- Jo Earlam

- July 24, 2022

- 8:12 pm

- 10 min read

Cotton finally starts to calm down and find its feet again

It is the mark of an educated mind to be able to entertain a thought without accepting it!

CTZ22 – 90.89 – (-0.71)

CTH23 – 87.30 – (-0.58)

CTK23 – 85.60 – (-0.51)

CTN23 – 83.73 – (-0.49)

CTZ23 – 77.08 – (-0.01)

Zhengzhou CF209 – 15,470 (+535)

Cotlook “A” Index – 109.65 (-1.25)

Daily volume – 13,883

AWP – 103.96

Open interest – 181,647

Certificated stock – 8,277

Z22/H23 spread – (+3.59)

Z22/Z23 spread – (+13.81)

September Options Expiry – 19th August 2022

December Options Expiry – 11th November 2022

December 1st Notice Day – 23rd November 2022

Introduction

– For the 1st time in 6 weeks Cotton has finished the week higher than the previous week! Z22 traded in a range of just 500 points between 88.80 and 93.80 before closing the week up 218 points at 90.89.

– Futures volume has dropped significantly this week, averaging just 19,256 daily, being 2/3rds of the previous week, whilst option trading remained active at 10,974 daily. Calls traded more than twice the volume of puts and there remains a distinct skew to “out of the money” calls against their comparative “out of the money” puts. As opined last week, we have seen implied at the money volatility drop off a little to 44% in Z22 and should be of no surprise noting the range of the week!

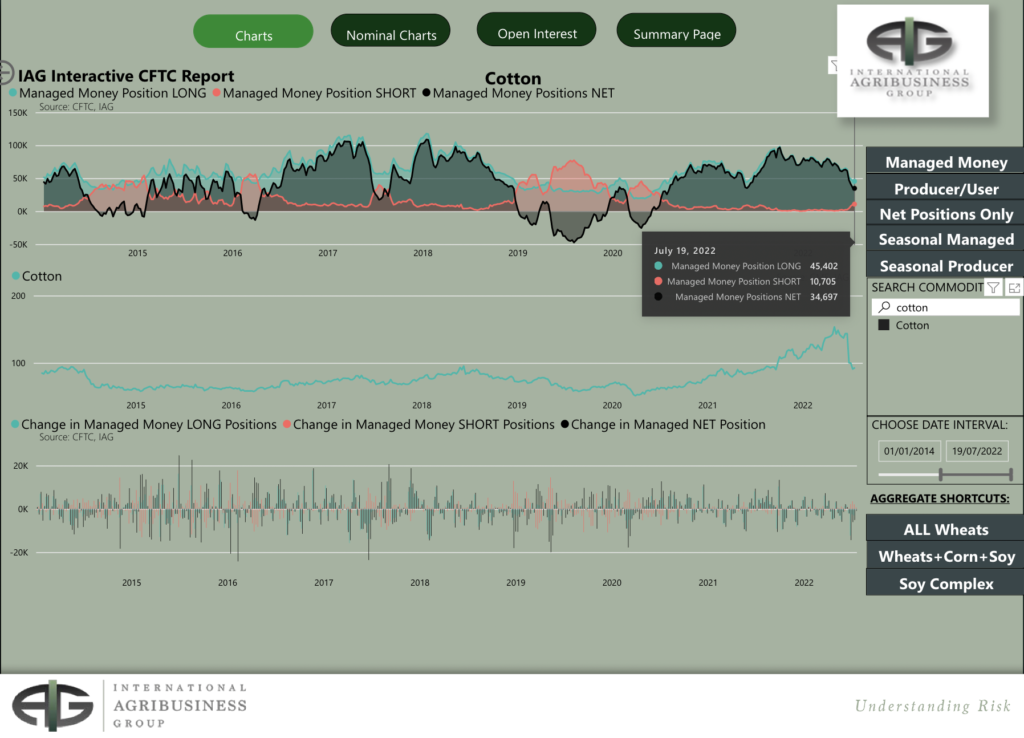

– The CFTC COT report as of last Tuesday showed that Managed Money (MM) were once again sellers. MM sold a net 934 to take their overall net long down to 34,967 contracts. Between MM, OR and NR the net long is down to a comparatively small 39,985 contracts. Back on the 17th May when prices peaked, this position was 90,024 contracts long. In short summary, a panic liquidation of circa 50k contracts/5 million bales has seen a circa 40c/lb drop in the spot price of Z22!

