- Ben Williams

- October 29, 2022

- 12:50 pm

- 10 min read

Huge drop in open interest & January becomes front month

Indices

Futures

Forex

– The January contract is now the effective front month on the basis that it is the contract with the highest open interest and therefore most liquidity. November expiry is just two weeks away and Friday through to Tuesday 1st November marks the start and end of the Rogers Roll period and the GSCI roll period runs from 7th to the 11th November. Therefore we are only going to see the open interest increase in the January contract in the coming weeks.

– Last week we mentioned the planting pace in Brazil, this week Mato Grosso finished at 67% planted which is the quickest pace in the last 8 years. However, in the Parana region planting has slowed due to heavy rains during the week and they are currently planting at their slowest pace in 8 years for this time of year at 44%. With heavy rains forecast in this region over the coming days this could mean things only gets worse (see below). With the third consecutive La Niña, we expect to see this drying out southern Brazil during the growing period.

– US exports slowed in the last week having got off to a great start earlier on in the year. With prices at decade highs for this time of year, buyers are discouraged, especially when you take into account the strength of the dollar affecting buyers purchasing power.

– The ongoing issue of low water levels in the US is having a profound affect on barge freight rates with space on vessels few and far between. This is because barges are only loading a fraction of the cargo they usually do to avoid grounding. Prices had risen 400% at their peak earlier in the month from the rate seen during most of the summer.

– These two factors have meant that 2022/23 sales totalled 7.2 million tonnes from Sept. 1 through Oct. 20 which is the lowest amount of sales for that time frame since 2012 apart from 2018.

– The CFTC report from 25.10.22 saw Managed Money increased their long position by 7,006 contracts and reduced their short position by 1,542. This left them with a net long position of 75,411.

– OR added to their long position and reduced their short position, leaving them with a net short 12,639 contracts. NR reduced both their long and short position, they are net short 23,355.

– The January contracts technical picture is very similar to that of the November contract as it continues to trade sideways in the channel of the 23.6% and 38.2% retrace levels from contract high and recent low. It was a pretty uneventful week as it traded in such a tight range of 33.6 and closed down 4.2. It looks to be trading into a contracting triangle with a breakout likely during next weeks trading.

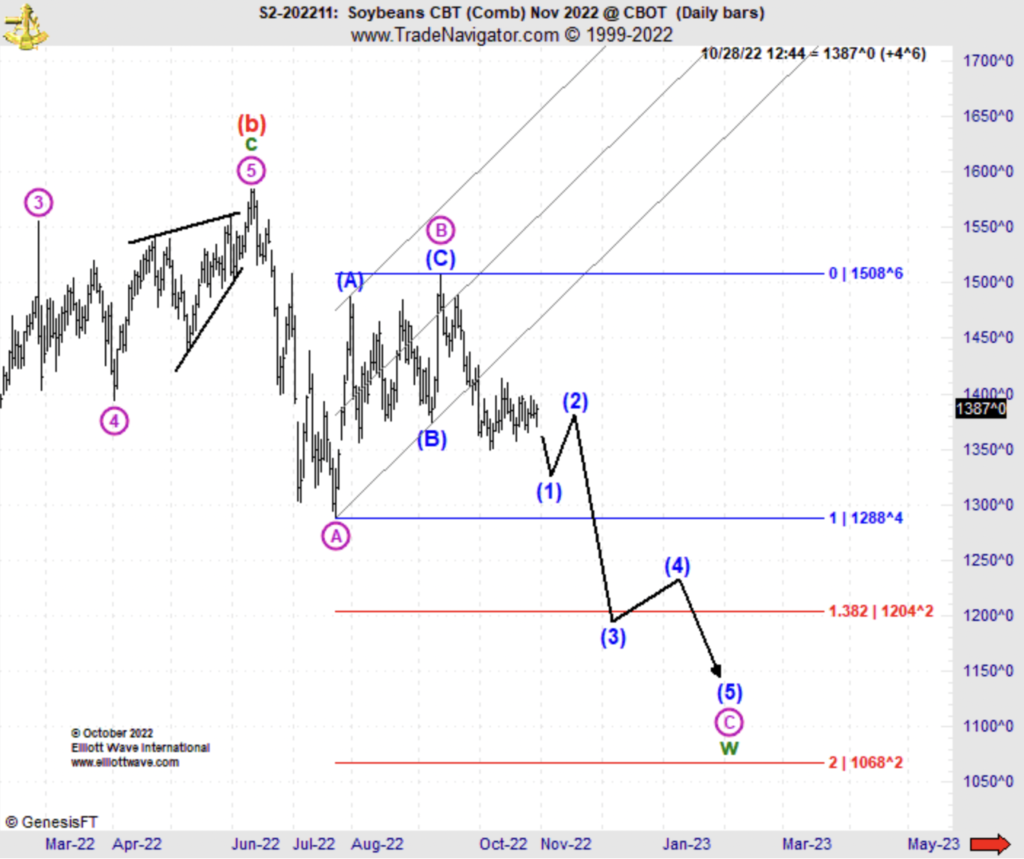

– Elliot Wave extended their forecast out to the end of January with them seeing prices reach as low as 1150. In the near term they see a wave 1 move down followed by a big bounce in a wave 2 movement then a wave 3 move to 1204.2 by the end of November.

Conclusion

With the current economic environment we are in, coupled with promising fundamentals, we think this downward move isn’t quite finished yet.

Written by:

Ben Williams

Copyright statement

No image or information display on this site may be reproduced, transmitted or copied (other than for the purposes of fair dealing, as defined in the Copyright Act 1968) without the express written permission of Earlam & Partners Ltd. Contravention is an infrigement of Copyright Act and its amendments and may be subject to legal action.

The risk of loss associated with futures and options trading can be substantial. Opinions set forth herein should not be viewed as an offer or solicitation to buy, sell or otherwise trade futures, options or securities. All opinions and information contained in this email constitute EAP’s judgment as of the date of this document and are subject to change without notice. EAP and their respective directors and employees may effect or have effected a transaction for their own account in the investments referred to in the material contained herein before or after the material is published to any customer of a Group Company or may give advice to customers which may differ from or be inconsistent with the information and opinions contained herein. While the information contained herein was obtained from sources believed to be reliable, no Group Company accepts any liability whatsoever for any loss arising from any inaccuracy herein or from any use of this document or its contents. This document may not be reproduced, distributed or published in electronic, paper or other form for any purpose without the prior written consent of EAP. This email has been prepared without regard to the specific investment objectives, financial situation and needs of any particular recipient. For the customers of EAP, this email is produced exclusively for our business and expert clients, it is not for general distribution and our services are not available to private clients. Past performance is not indicative of future results.