- Jo Earlam

- May 29, 2022

- 3:30 am

- 10 min read

July cotton breaks key support as the 2122 season draws to a close.

You can't change the weather but you can profit from it!

CTN22 – 139.42 (-1.19)

CTZ22 – 122.95 (-1.38)

CTH23 – 118.73 (-0.81)

CTK23 – 115.44 (-0.61)

CTN23 – 111.91 (-0.48)

Zhengzhou CF209 – 20,475 (-40)

Cotlook “A” Index – 158.70 (-4.50)

Daily volume – 21,363

AWP – 139.86

Open interest – 211,791

Certificated stock – 1,088

July / Dec spread – (+16.47)

July Options Expiry – 10th June 2022

July 1st Notice Day – 24th June 2022

September Options Expiry – 19th August 2022

December Options Expiry – 11th November 2022

December 1st Notice Day – 23rd November 2022

Introduction

– It was a less volatile week for the Cotton market with old crop July breaking key support at 140.75 on Friday, having traded in an 809 point range between 139.05 and 147.14, before ending the week down 285 points from the previous Friday close.

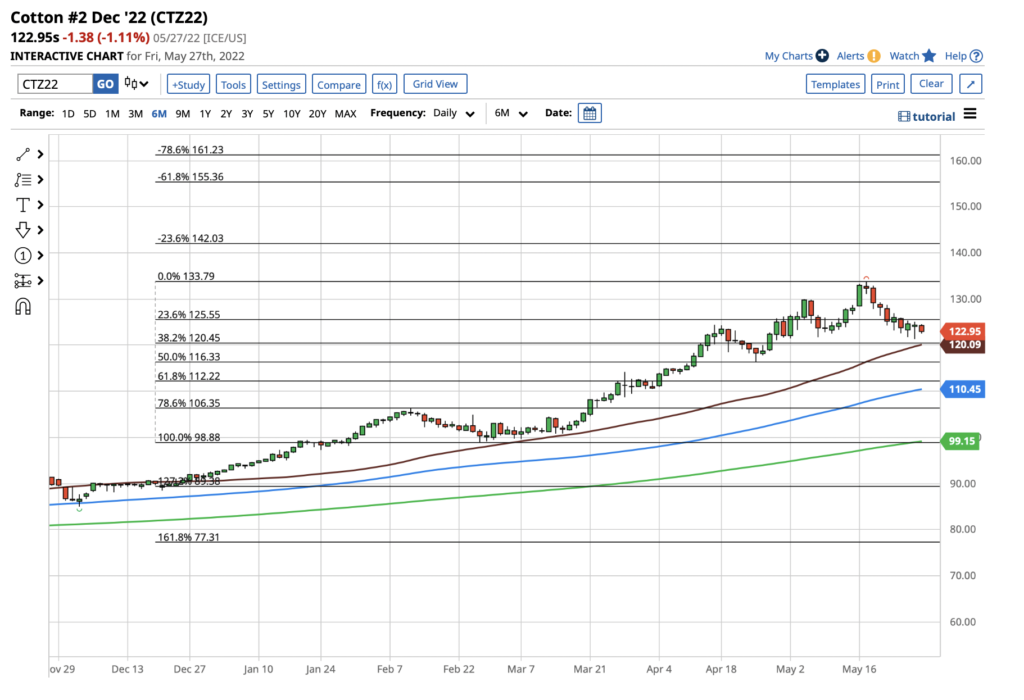

– For new crop Z22, prices traded in a 552 point range between 121.35 and 126.87 before closing the week down 223 points at 122.95. Open interest in Z22 now exceeds that of old crop July by nearly 11k contracts and Friday marked the 1st day of the Rogers roll period when funds roll from N22 to Z22 and lasts for 3 consecutive business days.

– Futures volume was almost exactly the same as the previous week, averaging 30,030 contracts daily. Options were quieter, averaging 5,924 with puts trading almost as actively as calls and we have not been able to say that for a month. Perhaps this is a hint that there is a potential change in trend in the making?