– Their remaining long is almost certainly a losing position and would not be a surprise us to see additional MM selling on any test of 100c/lb! Thanks as always to our friends at IAG for pictorial evidence of MM detailed below.

– EAP was lucky enough to travel to Greece last week to see some of our Mediterranean friends. Reliable information suggests that the Greek new crop will produce between 310 to 320k mt, available in volume from the the 1st week of October. Sales to date are no more than 50k mt and Ginner basis levels remain stubbornly high at between 1500 to 1700 on Z22 basis FOT Greece.

– This Cotton is likely to be in high demand because it is a well regarded piece of Cotton and like its smaller producing neighbour Spain, it is non contaminated and available for shipment at a time when not much else will be!

– Neighbouring Turkey is usually the main buyer of Greek, but again if reliable information from that market is to be taken seriously, any Greek ginner keen to sell additional Cotton now, may be wise to take the current historically high basis and historically low basis, noting the situation in Turkey is not improving at all!

– Delayed and high priced purchases of Cotton from many of the larger merchants have put the Turkish spinner under enormous pressure when there is at least 100k of available raw cotton in Turkish warehouses and a rising yarn inventory searching in vain for a home! Moreover, noting spinners have much higher expenses in the face of a 750 to 800k mt Turkish crop, EAP believe that selling it may take rather more time than many might think. Word on the street is many Turkish spinners will not be operating at full capacity until the end August or early September.

– The technical situation looks pretty clear to us and we maintain we are in a counter trend wave 4 that will likely fail near to 100c/lb and we can probably expect a sideways to higher market in the days and weeks ahead.

– Pictorial evidence of Z22 is provided below where we see a market which will be rangebound and much less volatile than the last 2 months!

– As a final thought take a look at two of our favourite leading indicators for the Cotton market being Weiqiao and Texhong. The charts speak for themselves about the yarn business right now!

Conclusion

Prices have held the recent 82.54 low and EAP suggest that a counter trend bounce may occur that could take prices as high as the low 100’s. Potentially, a test of the 200 day moving average is possible fuelled by some courageous end user physical buying and/or a hurricane inspired series of events. However, EAP maintain our longer term viewpoint that a final move to the 70’s will eventually play out by next May and the 22/23 season will prove to be an inverted season.

Useful links

*Please note that we only share CFTC CTO on weekend reports.

Written by:

Jo Earlam

Copyright statement

No image or information display on this site may be reproduced, transmitted or copied (other than for the purposes of fair dealing, as defined in the Copyright Act 1968) without the express written permission of Earlam & Partners Ltd. Contravention is an infrigement of Copyright Act and its amendments and may be subject to legal action.

Disclaimer

The risk of loss associated with futures and options trading can be substantial. Opinions set forth herein should not be viewed as an offer or solicitation to buy, sell or otherwise trade futures, options or securities. All opinions and information contained in this email constitute EAP’s judgment as of the date of this document and are subject to change without notice. EAP and their respective directors and employees may effect or have effected a transaction for their own account in the investments referred to in the material contained herein before or after the material is published to any customer of a Group Company or may give advice to customers which may differ from or be inconsistent with the information and opinions contained herein. While the information contained herein was obtained from sources believed to be reliable, no Group Company accepts any liability whatsoever for any loss arising from any inaccuracy herein or from any use of this document or its contents. This document may not be reproduced, distributed or published in electronic, paper or other form for any purpose without the prior written consent of EAP. This email has been prepared without regard to the specific investment objectives, financial situation and needs of any particular recipient. For the customers of EAP, this email is produced exclusively for our business and expert clients, it is not for general distribution and our services are not available to private clients. Past performance is not indicative of future results.