- Victor Fernandes

- December 13, 2022

- 10:51 am

- 10 min read

Chinese inflationary data shows signs of cooling!

Indices

Futures

Forex

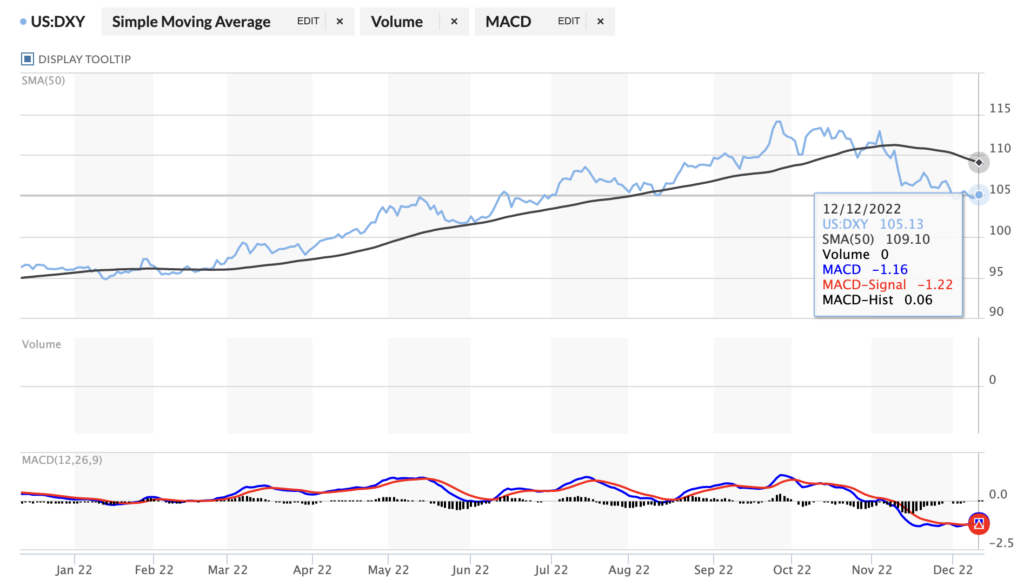

– The dollar index sold off last week and is now trading around 105.13 (chart below) due to recessionary fears, for three sessions the index slid as investors cautiously awaited US producer and consumer price data that would reveal longer-term expectations for monetary policy. The next FOMC meeting is scheduled for Wednesday 14th December 2022.

– U.S treasury yields moved lower on Friday with the 2 and 10 year closing trading at 4.33% and 3.56%, respectively. The 10 year attempts to clear the 3.8% level which is providing short term resistance.

– J.P. Morgan traders say a 6.9% or lower headline reading (5% probability) in Tuesday’s U.S. Consumer Price Index (CPI) report could trigger an 8-10% rally in the S&P 500. Analysts have also highlighted the drop in volatility and possibilities of a year end rally or sell off.

– U.S. Dollar Index (DXY) – 1 Month chart showing the correction after the 114.10 high on the 27th September 2022. Investors and traders wait for the next FOMC and data before making bullish bets on the dollar.

– European yields move higher with the German 10 year yields closing at 1.963% and Italian 10y yields at 3.842%.

– Sterling (GBP) has been trading at $1.22, not far from an almost six-month peak of $1.23 reached earlier this month (See Chart Below). This has buoyed in part by growing confidence that the UK is addressing fiscal plans and spending.

– The UK braces for strikes this festive period which will cause havoc to the national health service (NHS), travel and postage.

– GBP.USD – With the recent Dollar declines, GBP has now pushed up towards a 6 month high!

– Dutch natural gas futures were around €140/MWh in December, far above the six-month low of €97.8/MWh in November, as temperatures in Europe are falling after a mild November, raising heating demand and pressuring stocks.

– The price of electricity in Denmark has increased by 83% between the third quarter of 2021 and third quarter of 2022. The government now urges the public to help save energy by turning off lights and power outlets.

