- Jo Earlam

- July 8, 2023

- 11:45 am

- 10 min read

The summer doldrums hit the Cotton market early!

Great spirits have always encountered violent opposition from mediocre minds

CTZ23 81.17 – (+1.29)

CTH24 80.98 – (+1.19)

CTK24 81.04 – (+1.08)

CTN24 81.04 – (+0.93)

CTZ24 77.72 – (+0.54)

Zhengzhou WQU23 – 16,685 (+130)

Cotlook “A” Index – 91.10 (-0.65)

Daily volume – 21,532

AWP – 65.81

Open interest – 172,150

Certificated stock – 8,926

Z23/H24 spread – (+0.19)

H24/K24 spread – (-0.06)

K24/N24 spread – (0.00)

N24/Z24 spread – (+3.32)

December Options Expiry – 10th November 2023

December 1st Notice Day – 24th November 2023

Introduction

– The Cotton market had a super quiet USA Independence day holiday shortened week that finished 80 points higher than the previous week. Futures volume was an uninspiring 25,550 contracts daily and in options it was just 2,962 daily and saw one of the lowest volume days ever on Thursday!

– The intraday range for the front month Z23 contract was 179 points noting the entire range for the week was just 273 points between 79.21 and 81.94. This is not a surprise to EAP and we are strongly of the belief it will get quieter still, as new crop and the end of the calendar year progress, with a downward bias to the market!

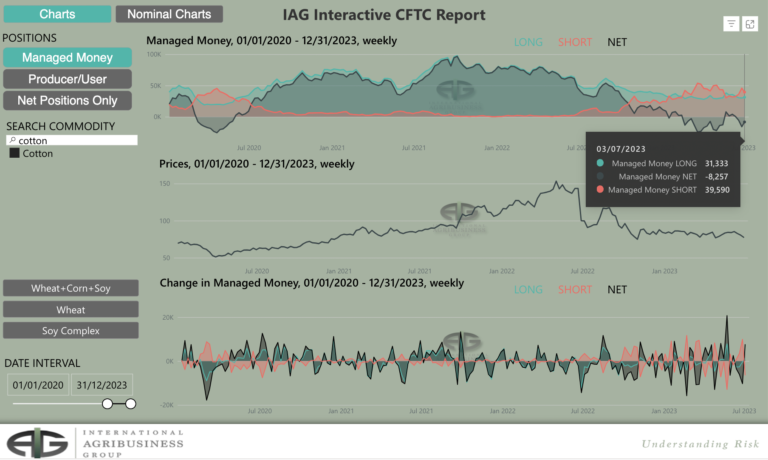

– The weekly CFTC COT report showed Managed Money (MM) to have been buyers in the week ending last Tueday. MM bought a net 7,752 contracts to take their net short to minus 8,257 contracts. Other and Non Reportables bought a net 1,115 and 1,351 contracts each to take their overall net long between the three to 10,679 net contracts long!

– Thanks to our friends at IAG for pictorial evidence of the fact

– The Indian monsoon has now fully covered the country, but its arrival was delayed in many areas and this has impacted sowing significantly in places as can be seen from the table below. As we have previously commented, if the rains are sufficient from this point, we are looking more at a delayed crop, rather than a reduced one, but this will lead to a pretty tight in-country balance sheet prior to harvest.

– Pakistan and the IMF have reached an agreement on a USD 3 billion financing deal to stave off the short-term threat of default. Whilst this solution will not solve all of the issues facing the Pakistani economy, it will bring some immediate relief. In terms of the cotton market, the flow of IMF dollars into the Pakistan banking system should help to ease the significant issues local mills have had in obtaining letters of credit in order to fulfil their contractual obligations.

– All of the US ISM Manufacturing components now have a reading below-50 which means we are in a severe contraction that typically happens in a recession. The ISM Manufacturing Index is made up of new orders, deliveries, inventory, production and employment. The U.S. economy is or will enter into a recession which does not bode well for demand for discretionary items such as clothing and apparel.

– Further evidence to support this viewpoint comes from the Johnson Redbook and U.S. retail sales. The former represents the weekly measure of comparable-store sales growth U.S. which has along with sales collapsed (table below). A worrying sign for those within the cotton sector.

– As the CFTC cotton on call report based on positions as of 30th June showed very little movement over the week. The overall current crop net on call sales position was reduced 427 contracts to 16,677 contracts, whilst the from month Z23 position was reduced 880 contracts to 4,882 contracts. The overall position remains the 3rd lowest from 22 on record for this week of the year indicating the lack of buyer fixation support in the market today,

– The USDA export sales report continued to show China as the only real game in town. Total net sales of 109,200 bales were reported for the 2022/23 marketing year and 130,400 bales for the 2023/34 marketing year. China took 61,700 bales for 2022/23 and 76,100 bales for 2023/24, though interestingly the former number included 31,100 bales of cancellations. Shipments of 260,100 bales need to pick up a bit in the final month of the season.

Conclusion

Z23 has traded in just over a 10c/lb range between 76.81 and 86.98 so far this calendar year. EAP suggest this contract is fully valued in the low to mid 80’s and maintain that end users should only consider a scale down long and/or “on call” fixations from the mid 70’s, to maybe into the 60’s at some point!

Useful links

*Please note that we only share CFTC CTO on weekend reports.

Written by:

Jo Earlam

Copyright statement

No image or information display on this site may be reproduced, transmitted or copied (other than for the purposes of fair dealing, as defined in the Copyright Act 1968) without the express written permission of Earlam & Partners Ltd. Contravention is an infrigement of Copyright Act and its amendments and may be subject to legal action.

Disclaimer

The risk of loss associated with futures and options trading can be substantial. Opinions set forth herein should not be viewed as an offer or solicitation to buy, sell or otherwise trade futures, options or securities. All opinions and information contained in this email constitute EAP’s judgment as of the date of this document and are subject to change without notice. EAP and their respective directors and employees may effect or have effected a transaction for their own account in the investments referred to in the material contained herein before or after the material is published to any customer of a Group Company or may give advice to customers which may differ from or be inconsistent with the information and opinions contained herein. While the information contained herein was obtained from sources believed to be reliable, no Group Company accepts any liability whatsoever for any loss arising from any inaccuracy herein or from any use of this document or its contents. This document may not be reproduced, distributed or published in electronic, paper or other form for any purpose without the prior written consent of EAP. This email has been prepared without regard to the specific investment objectives, financial situation and needs of any particular recipient. For the customers of EAP, this email is produced exclusively for our business and expert clients, it is not for general distribution and our services are not available to private clients. Past performance is not indicative of future results.