Corn finishes the week with double digit gains as specs cover their shorts!

– July Corn’23 (ZCN23) – Another strong move on Friday pushed the market higher with July’23 closing at 609.00. The holiday shortened week saw trading within a narrow range between 577.40 and 610.40. Closing above the 50 day moving average (MA) the market will need further support in the form of follow through buying to bolster the change in trend.

– The 50% Fib Retracement level located at 612.00 and the 100 and 200 day MA targets higher.

– Despite weakness in price action earlier in the week, Friday’s strong close was a good sign for the market. The specs covered some shorts as was reflected in the CFTC COT and buoyancy of the futures market. Trading volume came in at 325,00o contracts across the board.

– U.S. Export sales were poor for the period between 19th -25th May’23. Net sales of 186,700mt for 2022/23 were a touch dissapointing, with Mexico (172,400mt) the leading buyer ahead of Colombia (76,500mt incl switches).

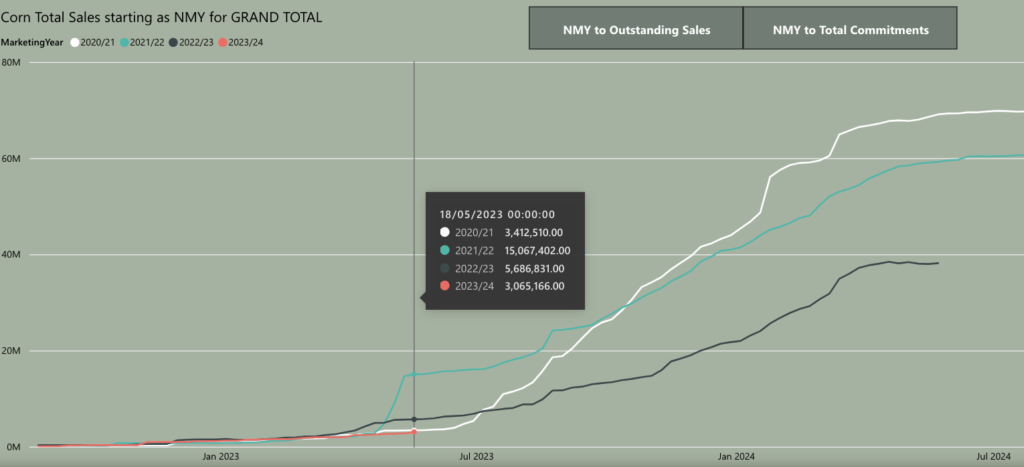

– New crop bookings 312,600 mt and slightly above the trade estimates. Mexico was the top buyer. New crop commitments now sit at 3.065 million mt (mmt) compared to the May WASDE estimate of 53 mmt for the full year.

– CFTC Commitment of traders (COT) report showed the managed money (MM) had covered some shorts. Their net short position was nearly halved by the week ending 30th May 2023 at 51,065. Forecasts of dry weather for newly planted corn and soybean crops in the U.S. Midwest is helping support prices and could be a catalyst for further short covering.

– Corn Total Sales – Weekly U.S. FAS, sales, shipments, accumulated shipments, total sales and outstanding sales data. New crop commitments now sit at 3.065 million mt compared to the May WASDE estimate of 53 MMT for the full year.

– Some areas experienced rains last week with more forecast in parts of Western Nebraska and Kansas. However, around 40% of the Midwest remains dry. The 6-10 (June 10th – 14th) day forecast shows cooler temperatures and rains which might provide some relief.

– At the start of the week around 92% of the U.S. Corn crop was planted according to the delayed Department of agriculture report. That was a 9% increase from the previous week and above the 5 year average at 84%. As of Sunday, 72% of the crop had emerged with further updates due for release later today.

– NOAA 6- 10 day Temperature and Precipitation – For the period between 10th – 14th June 2023 shows cooler temperatures and near normal rains for most of the midwest.

– Bumper crop harvest pressure in Brazil have led to falling corn prices in Mato Grosso which has improved ethanol crush margins by circa 31% at 725 BRL or $143 per tonne.

– Weather in Brazil saw a weather front bringing some welcomed showers into South Central Safrinha corn growing areas but dryness is seen through this week. Rains are fairly rare for this point of the year but now we wait to see how things progress through June.

– Argentina’s Rosario Board of Trade cut its soybean production estimates by 1.5mmt to 21.5mmt and left corn estimate at 32mmt which is still 13.5% below the USDA’s number. The market will be looking to see the USDA revised their South American production figures and ending stocks.

– Ukraines Ministry of Renovation and infrastructure said the U.N. brokered Black Sea Grain export deal had been halted as Russia was blocking registration of ships to all Ukrainian ports. Russia had agreed to a 2 month extension for the deal but the number of vessels leaving Ukraines ports were down heavily from April.

– In other news, we recently reported that China was making use of its wheat surplus and shifting away from Corn to wheat for its animal feed. The absence of China imports is negative for the market as U.S. corn orders are not seen. The complexities around Chinas recovery are puzzling traders trying to ascertain market sentiment.

Conclusion

The technical picture looks more positive with a strong close on Friday moving above a key resistance area. Further follow through buying will be needed but may be helped if specs decide to continue with their short covering. The dry weather in the U.S. could be a fundamental driver but the lack of demand and cancellations remains a concern. The next WASDE report is due for release on the 8th June and it will be interesting to see what happens with South American ending stock estimates. Market will need further support to build confidence on the latest countertrend move.

Written by:

Jo Earlam

Copyright statement

No image or information display on this site may be reproduced, transmitted or copied (other than for the purposes of fair dealing, as defined in the Copyright Act 1968) without the express written permission of Earlam & Partners Ltd. Contravention is an infrigement of Copyright Act and its amendments and may be subject to legal action.

The risk of loss associated with futures and options trading can be substantial. Opinions set forth herein should not be viewed as an offer or solicitation to buy, sell or otherwise trade futures, options or securities. All opinions and information contained in this email constitute EAP’s judgment as of the date of this document and are subject to change without notice. EAP and their respective directors and employees may effect or have effected a transaction for their own account in the investments referred to in the material contained herein before or after the material is published to any customer of a Group Company or may give advice to customers which may differ from or be inconsistent with the information and opinions contained herein. While the information contained herein was obtained from sources believed to be reliable, no Group Company accepts any liability whatsoever for any loss arising from any inaccuracy herein or from any use of this document or its contents. This document may not be reproduced, distributed or published in electronic, paper or other form for any purpose without the prior written consent of EAP. This email has been prepared without regard to the specific investment objectives, financial situation and needs of any particular recipient. For the customers of EAP, this email is produced exclusively for our business and expert clients, it is not for general distribution and our services are not available to private clients. Past performance is not indicative of future results.