- Jo Earlam

- October 1, 2021

- 1:00 pm

- 10 min read

Uncovered spinners face the highest prices in 10 years as speculators pile on the longs!

The game of history is usually played by the best and the worst over the heads of the majority in the middle.

CTZ21 104.53 (-1.27)

CTH22 101.44 (-2.44)

CTK22 100.44 (-2.51)

CTN22 97.71 (-2.39)

Zhengzhou CF201 – 20005 (+940)

Cotlook “A” Index – 115.65 (+3.65)

Daily volume – 48,794

AWP – 83.92

Open interest – 291,964

Certificated stock – 54,442

Dec/March spread – (+3.09)

December Options Expiry – 12th November 2021

December 1st Notice Day – 23rd November 2021

Introduction

– The start of the final quarter of 2021 for Cotton began with a new seasonal high, before prices took a much needed setback on Friday. For the week, CTZ21 closed 854 points higher than the previous week close, having traded in a very wide range of 1126 points between 96.02 and 107.28 on massive volume totalling 56,321 futures daily.

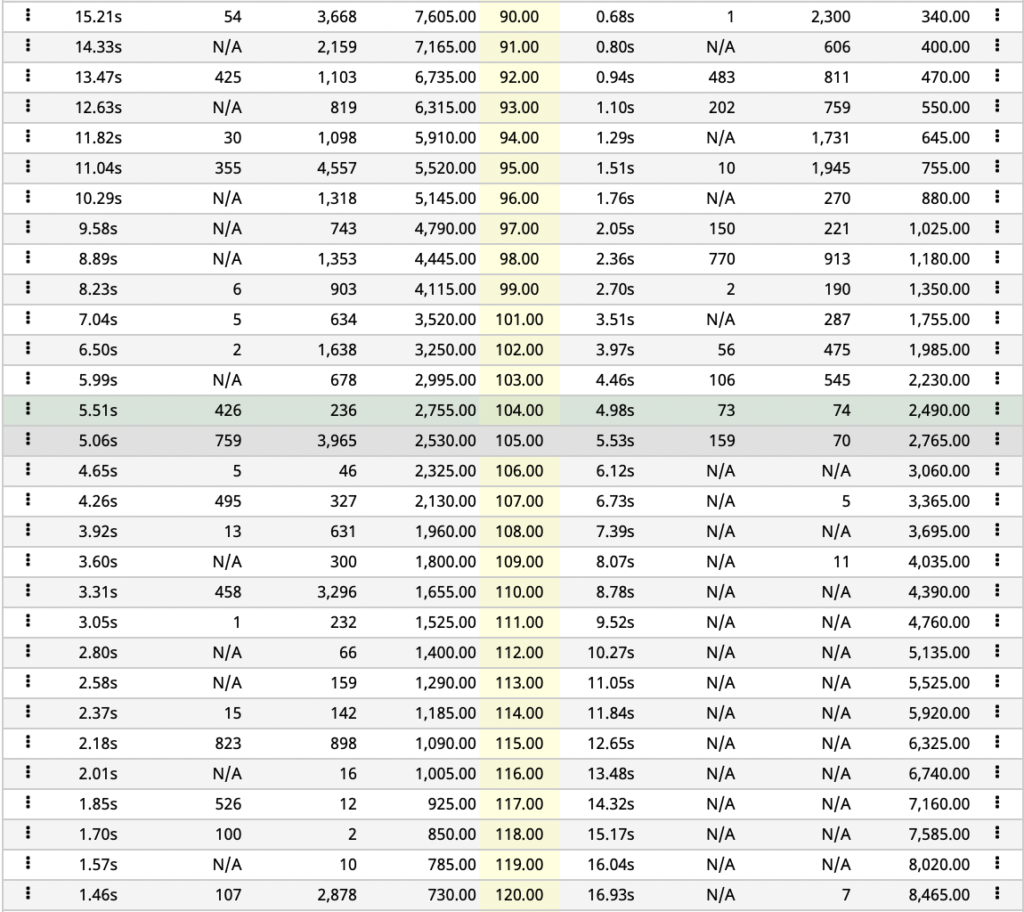

– In options, it was the busiest week since I can remember at 19,243 contracts daily with call buying outnumbering puts significantly. Implied at the money volatility in December closed at 37%, which in short means buying price movement protection is extremely expensive. The skew remains heavily to the calls where 10c/lb “Out of the Money” calls remain almost twice as expensive to buy as the comparative”Out of the Money” puts.

