- Harry Bennett

- October 17, 2022

- 2:48 pm

- 10 min read

UK Gilts continue their brutal sell off as the Kwasi Kwarteng U turn becomes a reality and UK confidence sinks!

Indices

Futures

Forex

– The United States 10-year Treasury yield, moved towards the 4% mark last week and just shy of levels not seen since October 2008. Investors are reassessing their outlook on U.S monetary policy and subsequent interest rate hikes.

– A report from the University of Michigan showing that US year-ahead inflation expectations increased for the first time since March, and a hotter-than-expected US inflation reading earlier this week slashed any hopes of a policy pivot.

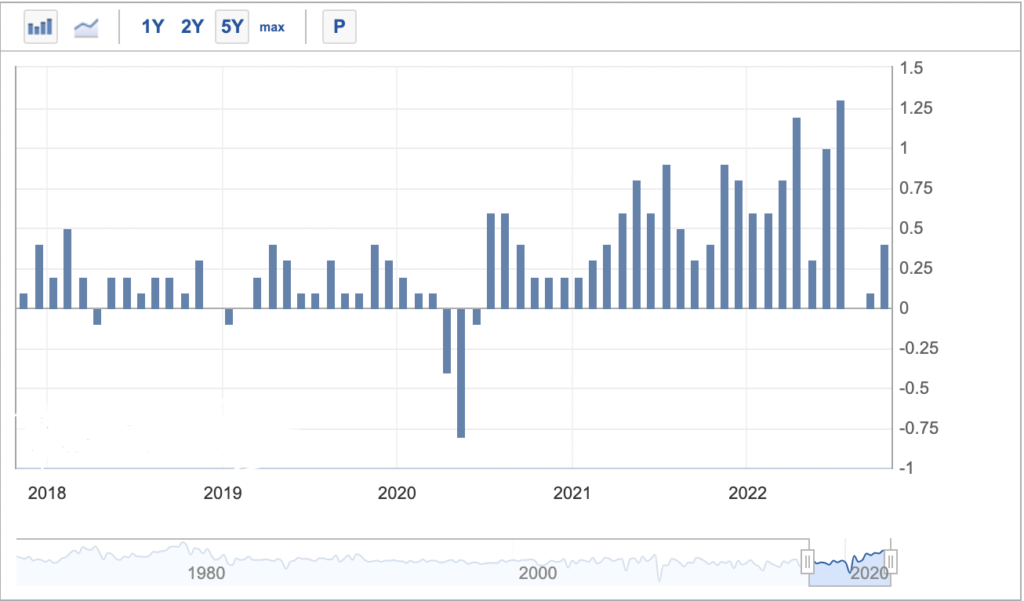

– Consumer Price Index in the US was up 0.4% in September of 2022, marking the highest reading in three months. The food index continued to rise, jumping 0.8%. These increases were partly offset by a 4.9% decline in gasoline cost, but prices of natural gas (2.9%) and electricity (0.4%) moved up. The core index which excludes food and energy rose 0.6% on the month, the same as in August, but above forecasts of 0.5% (See Figure 1 Below).

– The average 30-year mortgage rate climbed to 5.89%, the highest level since 2008, according to new data published by Freddie Mac. Mortgage rates briefly declined this summer despite rises from the Fed.

– Equities in London ended higher for a consecutive session on Friday, with the FTSE 100 index rising to 6,963.64 on Friday 14th October. The index was helped by an improvement in real estate and utility stocks.

– UK is going through turbulent times as Prime Minister Liz Truss announced a U-turn on the government’s plan to scrap the planned rise in corporation tax from 19% to 25% next April, which will end up raising £18 billion per year.

– Kwasi Kwarteng has been sacked as chancellor three weeks after his mini-budget caused havoc on the economy and Jeremy Hunt has been appointed instead. Lasting just 38 days, Kwasi is the second-shortest serving chancellor in history. The £45 bn unfunded tax cuts leading to his downfall.

