- Jo Earlam

- June 25, 2023

- 8:14 am

- 10 min read

July expires near its life of contract lows!

Money and success without anyone to share it with is a very lonely place!

CTN23 78.06 (-1.23)

CTZ23 78.67 (-1.48)

CTH24 78.88 (-1.41)

CTK24 79.14 (-1.27)

CTN24 79.37 (-1.13)

Zhengzhou WQU23 – 16,495 (-120) – 21st June

Cotlook “A” Index – 92.20 – 22nd June (Unchanged)

Daily volume – 29,857

AWP – 65.50

Open interest – 170,728

Certificated stock – 20,946

N23 / Z23 spread – (-0.61)

Z23/H24 spread – (-0.11)

H24/K24 spread – (-0.26)

K24/N24 spread – (-0.23)

July 1st Notice Day – 26th June 2023

December Options Expiry – 10th November 2023

December 1st Notice Day – 24th November 2023

Introduction

– Friday was the last day of trading for the July 23 contract before 1st notice day on Monday. Wild N23 did not disappoint in its last week of trading with a 487 point trading range between 76.91 and 81.78 and closing at the lower end of its life of contract range. There are just 2,548 of open interest in this contract that will be largely cleared up before the end of next week.

– New crop Z23 was, as expected, rather less volatile trading in a 300 point range between 78.20 and 81.20 and closing below trend line support that bodes for lower prices to come and will be of no surprise for readers of EAP reports in recent weeks.

– Volume averaged 31,883 contracts daily and for once put volume outnumbered calls albeit marginally. Implied at the money option volatility is below average at under 22% for Z23 and means protection using options is cheap! We expect it to get cheaper still and the trading range for the season ahead to disappoint those expecting the sort of trading ranges witnessed over the last 2 seasons!

– EAP have bleated on most of the season on the comparisons between N12 and N23. Both were clearly inverse as can be seen below and whilst not completely mimicking each other we feel the point is reasonably made!

– The below chart is of Z23 and noting we are nearly 6 months into the 17 month season EAP like to look at, we think it worthy to look at the market from a technical point of view only, to determine what might happen next!

– We had been looking for a break one way or the other out of the contracting triangle expecting it to be to the downside. This has now happened and note how prices have broken the trendline support! Moreover the medium (50 day) and longer term (100 and 200 day) moving averages are all converging and will likely offer stiff resistance to any potential bounces!

– Technically speaking, EAP would expect 80.49 (200 day) and the higher 82.09 (100 day) to be stiff resistance and if one was not already short but wished to be, then these are levels to consider!

– We would also add that we have seen on twitter this weekend, certain cotton “gurus” (supposedly savvy on the cotton market) trying to catch the falling knife by advocating that cotton is cheap and likely to go up! These characters have many followers and noting the crowd is usually wrong, we feel they may face some more pain in the weeks and months to come if prices head even lower as we expect!

– As always, the low for Cotton this season will almost certainly coincide with a spike lower and intraday turnaround of an impulsive nature, that is typical for Cotton (and in truth) for every other commodity when it reaches a significant turning point. We have not seen that so stay with the trend, like hedge funds do, and expect lower prices and sell the bounce if we get one!

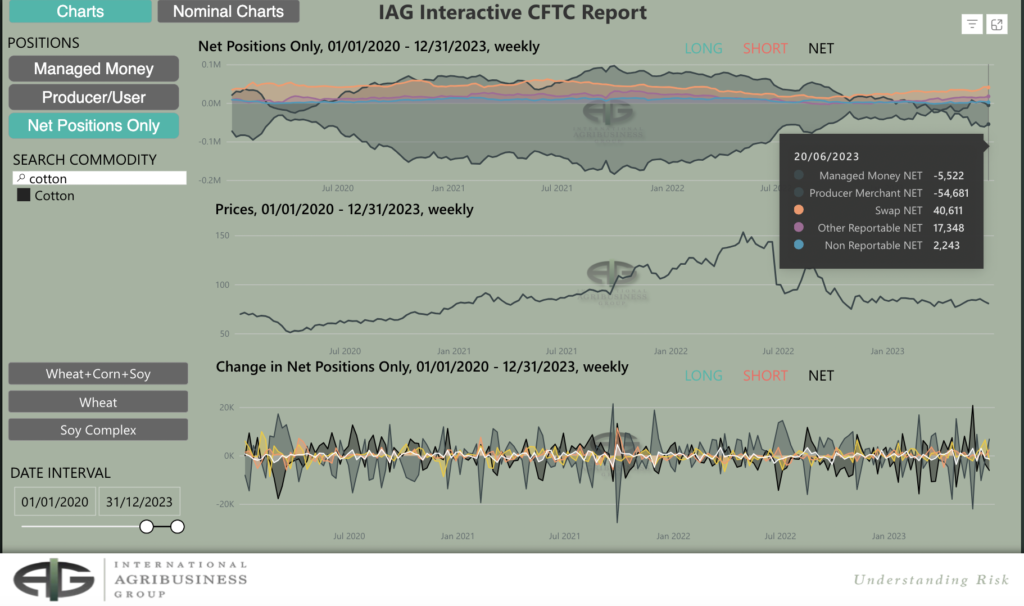

– The CFTC COT report as of last Tuesday showed Managed Money (MM) to be exiting recently acquired longs. These will have been losses to MM based on the fact that the average price long will have been in the low 80’s and as a general rule of thumb the “clever money” tends not to sit on losses and especially considering the aforementioned point that CTZ23 has broken trendline support!

– Between MM, OR and NR they now hold a net long of 14,069 contracts. Thanks as always to our friends at IAG for pictorial evidence of the fact!

– The one day delayed USA export sales report can be accessed by clicking on the link below.

– We had not intended to write a weekend report but in light of the impulsive nature of Friday’s move EAP wished to alert readers of what to expect next!

Next week is likely to be another busy one with the Chinese markets reopening and the USDA’s Planted Average report on Friday.

Conclusion

Our efforts remain solely on new crop Z23 which has traded between 77.56 and 86.98 so far this calendar year. EAP suggest this contract is fully valued in the mid to high 80’s and maintain that end users should only consider a scale down long and/or “on call” fixations from the mid 70’s, to maybe into the 60’s at some point!

Useful links

*Please note that we only share CFTC CTO on weekend reports.

Written by:

Jo Earlam

Copyright statement

No image or information display on this site may be reproduced, transmitted or copied (other than for the purposes of fair dealing, as defined in the Copyright Act 1968) without the express written permission of Earlam & Partners Ltd. Contravention is an infrigement of Copyright Act and its amendments and may be subject to legal action.

Disclaimer

The risk of loss associated with futures and options trading can be substantial. Opinions set forth herein should not be viewed as an offer or solicitation to buy, sell or otherwise trade futures, options or securities. All opinions and information contained in this email constitute EAP’s judgment as of the date of this document and are subject to change without notice. EAP and their respective directors and employees may effect or have effected a transaction for their own account in the investments referred to in the material contained herein before or after the material is published to any customer of a Group Company or may give advice to customers which may differ from or be inconsistent with the information and opinions contained herein. While the information contained herein was obtained from sources believed to be reliable, no Group Company accepts any liability whatsoever for any loss arising from any inaccuracy herein or from any use of this document or its contents. This document may not be reproduced, distributed or published in electronic, paper or other form for any purpose without the prior written consent of EAP. This email has been prepared without regard to the specific investment objectives, financial situation and needs of any particular recipient. For the customers of EAP, this email is produced exclusively for our business and expert clients, it is not for general distribution and our services are not available to private clients. Past performance is not indicative of future results.