CTZ21 93.29 (+0.99)

CTH22 92.64 (+0.98)

CTK22 92.64 (+0.98)

CTN22 90.48 (+0.73)

Zhengzhou CF201 – 17,300 (+55)

Cotlook “A” Index – 102.15 (-1.60) – 1st September

Daily volume – 21,405

AWP – 79.12

Open interest – 267,864

Certificated stock – 70,719

Dec/March spread – (+0.65)

December Options Expiry – 12th November 2021

December 1st Notice Day – 23rd November 2021

Introduction

– Cotton made a high of 96.71 on 17th August and the recent low of 91.80 followed just three days later. Since then, we have tested each side of this range and this week followed the pattern. Following a low of 92.08 yesterday, it seemed as if we were due a test of the range lows, but today’s closing increase of 99 points left us at 93.29 basis the front month Dec ’21. Demand for physical cotton remains robust and the basis is firm. Mill margins remain excellent even though lockdowns are causing consumption reductions in some countries.

– Despite some initial fears Hurricane Ida passed through major US cotton producing areas without causing notable damage (though not forgetting the human cost). Friends in the Delta tell us that the USDA crop progress report seems somewhat ahead of what is seen on the ground, which reminds us that this will be a rather nervy, and potentially volatile, hurricane season.

– In China the price paid at the Reserve auction has declined from previous highs. However, since buying was restricted to textile concerns only last week this is hardly surprising. Despite the restriction in the number of buyers, offtake remains brisk and 416,020 MT has now been released. Mills continue to take advantage of their recently received quotas to buy the at-hand, consignment stocks and there are reports of good enquiry for Q1 2022 as well.