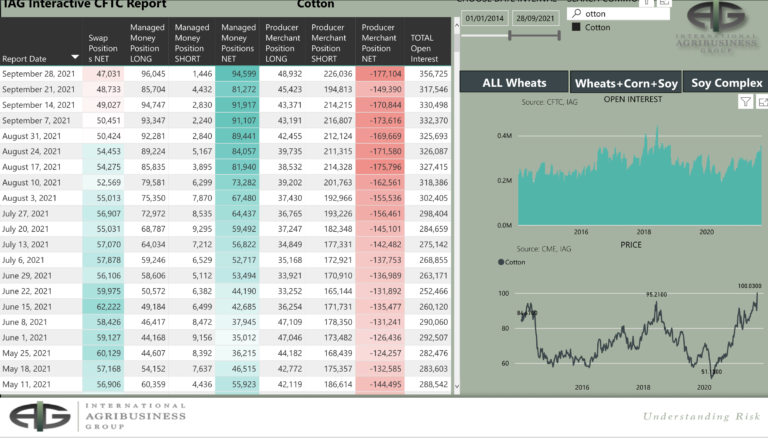

– Open interest continues to surge, now standing at 291,964 contracts and up 28,676 contracts on the week largely because funds piled on the longs…more on that later. This is the highest open interest in Cotton since 2018 and before that in 2008. There have only ever been just over 50 days when Cotton has ever had an open interest which has been higher than today. This is significant for the fact that we know that when these bets get unwound the Cotton market will make a countertrend move that will scare even the most hardy of traders.

– There are just 40 days to go until the expiry of the December options but the cost of protecting a move 5% higher (i.e. 110c/lb) will still cost the purchaser 4.3c/lb meaning his effective protection will only be above 114.3c/lb!

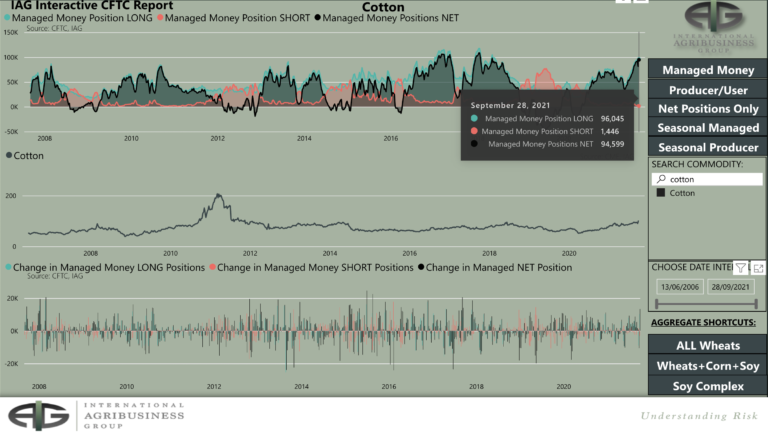

– For just over 15 years the CFTC have been publishing the weekly COT report and as can be seen from the above chart we are approaching extreme longs held by Managed Money (MM) who are just 13k off their biggest long ever. For the week MM bought a net 13,327, Other Reportables (OR) a net 11,475 and Non Reportables (NR) a net 4615. The total net long between MM, Or and NR now totals a massive 130,073 contracts net long and between the 3 categories of trader they bought 29,417 contracts in the week ending last Tuesday, when the market closed at 100.03 basis the December contract. Moreover they are probably even longer noting the price action of the last 3 days of the week!

– In conclusion, funds are long and rather happy based on Friday’s close of 104.53. We reiterate funds are trend followers not trend makers meaning they will get out when the chart tells them to and not before. At EAP we do not believe that they are in any rush to get out just yet! Uncovered spinners are on the other hand in a rather more uncomfortable position!

– I am not sure I can ever remember a week when the funds piled on the longs in a greater way! It is time to be on HIGH ALERT for when they may get out as it will likely smash the market just as quickly as it has gone up!

– For all commodities long term highs or lows tend to occur with a limit up or limit down move all in 1 day. This is what we need to be looking for in the days ahead for a possible short or long term high in the market.

– As always our efforts in determining when will centre on the previous occasions when this has happened. Moves for Cotton into the 100’s tend to be rare, but they have happened on several occasions over more than 200 years of data we have to hand.