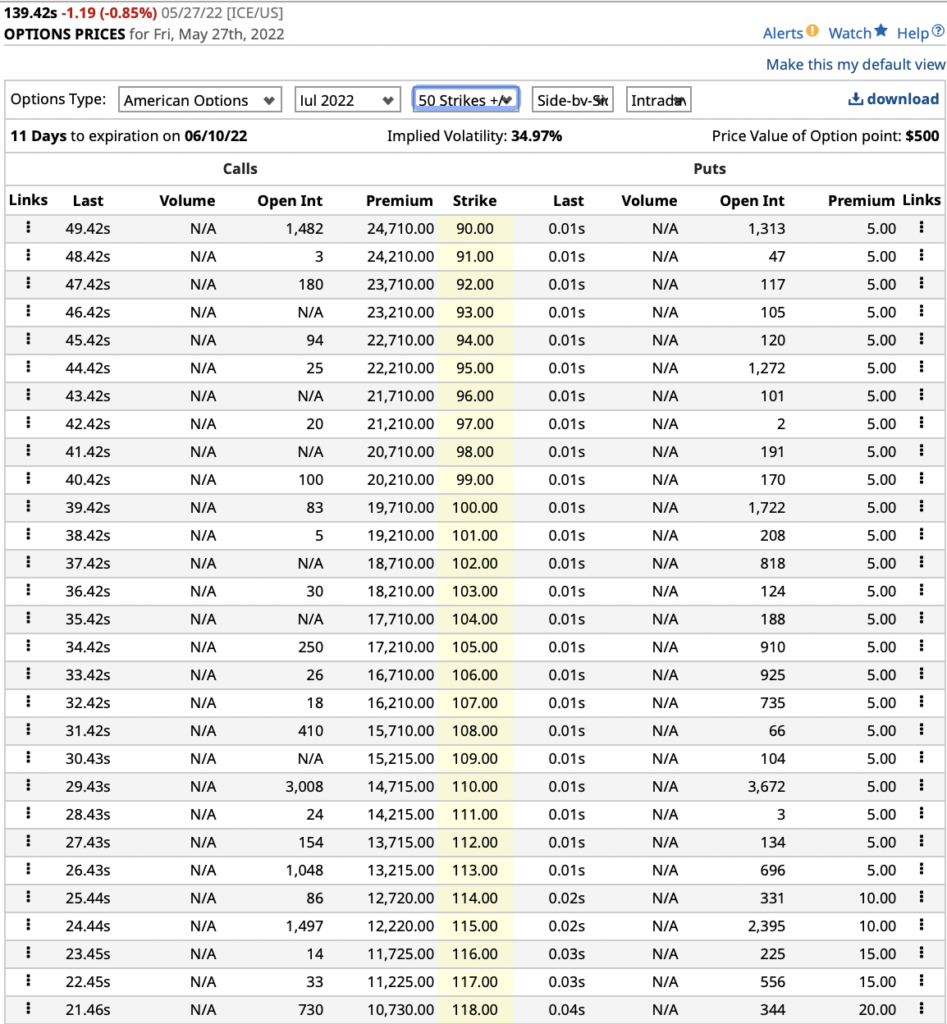

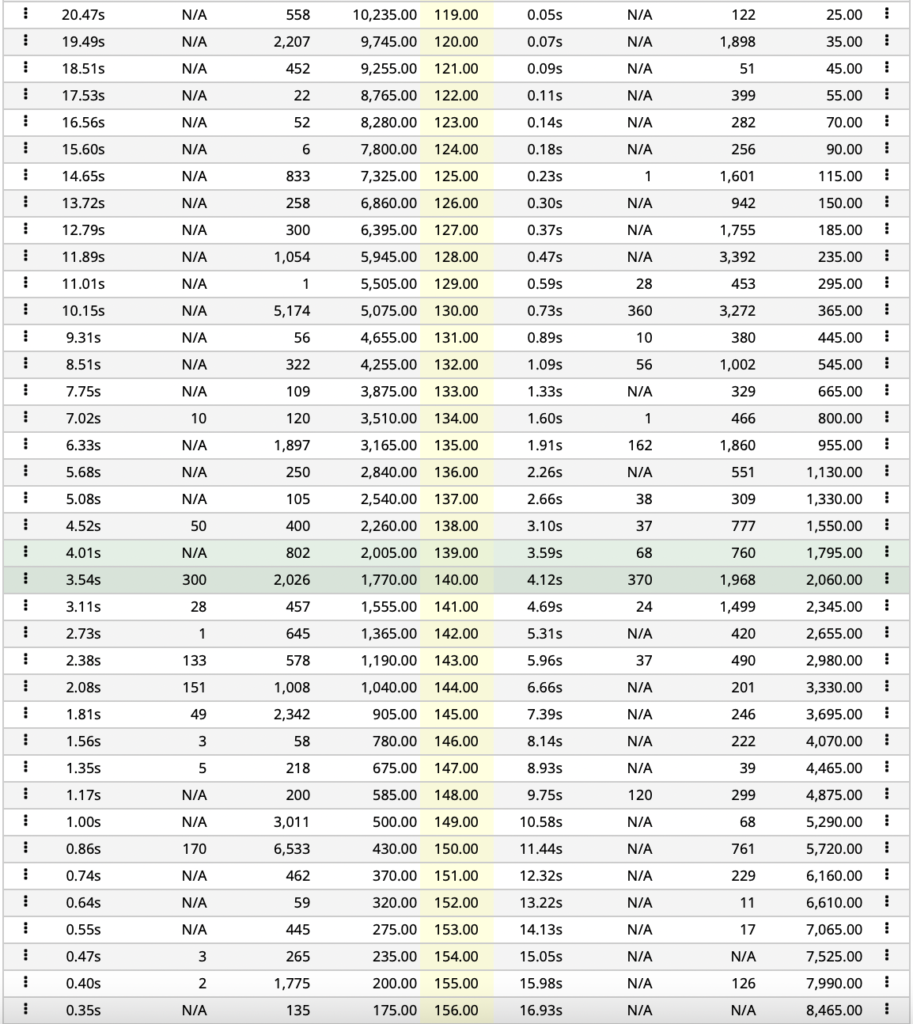

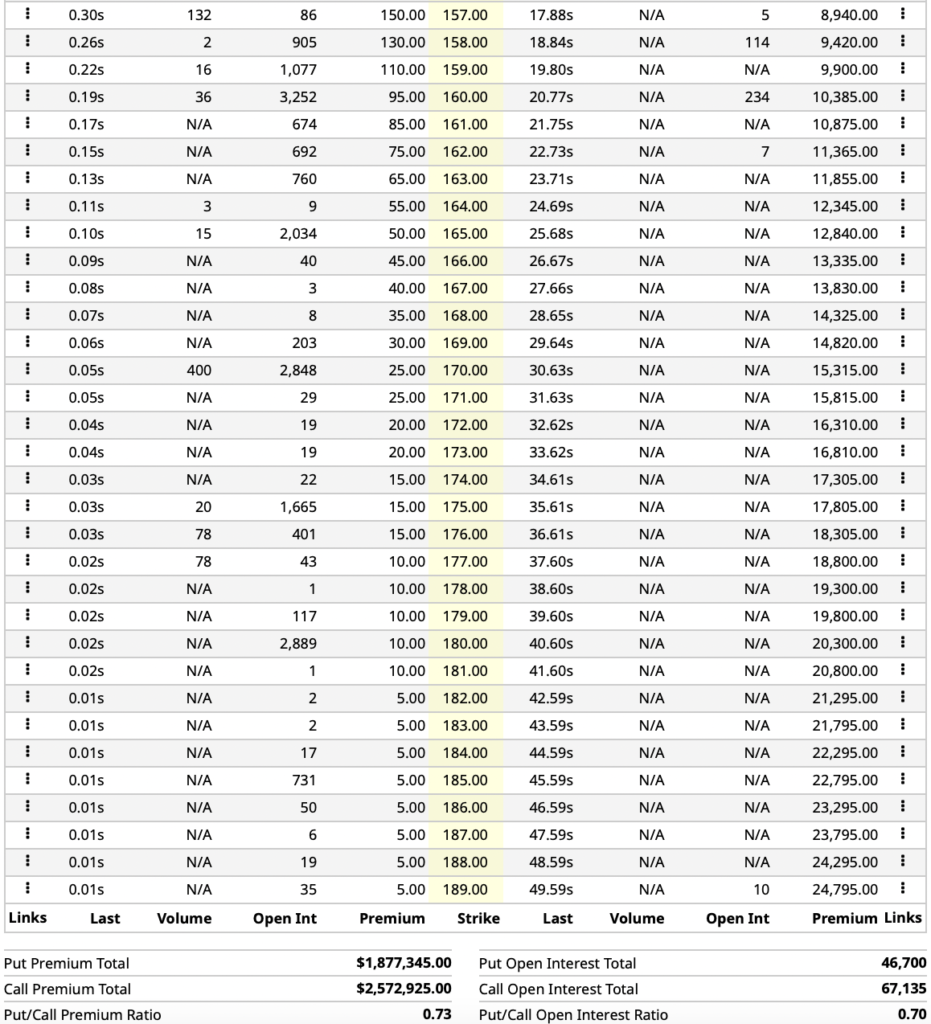

– July option expiry is just 2 weeks away and we have enclosed the open interest position below. Note how there is a lot of open interest at the 130 strike for both puts and calls and may be a place for futures to settle near when options expire in 2 weeks time noting maximum pain for holders of expiring options!

– Now that there is just one more trading day left in May, noting Monday is the Memorial day bank holiday and EAP’s year on year statistical analysis only looks at seasons beginning 1st June through to 31st May (thereby looking at Z, H, K & N futures months of the same season) we can take a look back at what has transpired over the last year. The chart of N22 is enclosed below!

