CTZ21 90.68 (+0.37)

CTH22 90.39 (+0.38)

CTK22 89.79 (+0.35)

CTN22 88.61 (+0.32)

Zhengzhou CF109– 17,185 (+5)

Cotlook “A” Index – 98.40 (+0.25) – 4th August

Daily volume – 17,967

AWP – 78.47

Open interest – 249477

Certificated stock – 91,059

Dec/March spread – (+0.29)

September Options Expiry – 20th August 2021

December Options Expiry – 12th November 2021

December 1st Notice Day – 23rd November 2021

Introduction

– Yesterday, at EAP were very much inspired by Liverpool’s very own Katarina Johnson-Thompson determination to finish her race at the Tokyo Olympics in the face of outstanding obstacles (https://www.eurosport.co.uk/athletics/tokyo-2020/2021/tokyo-2020-olympics-brave-katarina-johnson-thom-hobbles-to-finish-after-devastating-injury-during-20_vid1521317/video.shtml). Today, we were reminded of this by our own struggles to produce a market report in the face of such a lack of cotton market events!!!!

– We may be, “perhaps”, guilty of over dramatizing our own challenges, but it is true that the market is searching for a development to give it a more purposeful direction. The lead contract Dec ’21 closed today up 37 points at 90.68 and, once again, we look to see if 90 can hold. For two weeks we have had a closing range of 89.39 to 90.68 (today’s close) and the market very much needs an event to break the torpor.

– In China mills are now armed with import quotas and are focusing their attention on the consignment stocks in the port free trade zones. There were about 600-700,000 MT in warehouse prior to the release of quotas. Whilst it is too early yet to estimate the total volume of sales so far, the pace has been reported as brisk. At the same time, the excellent offtake of the, higher priced, reserve stocks continues and the total sales to date now stands at 228,946 MT.

– The global cash market has turned extremely quiet, especially for nearby shipments. There are a number of reasons for this, first of all there is, quite simply, very little cotton for available for nearby shipment and what there is quickly finds willing buyers. Secondly, recently some consuming nations, notably Bangladesh, Indonesia and Vietnam, have implemented complete or partial lockdowns, which has curtailed mill operations and caused a short-term hiatus in demand for cotton, even though the mills are making good money and would much prefer to keep spinning. Finally, as the market has, so far, failed to hold above the 90 cents level for a protracted period of time, and with the US crop seemingly increasing in size, some mills are playing a waiting game in the hope of better opportunities to cover their needs. Nevertheless, mills globally report positive yarn margins and strong end user demand. As quiet as it is, it does not appear that the good times are over for the spinning community!

– As we look to end user demand the below chart of Nike stock offers a positive picture. After posting excellent sales numbers at the end of June the stock has not looked back. Of course, being a sportswear brand, many Nike products rely on synthetic fibres rather than cotton, however, Nike’s recent performance is an extremely encouraging indication of the consumers’ demand for apparel.

– This week’s CFTC Cotton on Call Report is based positions as of 30th July and showed the first week on week decline in the December net on call sales position since December replaced July as the lead month. Overall, current crop net on call sales still increased very slightly to 98,250 contracts. Still the second highest ever for the equivalent week of the year and, still closing in on the all-time high position of 106,063 contracts.

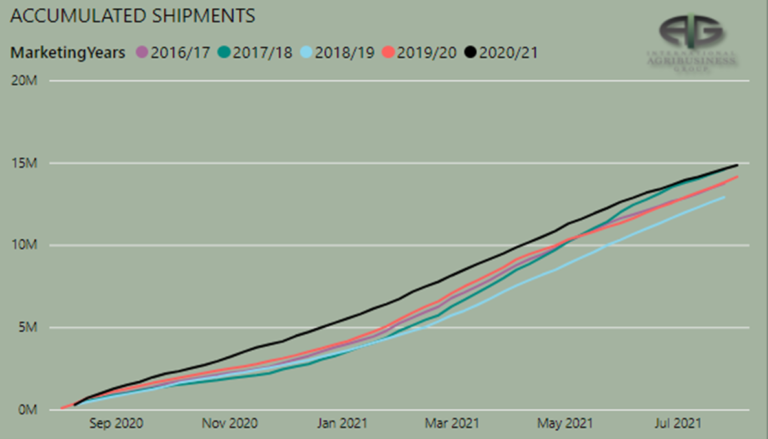

– The USDA export sales report reflected the above-mentioned slow pace of sales with combined sales of 166,400 bales for the 20/21 and 21/22 crop years. Exports of 229,500 bales take total exports to 16.052 for the marketing year and, with this report dated just three days prior to the new MY, the USDA estimate of 16.4 million bales of US exports for the season will have to be adjusted down.

Conclusion

The Cotton market continues to meander between 83 and 91c/lb which it has done for the best part of 2 months and for the time being looks to continue this sort of sideways trading action. Weather will be key to what happens in the weeks ahead and in the event prices can overcome the mid 90’s we may see some explosive price action that sees Cotton move into the 100’s being an area we have not seen for nearly 10 years!

Useful links

*Please note that we only share CFTC CTO on weekend reports.

Written by:

Jo Earlam

Copyright statement

No image or information display on this site may be reproduced, transmitted or copied (other than for the purposes of fair dealing, as defined in the Copyright Act 1968) without the express written permission of Earlam & Partners Ltd. Contravention is an infrigement of Copyright Act and its amendments and may be subject to legal action.

Disclaimer

The risk of loss associated with futures and options trading can be substantial. Opinions set forth herein should not be viewed as an offer or solicitation to buy, sell or otherwise trade futures, options or securities. All opinions and information contained in this email constitute EAP’s judgment as of the date of this document and are subject to change without notice. EAP and their respective directors and employees may effect or have effected a transaction for their own account in the investments referred to in the material contained herein before or after the material is published to any customer of a Group Company or may give advice to customers which may differ from or be inconsistent with the information and opinions contained herein. While the information contained herein was obtained from sources believed to be reliable, no Group Company accepts any liability whatsoever for any loss arising from any inaccuracy herein or from any use of this document or its contents. This document may not be reproduced, distributed or published in electronic, paper or other form for any purpose without the prior written consent of EAP. This email has been prepared without regard to the specific investment objectives, financial situation and needs of any particular recipient. For the customers of EAP, this email is produced exclusively for our business and expert clients, it is not for general distribution and our services are not available to private clients. Past performance is not indicative of future results.