- Ben Williams

- November 14, 2022

- 2:43 am

- 10 min read

Collapse of the US$?

Indices

Futures

Forex

– The US dollar took a hammering this week following the release of the US Consumer Price Index figure on Thursday. Core Inflation, the Federal Reserve’s preferred CPI gauge, slowed to 0.3% from a previous 0.6% which suggests we may see a softer approach from the Fed in further interest rate hikes which subsequently pushed the dollar lower. The Dollar index tanked 2.12% on Thursday followed by a further 1.77% and closed the week at 106.292. It has clearly broken out of its upward trend line and broke through the 38.2% retrace of its yearly high and low. The only support we see now is the 50% retrace and the 200 day MA.

– As we know a weak dollar is usually strong for commodities due to the fact that most are priced in dollars. If this dollar weakness continues we could see commodity prices rise but with the current state of soy demand due to Chinese lockdowns we doubt we will see a soy rally on the back of this.

– Argentina’s ‘soybean dollar’ that they introduced over September, to encourage soy exports and bring in dollars to the country, succeeded in both aspects after a total of $5 billion was brought into reserves which they will use for future IMF payments. But due to a slowdown in soy exports the country has given up around a fifth of the gains it made selling $368 million just last week. Recent drought and frosts in the key growing regions have caused significant damage to their wheat crop and subsequently delayed soy planting hence the reduction of production in this months WASDE.

– China imported 4.14 million tonnes of Soybeans in October which was the lowest volume for any month since October 2014. This is partly due to US export issues with low levels in the water ways but also down to the lack of demand as a result of the ongoing covid restrictions there.

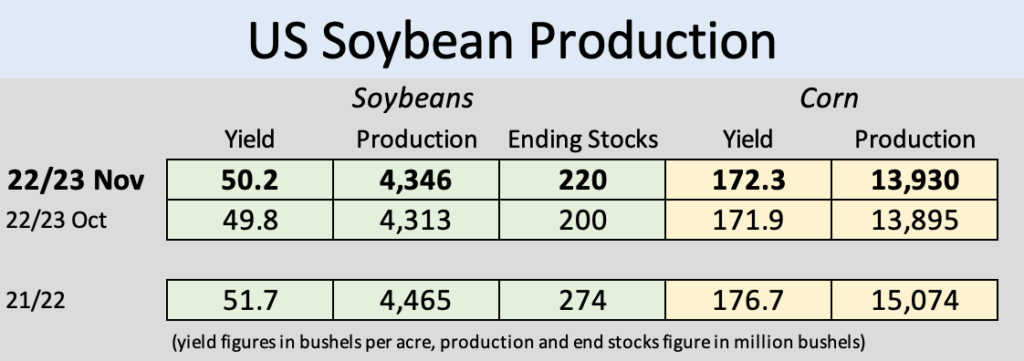

– The November WASDE showed increased US production to 4,346 million bushels due to higher yields in Iowa and Missouri. With exports unchanged we saw an increase in ending stocks.

– The main change to South American figures was a reduction in Argentinian production due to the widespread drought that the growing regions have been experiencing lately. Brazil’s production figure remained unchanged as their record crop looks increasingly likely.

– The CFTC commitment of traders report from this week was delayed until Monday due to US Veterans Day

