Record Brazilian trade surplus

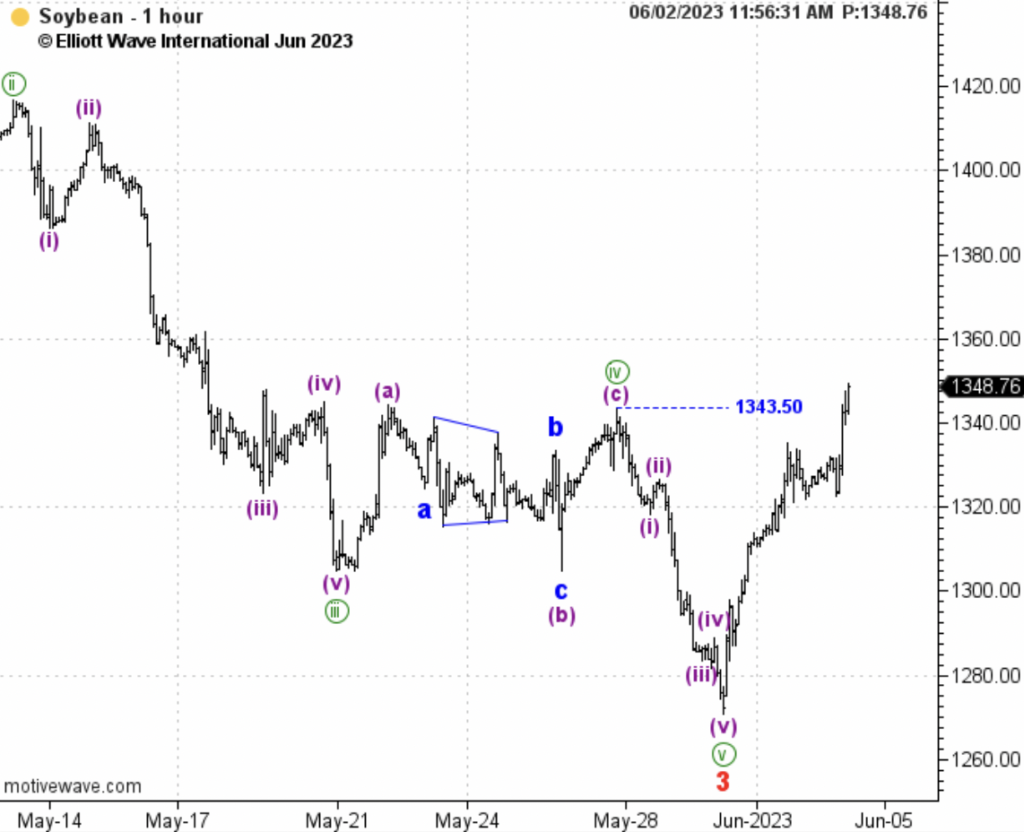

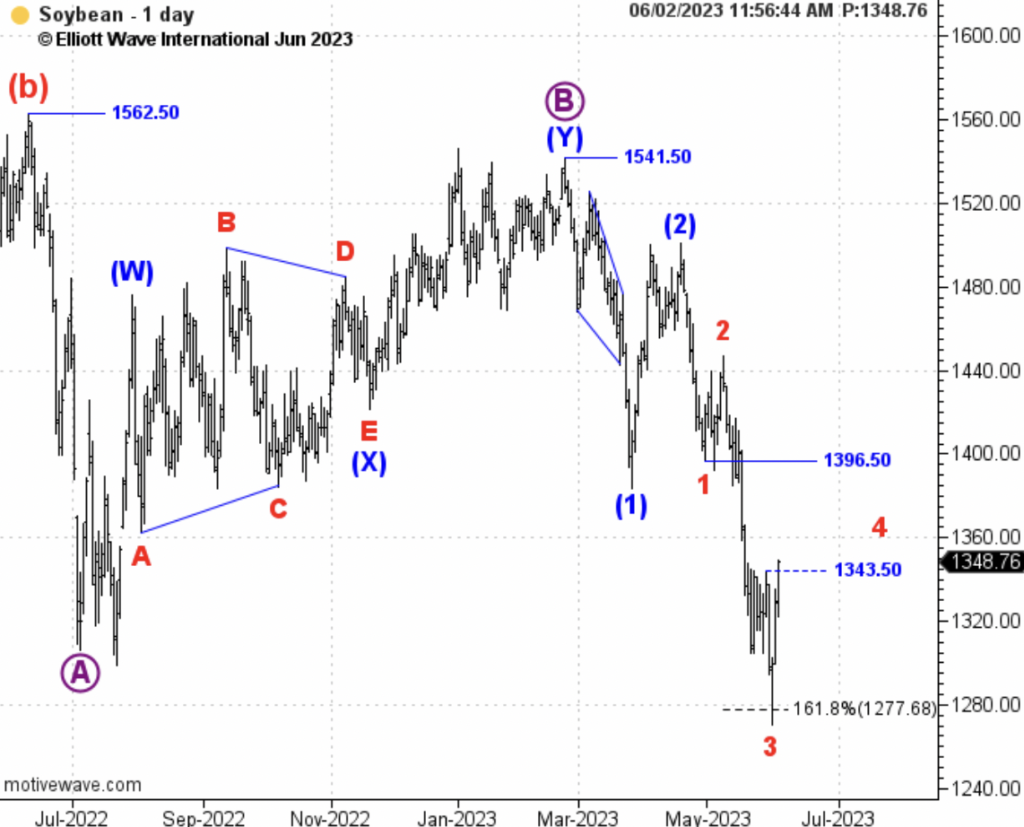

– The July contract traded in a 84.6 cents range in the holiday shortened trading week. Tuesday saw the market down over 40 cents and it closed below the previous low that had provided support. This selling followed through into Wednesday where the market bottomed at 1270.6, just below the 100% fib extension before bouncing, forming a hammer candle stick. From here the market rallied into the weeks close to finish up 15.2 cents.

– Elliot Wave see no evidence that the recent recovery in prices is ending but that a decline below 1320 would change that.

