- Jo Earlam

- July 2, 2023

- 3:46 pm

- 10 min read

End of the 2nd 1/4 of 2023 sees Cotton back above 80c/lb!

If knowledge can be learned so can virtue!

CTZ23 80.37 – (+1.34)

CTH24 80.25 – (+1.21)

CTK24 80.34 – (+1.15)

CTN24 80.39 – (+1.09)

CTZ24 77.72 – (+0.54)

Zhengzhou WQU23 – 16,575 (+265)

Cotlook “A” Index – 90.65 (+1.65)

Daily volume – 32,964

AWP – 63.57

Open interest – 175,174

Certificated stock – 17,051

Z23/H24 spread – (+0.12)

H24/K24 spread – (-0.09)

K24/N24 spread – (-0.05)

N24/Z24 spread – (-0.02)

December Options Expiry – 10th November 2023

December 1st Notice Day – 24th November 2023

Introduction

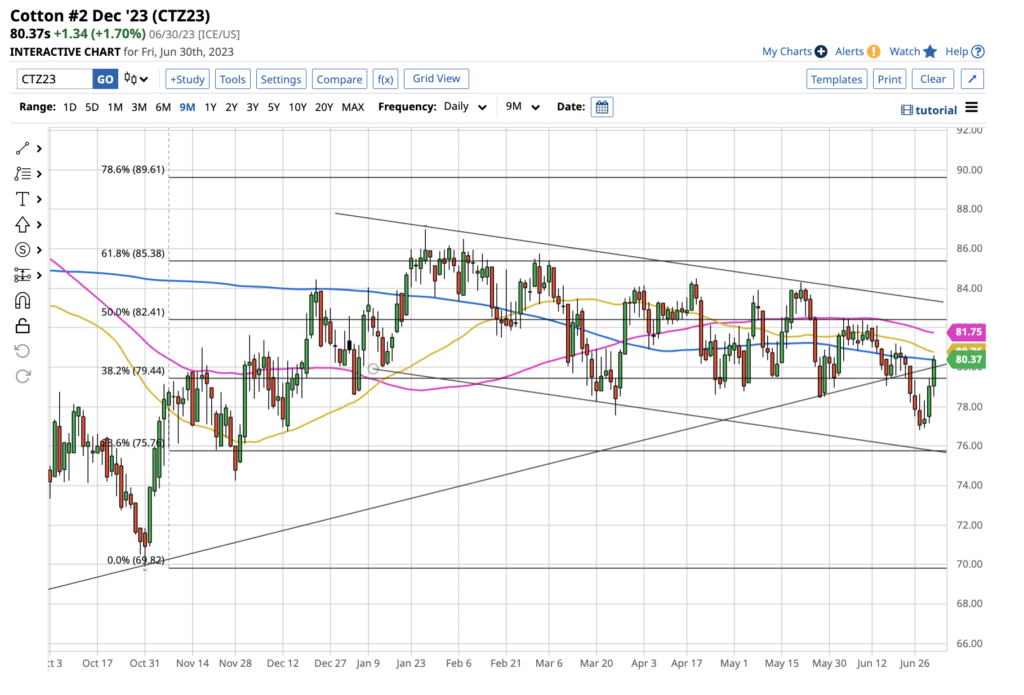

– The last week of the 2nd quarter of 2023 ended with Z23 closing the week up 170pts/lb at 80.37, having traded in a relatively wide 378 point range between 76.81 and 80.59. Volume was very similar to the week before at 30,206 futures daily and 6,041 options daily.

– Open interest moved up to over 175k and implied at the money option volatility at 22%. This remains at its 5 year average levels, but prior to the super volatile 21/22 and 22/23 seasons!

– There is a lot to be learned from volatility! The 15/16 season saw one of the smallest seasonal range’s of the century so far (13.5c) and volatility averaged under 20% for most of it! Volatility is a real time clue as to what is happening in the market. At 22% the answer right now to that question is “not a lot!”

– Open interest in Z23 options is detailed below and is interesting for the fact that most of the bets in calls are at the 90c strike and for puts at the 70c strike, with the underlying future’s price Z23 closing near the middle of the aforementioned strikes! A Z23 range for the remainder of this contract’s life between these levels looks likely!

– The skew remains to the calls meaning the price of “out of the money” calls are more expensive than the comparative “out of the money” puts!

– The June 30th USDA plantings report did not have much impact on the market on its publication on Friday.

– Cotton acreage at 11.087m acres was slightly below the average analyst’s figure of 11.2m acres. The forthcoming July WASDE is a week on Wednesday and the final yield on the aforementioned acreage is what the final USA crop production is all about. The final USDA acreage for the 22/23 season against the end June 2022 estimate proved to be more than 10% higher eventually! Clearly there is a strong possibility that the 11.2m could be a minimum of +/- 5% either way (maybe more) when all is said and done!

