- Jo Earlam

- July 2, 2021

- 10:20 am

- 10 min read

Cotton little changed on the week following the USDA end June planting intentions report!

No person has the power to have everything they want, but it is in their power not to want what they don't have, and to cheerfully put to good use what they do have!

CTZ21 86.97 (+1.07)

CTH22 86.76 (+0.97)

CTK22 86.29 (+0.73)

Zhengzhou CF109– 16,240 (+60)

Cotlook Forward “A” Index – 95.75 (+1.00)

Daily volume – 20,297

AWP – 74.70

Open interest – 217,471

Certificated stock – 126,034

Dec/March spread – (+0.21)

September Options Expiry – 20th August 2021

December Options Expiry – 12th November 2021

December 1st Notice Day – 23rd November 2021

Introduction

– Cotton prices, basis the front month December contract, closed the week down just 21 points having traded in a 326 point range between 84.68 and 87.94 on futures volume averaging 22,570 contracts. In fairness, volume picked up somewhat post the USDA planted acreage report on Wednesday. Perhaps traders wanted to see any potential surprises laid to rest before committing to the market!

– On Friday, China announced the intention to auction 600,000 MT of Reserve stocks between now and the end of September. The market seemed unperturbed by this announcement. Whilst this will, of course, alleviate any tightness in nearby Chinese supply, it does nothing to address the pressing tightness in the wider global market, which is the bigger story right now.

– In options, volume was double the previous week with call options trading almost twice as much as puts where there remains a distinct skew to the calls. i.e. “out of the money” calls are more expensive than the comparative “out of the money” puts!

– Monday is Independence day in the USA and the USA markets will be closed!

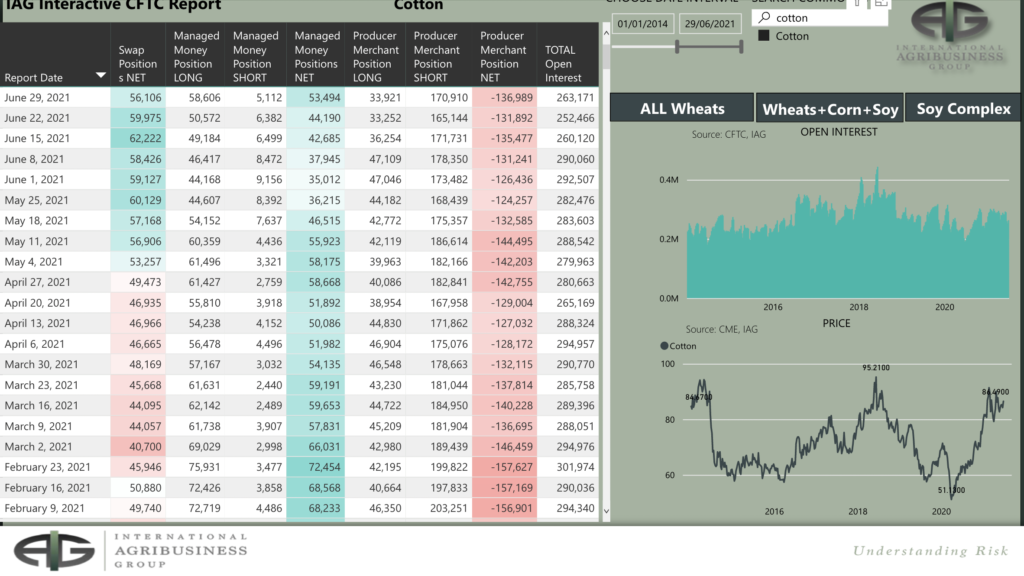

– The CFTC COT report after the close and as of last Tuesday saw Managed Money (MM) do some substantial buying, by adding a net 9,304 contracts to their existing long position. Between MM, Other and Non Reportables (OR & NR) their net long is back up to 80,833 contracts and we have to go back nearly 2 months to May 11th for when they held a longer position.

– We repeat previous comments that their overall position is still 60k contracts shy of their longest ever position, meaning there is plenty of ammunition to add to their long as and when and if they feel the time is right! We suspect the catalyst may come from the outside markets of Corn and Soy where funds are also net long but substantially smaller than they held a couple of months ago. Charts of both Soy and Corn are attached where they are poised to test seasonal highs.

– In India spinning mills are reliably reported to still be doing well! and trying to run at optimum capacity. The Indian futures market is 15% higher than the beginning of the last quarter. Stocks held by CCI and Maharashtra federation are 22 and 1 million lach bales respectively following liquidation of huge stocks!

– Technically the market is trading above its 50, 100 and 200 day moving averages and since the 14th April has been stuck between 80.99 and 88.50 basis CTZ21. The life of contract high was on the 25th February at 89.28. Clearly the market will have to break this level on a closing basis before it has any chance of embarking on the crucial 96c/lb level. Every time it has gone to the 90’s it has been rejected very quickly over the last 9 years and moved swiftly lower.

In earlier reports we have mentioned that when prices do break above the mid 90’s, the move to the 100s tends to be fast and furious! In the 94/95 season this happened in the March 95 contract when on the 15th February the contract went from about 95.50 to nearly 115.00 c/lb in just over 2 weeks and a move of just under 20c/lb. More recently, and in the 10/11 season it happened in the Dec contract when Z10 moved from just under 96c/lb on the 16th September 2010 to just under 120c/lb in a little over a month with a move of nearly 25c/lb. Pictorial evidence is detailed below and a clear reminder to be on high alert for what can happen. Cotton remains one of the world’s most volatile commodities even though it may not appear to be right now!

Conclusion

The market seems is stuck between 83 and 88c/lb for now, but in the event it breaks above its seasonal high at 89.28, we may see a retest of the mid 90’s and potentially an explosive move into the 100’s provided history is your guide. However, we remain respectful of the action in the outside markets, and the dollar in particular and continue to advise maintaining a “watch and wait” approach, with any position taking being very much of an incremental approach in what is clearly a weather market for the next 3 months at least.

Useful links

*Please note that we only share CFTC CTO on weekend reports.

Written by:

Jo Earlam

Copyright statement

No image or information display on this site may be reproduced, transmitted or copied (other than for the purposes of fair dealing, as defined in the Copyright Act 1968) without the express written permission of Earlam & Partners Ltd. Contravention is an infrigement of Copyright Act and its amendments and may be subject to legal action.

Disclaimer

The risk of loss associated with futures and options trading can be substantial. Opinions set forth herein should not be viewed as an offer or solicitation to buy, sell or otherwise trade futures, options or securities. All opinions and information contained in this email constitute EAP’s judgment as of the date of this document and are subject to change without notice. EAP and their respective directors and employees may effect or have effected a transaction for their own account in the investments referred to in the material contained herein before or after the material is published to any customer of a Group Company or may give advice to customers which may differ from or be inconsistent with the information and opinions contained herein. While the information contained herein was obtained from sources believed to be reliable, no Group Company accepts any liability whatsoever for any loss arising from any inaccuracy herein or from any use of this document or its contents. This document may not be reproduced, distributed or published in electronic, paper or other form for any purpose without the prior written consent of EAP. This email has been prepared without regard to the specific investment objectives, financial situation and needs of any particular recipient. For the customers of EAP, this email is produced exclusively for our business and expert clients, it is not for general distribution and our services are not available to private clients. Past performance is not indicative of future results.