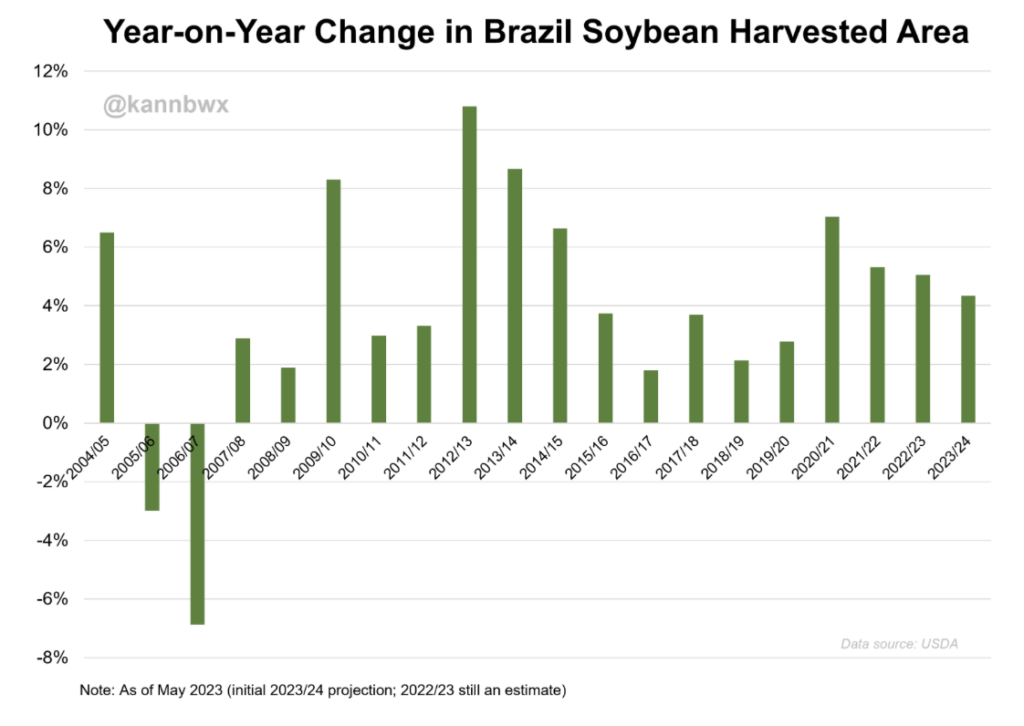

– Brazil posted a record trade surplus in May of $11.4 billion as a surge in exports more than offset the recent fall in commodity prices. Soybeans saw a growth of 23% in exports while oil and sugar increased by 21.4% and 91.8% respectively.

– Brazil is set to export 120,000 tonnes to the US next month due to the cheap price of Brazilian beans. Back in 2021, 178,000 tonnes were imported into the US between May-June. This year, if further sales are made, US purchases could be the largest since 2014 when imports hit 1.05 million tonnes.