– We have recently chosen to look at our seasons in a slightly different way in an effort to see whether opportunities for hedging can arise by doing so. We have now looked at the statistics of a season beginning 1st January all the way through to the 31st May the following year (effectively a 17 month season) but as always only using futures months of the same season. In other words, the December futures month is used from 1st January through to when March becomes the front month on account of having the highest open interest (lets assume 1st November). This means that the 22/23 season can already be examined having effectively been 5 months in the making!

– Just looking at this century the percentage move for a cotton season lasting 17 months rises to just over 75%. The last season price range is the 2nd highest since 1960 (eclipsed by the famous 10/11 season) but in percentage move terms was not an overly extraordinary season!

– There have been 5 occasions including the 21/22 season when the market has moved more than 100% this century out of 21 completed seasons.

– For the 22/23 season (so far) and assuming a 1st January start date the move is 92.50 to 133.79 which is a move of just under 45%. Clearly if we are to move an average 75%, one can expect that we have yet to see the full extent of the move for the season ahead.

– The skill will be to anticipate what is in store for the 22/23 season? To do that will require a look at not only the statistics, but the technicals (reading charts), Cotton fundamentals, Money (hedge funds) and Macros which EAP will try to assess in the weeks ahead.

– In addition we will be looking at the average number of days between highs and lows going back as far as we can based on a 17 month season and sharing our insights with our clients.

