- Ben Williams

- October 15, 2022

- 2:44 pm

- 10 min read

Increase to Brazilian production in October's WASDE

Indices

Futures

Forex

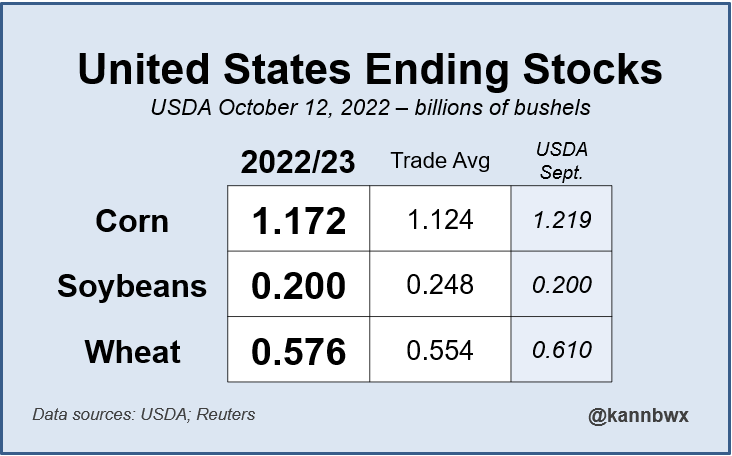

– Weekly US export figures for soybeans rose this week but were the lowest for the the week since 2011. Last week export shipments were 93 million bushels short of hitting the USDA’s export target and this week it was 100 million short. Low water levels in the US are continuing to send business to South America, however the Mississippi River did re-open to barge traffic this week.

– Argentinian farmer sales dropped 79% in the start of October at 376,00, this was following the end of the government incentive for sales during September with the ‘soy dollar’. 22/23 crop is due to be planted soon with sales of new crop rose by 10% on the week with a total figure of 1.55 million million tonnes sold so far. This figure is 28% lower than last year.

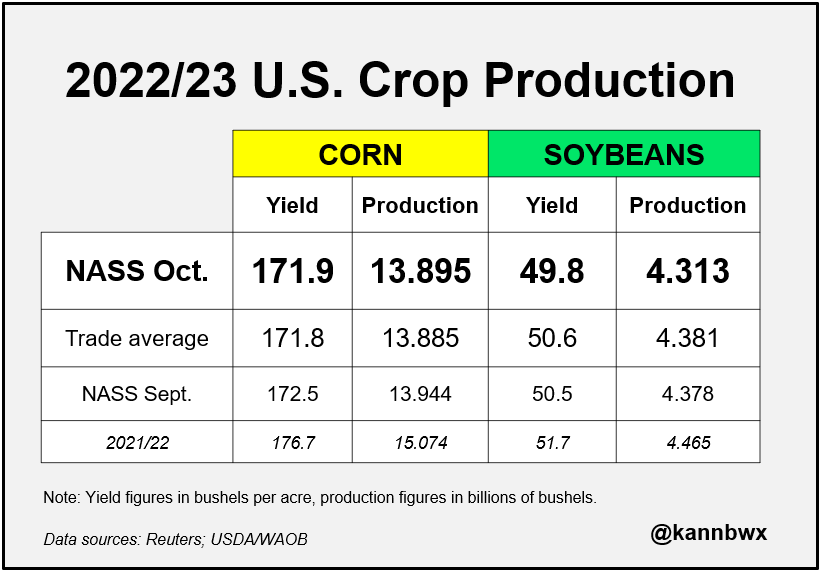

– This months WASDE was released on Wednesday and the USDA reduced their US soybean crop figures with both yield and production receiving downgrades which was largely unexpected by trade analysts. Ending stocks remained the same which is mostly down to the fact that the export figure was also reduced.

