– Friday’s Non Farm Payroll employment figures rose by 236,000 in March whilst unemployment rate remained steady at 3.5% (chart below). The trends continued to move higher in leisure and hospitality, professional and health care sectors.

– U.S. Bond yields pushed higher, the US treasury 2 year treasury yield moved higher on Friday reaching 3.99%, while the 10-year benchmark also rose by seven basis points to 3.41%.

– The equity markets are pinning hopes that a strong U.S. labour market can help stimulate consumer spending and prevent the economy from slipping into a recession. Considering the bouts of weakness last week, the Dow Jones and S&P 500 are up 0.17% and 1.01% respectively for the month of April.

– The shortened week saw European Stock markets move higher ahead of the bank holiday Easter Weekend. The benchmark Stoxx 600 finished the week up 0.48% whilst the Dax30 closed 0.16% lower at 15,597.89.

– Last week, the Sterling / Euro (GBP.EUR) currency pair traded in a tight range between 1.1375 and 1.1456. Currently, the currency paid is trading at 1.1393 (chart below).The Euro found some strength from hawkish comments from the European Central Bank (ECB). The ECB has signalled it will likely raise the deposit rate by 0.5% to 3%.

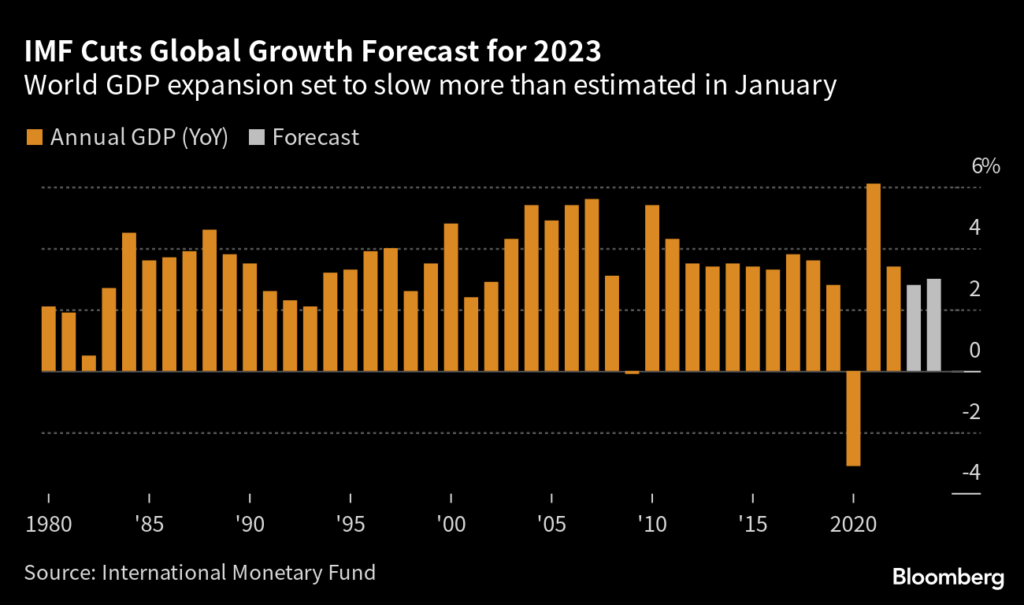

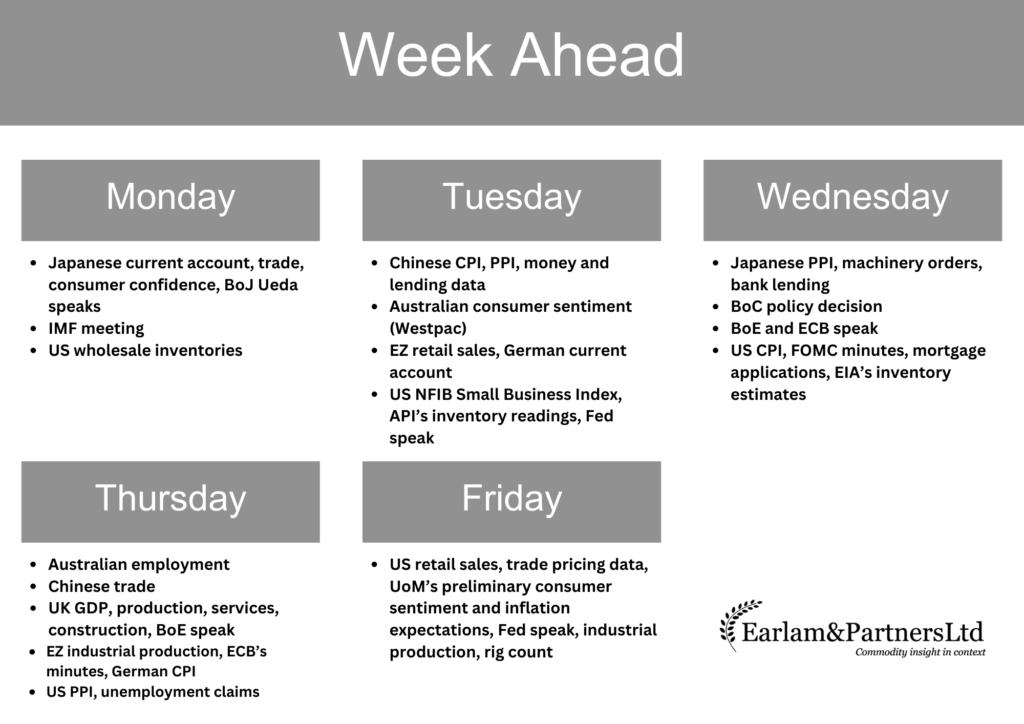

– In the UK, the Bank of England remains vigilant of further banking pressure but is cautiously optimistic of the economy at present. The IMF outlook of the UK’s economy was bleak entering into 2023 but that has changed after the IMF upgrade. However, the UK is still on track to be the worst performing G7 economy this year.

– The Bank of Japan (BOJ) once again comes under pressure as they plan to maintain their ultra loose monetary policy. The new BOJ Governer Kazuo Ueda reinforced the view of his predecessor that rates should remain unchanged at -0.1%. The Japanese Yen (JPY) has slid to 133.14 against the US Dollar.

– The IMF has stated that the current US, China tensions could cost the world 2% of its overall output as emerging markets become more vulnerable to the shift in foreign investment. To combat this, companies and policymakers are exploring ways to make their supply chains more resilient.

– Saudi Arabia has pledged financial support to Pakistan in a bid to secure the IMF deal. The negotiations to secure funding have been ongoing since February and causing huge problems on the countries trade flow and import requirements.

