- Harry Bennett

- January 17, 2023

- 4:54 pm

- 10 min read

U.S. Stock and Bond investors have a three day weekend as the markets are closed for Martin Luther King Jr Day!

Indices

Futures

Forex

– U.S. stock markets moved positively ahead of the 3 day weekend, gains last Thursday with the Dow Jones (DJIA) added more than 200 points, while the S&P 500 and the Nasdaq advanced 0.3% and 0.6% respectively.

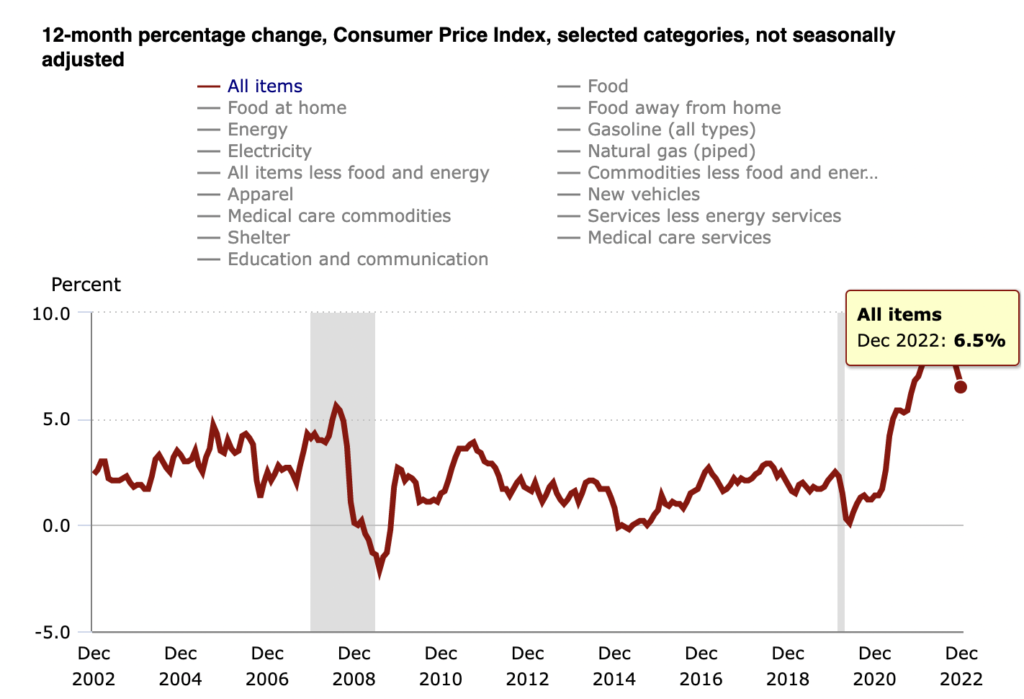

– Investors digested December’s U.S. CPI figures that showed the annual headline and core inflation rates slowed to 6.5% and 5.7% respectively. Question marks now remain as to whether this is enough to stop the Federal Reserve from their hike path.

– The yield on the US 10-year Treasury note has bottomed around 3.5%, closing in on its lowest level since last September. This comes as prospects of a less aggressive Federal Reserve boosted appetite for government debt.

– Sterling (GBP) held above $1.20 against the Dollar last week, hovering around it’s highest level since December 14th as traders welcomed upbeat data and positive comments from a Bank of England policymaker. Britain’s economy grew by 0.1% in November, a shock increase in GDP (Gross domestic product) due to an expansion in consumer-facing services.

– Equities in London extended their gains for a third consecutive session on Friday, with the FTSE 100 finishing near record levels. The weekly high reached 7,864.95 last week. The index has benefited from China reopening trade and looks to try and push beyond its all time high above the 8,000 level.

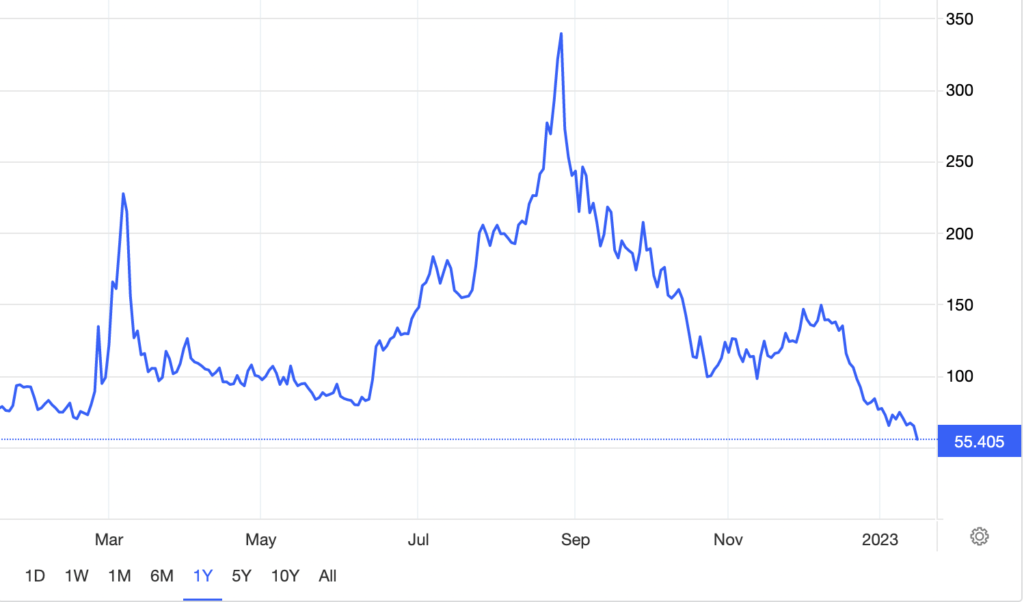

– European gas prices slump to 16-month low ((Chart below) September 2021) as stockpiles were full in China. Chinese importers were diverting pending shipments as prices domestically plummeted. This could ease price pressure away from the West.