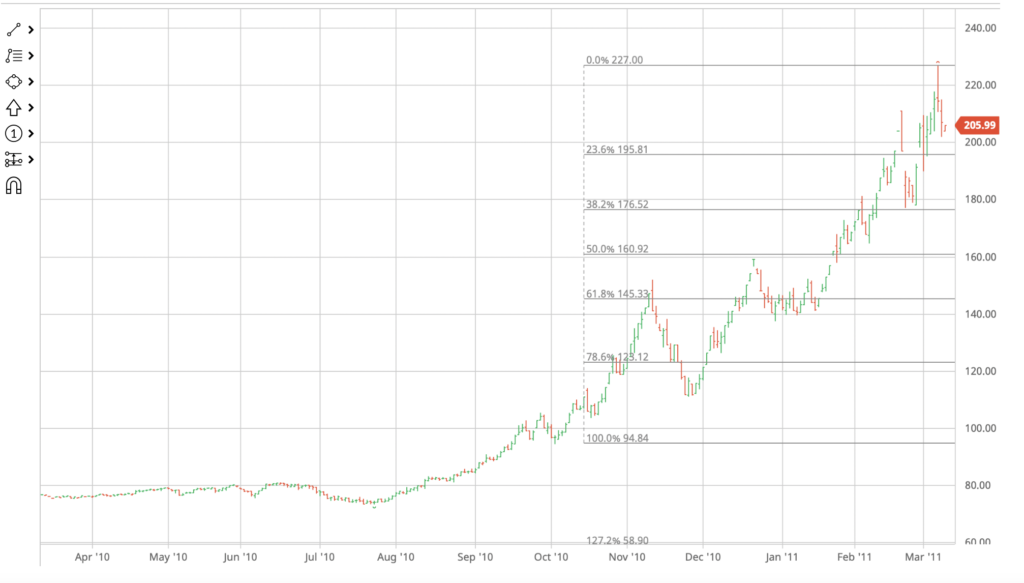

– Believe it or not, the first occasion was back in 1864/65 season and during the American Civil war when prices reached an eye watering 189c/lb, the second in 94/95 when we reached 117c/lb, the third in 10/11 at 227c/lb, the 4th in 11/12 at 145c/lb and finally this season in 21/22. Clearly the move to the 100’s is becoming far more prevalent this century than in the previous 2 which happened only once each.

– Included below are the 3 charts of the what happened previously in 94/95, 10/11 and 11/12 which are well worth taking a few minutes to study carefully in an effort to determine what will happen next.

– EAP’s conclusion from the historic previous occasions when prices hit the 100’s compared to day is that the current move has further to go but we should remain on high alert for a meaningful set back in the next week or two but is unlikely to be the final high for the 21/22 season!

– In the 94/95 season, the bull move (like this season) began just below 90c/lb and it was more than a month before prices embarked on any sort of meaningful setback. It was much the same in the 10/11 season and the 1st set back also proved to not be the final high. For 11/12 we were in a solid bear market and the move down was swift and painful and for the purposes of anticipating what happens in 21/22 is not relevant to our thoughts!

– Looking at the chart above and technically speaking the market looks like there is further upside to be expected, having surged over 11c/lb in just under 2 weeks. Assuming we find a near term high somewhere between 109.50 and 114c/lb, a move back to test the breakout at 96-102c/lb would be quite normal. Until the unfixed “on call sales” are at least partially sorted out and the funds are less long, we can expect lots and lots of volatility in the Cotton market.

– In an earlier report we pointed out the average daily move for the spot futures month was 158 points for the 2122 season so far. However for the last 2 weeks that daily move has more than doubled to 319 points. Expect more of the same!

