- Harry Bennett

- November 15, 2022

- 7:48 am

- 10 min read

U.S. Inflation starts to cool down but how will the Fed respond?

Indices

Futures

Forex

– The Dollar had its worst day since March 2009 last week, the dollar index has since fallen below 107.00, a level not seen since mid-August, as U.S. data is better than expected. This has potentially set the stage for a slower pace of interest rate hikes by the Federal Reserve.

– A Bureau of Labor Statistics report showed that the annual inflation rate eased to 7.7%, below economists’ forecasts of 8%. The report also showed the CPI coming in cooler than expected on a month-on-month basis and in its core reading.

– A rise in cancellations from Asia to the U.S. is slowing the U.S. export market and global shippers are warnings of more “radical” cuts in vessels. The Port of Savannah and Port of Long Beach are seeing the sharpest increase in shipping container delays.

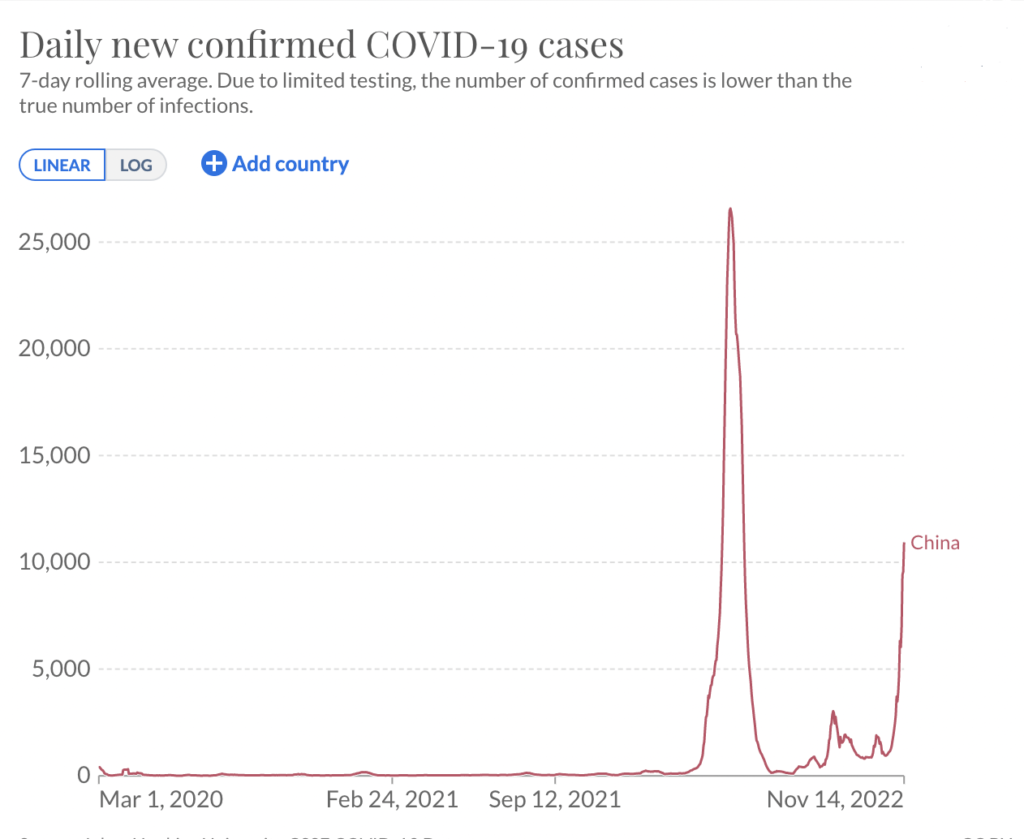

– Covid infections are surging in the capital of China’s export-heavy Guangdong province, raising concerns of another slowdown on the economy. Could this spark another bout of strict lockdowns? Schools in the main districts of Guangzhou closed and more people are ordered to work from home.

– Bank of Japan’s (BOJ’s) Governor Haruhiko Kuroda plans to stick to monetary easing to support the economy in the short term. Focus is on stable inflation and wage growth. It’s dovish policy faced some criticism as the Japanese Yen saw significant downward pressure.

– Covid infections are surging in the capital of China’s export-heavy Guangdong province, raising concerns of another slowdown on the economy. Could this spark another bout of strict lockdowns? Schools in the main districts of Guangzhou closed and more people are ordered to work from home.

– The European Union’s executive commission slashed its forecast for economic growth next year, saying the 19 countries that use the euro currency will slide into recession over the winter as peak inflation remains. This will last longer than expected and high fuel and heating costs will erode consumers purchasing power.

– European yields continued to follow U.S. lower with the German 10 year yield trading below 2% last week and Italian yields moving close to 4%.

– Sterling (GBP) extended gains against the USD, to trade above the $1.18 mark for the first time late August. Data on Friday showed the UK economy contracted 0.2% in the third quarter, less than markets had expected, suggesting the Bank of England will maintain its policy tightening path as the UK inflation rate is running at a 40-year high.

– Imports of goods and services to the United Kingdom dropped 3.8% to GBP 72.3 billion in September 2022, down from August’s all-time high of GBP 75.1 billion. Goods purchases were down by 5.0%, with imports from the EU falling 7.3% due to lower purchases of chemicals and fuel.

Conclusion

The global macroeconomic outlook does not look promising as global recessionary fears continue to mount. Inflationary data in the U.S cools but questions around China remain. Consumer purchasing power is falling across the globe which is why an economic slowdown is so evident. The winter in the UK and EU loom and this is made worse with the extremely fragile Russian – Ukraine war. Food markets look fragile as weather variation impacts markets.

Written by:

Harry Bennett

Copyright statement

No image or information display on this site may be reproduced, transmitted or copied (other than for the purposes of fair dealing, as defined in the Copyright Act 1968) without the express written permission of Earlam & Partners Ltd. Contravention is an infrigement of Copyright Act and its amendments and may be subject to legal action.

The risk of loss associated with futures and options trading can be substantial. Opinions set forth herein should not be viewed as an offer or solicitation to buy, sell or otherwise trade futures, options or securities. All opinions and information contained in this email constitute EAP’s judgment as of the date of this document and are subject to change without notice. EAP and their respective directors and employees may effect or have effected a transaction for their own account in the investments referred to in the material contained herein before or after the material is published to any customer of a Group Company or may give advice to customers which may differ from or be inconsistent with the information and opinions contained herein. While the information contained herein was obtained from sources believed to be reliable, no Group Company accepts any liability whatsoever for any loss arising from any inaccuracy herein or from any use of this document or its contents. This document may not be reproduced, distributed or published in electronic, paper or other form for any purpose without the prior written consent of EAP. This email has been prepared without regard to the specific investment objectives, financial situation and needs of any particular recipient. For the customers of EAP, this email is produced exclusively for our business and expert clients, it is not for general distribution and our services are not available to private clients. Past performance is not indicative of future results.