CTZ22 87.04 (-1.40)

CTH23 85.28 (-1.48)

CTK23 84.39 (-1.48)

CTN23 83.29 (-1.22)

CTZ23 79.17 (-0.25)

Zhengzhou WQF23 – 13,420 (+5)

Cotlook “A” Index – 105.75 (+3.20) – 16th November

Daily volume – 29,635

AWP – 76.74

Open interest – 196,112

Certificated stock – 880

Z22 / H23 spread – (+1.76)

H23 / K23 spread – (+0.89)

Z22 / Z23 spread – (+7.87)

December Options Expiry – 11th November 2022

December 1st Notice Day – 23rd November 2022

Introduction

– The recent rally seems to have run out of steam in the last two days. The front month March ’23 has rallied from a low of 70.10 on 31st October to a nearby high of 89.92 yesterday, before dropping back to close at 85.28 today! It has been our belief that cotton is overvalued as we approach 90 cents, and this latest failure has done little to change our minds.

– All markets welcomed some rare, encouraging news on the inflation front earlier this week when US PPI for October came in at an annualised 8.0% against an expected 8.3%.

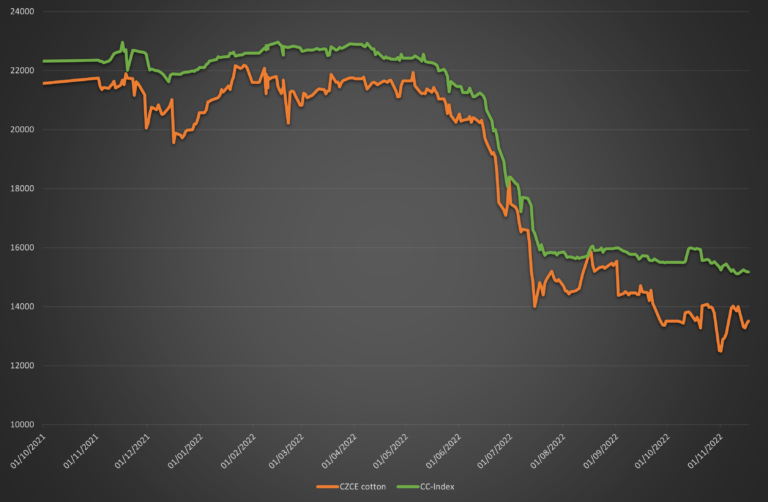

– The slow pace of China Reserve buying has proved somewhat puzzling when placed against reports of still ample supply in China, sluggish demand and what has proven to be lacklustre market performance over the period of the purchase (on the first day of the purchase the CZCE front month closed at 15,220 vs. 13,420 today). Just 86,720 MT has been purchased to date and the aforementioned conditions would certainly suggest that should be a much higher volume.

– Reports in the country are that there are, at least, 1.25 million MT of old crop Xinjiang unsold, whilst the new crop harvest gathers pace. The lack of deliveries to the reserve under these conditions would suggest that stocks are, in fact, much tighter than believed. But in that case, how to explain the price action?? Of course, demand is poor and mills are struggling, but if cotton was so thin on the ground one would expect at least a small supply squeeze on prices to the upside.

– One explanation we hear is that the mills are buying the cotton and, over the course of the purchase programme, the reported free stock has come down by about half. Nevertheless, at this pace to get down to zero would take us into the new year.

– The answer may actually lie in perception. As we know, the bulk of Chinese cotton is now produced in Xinjiang and, to state the obvious, Xinjiang is far away. In the past, when the bulk of the Chinese crop was produced in the Eastern regions the market would already be receiving new arrivals in large volume at this time. Now however, the first trickles of Xinjiang new crop are only just beginning to be shipped east and it will only be December and January before we see a healthy volume of new crop available in the east coast textile markets. When we view it through this lens, 1.25 MMT is not actually that much cotton. In fact, if we look at China free stocks at the end of October for the last five years the current level falls right in the middle!!

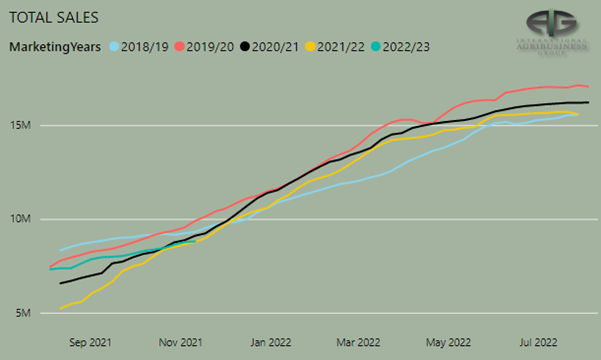

– The USDA export sales report for the week ending 10th November reflected the poor sales conditions seen at the ICA Las Vegas event. Net sales of 25,100 bales for current crop were led by Taiwan with 5,800 bales (the outgoing President perhaps???). For new crop sales of 8,100 bales were reported.

– The CFTC cotton on call report, based positions for the week ending 11th November showed only a small reduction of 976 contracts to the net on call sales position for current crop. Having said that, a reduction in Dec positions of 2,419 contracts suggests rolling to forward months has continued. The lead month H23 contract has a net position of 18,707 contracts which is the 8th highest for this time of the year and does not seem to form a pool of major support.

Conclusion

The cotton market has found resistance again just shy of 90c/lb basis H23. We maintain that for H23 we see prices in the mid to high 80’s as fully valued and any move for this contract into the 90’s as an outright selling opportunity. Our bearish stance is based upon a lack of demand which will eventually be addressed by continued monthly WASDE reductions to world consumption. We would not want to be short Cotton long term under 70c/lb but feel a sideways market is likely for the rest of the 22/23 season!

Useful links

*Please note that we only share CFTC CTO on weekend reports.

Written by:

Chris Williams

Copyright statement

No image or information display on this site may be reproduced, transmitted or copied (other than for the purposes of fair dealing, as defined in the Copyright Act 1968) without the express written permission of Earlam & Partners Ltd. Contravention is an infrigement of Copyright Act and its amendments and may be subject to legal action.

Disclaimer

The risk of loss associated with futures and options trading can be substantial. Opinions set forth herein should not be viewed as an offer or solicitation to buy, sell or otherwise trade futures, options or securities. All opinions and information contained in this email constitute EAP’s judgment as of the date of this document and are subject to change without notice. EAP and their respective directors and employees may effect or have effected a transaction for their own account in the investments referred to in the material contained herein before or after the material is published to any customer of a Group Company or may give advice to customers which may differ from or be inconsistent with the information and opinions contained herein. While the information contained herein was obtained from sources believed to be reliable, no Group Company accepts any liability whatsoever for any loss arising from any inaccuracy herein or from any use of this document or its contents. This document may not be reproduced, distributed or published in electronic, paper or other form for any purpose without the prior written consent of EAP. This email has been prepared without regard to the specific investment objectives, financial situation and needs of any particular recipient. For the customers of EAP, this email is produced exclusively for our business and expert clients, it is not for general distribution and our services are not available to private clients. Past performance is not indicative of future results.