- Ben Williams

- November 26, 2022

- 4:57 pm

- 10 min read

Return of the 'Soy Dollar' in Argentina!

Indices

Futures

Forex

– Argentina announced on Friday that as of Monday, they are reinstating the preferential exchange rate for soybean exports and the beans derivatives. When this policy was implemented during September the rate producers received was 200 pesos per dollar but now, farmers will receive 230 pesos per dollar in a move to encourage greenback into the country. This is nearly 40% higher than the official rate of 166 pesos per dollar. Chinese traders and crushers have said they expect to buy 1-1.5 million tonnes during the validity of the ‘soy dollar’ in an attempt to increase their coverage for nearby shipments. Sources suggest China are only 30% covered for January demand.

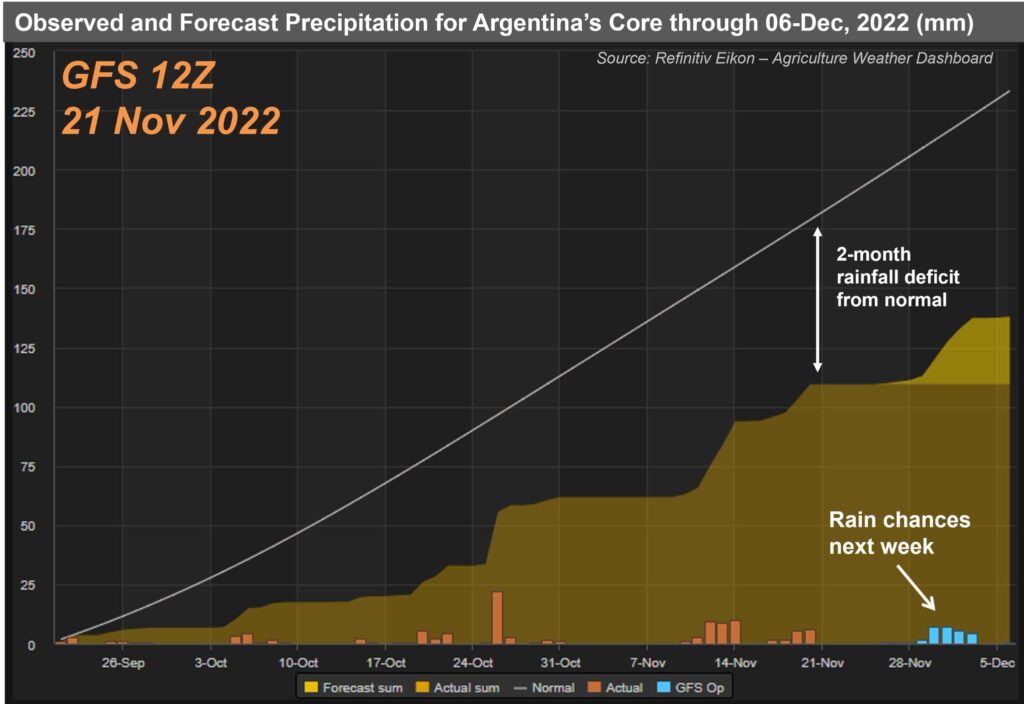

– With reference to Argentinas crop, they could be facing some issues soon due to drought conditions across the main growing areas. There is a potential for some rain showers over the course of next week but the rainfall is far below the normal conditions and much of the rain that has fallen has been dried up by hot soil temperatures. Any rain seen during the remainder of the month will help but not solve their crop problems.

– National protests have taken off across China as the general public grow tired of the continuous lockdowns in the government’s attempt to keep enforcing their zero covid policy. As the worlds biggest consumer of beans, having large portions of the population locked down and unable to go out for meals etc has put a large strain on the demand for beans. The government are unlikely to listen to the masses due to the fact that they refuse to use foreign vaccines and there is a lack of effective domestic vaccines meaning a low vaccine rate amongst the elderly. Seeing Chinese buying return to the market in full force still seems a way off yet.

– US producers could struggle into the new year as they need to repay the short term loans they take out before spring planting to finance fertiliser and seeds etc. They usually repay these loans with cash from the harvest, however with rising input costs as well as rising interest rates going into the new year, this short term debt is looking a lot more expensive and farmers are going to be scrambling for cash to repay this bigger, more expensive loans. Gone are the days of cheap money and this looks to hit the agricultural industry the worst with the farmers cost of debt carried nearly 32% higher than last year.

– The January contract traded in a tighter range this week of 30.8 cents. It traded fairly sideways for most of the week with trading closed on Thursday due to Thanksgiving. It then found resistance at the 200 day MA and downward trend line during Fridays trading and closed the week below the 50% retrace.

