- Harry Bennett

- January 24, 2023

- 2:02 pm

- 10 min read

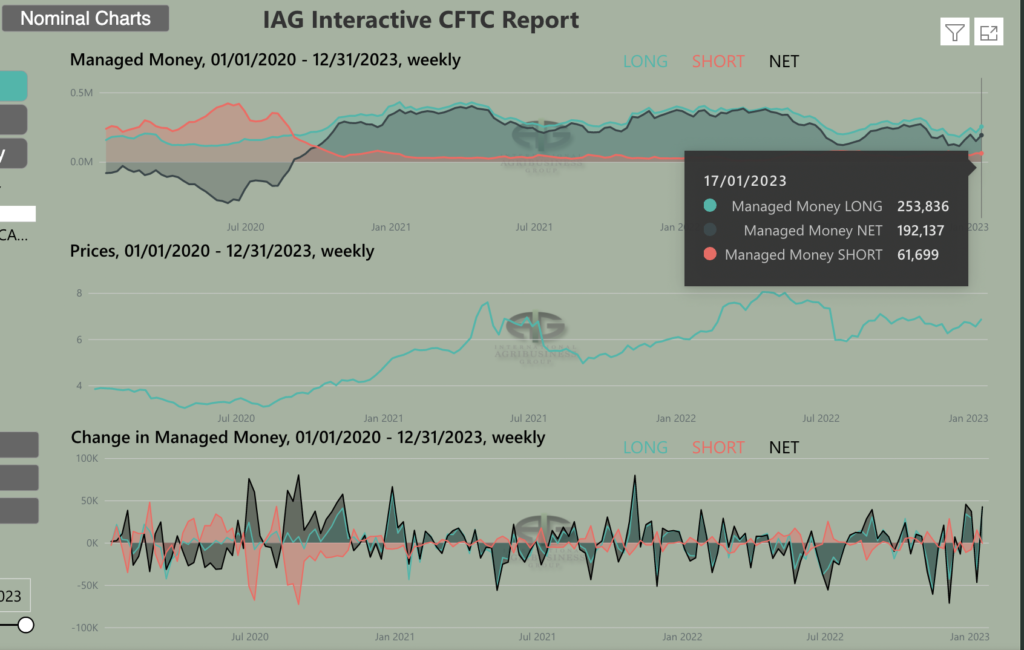

The funds add over 42,000 contracts to their long position, taking their overall position to 192,137!

Indices

Futures

Forex

– March Corn’23 (ZCH23) – Little change to the technical picture as the market struggles to decisively move beyond 690.00. We remain trapped within the contracting triangle circa 650 – 688.00. The March contract is now poised between the 100 day (orange line) and 50 day (grey) moving averages. Support will be found at 50% & 61.8% Fibonnacci Retracement located around the 653.30 and 639.00 handle.

– Trading this week took place within a narrow 20 cent range between 668.60 and 688.60. Despite prices breaking through 680.00 the front month March’23 appeared to run out of steam as prices failed to eclipse that 690.00 handle. Daily futures volume remained subdued, the shortened week saw an average of just 92,314 contracts traded daily.

– Corn export sales were strong this week and came in above trade guesstimates at 1.132 million mt. This was far above the 4 – week average. Leading buyers included Japan (340,000), Mexico (271,000) and South Korea (134,500). Weak demand has been a major issue for U.S. corn as the South American crops are able to compete.

– The CFTC Commitment of traders report, revealed a net change of 42,532 contracts. Their overall position now stands at 192,137 (chart below) contracts net long. We suspect the funds have trimmed their bullish bets on Corn given the news of rains in Argentina.

– Farmdoc (data analysts) have just released their preliminary estimates for supply and demand figures. Acreage was set to 92.5 million which is above the USDA basline. Carryoput is expected to increase to 2.046 billion bushels which is much higher than the current projection at 1.722 bbu.

– CFTC Commitment of Traders – The managed money extended their net long position by 42,532 contracts for the week ending 17th January 2023. Corn & Soy prices saw pressure late this week with rains in Argentina so may be marginally less bullish.