Conclusion

The macro view is rather unchanged after a wobbly start to the week upon signs of a slowing economy in terms of private payroll and job openings. The question marks and concerns around recessionary fears remain and the view for equity markets are mixed after weeks of shrugging off the uncertainty. Projections of global economic growth remain lacklustre and at their lowest levels since 1990. Central banks continue to jostle through the complex macro environment and it’s hard to get overly optimistic or pessimistic at present.

Written by:

Jo Earlam

Copyright statement

No image or information display on this site may be reproduced, transmitted or copied (other than for the purposes of fair dealing, as defined in the Copyright Act 1968) without the express written permission of Earlam & Partners Ltd. Contravention is an infrigement of Copyright Act and its amendments and may be subject to legal action.

The risk of loss associated with futures and options trading can be substantial. Opinions set forth herein should not be viewed as an offer or solicitation to buy, sell or otherwise trade futures, options or securities. All opinions and information contained in this email constitute EAP’s judgment as of the date of this document and are subject to change without notice. EAP and their respective directors and employees may effect or have effected a transaction for their own account in the investments referred to in the material contained herein before or after the material is published to any customer of a Group Company or may give advice to customers which may differ from or be inconsistent with the information and opinions contained herein. While the information contained herein was obtained from sources believed to be reliable, no Group Company accepts any liability whatsoever for any loss arising from any inaccuracy herein or from any use of this document or its contents. This document may not be reproduced, distributed or published in electronic, paper or other form for any purpose without the prior written consent of EAP. This email has been prepared without regard to the specific investment objectives, financial situation and needs of any particular recipient. For the customers of EAP, this email is produced exclusively for our business and expert clients, it is not for general distribution and our services are not available to private clients. Past performance is not indicative of future results.