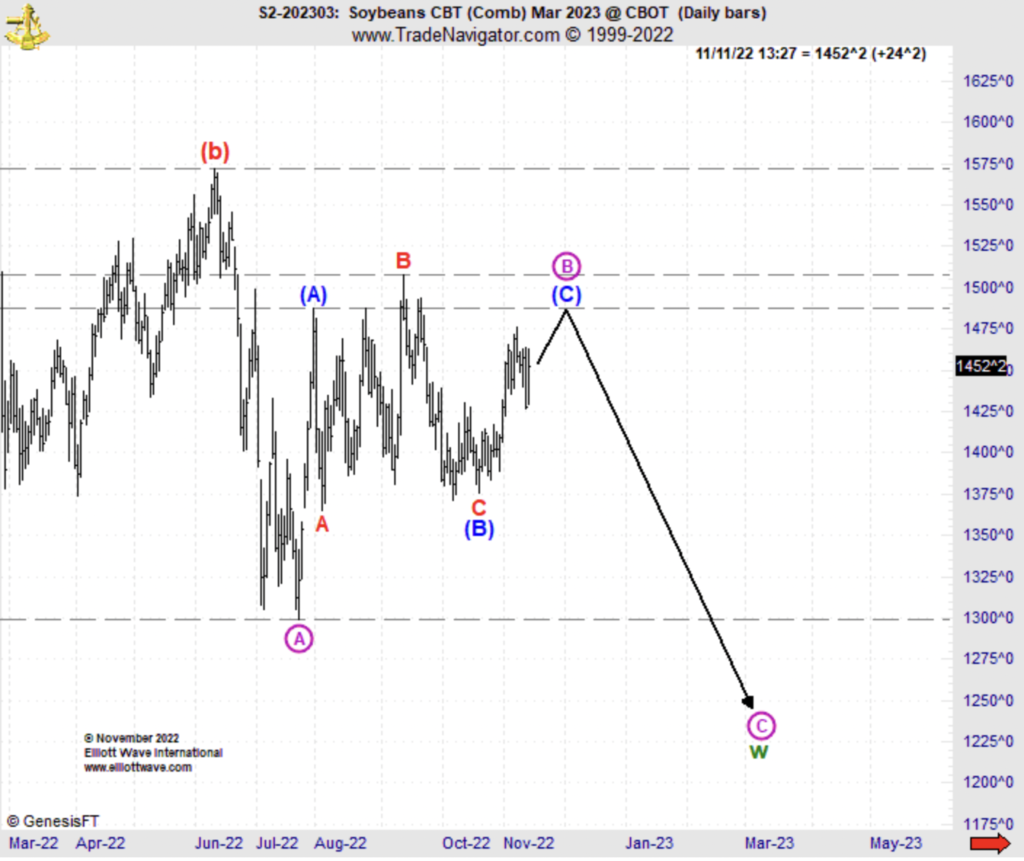

– The January contract traded in a range of 48.6 but only closed the week down 12.2 in what looked to be a continuation of the sideways trading market that we have seen over the last 3-4 months. Monday through to Wednesday were pretty uneventful but come Thursday we saw a 29 cent drop closing below the 200 day moving average and the 50% retrace level. These losses were made back on the Friday as the market rose 27 cents and closed back above those levels. The market looks to be continuing to find resistance at the overhead down trend and we think a downward move over the coming weeks is likely.

– Elliot Wave see near term strength with prices going as high 1494.6 by the third week of November. However, they are still expecting prices to hit the 1250 level early next year.

Conclusion

This bounce is likely to encounter overhead resistance fairly soon which we expect to be followed by a downward move. With Chinese lockdowns not showing any signs of slowing down as rumours suggested, despite some slight easing of rules and Brazil still looking set for a record crop we are bearish this market.

Written by:

Ben Williams

Copyright statement

No image or information display on this site may be reproduced, transmitted or copied (other than for the purposes of fair dealing, as defined in the Copyright Act 1968) without the express written permission of Earlam & Partners Ltd. Contravention is an infrigement of Copyright Act and its amendments and may be subject to legal action.

The risk of loss associated with futures and options trading can be substantial. Opinions set forth herein should not be viewed as an offer or solicitation to buy, sell or otherwise trade futures, options or securities. All opinions and information contained in this email constitute EAP’s judgment as of the date of this document and are subject to change without notice. EAP and their respective directors and employees may effect or have effected a transaction for their own account in the investments referred to in the material contained herein before or after the material is published to any customer of a Group Company or may give advice to customers which may differ from or be inconsistent with the information and opinions contained herein. While the information contained herein was obtained from sources believed to be reliable, no Group Company accepts any liability whatsoever for any loss arising from any inaccuracy herein or from any use of this document or its contents. This document may not be reproduced, distributed or published in electronic, paper or other form for any purpose without the prior written consent of EAP. This email has been prepared without regard to the specific investment objectives, financial situation and needs of any particular recipient. For the customers of EAP, this email is produced exclusively for our business and expert clients, it is not for general distribution and our services are not available to private clients. Past performance is not indicative of future results.