or from any use of this document or its contents. This document may not be reproduced, distributed or published in electronic, paper or other form for any purpose without the prior written consent of EAP. This email has been prepared without regard to the specific investment objectives, financial situation and needs of any particular recipient. For the customers of EAP, this email is produced exclusively for our business and expert clients, it is not for general distribution and our services are not available to private clients. Past performance is not indicative of future results.