- Chris Williams

- July 28, 2022

- 8:54 pm

- 10 min read

A concerning economic outlook

The capacity to learn is a gift; the ability to learn is a skill; the willingness to learn is a choice.

CTZ22 96.21 (+1.14)

CTH23 92.67 (+1.21)

CTK23 91.15 (+1.28)

Zhengzhou CF209 – 14,860 (+35)

Cotlook “A” Index – 129.90 (+2.70) – 27th July

Daily volume – 13,355

AWP – 103.96

Open interest – 184,989

Certificated stock – 8,277

Dec / March spread – (+3.54)

September Options Expiry – 19th August 2022

December Options Expiry – 11th November 2022

December 1st Notice Day – 23rd November 2022

Introduction

– The summer is upon us and the news is thin! The market does appear to be settling into a range and seems to be slowly working it’s way higher to test the top end, perhaps towards a dollar. It would certainly seem that we would need an external event to move the market significantly in one direction or the other. The front month Dec ’22 closed today at 96.21 up 114 points for the day.

– Arrivals are gathering pace in Brazil and farmers’ main focus is upon fulfilling forward orders to the merchant community. However, we are hearing reports on the ground of the crop coming in of a lower quality than was expected and of a number of rejections on take up.

– The macro outlook continues to deteriorate. The Fed yesterday implemented their second consecutive 75 basis point rise in interest rates in order to attempt to combat ever rising inflation. Meanwhile, US GDP fell for the second quarter in a row, meaning that the country is now, technically, in a recession. None of this bodes well for consumption.

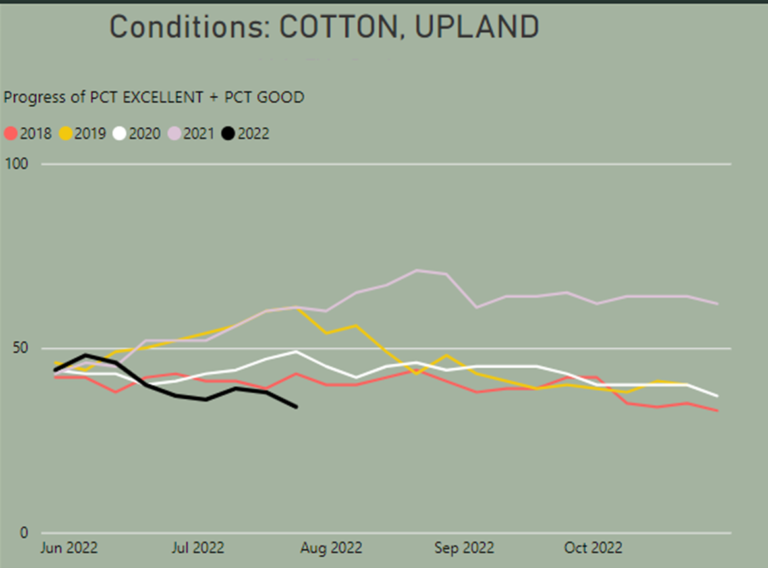

– The USDA Crop Progress Report published Monday showed a continued deterioration of the crop condition. We are now well past the point where the Texas crop can be saved and the only question remaining is how bad a number will we see.

– The USDA export report for the week ending 21st July reflected the abysmal demand seen in the market. For the soon to be no longer 2021/22 season net reductions of 4,000 bales were reported. For the new crop 2022/23 season we saw meagre sales of 55,700 bales reported. Exports carried on the disappointing tone of the report with 252,900 bales reported as shipped.

– CFTC cotton on call report, based positions on 22nd July showed little change in the net position. The overall current crop on call sales position stands at 61.503 contracts which is the fourth highest for this week of the year, whilst the Dec only position stands at 36,838 contracts which is the highest for this time.

Conclusion

Prices have held the recent 82.54 low and EAP suggest that a counter trend bounce may occur that could take prices as high as the low 100’s. Potentially, a test of the 200 day moving average is possible fuelled by some courageous end user physical buying and/or a hurricane inspired series of events. However, EAP maintain our longer term viewpoint that a final move to the 70’s will eventually play out by next May and the 22/23 season will prove to be an inverted season.

Useful links

*Please note that we only share CFTC CTO on weekend reports.

Written by:

Chris Williams

Copyright statement

No image or information display on this site may be reproduced, transmitted or copied (other than for the purposes of fair dealing, as defined in the Copyright Act 1968) without the express written permission of Earlam & Partners Ltd. Contravention is an infrigement of Copyright Act and its amendments and may be subject to legal action.

Disclaimer

The risk of loss associated with futures and options trading can be substantial. Opinions set forth herein should not be viewed as an offer or solicitation to buy, sell or otherwise trade futures, options or securities. All opinions and information contained in this email constitute EAP’s judgment as of the date of this document and are subject to change without notice. EAP and their respective directors and employees may effect or have effected a transaction for their own account in the investments referred to in the material contained herein before or after the material is published to any customer of a Group Company or may give advice to customers which may differ from or be inconsistent with the information and opinions contained herein. While the information contained herein was obtained from sources believed to be reliable, no Group Company accepts any liability whatsoever for any loss arising from any inaccuracy herein or from any use of this document or its contents. This document may not be reproduced, distributed or published in electronic, paper or other form for any purpose without the prior written consent of EAP. This email has been prepared without regard to the specific investment objectives, financial situation and needs of any particular recipient. For the customers of EAP, this email is produced exclusively for our business and expert clients, it is not for general distribution and our services are not available to private clients. Past performance is not indicative of future results.