- Jo Earlam

- June 2, 2022

- 10:11 am

- 10 min read

Rains in Texas, Shipments delays and yarn stocks build!

Bull markets are born on pessimism, grow on skepticism, mature on optimism, and die on euphoria. -Sir John Templeton

CTN22 – 139.11 (+3.05)

CTZ22 – 120.10 (+1.67)

CTH23 – 115.77 (+1.47)

CTK23 – 112.55 (+1.16)

CTN23 – 109.10 (+0.79)

Zhengzhou CF209 – 20,320 (-195)

Cotlook “A” Index – 156.95 (-0.50)

Daily volume – 36,672

AWP – 139.86

Open interest – 210,800

Certificated stock – 1,087

July / Dec spread – (+19.01)

July Options Expiry – 10th June 2022

July 1st Notice Day – 24th June 2022

September Options Expiry – 19th August 2022

December Options Expiry – 11th November 2022

December 1st Notice Day – 23rd November 2022

Introduction

– It was a rather nasty start for Cotton in a Memorial Day holiday shortened week, that has seen the end of the Rogers Roll period on Wednesday, only to see a sharp recovery today highlighted in the chart of Z22 below where we have included a 1 month and 1 year chart. Note how the longer term chart has respected Fib retrace levels almost exactly!

– Open interest in Z22 continues to climb over old crop N22, which now exceeds the latter contract by nearly 26k contracts.

– Prices in old crop July have also faltered, despite the supportive unfixed “on call” position of end users, who will have welcomed the weakness seen this week in the face of the 2nd highest unfixed position in the 22 years of data available. Only the 2018 season exceeds the one we have today!

– Report 21 tonight confirmed this and is detailed on the link below and shows positions as of last Friday when July closed at 139.42. The unfixed portion is now down to a net 32,383 contracts net unfixed.

– Continued fixations will have been seen against July this week with July dipping to as low as 134.12 today, before bouncing and noting there are only 3 weeks to go when all this must be cleared up.

– Shipments by merchants to end users are still not occurring and often 3 to 4 months late and it is perhaps not too surprising there is talk of spinners exercising the right to invoice back! This is not only for fixed priced sales that are not being shipped in the face of a 19c/lb inverse but also for unfixed basis sales against the July contract, leading one to question if some of these “unfixed basis July” will just be closed out! The question springs to mind of whether the spinner actually knows his rights?

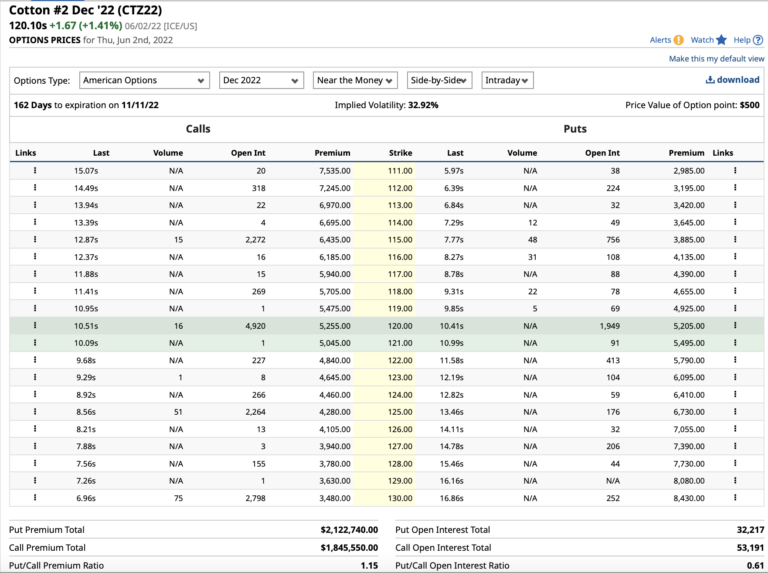

– Last weekend we looked at the open interest in July options but today we are taking a look at the open interest in new crop Z22 options and the near the money option open interest is included below, with a link to the entire open interest in the link at the bottom of this mail.

– There are bets all the way out to the 250 strike in December but volume bets at the 150 strike in particular and going all the way to the 200 strike. The put open interest is rather less and the skew remains heavily to the calls!

– Whilst it is clear that India and Bangladesh are still purchasing available Cotton it is not the same elsewhere and yarn stocks are building fast in the likes of Turkey and other Far Eastern markets, despite the lack of available Cotton. Demand concerns and build up of yarn is likely to weigh on the market in our opinion and a sell the rallies approach should prevail against Z22!

Conclusion

We maintain that involvement in N22 is something to avoid if possible, but for new crop December we maintain this contract is very fully valued above 125c/lb and the recent spike in N22 offered a golden opportunity to lock in a good proportion of new crop sales 25c/lb higher than one could get just 6 weeks ago.

Useful links

*Please note that we only share CFTC CTO on weekend reports.

Written by:

Jo Earlam

Copyright statement

No image or information display on this site may be reproduced, transmitted or copied (other than for the purposes of fair dealing, as defined in the Copyright Act 1968) without the express written permission of Earlam & Partners Ltd. Contravention is an infrigement of Copyright Act and its amendments and may be subject to legal action.

Disclaimer

The risk of loss associated with futures and options trading can be substantial. Opinions set forth herein should not be viewed as an offer or solicitation to buy, sell or otherwise trade futures, options or securities. All opinions and information contained in this email constitute EAP’s judgment as of the date of this document and are subject to change without notice. EAP and their respective directors and employees may effect or have effected a transaction for their own account in the investments referred to in the material contained herein before or after the material is published to any customer of a Group Company or may give advice to customers which may differ from or be inconsistent with the information and opinions contained herein. While the information contained herein was obtained from sources believed to be reliable, no Group Company accepts any liability whatsoever for any loss arising from any inaccuracy herein or from any use of this document or its contents. This document may not be reproduced, distributed or published in electronic, paper or other form for any purpose without the prior written consent of EAP. This email has been prepared without regard to the specific investment objectives, financial situation and needs of any particular recipient. For the customers of EAP, this email is produced exclusively for our business and expert clients, it is not for general distribution and our services are not available to private clients. Past performance is not indicative of future results.