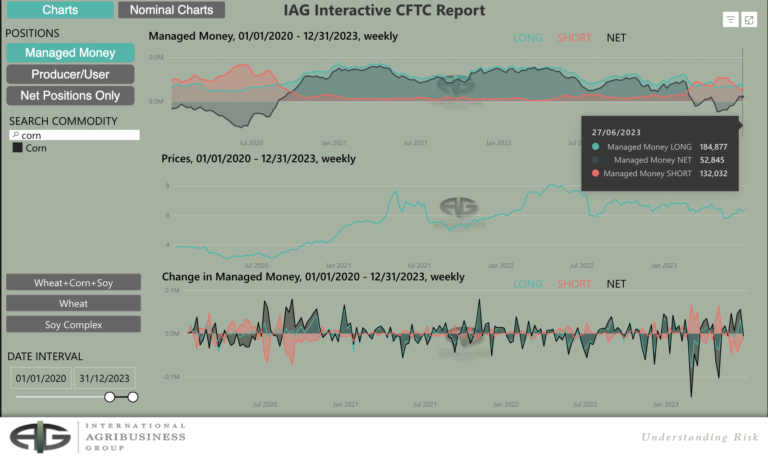

– The COT report was significant for the fact that Managed Money (MM) were big sellers in the week ending last Tuesday, when prices closed at 77.06, which was the lowest close for Z23 since 29th November last year. December even made a new intraday calendar year low for the Z23 contract on that day!

– MM sold a net 10,287 contracts, taking their net short to 15,809 contracts! Other and Non Reportables sold a net 274 and 2,847 each taking the overall net position between MM, OR and NR to just 661 contracts long.

– The position is effectively zero and the market is stuck in the middle of the just over 10c/lb range we have been in for the last 6 months! We maintain that an eventual break of the mid 70’s on a closing basis is a strong possibility!

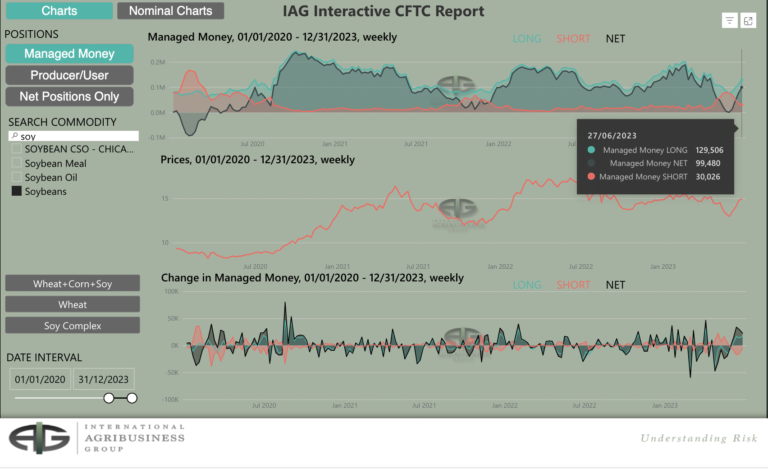

– The plantings report proved to be a lot more interesting for the big brothers! Soy rocketed upwards whilst Corn did the opposite. Fund positions (MM) show them to be on the right side of Soy and flat Corn!

– The chart of Cotton from a tecnical point of view offers few clues. It is a sideways market that is searching for direction. The funds have more than enough firepower to take it higher, but little reason to do it.

– The end user has no margin at current levels and will ignore a move higher that will likely fail in the event funds choose to buy it!

– Fundamentals can often be railroaded by Money, but for now we think that Macro factors will mean they are unlikely to get involved in a big long position. The path of least resistance should eventually prove to be down!

Conclusion

Z23 has traded in just over a 10c/lb range between 76.81 and 86.98 so far this calendar year, having made a new low last week. EAP suggest this contract is fully valued in the low to mid 80’s and maintain that end users should only consider a scale down long and/or “on call” fixations from the mid 70’s, to maybe into the 60’s at some point!

Useful links

*Please note that we only share CFTC CTO on weekend reports.

Written by:

Jo Earlam

Copyright statement

No image or information display on this site may be reproduced, transmitted or copied (other than for the purposes of fair dealing, as defined in the Copyright Act 1968) without the express written permission of Earlam & Partners Ltd. Contravention is an infrigement of Copyright Act and its amendments and may be subject to legal action.

Disclaimer

The risk of loss associated with futures and options trading can be substantial. Opinions set forth herein should not be viewed as an offer or solicitation to buy, sell or otherwise trade futures, options or securities. All opinions and information contained in this email constitute EAP’s judgment as of the date of this document and are subject to change without notice. EAP and their respective directors and employees may effect or have effected a transaction for their own account in the investments referred to in the material contained herein before or after the material is published to any customer of a Group Company or may give advice to customers which may differ from or be inconsistent with the information and opinions contained herein. While the information contained herein was obtained from sources believed to be reliable, no Group Company accepts any liability whatsoever for any loss arising from any inaccuracy herein or from any use of this document or its contents. This document may not be reproduced, distributed or published in electronic, paper or other form for any purpose without the prior written consent of EAP. This email has been prepared without regard to the specific investment objectives, financial situation and needs of any particular recipient. For the customers of EAP, this email is produced exclusively for our business and expert clients, it is not for general distribution and our services are not available to private clients. Past performance is not indicative of future results.