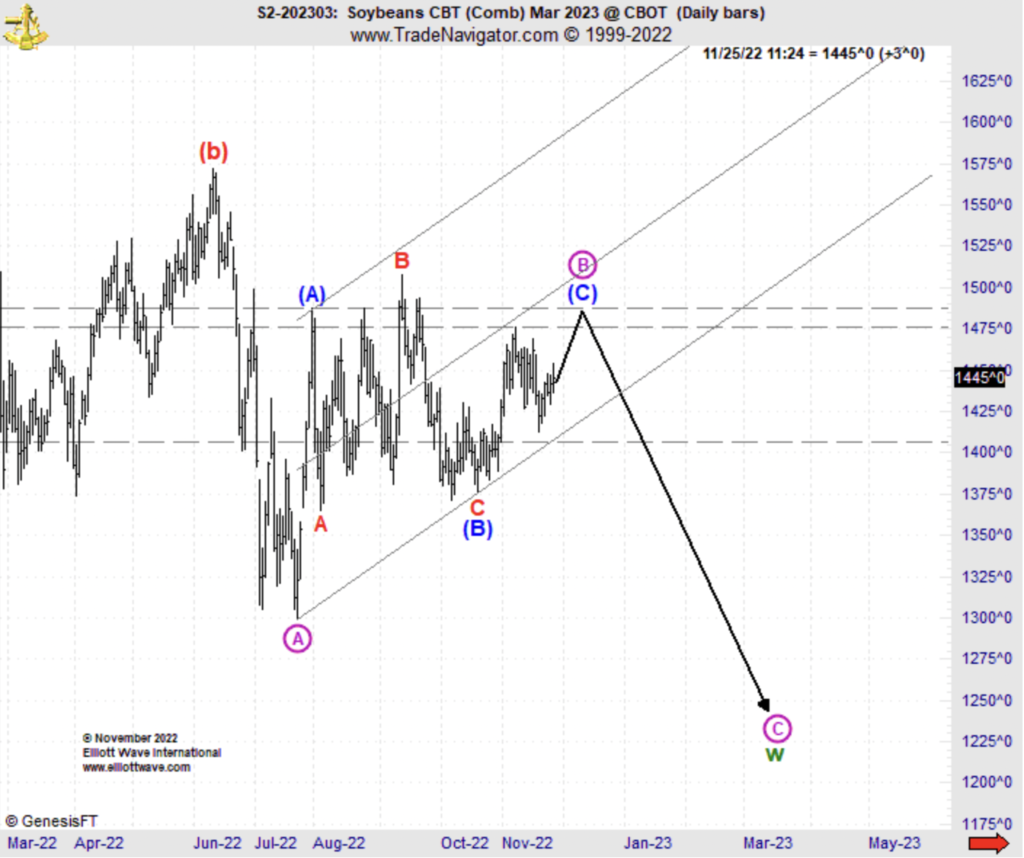

– Elliot Wave see near term strength with prices going as high as 1490 basis the March contract, by the mid December. However, they are expecting it to be short-lived and still see prices going to the 1250 level early next year.

Conclusion

This bounce is likely to encounter overhead resistance fairly soon which we expect to be followed by a downward move. With Chinese lockdowns not showing any signs of slowing down as rumours suggested and Brazil still looking set for a record crop we are bearish this market.

Written by:

Ben Williams

Copyright statement

No image or information display on this site may be reproduced, transmitted or copied (other than for the purposes of fair dealing, as defined in the Copyright Act 1968) without the express written permission of Earlam & Partners Ltd. Contravention is an infrigement of Copyright Act and its amendments and may be subject to legal action.

The risk of loss associated with futures and options trading can be substantial. Opinions set forth herein should not be viewed as an offer or solicitation to buy, sell or otherwise trade futures, options or securities. All opinions and information contained in this email constitute EAP’s judgment as of the date of this document and are subject to change without notice. EAP and their respective directors and employees may effect or have effected a transaction for their own account in the investments referred to in the material contained herein before or after the material is published to any customer of a Group Company or may give advice to customers which may differ from or be inconsistent with the information and opinions contained herein. While the information contained herein was obtained from sources believed to be reliable, no Group Company accepts any liability whatsoever for any loss arising from any inaccuracy herein or from any use of this document or its contents. This document may not be reproduced, distributed or published in electronic, paper or other form for any purpose without the prior written consent of EAP. This email has been prepared without regard to the specific investment objectives, financial situation and needs of any particular recipient. For the customers of EAP, this email is produced exclusively for our business and expert clients, it is not for general distribution and our services are not available to private clients. Past performance is not indicative of future results.