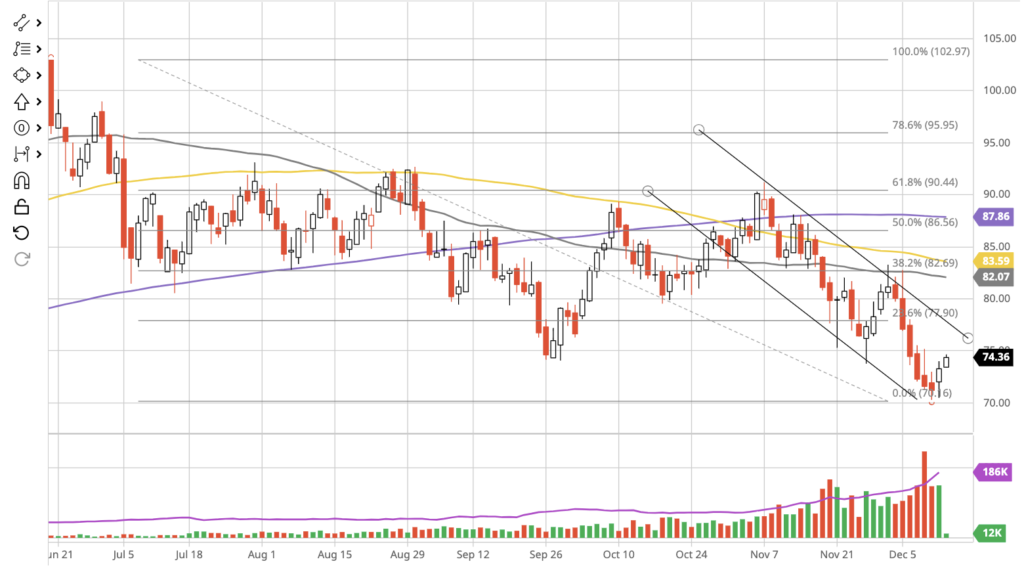

– Despite a bounce yesterday, Oil markets continued their losing streaks last week with Brent and Crude Oil futures closing the week with 11.2% and 11% declines, respectively, $76.10 per barrel (bbl) and $71.02/bbl. Lagging economic growth weighs heavy on the market which is evident in the largest weekly % declines for both benchmarks since April 2022.

– Crude Oil WTI Feb’23 (GLG23) – Large sell off for Crude oil as a global slowdown weighs heavy on demand.

– Asian futures all up over one percent overnight, with the Hang Seng once again leading the way at 19,956, helped by a steep rise in the property sector on the hope of further support measures from the Chinese authorities next week.

– The Chinese economy has grown at just 3% through the first three quarters of 2022. Considering China’s boom in the past two decades this is a mere fraction of its long-term average growth. Recent easing should support growth and a fully functioning Chinese economy is good for global demand and supply.

– Japan’s economy looks increasingly likely to enter into a recession as export growth has drastically slowed in recent months. Japan recently reported a larger than expected trade deficit of $15 billion for the month of October.

Conclusion

There is little change to the global macroeconomic outlook which still looks muddled as the reality of a global recession begins to set in. The question now becomes how deep will this be? Most traders are focusing on the CPI prints and the impending Federal reserve hike on Wednesday. Energy bills spike in Europe as the cold weather sets in, adding more pressure to consumer’s purchasing power and the overall economic slowdown.

Written by:

Victor Fernandes

Copyright statement

No image or information display on this site may be reproduced, transmitted or copied (other than for the purposes of fair dealing, as defined in the Copyright Act 1968) without the express written permission of Earlam & Partners Ltd. Contravention is an infrigement of Copyright Act and its amendments and may be subject to legal action.

The risk of loss associated with futures and options trading can be substantial. Opinions set forth herein should not be viewed as an offer or solicitation to buy, sell or otherwise trade futures, options or securities. All opinions and information contained in this email constitute EAP’s judgment as of the date of this document and are subject to change without notice. EAP and their respective directors and employees may effect or have effected a transaction for their own account in the investments referred to in the material contained herein before or after the material is published to any customer of a Group Company or may give advice to customers which may differ from or be inconsistent with the information and opinions contained herein. While the information contained herein was obtained from sources believed to be reliable, no Group Company accepts any liability whatsoever for any loss arising from any inaccuracy herein or from any use of this document or its contents. This document may not be reproduced, distributed or published in electronic, paper or other form for any purpose without the prior written consent of EAP. This email has been prepared without regard to the specific investment objectives, financial situation and needs of any particular recipient. For the customers of EAP, this email is produced exclusively for our business and expert clients, it is not for general distribution and our services are not available to private clients. Past performance is not indicative of future results.