– There are increasing concerns about the Chinese economic problems associated with the long drag of lockdowns. With its rapid move to open their economy they will need to overcome their mass COVID cases which have reached 80% in the largest annual human migration for Lunar New Year.

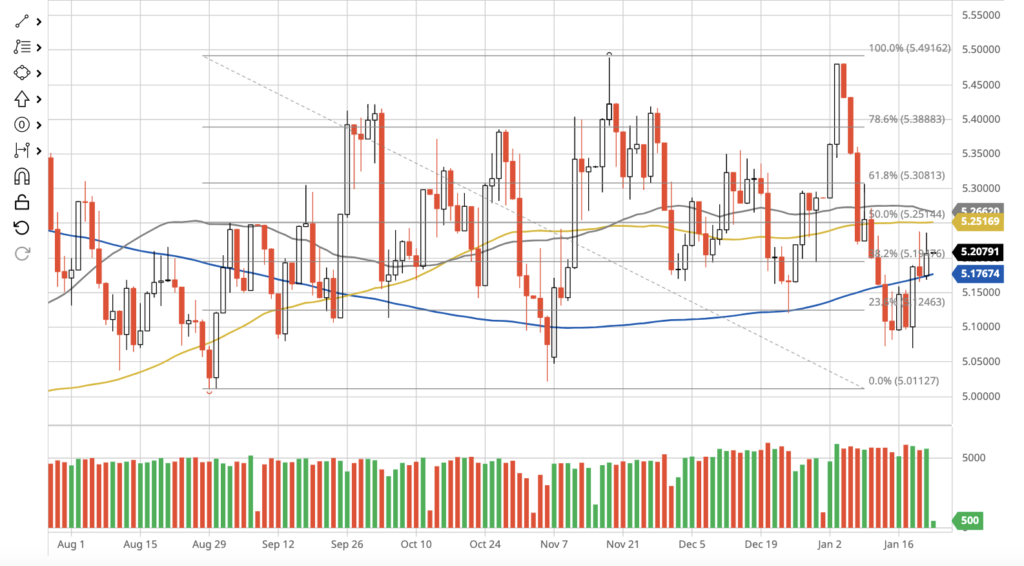

– Despite the concerns, Copper (often referred to as a barometer for economic activity) was trading near to seven-month highs (chart below) amid continued optimism that China’s reopening from Covid lockdowns will boost demand for the precious metal. Markets will remain fairly quiet this week as Asian holidays are in full swing for this Lunar New Year.

– Spot Copper Prices – Copper is trading near seven month highs on China optimism. Copper is often viewed as a barometer of the world economic growth.

– In South America, forecasts call for only light rains as dry conditions persist in most of Southern Brazil and Argentina. The promising news is that these areas may see significant rains early this week.

– Brazil’s winter crop is nearly harvested but delays may impact the Safrinha crop planting. This reduces the window for planting and increases the risks of frost.

– An article from reuters highlighted Brazil’s 2022/2023 summer grain production will outgrow total storage capacity for the first time in 20 years amid expectations of a record soybean harvest. We think it is a little early to accurately predict the overall harvest. However, to combat this farmers will often use silo bags (photo below) for storage. This being a highly cost effective method for storage.

– Storage Capacity at its brink – Silo bags are often used as a cost effective storage solution as the old problem of a deficit in grain storage continues. Crop production in Brazil vastly outpaces storage capacity.

– Last week the Brazilian Reais reversed course and slipped against the USD and is currently trading at 5.20. The volatile swings in this currency pair continue. Recent announcements from President Lula Da Silva said that the country’s minimum wage must rise in line with economic growth (7.43% increase year on year) to 1,302 Reais.