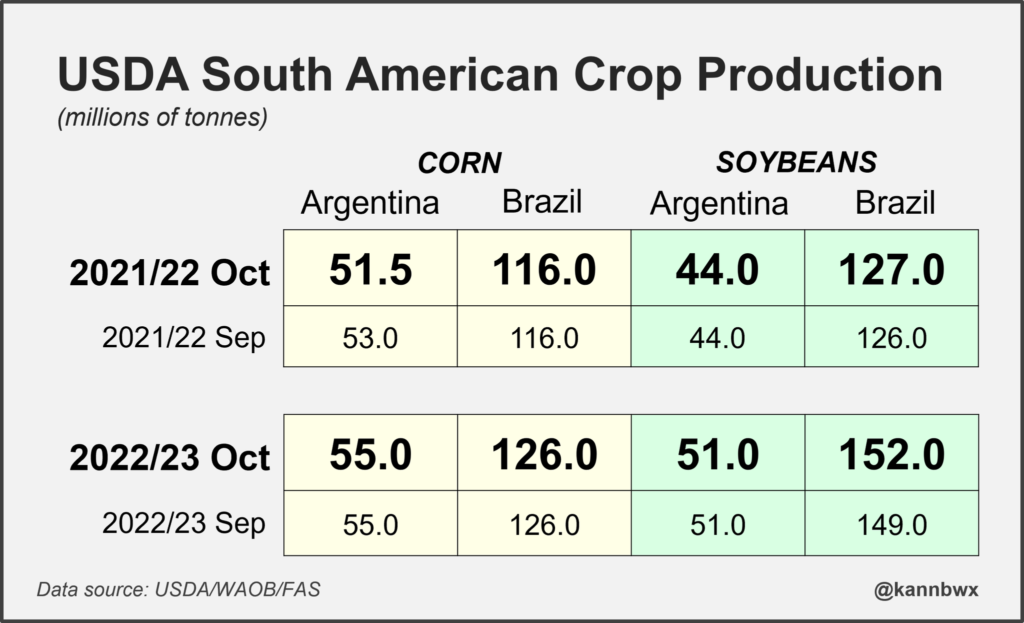

– In South America the USDA increased Brazil’s production figure by 3 million tonnes from 149 to 152 million. Argentinian crop figures remained unchanged.

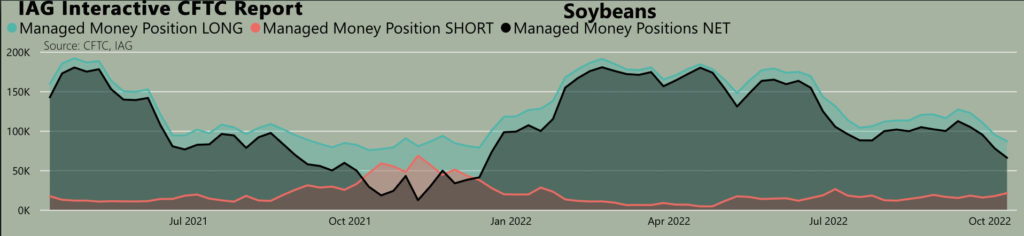

– The CFTC report from 11.10.22 saw Managed Money reduce their long position once again, this time by 7,963 contracts and increased their short position by 3,787. This left them with a net long position of 65,738, which is the lowest it has been all year as you can see from the graph above.

– OR reduced their long and short positions, leaving them with a net short 14,127 contracts. NR added to their long and short positions, they are net short 30,508.

