- Harry Bennett

- November 1, 2022

- 2:38 pm

- 10 min read

The ECB remain committed to hiking interest rates to combat inflation but will the U.S. Federal Reserve pause hikes moving into 2023?

Indices

Futures

Forex

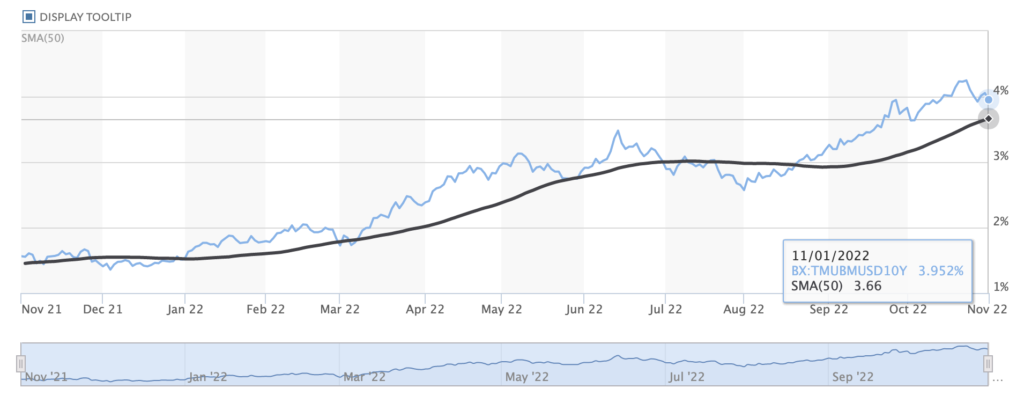

– Last week U.S. Treasury yields climbed on Friday as inflation data and employment figures came in line with estimates. Stronger than expected GDP growth of 2.6% was a positive sign for traders. The 2 year and 10 year treasury yields are currently trading around 4.4% and 4% respectively (10 yr treasury yield chart below)

– The U.S. appeals court has temporarily blocked Biden’s student loan forgiveness initiative. The move would have cost taxpayers $400 billion according to Congressional Budget office.

– The Dow advanced more than 800 points on Friday, and the S&P 500 and the tech heavy Nasdaq was up over 2.25%. Investors welcomed the economic data and positive earnings reports. For the week, the S&P 500, Dow and Nasdaq were up 3.8%, 5.01% and 2.04% respectively.

– The World Bank warns of a global recession next year with subsequent financial crises in emerging markets and developing economies.

– European Central Bank president Christine Lagarde has said the ECB must keep raising rates despite the inflation risks. The ECB’s mandate is price stability and the goal is to bring inflation back to the 2% target.

– Germany may allow China’s Cosco shipping line to take a smaller stake (24.9%) in the Hamburg port terminal. This is despite efforts from foreign ministries to block the deal for political concerns.

– Eurozone inflation climbed to 10.7% in October, energy costs along with other impacts from the Ukraine war will impact European economies over the next 12 months. Consumers will need to cut back on spending. The International Monetary Fund (IMF) reckons the Eurozone area will see growth of 3.1% in 2022 and just 0.5% in 2023.

– The UK continues to battle through its political instability. The UK’s treasury sources has been keen to stress the difficulties that the fiscal package will have on the UK as a whole. Tax rises look likely across the board but the full package will be announced on the 17th November 2022.

– According to the latest PMI data released by S&P Global, the UK’s economic outlook now looks even more gloomy. Business activity fell for its third consecutive month in October at 47.50, marking its steepest decline since the global financial crisis (March 2009), excluding the pandemic.

– GBP continues its attempts to regain lost ground against the Dollar (USD). The weekly close was 1.16155, with the 100 day moving average looking like an area of resistance along with the 61.8% Fibonacci retracement (chart below).

– China’s consumer prices rose in September at their fastest pace in more than 2 years (chart below). Food prices have exploded, in particular prices of pork have soared as some farmers have been reluctant to sell pigs their pigs which has tightened supply.

– In Brazil, President Jair Bolsanaro lost to the left in what was a tight Brazilian election. Economists have warned that inflation will rise as the Brazilian Real (R$) currency will fall.

Conclusion

The global macroeconomic outlook does not look promising as global recessionary fears continue to mount. Inflationary data in the U.S continues to rise and China’s stance on policy offers more economic gloom. Business activity is falling across the globe which is evident by the data prints. Energy crisis’s loom and this is made worse with the extremely fragile Russian – Ukraine war. Hedge funds rebuild their long position across the grain, oilseed and cattle commodity markets.

Written by:

Harry Bennett

Copyright statement

No image or information display on this site may be reproduced, transmitted or copied (other than for the purposes of fair dealing, as defined in the Copyright Act 1968) without the express written permission of Earlam & Partners Ltd. Contravention is an infrigement of Copyright Act and its amendments and may be subject to legal action.

The risk of loss associated with futures and options trading can be substantial. Opinions set forth herein should not be viewed as an offer or solicitation to buy, sell or otherwise trade futures, options or securities. All opinions and information contained in this email constitute EAP’s judgment as of the date of this document and are subject to change without notice. EAP and their respective directors and employees may effect or have effected a transaction for their own account in the investments referred to in the material contained herein before or after the material is published to any customer of a Group Company or may give advice to customers which may differ from or be inconsistent with the information and opinions contained herein. While the information contained herein was obtained from sources believed to be reliable, no Group Company accepts any liability whatsoever for any loss arising from any inaccuracy herein or from any use of this document or its contents. This document may not be reproduced, distributed or published in electronic, paper or other form for any purpose without the prior written consent of EAP. This email has been prepared without regard to the specific investment objectives, financial situation and needs of any particular recipient. For the customers of EAP, this email is produced exclusively for our business and expert clients, it is not for general distribution and our services are not available to private clients. Past performance is not indicative of future results.