- Chris Williams

- November 20, 2022

- 3:46 pm

- 10 min read

Cotton gets back to reality

"I learnt all about life with a ball at my feet"

Ronaldinho

CTZ22 – 85.16 (-1.88)

CTH23 – 83.78 (-1.50)

CTK23 – 83.07 (-1.32)

CTN23 – 82.02 (-1.27)

CTZ23 – 78.96 (-0.21)

Zhengzhou WQF23 – 13,530 (+110)

Cotlook “A” Index – 104.05 (-1.35)

Daily volume – 34,239

AWP – 77.78

Open interest – 194,376

Certificated stock – 880

Z22/H23 spread – (+1.38)

H23/K23 spread – (+0.71)

Z22/Z23 spread – (+6.20)

December 1st Notice Day – 23rd November 2022

March Options Expiry – 10th February 2023

March 1st Notice Day – 22nd February 2023

Introduction

– CTH23 had another quieter week trading in a 777 point range between 82.15 and 89.92 before closing the week down just 78 points. Volume tailed off as the week wore on, averaging just 44,506 futures daily. Options were also quieter averaging 7,222 daily.

– With just a couple of days until Z22 1st notice day, open interest is down to just over 10k in this contract, whilst H23 is 10x higher at over 100k contracts. Implied at the money option volatility in H23, at just over 41%, is expensive, but reflective of the fact that the average daily range remains high at 339 points daily!

– We expect volatility to calm down a lot in the weeks and months ahead but provided we settle down into a 75-90c/lb trading range for H23 over the coming days and weeks.

– EAP have been at the Sourcing Summit in Miami this week! We can honestly say this has to be one of the very best conferences on the Cotton calendar! Superb venue quality speakers and interesting participants! The view here remains sombre, the near term viewpoint remains bearish and we doubt hardly any business has been concluded over the week, noting mills on average are operating at about 60-70% capacity. Negative margins on unsold yarn stocks and continued arrivals of high priced cotton are not helping sentiment! Longer term, few argue that cotton in the mid 70s or lower possibly late in the first 1/4 of 2023 would be a buying opportunity not to be missed!

– The status of the Brazilian cotton crop shows that 100% of the crop has been harvested with 28% exported for the marketing year. The main export markets include China (209,000mt), Bangladesh (74,000mt), Turkey (52,000mt), Vietnam (50,000mt) and Pakistan (45,000mt). Data provided between Aug- October’22 for the season to date. Production estimates for 2022 crop are 2.5 million mt and 2.946 mmt for 2023.

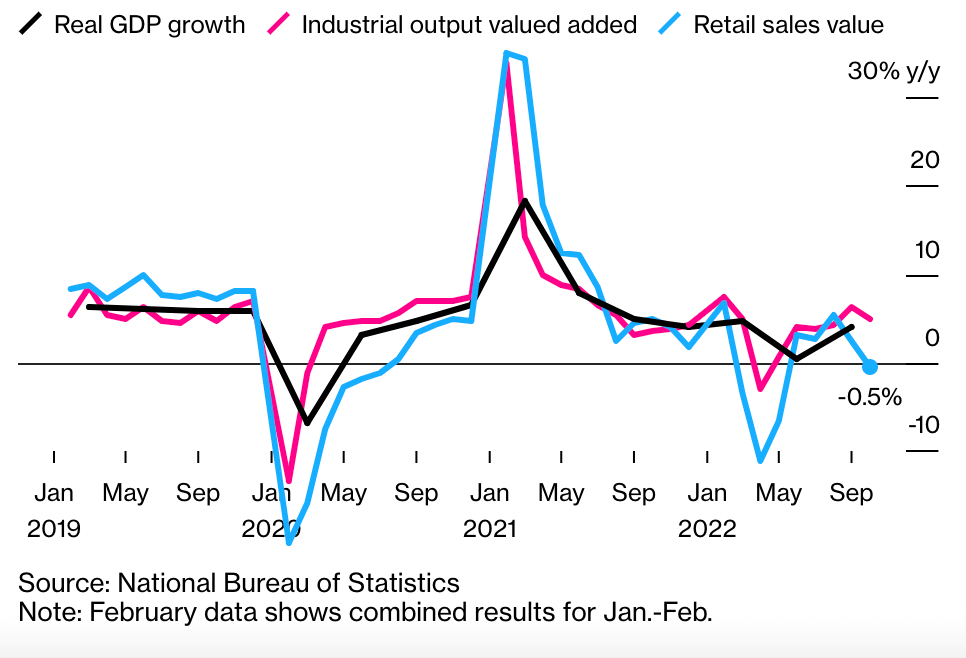

– In China, retail sales contracted 0.5% in October (chart below), this unexpected drop marked the country’s first decline since May and the data was far below economists’ estimates (+0.7%). The backlash from its zero COVID policy mounts, as industrial output and property markets slump and recession risks loom.

