CTZ21 116.46 (-2.36)

CTH22 112.91 (-2.53)

CTK22 111.51 (-2.39)

CTN22 109.32 (-1.93)

Zhengzhou CF201 – 21,440 (-20)

Cotlook “A” Index – 126.45 (+1.25) – 3rd Nov

Daily volume – 41,469

AWP – 93.37

Open interest – 284,209

Certificated stock – 18,357

Dec/March spread – (+3.55)

December Options Expiry – 12th November 2021

December 1st Notice Day – 23rd November 2021

March Options Expiry – 11th February 2022

March 1st Notice Day – 22nd February 2022

Introduction

– The week so far has seen 4 days of three figure daily market moves, which have included a fresh seasonal high on the Dec ’21 contract of 121.67 usc/lb. Whilst Dec ’21 may still be the lead month for purposes of continuation charts and the like, March ’22 is now the effective lead month by dint of open interest. March ’22 today closed at 112.91 usc/lb, down 253 points on the day. Whilst the daily moves are often more volatile above 100 usc/lb, the current volatility is also driven by the approaching Dec ’21 expiry and the March ’22 contract cannot completely escape the influence of its predecessor month.

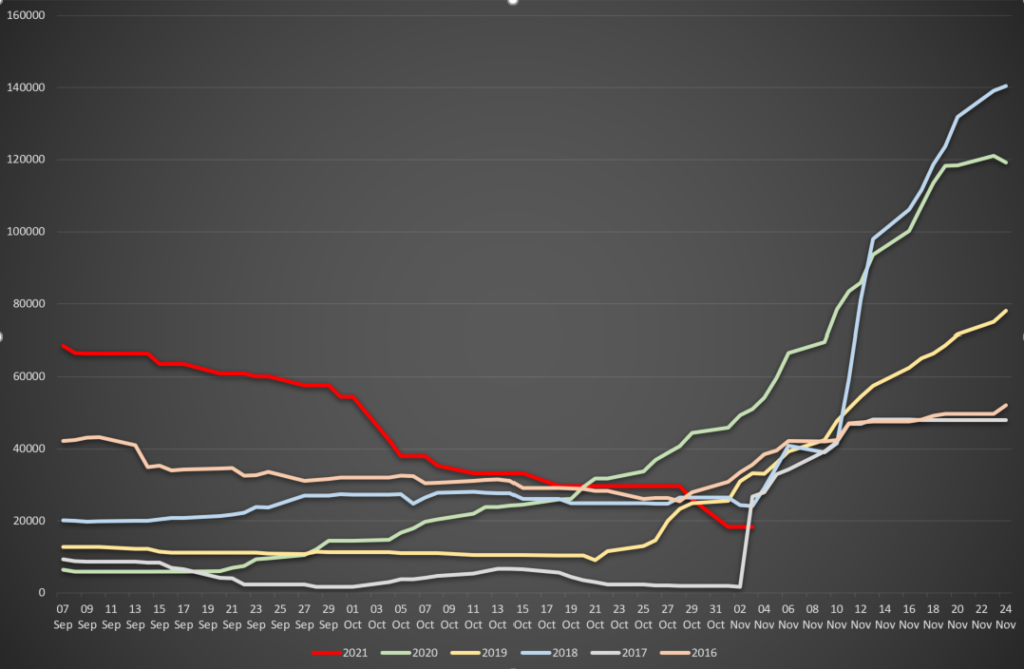

– As we approach Dec ‘21 FND, many unfixed mills may not be paying enough attention to the levels of certificated stock. As is normal approaching the harvest, the levels of cert stock fell post the expiry of the July ’21 contract. However, due to the delayed US harvest, stocks have continued to fall throughout the month of November and now stand at 18,357 bales. This is the lowest level since 6th October last year when stocks were 16,775 bales. In itself, that is not an alarming observation, but the difference is that 16,775 bales marked the low for last year’s cert stock volume as cotton began to be certified beyond this point. By our current date in 2020 cert stocks had already climbed to 54,155 bales. In fact, over the previous 5 years, the stocks on 4th November were as follows: 2020 54,155 bales; 2019 33,212 bales; 2018 35,045 bales; 2017 32,922 bales; 2016 39,557 bales.

– As can be seen from the chart below we are running out of time for cert stock to build. In most of the previous five seasons cert stock was not only above the current level at this date but was also already in an uptrend. The exception was 2017 when, with a 21 million bale crop on the way, the trade made a concerted move to build cert stock in order to force carry on to the Z/H which led to a sharp jump in cert stock level at the start of November.