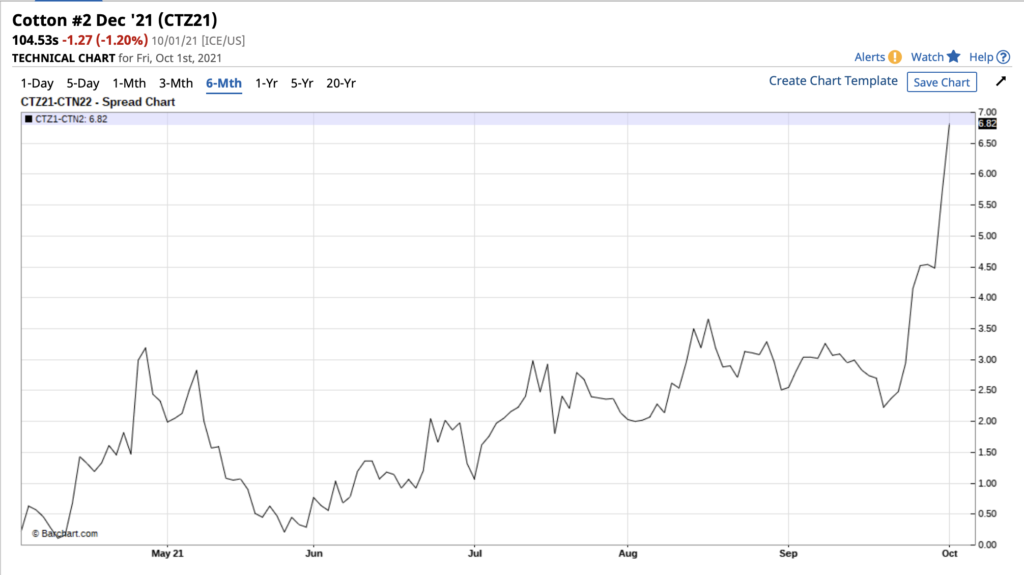

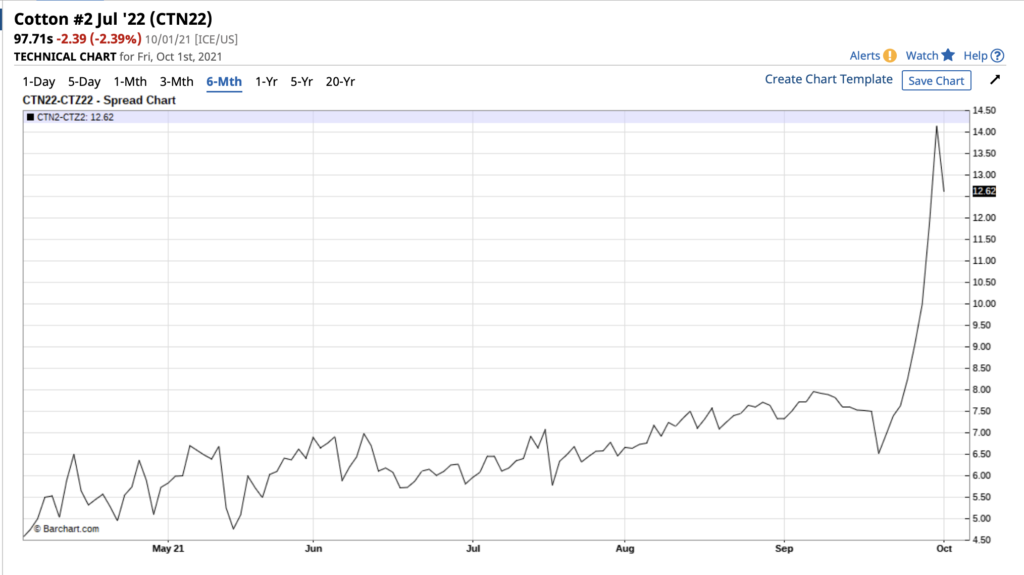

– The spreads between Z21, H, K and N22 are reaching extremes with July now nearly 7c/lb below the front month of December. the spread between current crop N22 and new crop Z22 reached a new high the last week at 1500. We remain in highly volatile times! See charts below for confirmation ion the fact!

– In the physical market business is still occurring but at a much reduced level. We are almost certainly over valued at current NY prices but rarely does that mean we cannot go even higher. We need to see some capitulation by the end user and frightened shorts before that is likely to happen!

Conclusion

We expect a new high again to occur next week maybe in the 110’s before a much needed and meaningful set back is likely to occur. Any set back, following a spike high, will almost certainly see excellent support at the breakout area of 96-100c/lb. Those on the short side of the ledger should not see any such move as a reversal, but as a not to be missed buying opportunity!!

Useful links

*Please note that we only share CFTC CTO on weekend reports.

Written by:

Jo Earlam

Copyright statement

No image or information display on this site may be reproduced, transmitted or copied (other than for the purposes of fair dealing, as defined in the Copyright Act 1968) without the express written permission of Earlam & Partners Ltd. Contravention is an infrigement of Copyright Act and its amendments and may be subject to legal action.

Disclaimer

The risk of loss associated with futures and options trading can be substantial. Opinions set forth herein should not be viewed as an offer or solicitation to buy, sell or otherwise trade futures, options or securities. All opinions and information contained in this email constitute EAP’s judgment as of the date of this document and are subject to change without notice. EAP and their respective directors and employees may effect or have effected a transaction for their own account in the investments referred to in the material contained herein before or after the material is published to any customer of a Group Company or may give advice to customers which may differ from or be inconsistent with the information and opinions contained herein. While the information contained herein was obtained from sources believed to be reliable, no Group Company accepts any liability whatsoever for any loss arising from any inaccuracy herein or from any use of this document or its contents. This document may not be reproduced, distributed or published in electronic, paper or other form for any purpose without the prior written consent of EAP. This email has been prepared without regard to the specific investment objectives, financial situation and needs of any particular recipient. For the customers of EAP, this email is produced exclusively for our business and expert clients, it is not for general distribution and our services are not available to private clients. Past performance is not indicative of future results.