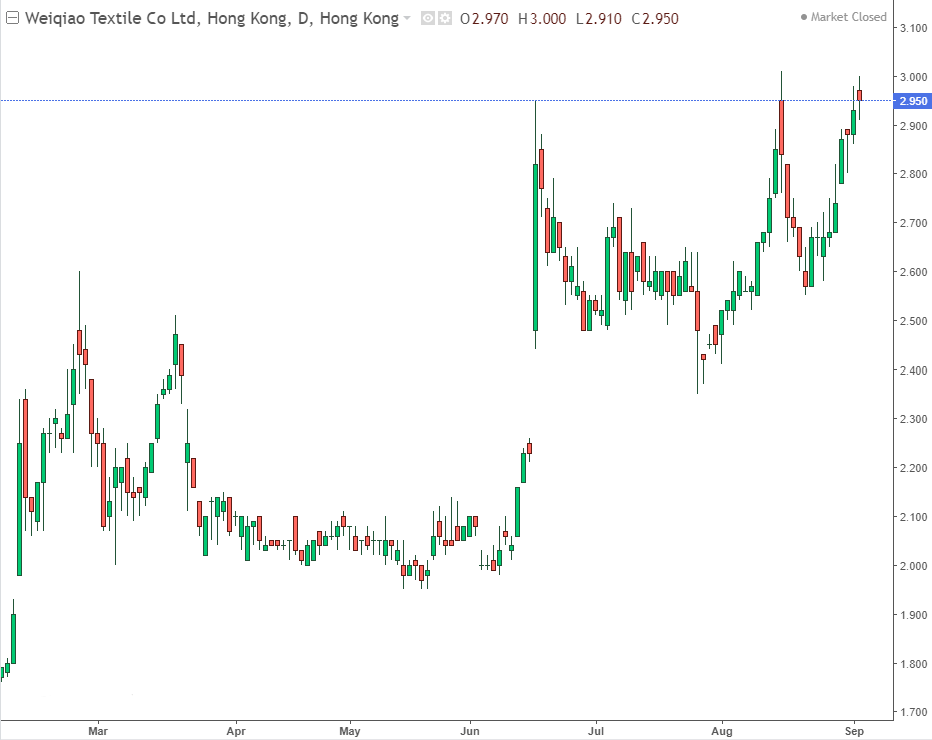

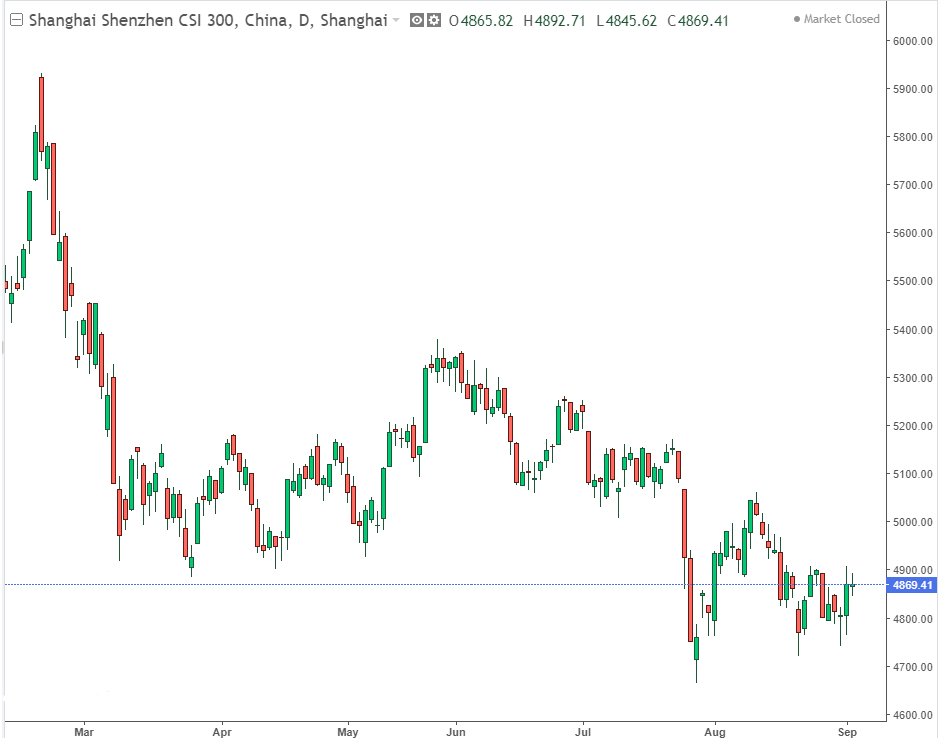

– An illustration of the robust health of the Chinese textile industry can be seen from the chart of Weiqiao Textiles (below left), which is even more impressive when placed in perspective against the overall performance of the Shanghai Shenzhen CSI300 index (below right).

– This week’s CFTC Cotton on Call Report is based positions as of 27th August. Total net unfixed on call sales over purchases increased 5,536 contracts to an all-time record of 112,574 contracts and counting. Interestingly, most of the increase came in the March contract which increased 4,239 contracts to net 31,294. However, December remains where the action is. Though we are slightly down from the all-time highs set five weeks ago, at 35,784 contracts it remains the largest position for this week of the year. By way of comparison, the second highest December position for week 35 was 18,480 contracts in the 2011/12 season. Mills seem to be disinclined to fix, hoping for a market event to save them – this is worrying to say the least!!!

– USDA export sales for the week ending 26th August were reported as a rather lacklustre 105,200 bales, with Pakistan (27,600 bales) and Vietnam (17,200 bales) the largest buyers. For 2022/23 crop 23,800 bales were sold to Turkey only.

Conclusion

Since testing long term highs the market has spent the last two weeks or so in consolidation mode. Over the last 30 days of trading the market close has been between 89.39 and 94.90. A closing break of either of these levels will determine where we go to next! Based on the cash premium being paid in the Cotton, soy and corn markets and the current upwards direction of other soft commodities and the risk of seasonal weather spikes, we believe this break is more likely to come to the upside.

Useful links

*Please note that we only share CFTC CTO on weekend reports.

Written by:

Jo Earlam

Copyright statement

No image or information display on this site may be reproduced, transmitted or copied (other than for the purposes of fair dealing, as defined in the Copyright Act 1968) without the express written permission of Earlam & Partners Ltd. Contravention is an infrigement of Copyright Act and its amendments and may be subject to legal action.

Disclaimer

The risk of loss associated with futures and options trading can be substantial. Opinions set forth herein should not be viewed as an offer or solicitation to buy, sell or otherwise trade futures, options or securities. All opinions and information contained in this email constitute EAP’s judgment as of the date of this document and are subject to change without notice. EAP and their respective directors and employees may effect or have effected a transaction for their own account in the investments referred to in the material contained herein before or after the material is published to any customer of a Group Company or may give advice to customers which may differ from or be inconsistent with the information and opinions contained herein. While the information contained herein was obtained from sources believed to be reliable, no Group Company accepts any liability whatsoever for any loss arising from any inaccuracy herein or from any use of this document or its contents. This document may not be reproduced, distributed or published in electronic, paper or other form for any purpose without the prior written consent of EAP. This email has been prepared without regard to the specific investment objectives, financial situation and needs of any particular recipient. For the customers of EAP, this email is produced exclusively for our business and expert clients, it is not for general distribution and our services are not available to private clients. Past performance is not indicative of future results.