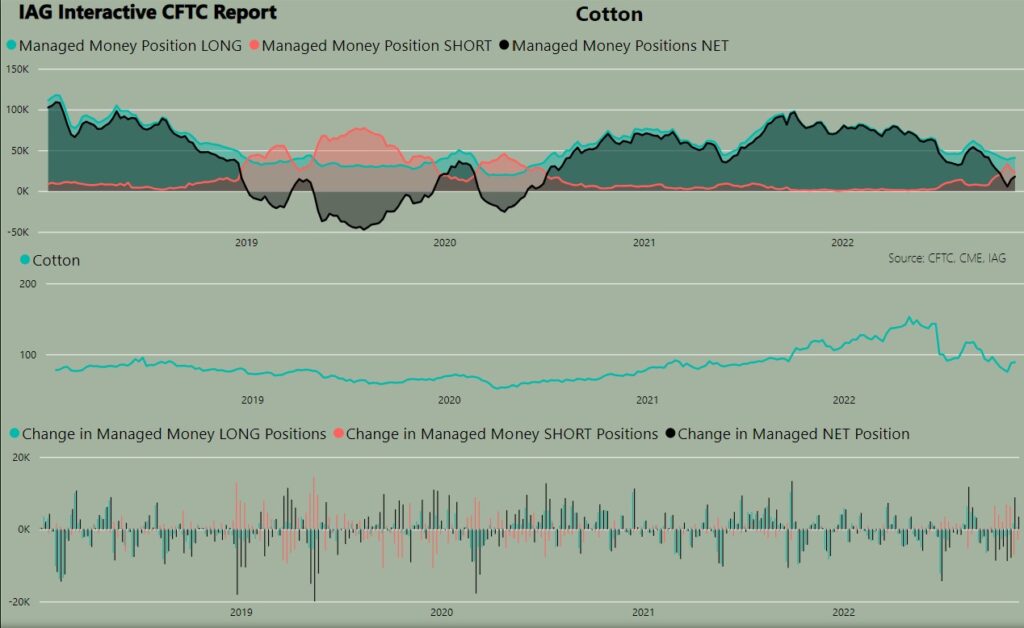

– This week’s CFTC Commitment of Traders report showed the specs (Managed Money, Other Reportables and Non Reportables) adding 4,316 contracts to their net long position. Interestingly, this came mainly from a reduction of the outright short positions which were reduced by 3,005 contracts whilst the outright long position was increased by 1,311 contracts. The net spec position now stands at 19,953 contracts which is a very small position historically – as always, our thanks to our friends at IAG for the pictorial evidence of this below.

Conclusion

The cotton market has found resistance just under 90c/lb basis H23. We maintain that for H23 we see prices in the mid to high 80’s as fully valued and any move for this contract into the 90’s as an outright selling opportunity. Our bearish stance is based upon a lack of demand which will eventually be addressed by continued monthly WASDE reductions to world consumption. We would not want to be short Cotton long term under 70c/lb but feel a sideways market is likely for the rest of the 22/23 season!

Useful links

*Please note that we only share CFTC CTO on weekend reports.

Written by:

Chris Williams

Copyright statement

No image or information display on this site may be reproduced, transmitted or copied (other than for the purposes of fair dealing, as defined in the Copyright Act 1968) without the express written permission of Earlam & Partners Ltd. Contravention is an infrigement of Copyright Act and its amendments and may be subject to legal action.

Disclaimer

The risk of loss associated with futures and options trading can be substantial. Opinions set forth herein should not be viewed as an offer or solicitation to buy, sell or otherwise trade futures, options or securities. All opinions and information contained in this email constitute EAP’s judgment as of the date of this document and are subject to change without notice. EAP and their respective directors and employees may effect or have effected a transaction for their own account in the investments referred to in the material contained herein before or after the material is published to any customer of a Group Company or may give advice to customers which may differ from or be inconsistent with the information and opinions contained herein. While the information contained herein was obtained from sources believed to be reliable, no Group Company accepts any liability whatsoever for any loss arising from any inaccuracy herein or from any use of this document or its contents. This document may not be reproduced, distributed or published in electronic, paper or other form for any purpose without the prior written consent of EAP. This email has been prepared without regard to the specific investment objectives, financial situation and needs of any particular recipient. For the customers of EAP, this email is produced exclusively for our business and expert clients, it is not for general distribution and our services are not available to private clients. Past performance is not indicative of future results.