- Harry Bennett

- October 10, 2022

- 9:27 pm

- 10 min read

Corn prices finish the week higher, December'22 was up 5 3/4 cents for the week!

Indices

Futures

Forex

– December Corn’22 (ZCZ22) – Little change in the technical picture as the market consolidates through the week around 680 basis December’22. Trading took place within a narrow 20 cent range between 691.40 and 671.40. The 61.8% Fibonacci continues to act as a big area of resistance with support at 664.10 (50% Fib level) which coincides with both the 50 & 100 day moving averages and further down at 640.00 (38.2%) with the 200 day moving average hovering between these two levels. The candlestick from Fridays trading session was bullish suggesting we will see some follow through buying.

– Corn continues its period of consolidation as the market is yet to decide its next move. Efforts to climb higher are met by resistance as the trade waits for more data on the overall crop size. Futures 6 ¼ to 7 ¾ cent gains, December was up 5 ¾ cents for the week. There is now a significant carry from December to March of 7 ¾ cents as the market is in contango.

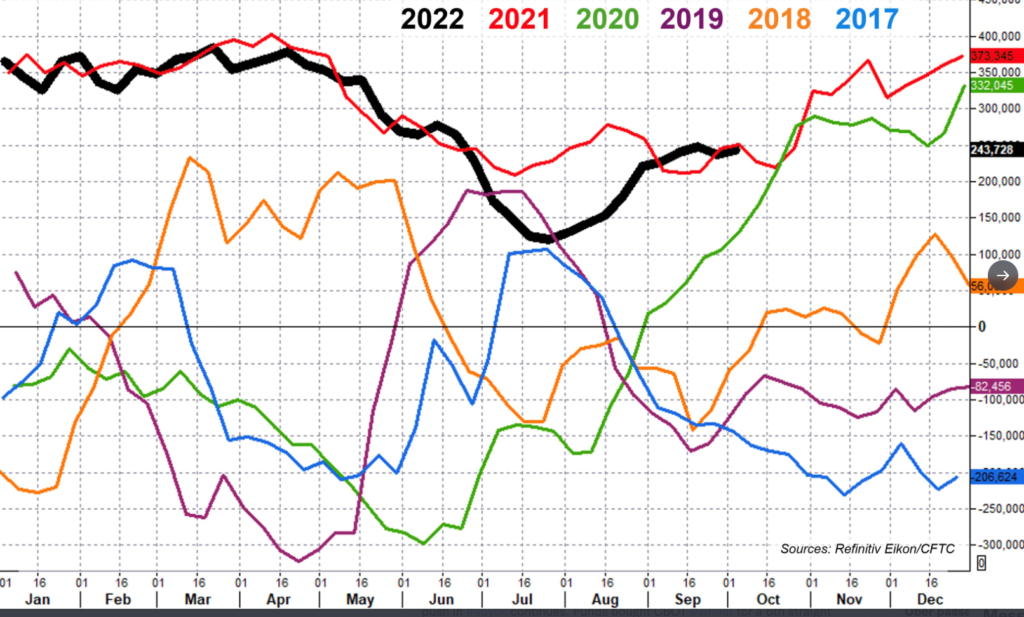

– Despite the trim last week, the weekly CFTC data showed the managed money had increased their net long position by 5,874 contracts to 243,728 (chart below). Commercial short hedges mounted to 440,762 contracts.

– Sales were lacklustre for both Soy and Corn which were both lower week on week. For corn, sales totaled 227,000 mt which was almost 50% lower than the previous week at 512,000. Mexico were the leading buying (147,300 mt) and Honduras (28,200 mt). Exports came in at 645,500 which was a marginal improvement week on week.

– CFTC Managed money net position – Funds increase their net long position by 5,874 contracts taking their position to 243,728 net long. (Data from USDA, Reuters)