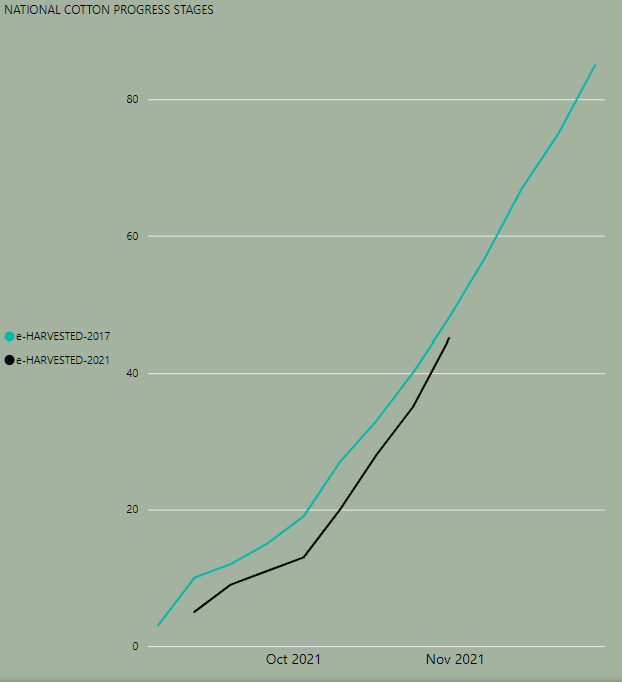

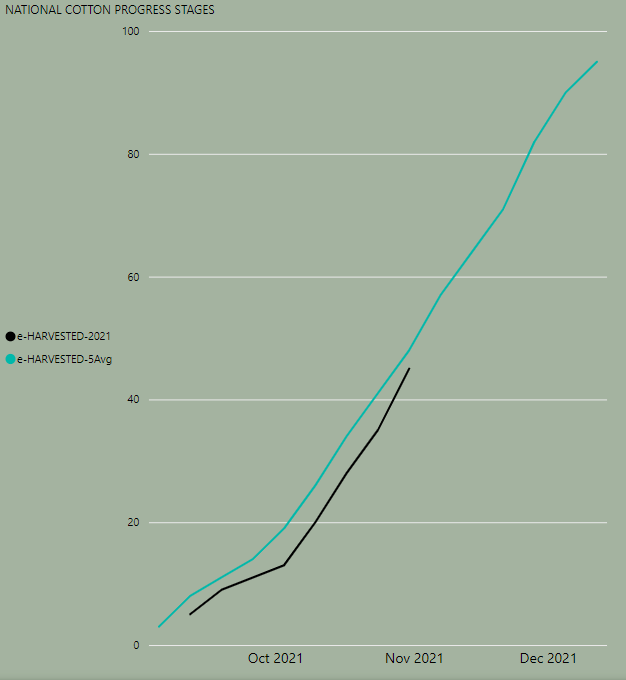

– The below two charts show current harvest progress. The first shows current harvest progress lagging the 5-year average and the second shows it behind the 2017 pace for this time of year. Whilst the current harvest pace is 45% vs. the equivalent 2017’s 48%, it should also be remembered that we are currently looking at a USDA estimated crop of 18.5 million bales vs. 21 million bales in 2017 i.e. on 4th November 2017 there was more cotton available to bring to the board than on 4th November 2021.

– So, why does this matter? First of all, a deliberate build-up of cert stock would be a signal to the market of an intended (or threatened) delivery on the Z21 contract and may well be one of the few things that can still come to the rescue of the unfixed on call buyer at this late stage. However, it is clear that there is precious little time remaining for this to occur!

– And what of the other side of the equation? As of today, the total US sales commitments stand at 9.072 million bales and shipments at only 2.207 million bales. With good volume of contracted sales to China for Q1 and the in-country US basis in favour of taking delivery, we would imagine a merchant could easily justify taking the board to the powers that be. Should such a scenario take place then anyone on the short side would be faced with two options: either find some non-existent bales to deliver or cut their losses at whatever level Dec ’21 is. In other words, of a taker of the board does emerge things are set up for a classic short squeeze on the Dec!

– In view of the above, this week’s CFTC Cotton on Call Report reporting a draw down of only 1,661 contracts in the Dec ’21 net on call sales position and an overall 1,539 increase in the current crop position seems negligent in the extreme. To put it quite simply, if you are unfixed the Dec ’21 at this point, letting your position run and hoping for salvation is no more a strategy than jumping out of a plane in the hope of landing on a trampoline!!!!!

