- Ben Williams

- January 24, 2023

- 2:08 pm

- 10 min read

New highs are short lived

Indices

Futures

Forex

– The March contract hit its highest level since June 2022 this week, largely on the back of the Argentinian drought, but remains in this upward trend channel that is has traded in for the last 3 months. We think the market has topped out here with a favourable rain forecast in Argentina over the coming week or so which ease concerns over the crop.

– The Argentinian government are looking for solutions to help the grain industry there which has suffered greatly from this drought that began back in May. As the worlds largest exporter of soybean oil and meal, their production is being closely watched but there is no drought the crop is already greatly reduced as a result of the conditions.

– As a result of these conditions in Argentina, the funds are getting increasingly long of soymeal futures having hit their third consecutive record level of 151,000 contracts.

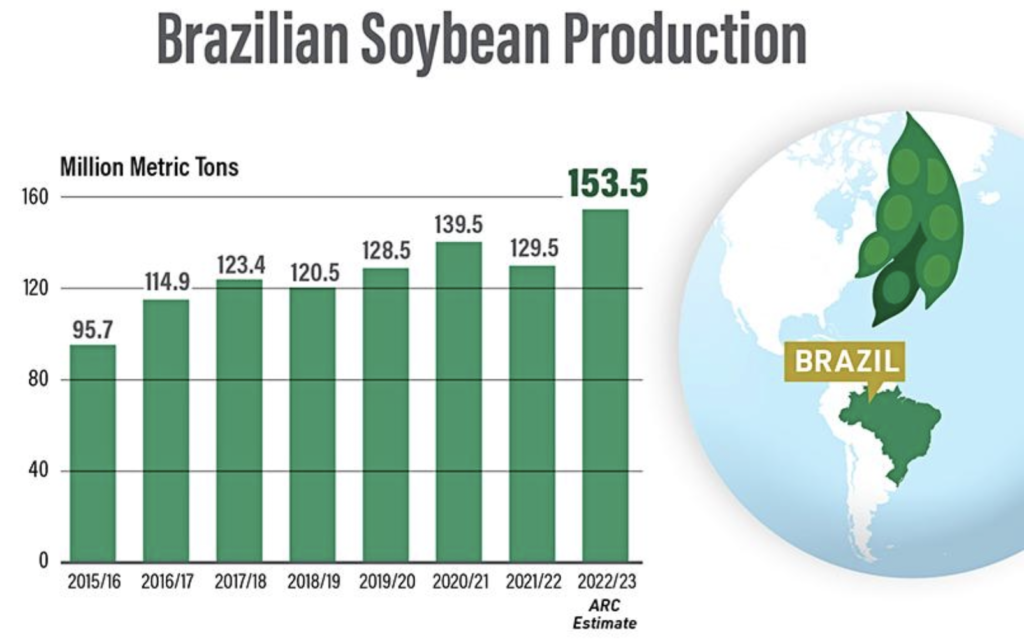

– Harvest of the Brazilian crop has begun but is slightly behind schedule. It will be carried out over the next 4-6 weeks and estimates from consultancies there suggest yields could be higher than expected in Mato Grosso. The crop is looking like it is going to be too big for the countries storage capacity which could mean forced sales.

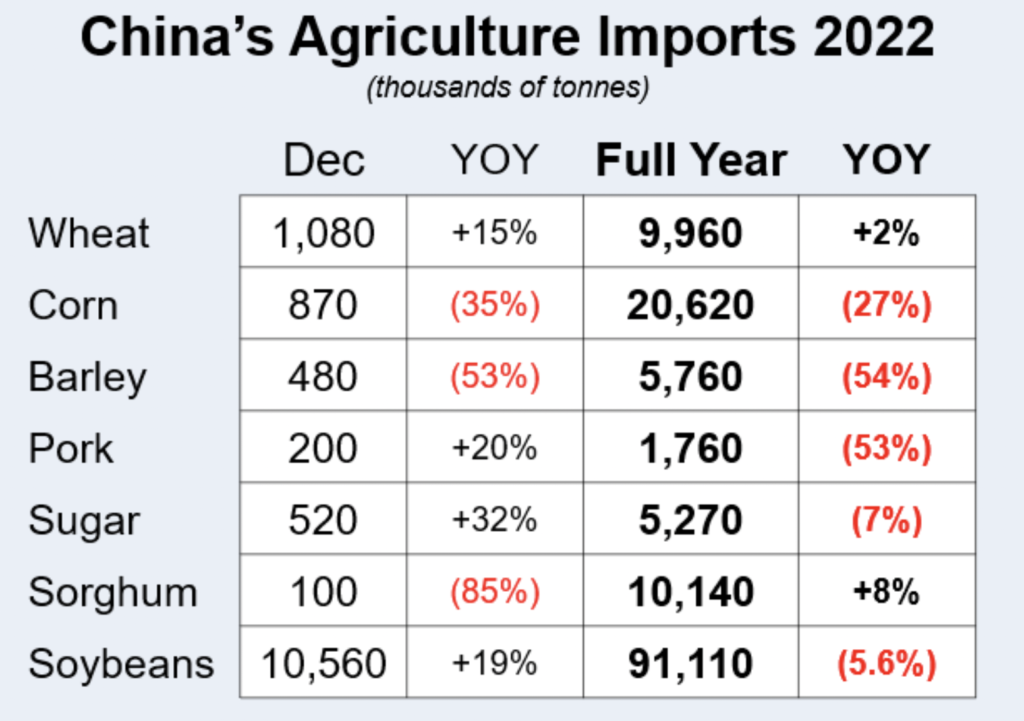

– Chinese soybean import figures were strong over the month of December at a record figure of 10.56 million tonnes. This was also the highest monthly figure since June 2021, however when looking at the yearly figure, imports were still down 5.6%.