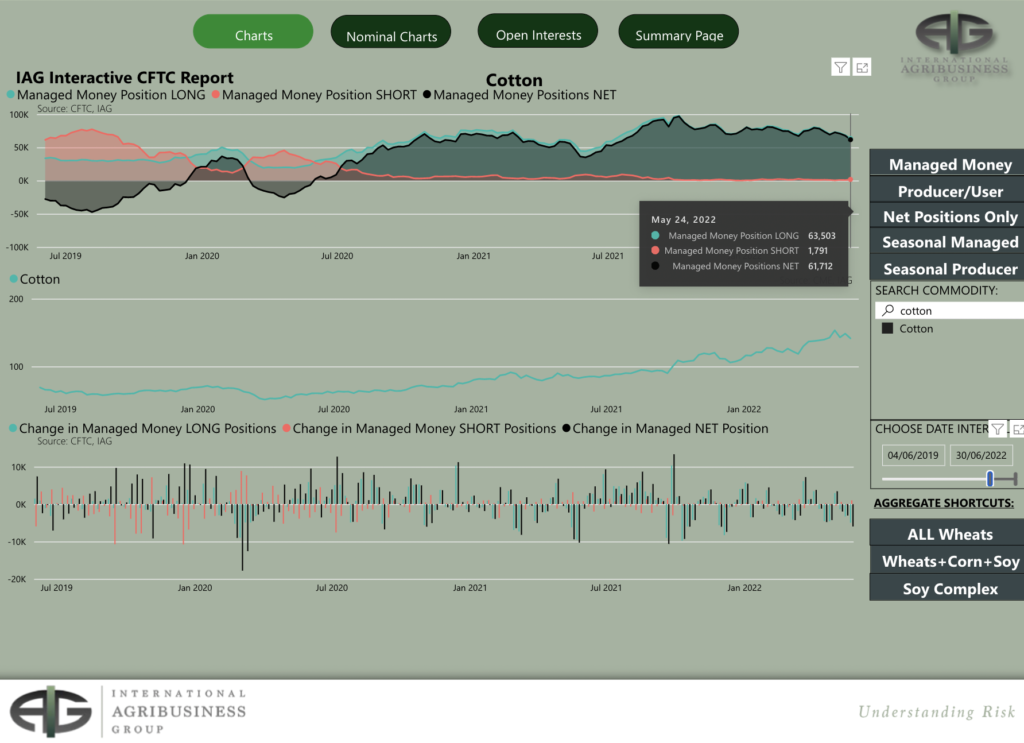

The CFTC COT report as of last Tuesday showed Managed Money (MM) to be exiting some of their longs once again. Thanks to our friends at IAG as always for the pictorial evidence of the fact below.

Between MM, OR and NR their long position is down to a net long of 83,343 contracts.

– In other news, there were talks this week of Russia opening Ukraine’s ports to allow for grain and food shipments, in return for lifting of some sanctions by European nations. This would be a huge relief for many nations who are facing food shortages at the moment. However, there are major safety concerns over vessels & crews sailing into a war zone. As of Friday, it looks like the US have said there are no talks about relaxing the sanctions in order for these grain exports to occur.

– The Memorial Day weekend marks the beginning of 2022 summer season and noting that stocks, bonds and all markets have been especially volatile over recent weeks. we should be expecting more of the same as traders take some much needed rest! As participation declines, market moves can often be exaggerated, noting we have a war in Ukraine, Inflation is at its highest in decades and tensions between the USA and China have increased.

Conclusion

We maintain that involvement in N22 is something to avoid if possible, but for new crop December we maintain this contract is very fully valued above 125c/lb and the recent spike in N22 offered a golden opportunity to lock in a good proportion of new crop sales 25c/lb higher than one could get just 6 weeks ago.

Useful links

*Please note that we only share CFTC CTO on weekend reports.

Written by:

Jo Earlam

Copyright statement

No image or information display on this site may be reproduced, transmitted or copied (other than for the purposes of fair dealing, as defined in the Copyright Act 1968) without the express written permission of Earlam & Partners Ltd. Contravention is an infrigement of Copyright Act and its amendments and may be subject to legal action.

Disclaimer

The risk of loss associated with futures and options trading can be substantial. Opinions set forth herein should not be viewed as an offer or solicitation to buy, sell or otherwise trade futures, options or securities. All opinions and information contained in this email constitute EAP’s judgment as of the date of this document and are subject to change without notice. EAP and their respective directors and employees may effect or have effected a transaction for their own account in the investments referred to in the material contained herein before or after the material is published to any customer of a Group Company or may give advice to customers which may differ from or be inconsistent with the information and opinions contained herein. While the information contained herein was obtained from sources believed to be reliable, no Group Company accepts any liability whatsoever for any loss arising from any inaccuracy herein or from any use of this document or its contents. This document may not be reproduced, distributed or published in electronic, paper or other form for any purpose without the prior written consent of EAP. This email has been prepared without regard to the specific investment objectives, financial situation and needs of any particular recipient. For the customers of EAP, this email is produced exclusively for our business and expert clients, it is not for general distribution and our services are not available to private clients. Past performance is not indicative of future results.