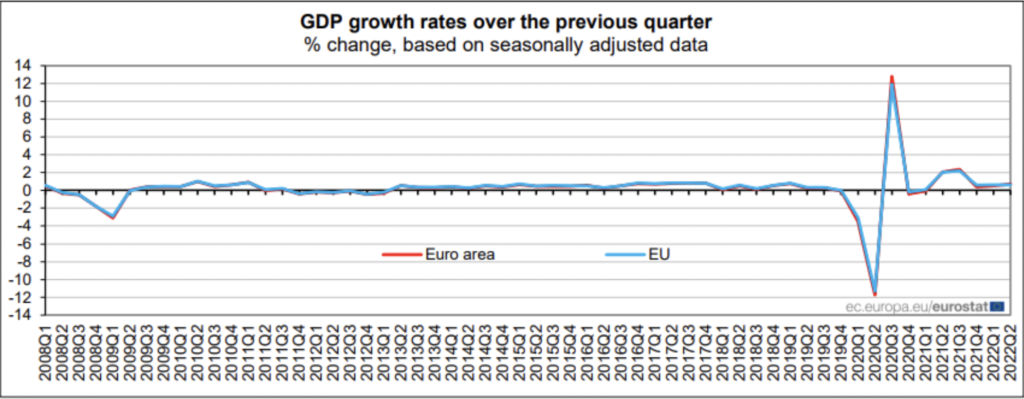

– The Euro area’s economy is now expected to grow by just 0.5% in 2023 as factors including record inflation and the continued impact of the COVID-19 pandemic weigh on the outlook. The 19-country eurozone is now projected to post the slowest growth of any region worldwide next year after the IMF cut its forecast by 0.7 percentage points from its previous outlook delivered just three months ago.

– China’s annual inflation rose to 2.8% year on year in September, up from 2.5% in the prior month and in line with analyst estimates. This its highest level since April 2020 as food costs spiral. Non-food inflation eased to 1.5% from 1.7%, amid smaller increases in prices of transport & communication (4.5% vs 4.9%), housing (0.3% vs 0.6%), clothing (0.5% vs 0.6%), and education, culture (1.2% vs 1.6%).

– China has set a target consumer price index (CPI) at 3% for 2022 but remain far adrift of their targets.

– A wage strike at South Africa’s port and rail operator has affected about 75% of the bulk minerals that are typically exported every day from its mines globally. This adds to a string of setbacks for the company (Transnet) and worsening shipping congestion in the region.

– The Japanese yen (JPY) continued to slide on Friday as it fell to a 32-year low against the dollar. The U.S. dollar’s surge looks to be showing no signs of slowing down amidst rising interest rates by the Federal Reserve. Efforts to tame inflation have meant investors are heading towards the US ‘safe’ haven.

Conclusion

The global macroeconomic outlook does not look very promising as global recessionary fears continue to mount. Inflationary data in the U.S continues to rise and China’s economic woes continue. The EU and UK will need to battle through their energy crisis’s this winter which is weighing on consumers overall purchasing power. Tightness in global supply chains shows a rotation away from equity markets and into the commodity sector as hedge funds build their net long positions in the grain markets. Swift reversals from the funds could lead to dramatic price movements.

Written by:

Harry Bennett

Copyright statement

No image or information display on this site may be reproduced, transmitted or copied (other than for the purposes of fair dealing, as defined in the Copyright Act 1968) without the express written permission of Earlam & Partners Ltd. Contravention is an infrigement of Copyright Act and its amendments and may be subject to legal action.

The risk of loss associated with futures and options trading can be substantial. Opinions set forth herein should not be viewed as an offer or solicitation to buy, sell or otherwise trade futures, options or securities. All opinions and information contained in this email constitute EAP’s judgment as of the date of this document and are subject to change without notice. EAP and their respective directors and employees may effect or have effected a transaction for their own account in the investments referred to in the material contained herein before or after the material is published to any customer of a Group Company or may give advice to customers which may differ from or be inconsistent with the information and opinions contained herein. While the information contained herein was obtained from sources believed to be reliable, no Group Company accepts any liability whatsoever for any loss arising from any inaccuracy herein or from any use of this document or its contents. This document may not be reproduced, distributed or published in electronic, paper or other form for any purpose without the prior written consent of EAP. This email has been prepared without regard to the specific investment objectives, financial situation and needs of any particular recipient. For the customers of EAP, this email is produced exclusively for our business and expert clients, it is not for general distribution and our services are not available to private clients. Past performance is not indicative of future results.