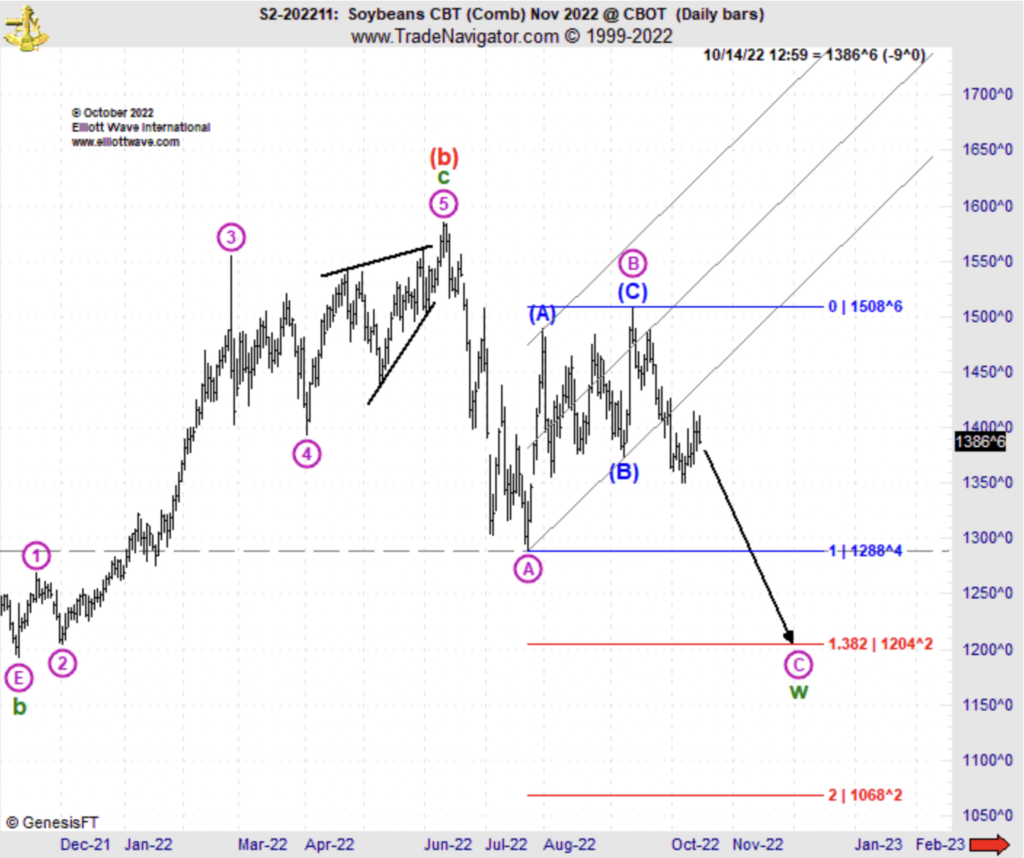

– The November contract traded in a range of 48.8c, closing up 16.6c. The market broke out of that downward trend to the upside on Monday with a sharp move up before retreating slightly. It failed to close above the 38.2% retrace level on Wednesday, Thursday and Friday. We see short term support at the 23.6% retrace level but after that there is little technical support other than the July low.

– Elliot Wave expect the market to continue down to 1200 by the end of November. They are expecting possible resistance at the July low of 1288.4.

Conclusion

With the current economic environment we are in, coupled with promising fundamentals, we think this downward move isn’t quite finished yet.

Written by:

Ben Williams

Copyright statement

No image or information display on this site may be reproduced, transmitted or copied (other than for the purposes of fair dealing, as defined in the Copyright Act 1968) without the express written permission of Earlam & Partners Ltd. Contravention is an infrigement of Copyright Act and its amendments and may be subject to legal action.

The risk of loss associated with futures and options trading can be substantial. Opinions set forth herein should not be viewed as an offer or solicitation to buy, sell or otherwise trade futures, options or securities. All opinions and information contained in this email constitute EAP’s judgment as of the date of this document and are subject to change without notice. EAP and their respective directors and employees may effect or have effected a transaction for their own account in the investments referred to in the material contained herein before or after the material is published to any customer of a Group Company or may give advice to customers which may differ from or be inconsistent with the information and opinions contained herein. While the information contained herein was obtained from sources believed to be reliable, no Group Company accepts any liability whatsoever for any loss arising from any inaccuracy herein or from any use of this document or its contents. This document may not be reproduced, distributed or published in electronic, paper or other form for any purpose without the prior written consent of EAP. This email has been prepared without regard to the specific investment objectives, financial situation and needs of any particular recipient. For the customers of EAP, this email is produced exclusively for our business and expert clients, it is not for general distribution and our services are not available to private clients. Past performance is not indicative of future results.