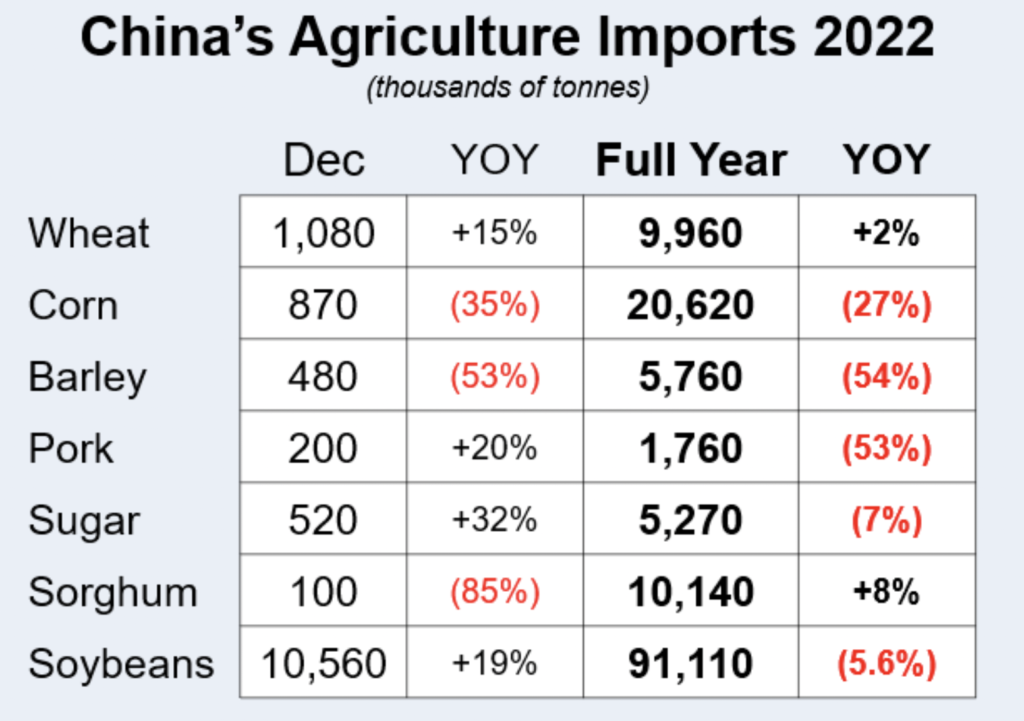

– Chinas corn, barley and pork imports were sharply down despite the pick up in demand for Wheat and Sorghum. Corn imports were down 27% YOY whilst Pork was down 53%! December Soy imports were strong suggesting we are seeing a pick up but the volume is still down year on year. (table below)

Conclusion

The WASDE report bolstered some strength in the futures market before meeting resistance. The front month remains locked within the contracting triangle. However, the poor U.S. demand outlook is a major cause of concern. Despite issues with weather in South America there appears to be ample supplies globally. China are buying from Brazil who anticipate large production estimates for this season. Now the question remains whether the funds build upon their longs or wait to see more from the fundamentals.

Written by:

Harry Bennett

Copyright statement

No image or information display on this site may be reproduced, transmitted or copied (other than for the purposes of fair dealing, as defined in the Copyright Act 1968) without the express written permission of Earlam & Partners Ltd. Contravention is an infrigement of Copyright Act and its amendments and may be subject to legal action.

The risk of loss associated with futures and options trading can be substantial. Opinions set forth herein should not be viewed as an offer or solicitation to buy, sell or otherwise trade futures, options or securities. All opinions and information contained in this email constitute EAP’s judgment as of the date of this document and are subject to change without notice. EAP and their respective directors and employees may effect or have effected a transaction for their own account in the investments referred to in the material contained herein before or after the material is published to any customer of a Group Company or may give advice to customers which may differ from or be inconsistent with the information and opinions contained herein. While the information contained herein was obtained from sources believed to be reliable, no Group Company accepts any liability whatsoever for any loss arising from any inaccuracy herein or from any use of this document or its contents. This document may not be reproduced, distributed or published in electronic, paper or other form for any purpose without the prior written consent of EAP. This email has been prepared without regard to the specific investment objectives, financial situation and needs of any particular recipient. For the customers of EAP, this email is produced exclusively for our business and expert clients, it is not for general distribution and our services are not available to private clients. Past performance is not indicative of future results.