CTZ22 91.60 (-1.21)

CTH23 87.88 (-1.02)

CTK23 86.11 (-0.95)

Zhengzhou CF209 – 14,790 (+395)

Cotlook “A” Index – 129.30 (-0.70) – 20th July

Daily volume – 14,686

AWP – 109.10

Open interest – 180,119

Certificated stock – 8,277

Dec / March spread – (+3.72)

September Options Expiry – 19th August 2022

December Options Expiry – 11th November 2022

December 1st Notice Day – 23rd November 2022

Introduction

– After the “excitement” of last week and, indeed, recent times, this week’s action has been much more subdued. It may well be attributable to the summer doldrums as many would opine, or we may (whisper it) be seeing the market establishing a base. If it does prove to be the latter, it will be a relief to both mills and merchants alike as they try to establish levels at which business may be done.

– After a solid start, Chinese Reserve procurement has slowed notably this week with a low of just 480 MT purchased on Monday and around 3,000 MT daily has been picked up since then for a total now standing at 26,440 MT. On the surface this would indicate that the abundance of supply is not what it previously seemed and a better home for cotton is to be found in the open market. However, since the start of the Reserve purchase the CZCE has lost 1,325 RMB/MT whilst the CC Index has lost 1,820 RMB/MT. Cash business is reported as slow and taking place at around 16,000 RMB/MT. This is similar level to today’s Reserve price which suggests that those who need to buy are willing to match the Reserve but not outbid it.

– So, despite the slow pace the market is hardly screaming at us that supply is tighter than we think. A conclusion is tough to draw. Reports in country are that ginners are resisting delivering at these prices, where they would reportedly crystallise an 8,000 RMB/MT loss (over 50 usc/lb), and are pushing for an increased Reserve price and volume. There is even talk that this was pushed to President Xi on his visit to Xinjiang last week (always remember that the major ginner in Xinjiang is the army!).

– Whether this is indeed the case or merely market talk remains to be seen, but the action from here will give us a very good indication as to the China balance sheet. If supply is truly burdensome then at some point deliveries to the Reserve will have to pick up in pace. However, if deliveries do not pick up then this should also be accompanied by an appreciation in the domestic free market price which will indicate that supply is notably tighter than previously reported. Pay careful attention!!!

– In the rest of the world, China has been markedly absent in the yarn markets leading to a concerning build of yarn stocks in all major yarn producing markets. The lack of a bid on yarn has made it very tough to determine a break-even price for cotton purchases, though tentative indications are, at present, in the mid 90’s landed.

– At EAP we focus a lot on the importance of currencies but have perhaps neglected the Pakistani Rupee of late. Considering that Pakistan is both an important producing and consuming market the movement of the PKR is of significant importance. As can be seen from the chart below, it has been badly hit against the dollar in recent months. This of course makes cotton imports much more expensive against domestic production, however, it will have the advantage of making yarn spun from domestic cotton more competitive in the export market in dollar terms.

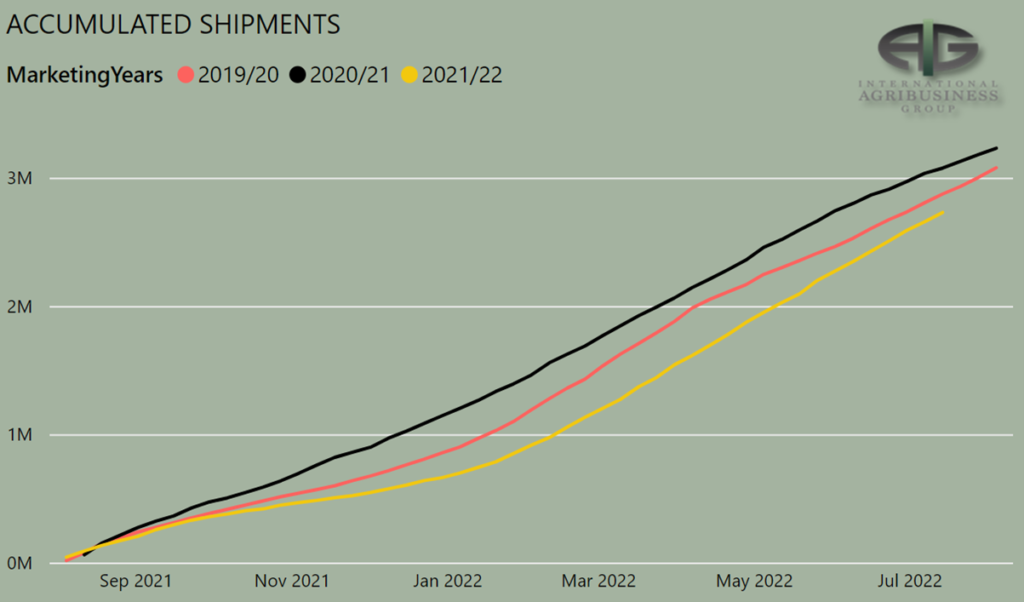

– The USDA export report for the week ending 14th July showed total sales over the two crop years of 167,300 bales. Vietnam was the largest buyer with 101,600 bales across the two crop years. This does seem on the high side given the doleful conditions in the local market, but it is not unrealistic that a large mill may have stepped in with a volume purchase. As can be seen from the above numbers, demand elsewhere was anaemic with just 65,700 bales bought in the rest of the world. Reported shipments for the week were 330,800 bales.

– CFTC cotton on call report, based positions on 15th July showed a small increase in the net on call sales position for current crop of 1,471 contract to 59,268 contracts. This is the 4th highest position for the calendar year. For December contract the position is 35,874 contracts which is the highest ever, but with plenty of time for mills to fix before this becomes a concern.

Conclusion

Prices traded down to 82.54 last Friday but finished limit up by the close of the day. Cotton price action into the end of this week will help us to determine if the selling is over and whether we have a short term bottom in the market? Assuming this is the case we would suggest that a counter trend bounce may occur that could take prices as high as the low 100’s. Potentially, a test of the 200 day moving average is possible fuelled by some courageous end user physical buying and/or a hurricane inspired series of events. However, EAP maintain our longer term viewpoint that a final move to the 70’s will eventually play out by next May and the 22/23 season will prove to be an inverted season.

Useful links

*Please note that we only share CFTC CTO on weekend reports.

Written by:

Chris Williams

Copyright statement

No image or information display on this site may be reproduced, transmitted or copied (other than for the purposes of fair dealing, as defined in the Copyright Act 1968) without the express written permission of Earlam & Partners Ltd. Contravention is an infrigement of Copyright Act and its amendments and may be subject to legal action.

Disclaimer

The risk of loss associated with futures and options trading can be substantial. Opinions set forth herein should not be viewed as an offer or solicitation to buy, sell or otherwise trade futures, options or securities. All opinions and information contained in this email constitute EAP’s judgment as of the date of this document and are subject to change without notice. EAP and their respective directors and employees may effect or have effected a transaction for their own account in the investments referred to in the material contained herein before or after the material is published to any customer of a Group Company or may give advice to customers which may differ from or be inconsistent with the information and opinions contained herein. While the information contained herein was obtained from sources believed to be reliable, no Group Company accepts any liability whatsoever for any loss arising from any inaccuracy herein or from any use of this document or its contents. This document may not be reproduced, distributed or published in electronic, paper or other form for any purpose without the prior written consent of EAP. This email has been prepared without regard to the specific investment objectives, financial situation and needs of any particular recipient. For the customers of EAP, this email is produced exclusively for our business and expert clients, it is not for general distribution and our services are not available to private clients. Past performance is not indicative of future results.