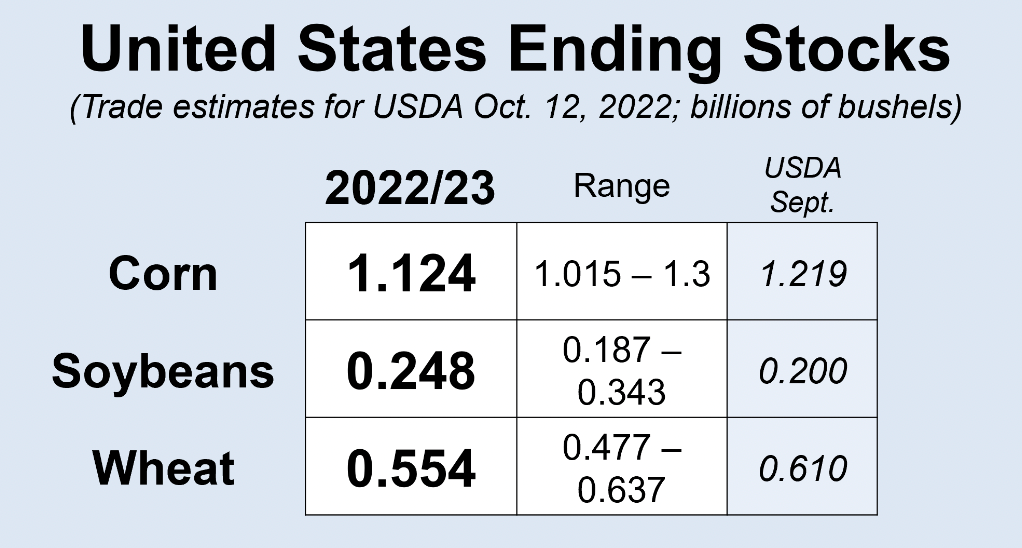

– Analysts see U.S. corn yield falling to 171.80 bushels / acre in USDA WASDE report which is due for release on Wednesday 12th October 2022. The range of estimates are between 170.10 and 173.90 bpa.

– Whilst it is expected to be a smaller corn crop this year, it is the reduction of stocks in September which may bring stocks closer to 1 billion bushels. This would be an 18% reduction from the previous year and very tight historically.

– Freezing weather was seen in parts of North Dakota, Iowa and Minnesota over the weekend. The cold weather may lead to the first widespread freeze of the season as temperatures and precipitation look to drop over the 8 – 14 day outlooks.

– National Weather Service maps show below normal temperatures across large parts of the Corn belt. Precipitation is also leaning below normal for the period between 17th -23rd October 2022 (map below).

– US Ending Stocks – Ending stocks to fall to nearly 1.0 – 1.1 billion bushels for 22/23 crop which is historically very tight.

– 8 – 14 day Temperature & Precipitation – Maps show below normal temperatures across large parts of the Corn belt. Precipitation is also leaning below normal for the period between 17th -23rd October 2022.

– According to Ukraine’s Ministry of Infrastructure, exports of agricultural products continue to flow from Ukraine as more than 6.90 million mt were shipped in September. The majority of which were shipped out of Odesa port.

– Brazil’s CONAB increases their estimates of the 22/23 crop at 126.942 mmt. This was an increase of 12.5% to the overall production estimate and also including a 96.277 mmt Safrinha crop. Soybean and first crop corn planting is getting underway in most of the major growing areas.

– We would warn that there is still a long time between now and the main Safrinha harvest so caution over estimating the overall crop size. All eyes will be on the USDA’s next global production estimates, due for release on the 12th October at noon ET.

Conclusion

The weather premium for U.S. market is firmly in place as yields may be further reduced. We may see further downgrades and reductions in both the U.S., China and Europe if the adverse weather continues. The funds are still long despite their brief pause and could act as the catalyst to take this market much higher. The movement above key resistance levels would bolster this bullish tone.

Written by:

Harry Bennett

Copyright statement

No image or information display on this site may be reproduced, transmitted or copied (other than for the purposes of fair dealing, as defined in the Copyright Act 1968) without the express written permission of Earlam & Partners Ltd. Contravention is an infrigement of Copyright Act and its amendments and may be subject to legal action.

The risk of loss associated with futures and options trading can be substantial. Opinions set forth herein should not be viewed as an offer or solicitation to buy, sell or otherwise trade futures, options or securities. All opinions and information contained in this email constitute EAP’s judgment as of the date of this document and are subject to change without notice. EAP and their respective directors and employees may effect or have effected a transaction for their own account in the investments referred to in the material contained herein before or after the material is published to any customer of a Group Company or may give advice to customers which may differ from or be inconsistent with the information and opinions contained herein. While the information contained herein was obtained from sources believed to be reliable, no Group Company accepts any liability whatsoever for any loss arising from any inaccuracy herein or from any use of this document or its contents. This document may not be reproduced, distributed or published in electronic, paper or other form for any purpose without the prior written consent of EAP. This email has been prepared without regard to the specific investment objectives, financial situation and needs of any particular recipient. For the customers of EAP, this email is produced exclusively for our business and expert clients, it is not for general distribution and our services are not available to private clients. Past performance is not indicative of future results.