– We are fast approaching the Lunar New Year in China, however, also looming is potentially the second lowest economic growth since 1976. China’s economy is said to have grown by 2.8% last year and by just 1.9% in Q4 as COVID lockdowns hit the country hard. Full data to be released on Tuesday 17th January 2023.

– The stock market is signalling for hopes of a strong recovery as global funds are buying Chinese stocks in an emphatic manner. Hong Kong listed stocks have had their best start since 2006.

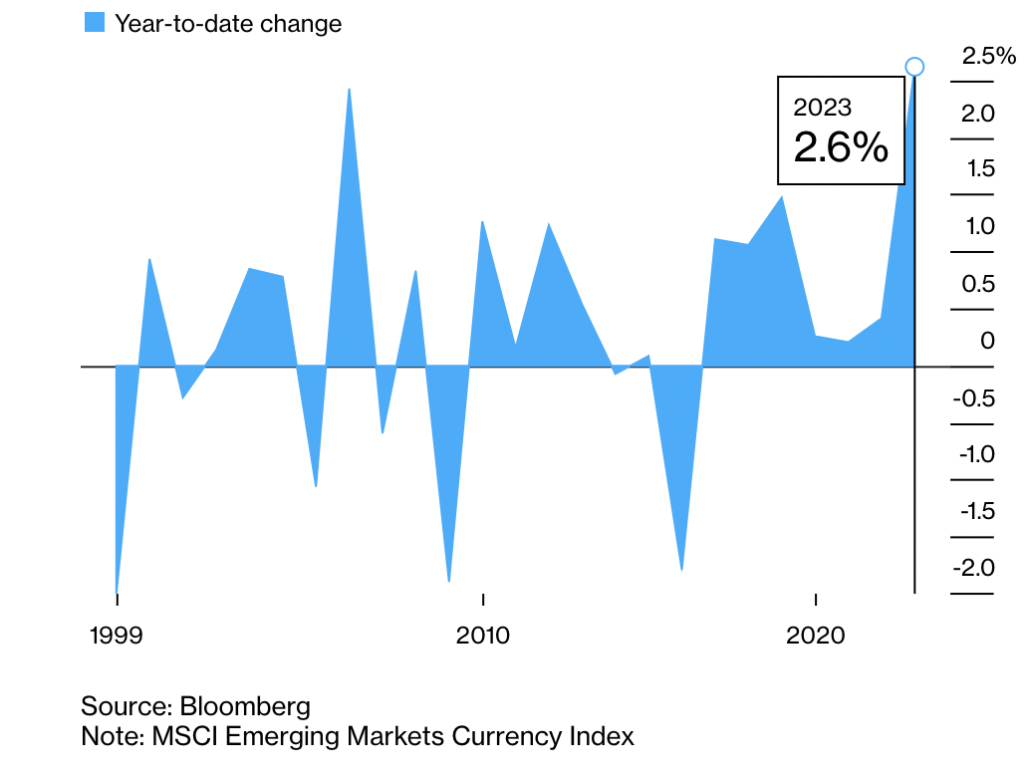

– Emerging market currencies exchange rates post their best start in decades. The MSCI Emerging Markets Currency Index has spike to 2.6% at the start of 2023 as asset managers turn more bullish on the emerging markets. The Thai Baht rallied 14.1% against the US Dollar.

– Since the start of 2023 Bitcoin has had 1 day trading in the red! The 22% move in just 15 days has added almost $200 billion to the combined crypto market with Ethereum, Cardarno & Dogecoin all following suit. The market is now bracing for the $10 billion crypto giant Digital Currency Group (DCG) to begin offloading assets following it’s devastating lawsuit.

Conclusion

Stocks pushed higher with the major benchmark indices boasting their largest weekly % gains since November. Big U.S. banks helped bolster the CPI figures which initially offered a subdued reaction. The market appears to be pricing in hopes of an interest rate hikes slow down, however, question marks remain. Positive signs from UK GDP data point to a shallow recession but we caution being overly optimistic. Globally consumers purchasing power has been hit hard and it will inevitable take time to recover.

Written by:

Harry Bennett

Copyright statement

No image or information display on this site may be reproduced, transmitted or copied (other than for the purposes of fair dealing, as defined in the Copyright Act 1968) without the express written permission of Earlam & Partners Ltd. Contravention is an infrigement of Copyright Act and its amendments and may be subject to legal action.

The risk of loss associated with futures and options trading can be substantial. Opinions set forth herein should not be viewed as an offer or solicitation to buy, sell or otherwise trade futures, options or securities. All opinions and information contained in this email constitute EAP’s judgment as of the date of this document and are subject to change without notice. EAP and their respective directors and employees may effect or have effected a transaction for their own account in the investments referred to in the material contained herein before or after the material is published to any customer of a Group Company or may give advice to customers which may differ from or be inconsistent with the information and opinions contained herein. While the information contained herein was obtained from sources believed to be reliable, no Group Company accepts any liability whatsoever for any loss arising from any inaccuracy herein or from any use of this document or its contents. This document may not be reproduced, distributed or published in electronic, paper or other form for any purpose without the prior written consent of EAP. This email has been prepared without regard to the specific investment objectives, financial situation and needs of any particular recipient. For the customers of EAP, this email is produced exclusively for our business and expert clients, it is not for general distribution and our services are not available to private clients. Past performance is not indicative of future results.