– The CFTC commitment of traders report from 17.01.23 showed that Managed Money added to their long position quite substantially with 29,027 contracts and reduced their short positions by 7,567. They now have a net long position of 168,298. This marked their biggest bout of buying in a year and they now hold their most bullish position ever for this week.

– OR added to both their long position and their short position and are net long 4,952. NR added to their long position and their short position, they are net short 41,597 contracts.

– The March contract traded in a 44.4 cent range this week in a 4 day trading week. Tuesday saw great strength which carried over into Wednesday, eventually hitting the upper line of the trend channel and coming right off. This continued through Thursday and Friday with the market settling below the 78.6% retrace level.

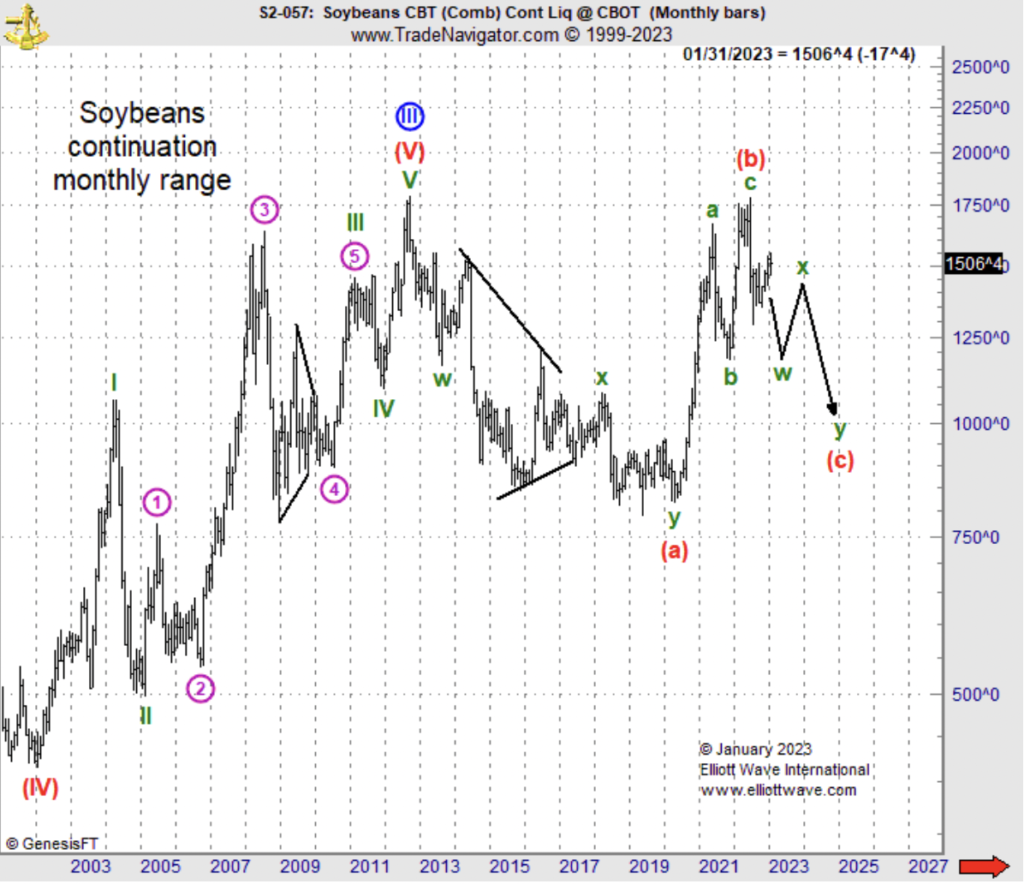

– Elliot Wave remain bearish soybeans and expect to see this downward move continue below 1250 during the first half of this year.

Conclusion

The market may continue to trend in this upward trend channel but we expect it to encounter overhead resistance fairly soon which we think will be followed by a downward move. With Brazil still looking set for a record crop we are bearish this market.

Written by:

Ben Williams

Copyright statement

No image or information display on this site may be reproduced, transmitted or copied (other than for the purposes of fair dealing, as defined in the Copyright Act 1968) without the express written permission of Earlam & Partners Ltd. Contravention is an infrigement of Copyright Act and its amendments and may be subject to legal action.

The risk of loss associated with futures and options trading can be substantial. Opinions set forth herein should not be viewed as an offer or solicitation to buy, sell or otherwise trade futures, options or securities. All opinions and information contained in this email constitute EAP’s judgment as of the date of this document and are subject to change without notice. EAP and their respective directors and employees may effect or have effected a transaction for their own account in the investments referred to in the material contained herein before or after the material is published to any customer of a Group Company or may give advice to customers which may differ from or be inconsistent with the information and opinions contained herein. While the information contained herein was obtained from sources believed to be reliable, no Group Company accepts any liability whatsoever for any loss arising from any inaccuracy herein or from any use of this document or its contents. This document may not be reproduced, distributed or published in electronic, paper or other form for any purpose without the prior written consent of EAP. This email has been prepared without regard to the specific investment objectives, financial situation and needs of any particular recipient. For the customers of EAP, this email is produced exclusively for our business and expert clients, it is not for general distribution and our services are not available to private clients. Past performance is not indicative of future results.