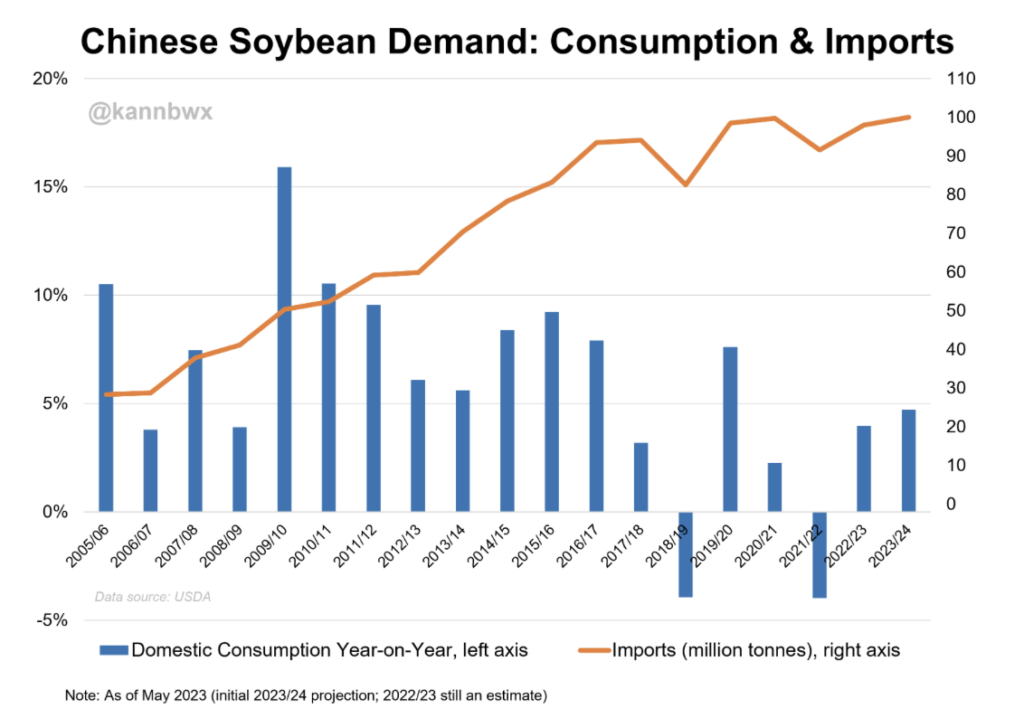

– Chinese soybean imports have died down despite the hype about the economy reopening there. Having seen a huge increase in imports during the first decade of the 2000s, demand has started to tail off slightly there. This comes at a pretty bad time considering the crop that Brazil has produced, and is going to produce in years to come. The result is that soy stocks are likely to reach an all time high in mid 2024. This is not bullish at all!

– The US crop appears to be in good health though in need of rains after a dry couple of weeks. According to forecasts it is going to be another week before many regions see rains which has raised the dryness concerns slightly.

– With El Niño likely to occur in the coming months, US farmers are hopeful of heavier rains to relieve some drought stricken areas. However, food producers across many parts of Asia have been hit by hot and dry weather with El Niño expected to reduce the impact of South Asia’s monsoon season. This will undoubtably reflect into lower production which will likely push food prices higher despite bigger crops in North and South America.

– The CFTC commitment of traders report from 30.05.23 showed that MM reduced both their long and short positions, by 7,324 and 3,708 respectively, leaving them net long 529 contracts.

– OR increased their long positions and reduced their shorts, leaving them 17,152 contracts long. NR added to their long and reduced their short positions meaning they are 28,458 contracts short.

Conclusion

We think the soybean market has found its bottom here for the time being but lower prices are still likely further along the line

Written by:

Jo Earlam

Copyright statement

No image or information display on this site may be reproduced, transmitted or copied (other than for the purposes of fair dealing, as defined in the Copyright Act 1968) without the express written permission of Earlam & Partners Ltd. Contravention is an infrigement of Copyright Act and its amendments and may be subject to legal action.

The risk of loss associated with futures and options trading can be substantial. Opinions set forth herein should not be viewed as an offer or solicitation to buy, sell or otherwise trade futures, options or securities. All opinions and information contained in this email constitute EAP’s judgment as of the date of this document and are subject to change without notice. EAP and their respective directors and employees may effect or have effected a transaction for their own account in the investments referred to in the material contained herein before or after the material is published to any customer of a Group Company or may give advice to customers which may differ from or be inconsistent with the information and opinions contained herein. While the information contained herein was obtained from sources believed to be reliable, no Group Company accepts any liability whatsoever for any loss arising from any inaccuracy herein or from any use of this document or its contents. This document may not be reproduced, distributed or published in electronic, paper or other form for any purpose without the prior written consent of EAP. This email has been prepared without regard to the specific investment objectives, financial situation and needs of any particular recipient. For the customers of EAP, this email is produced exclusively for our business and expert clients, it is not for general distribution and our services are not available to private clients. Past performance is not indicative of future results.