- Harry Bennett

- January 25, 2023

- 2:11 pm

- 10 min read

The Chinese Lunar New Year is underway but at what cost?

Indices

Futures

Forex

– The Dollar Index found support around 102.00 on Friday after facing heightened volatility in recent trading sessions. Traders reviewed a flurry of U.S. data released on Thursday which showed aggressive interest rate hikes from the Federal Reserve are already having an impact on the economy (Chart Below).

– The number of Americans filing new claims for unemployment benefits fell by 15,000 from the week prior. This takes the overall figure down to 190,000 for the week ending January 14th. This unemployment figure is now its lowest in four months and well below market expectations of 214,000.

– The Producer price index (PPI) for final demand in the US dropped 0.5 percent from a month earlier in December 2022. This followed a revised 0.2 percent gain in November against market expectations of a 0.1 percent decline.

– The Nasdaq and S&P futures look firm following bouts of strength last week. Currently trading at 11,345 and 4,023 respectively. The latter displaying significant support around the 3,880/3,900 zone with the 200day moving average now around the 4,020 level.

– US Dollar Index ($DXY) – Daily Dollar index chart, showing how the U.S. currency compares against the 6 top competing currencies. Dollar has been in a sharp downtrend since the middle of November!

– The European Central Bank (ECB) said last week that China’s reopening from lockdowns will push inflation higher in Europe. This is due to the added demand in commodities and energy complex in particular.

– The Euro has reached a 9-month high against the Dollar as Hawkish comments on European interest rates contrasted the move. ECB announced that interest rates would rise by 50 points in both February & March with no sign that rates would stop climbing in the months after.

– Retail sales in the UK fell 1% month-over-month in December of 2022, this comes after an upwardly revised 0.5% drop in November. Sales at non-food stores fell 2.1% as consumers cut back on spending because of increased prices and affordability concerns.

– Investors appear more confident on Sterling (GBP), last week a 6- week high against the USD was reached before moving higher in todays trading at 1.2448 . Policymakers in the UK are set to raise interest rates by 0.5% to 4.0% at February’s meeting following 9 consecutive rate hikes.

– UK Retail Sales (MOM) – Retail sales were poor in December, with the headline figure -1.0% month on month below analysts estimates at 0.5%.

– The State Bank of Pakistan raised its interest rates by 100 basis points last week which is the highest rate hike in more than 24 years. This aggressive monetary policy comes as the economy struggles to keep up with raging inflation, a collapsing currency & stalled foreign financing.

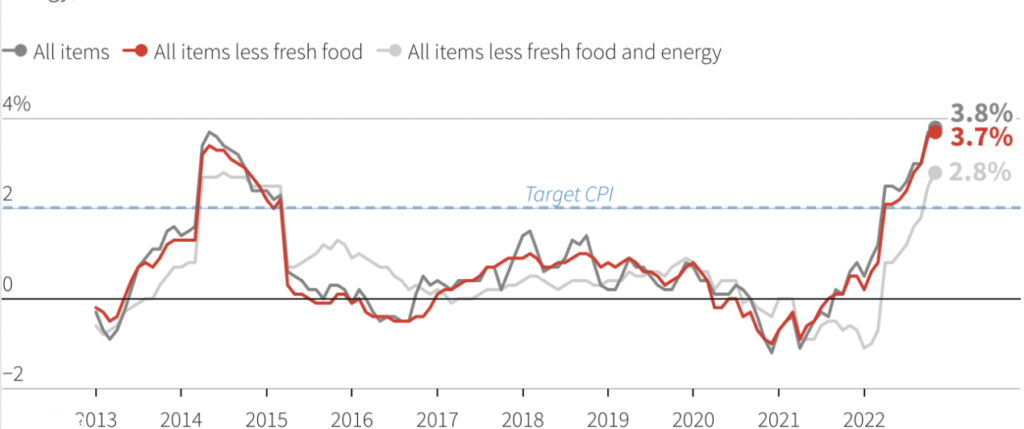

– The core consumer price index (CPI) in Japan jumped 4% in December 2022 YOY, accelerating at its fastest pace since December 1981. This comes inflationary pressures continued to mount. December’s figure followed a 3.7% gain in November and matched analysts’ expectations (Image Below).

– Chinese passenger trips for the Chinese New Year increased by over 50% YoY! A total of 26 million trips were made which may have a detrimental impact on the spiralling number of COVID cases. According to a prominent government scientist 80% of the population has been infected.

– Japanese CPI Data – Japan’s core inflation figure reached new highs last week after an increase of 4% from a year prior!

Conclusion

Markets will be focusing on some heavyweight equities which will release their earnings reports in the coming week. The Federal Reserve will be shut off until the FOMC meeting next month with all eyes on the economic reports scheduled in the interim. Durable good orders, new home sales and consumer sentiment are the main drivers for what the Fed will do next. The approach from the majority of Central Banks calls for aggressive monetary policy methods to cool down inflationary pressure and lagging economic activity.

Written by:

Harry Bennett

Copyright statement

No image or information display on this site may be reproduced, transmitted or copied (other than for the purposes of fair dealing, as defined in the Copyright Act 1968) without the express written permission of Earlam & Partners Ltd. Contravention is an infrigement of Copyright Act and its amendments and may be subject to legal action.

The risk of loss associated with futures and options trading can be substantial. Opinions set forth herein should not be viewed as an offer or solicitation to buy, sell or otherwise trade futures, options or securities. All opinions and information contained in this email constitute EAP’s judgment as of the date of this document and are subject to change without notice. EAP and their respective directors and employees may effect or have effected a transaction for their own account in the investments referred to in the material contained herein before or after the material is published to any customer of a Group Company or may give advice to customers which may differ from or be inconsistent with the information and opinions contained herein. While the information contained herein was obtained from sources believed to be reliable, no Group Company accepts any liability whatsoever for any loss arising from any inaccuracy herein or from any use of this document or its contents. This document may not be reproduced, distributed or published in electronic, paper or other form for any purpose without the prior written consent of EAP. This email has been prepared without regard to the specific investment objectives, financial situation and needs of any particular recipient. For the customers of EAP, this email is produced exclusively for our business and expert clients, it is not for general distribution and our services are not available to private clients. Past performance is not indicative of future results.