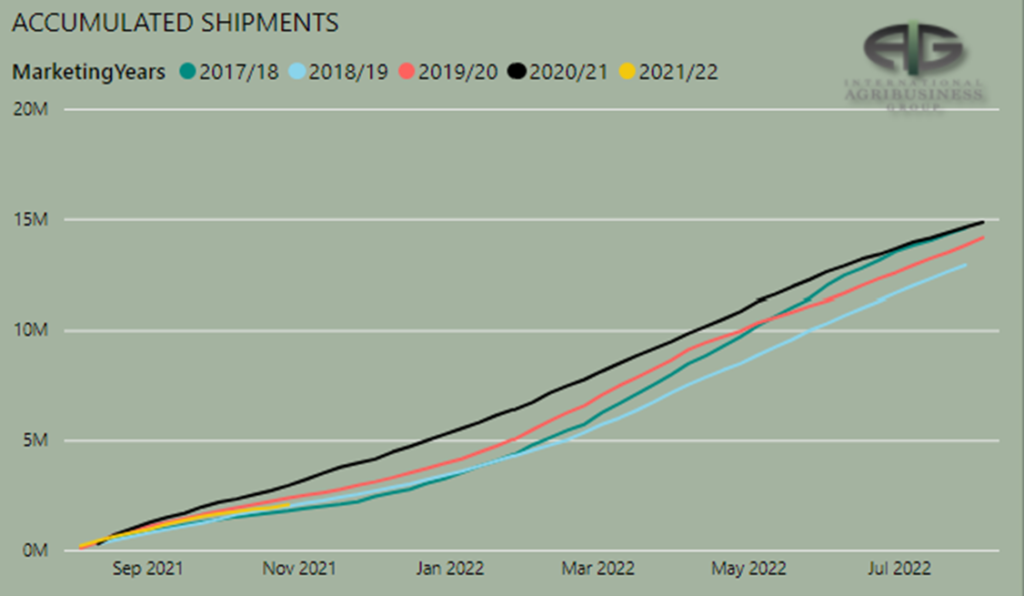

– The USDA export sales report for the week ending 28th October showed sales declining for another week. Total net sales were 139,100 bales and China was once again the main buyer with 44,800 bales. Pima sales, on the other hand, reached an MY high of 31,800 bales. Exports were up for the week, but still only reached 141,900 bales and, as we have previously commented, this pace needs to pick up in order to reach the USDA export target of 15.5 million bales. Though, as can be seen from the below chart from our friends at IAG, this is not an impossible feat at this early stage of the season.

– On a technical viewpoint only and we do stress this point, the price action on Tuesday was quite bearish on the basis that we reached a new seasonal high of 12167 but saw a close that was 442 points lower. We have long pointed out that such aggressive moves often signal a change in trend. Cotton had also been up for 7 consecutive days and was over bought and moved up as much as 1579 points in just 2 weeks.

– A degree of caution is perhaps warranted at current levels and we remind everyone that the period from now until Z21 1st notice day on 23rd November is likely to be extremely volatile. Daily movement for Z21 is still averaging about 400 points daily since we broke the 97c/lb level and we expect this to continue all the way through the expiry of the December contract!

Conclusion

Cotton has made another new high on Tuesday at 121.67 but has so far not been able to hold the 120’s on a closing basis. Prices remain remarkably firm and whilst business is occurring we are of the opinion that there will be some demand destruction at current prices. Pull backs are entirely possible but almost certainly will be short lived. In the event of weakness basis March to between 100 and 105c/lb we believe it would be an opportunity to buy rather than anything more sinister! We are strongly of the opinion that prices are likely to remain in the 100’s for the rest of the season and the final seasonal high will not be seen until the part of the 1st quarter of 2022.

Useful links

*Please note that we only share CFTC CTO on weekend reports.

Written by:

Jo Earlam

Copyright statement

No image or information display on this site may be reproduced, transmitted or copied (other than for the purposes of fair dealing, as defined in the Copyright Act 1968) without the express written permission of Earlam & Partners Ltd. Contravention is an infrigement of Copyright Act and its amendments and may be subject to legal action.

Disclaimer

The risk of loss associated with futures and options trading can be substantial. Opinions set forth herein should not be viewed as an offer or solicitation to buy, sell or otherwise trade futures, options or securities. All opinions and information contained in this email constitute EAP’s judgment as of the date of this document and are subject to change without notice. EAP and their respective directors and employees may effect or have effected a transaction for their own account in the investments referred to in the material contained herein before or after the material is published to any customer of a Group Company or may give advice to customers which may differ from or be inconsistent with the information and opinions contained herein. While the information contained herein was obtained from sources believed to be reliable, no Group Company accepts any liability whatsoever for any loss arising from any inaccuracy herein or from any use of this document or its contents. This document may not be reproduced, distributed or published in electronic, paper or other form for any purpose without the prior written consent of EAP. This email has been prepared without regard to the specific investment objectives, financial situation and needs of any particular recipient. For the customers of EAP, this email is produced exclusively for our business and expert clients, it is not for general distribution and our services are not available to private clients. Past performance is not indicative of future results.