- Jo Earlam

- February 25, 2023

- 5:41 am

- 10 min read

Marketing year high for USA export sales, powers Cotton higher!

The author visited the Meridian Observatory in Greenwich, London yesterday (see picture below) and the site of the "Prime Meridian", where on a wall it was written that "Calendars help us keep count of the natural cycles of time. Around the world most cultures base their calendars on the apparent movement of the Sun, the Moon or the stars - or on a combination of the three! Leaders and despots have tried to reorganise calendars to show their authority or to signal a new era, but the structure of a calendar is so deeply deeply established in a culture that it proves impossible to change!"

CTK23 84.90 (+2.74)

CTN23 85.08 (+2.45)

CTZ23 84.32 (+2.10)

Zhengzhou WQK23 – 14,380 (-95)

Cotlook “A” Index – 97.35 (+0.25)

Daily volume – 38,132

AWP – 70.78

Open interest – 185,602

Certificated stock – 1,147

K23/N23 spread – (-0.18)

N23/Z23 spread – (+0.76)

May Options Expiry – 14th April 2023

May 1st Notice Day – 24th April 2023

Introduction

– A bank holiday shortened week saw a stellar export report on Friday, which took Cotton out of its slumber and gave the impetus to drive prices upwards, finishing the week up 340 points higher than the previous Friday close. Prices traded in a 397 point range between 81.08 and 85.05, with futures volume averaging just 31,970 daily and much reduced from the previous week, now the roll period is over.

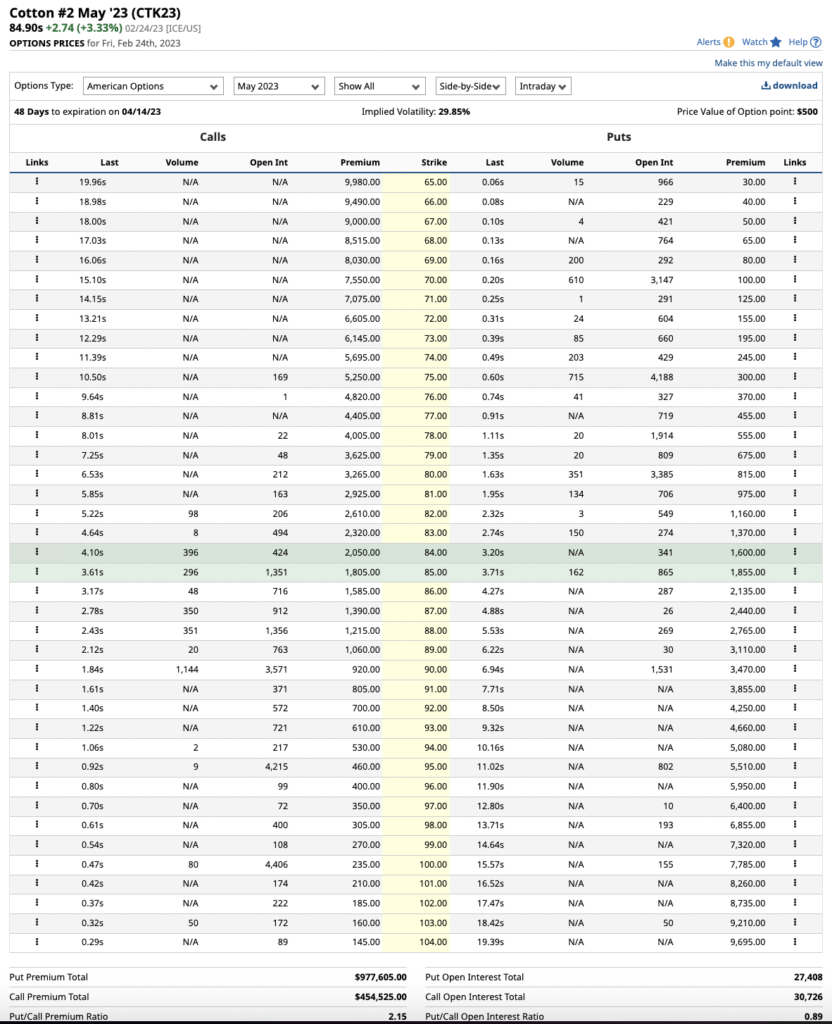

– For options, trading volume was almost half the previous week, but implied at the money volatility for K23 remains relatively high at just under 30 and provides continued opportunity to those who believe the tight trading range we have been in for approaching 4 months is to continue!

– Open interest in options for the nearby K23 contract provides excellent insight as to where “insurance bets” are open and we have enclosed pictorial evidence below, for which we have the following comments to make.

– In puts most of the open bets lie at the 80, 75 and 70 strikes. For calls they are at the 90, 95 and 100 strikes. The futures price of K23 closed on Friday right in the middle of those strikes, i.e. 85c/lb where all those open bets would expire worthless!

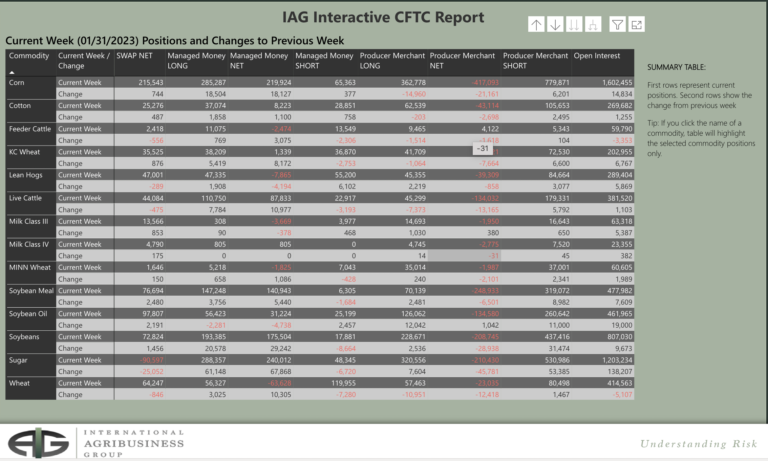

– The 1 month delayed CFTC COT report was finally published on Friday giving details of traders positions as of the end of January and still 3 weeks behind where they should be.

– There was not much change and pictorial evidence is provided from our friends at IAG of all the softs and grains. Funds still hold sizeable longs in both Soy and Corn and perhaps provides evidence as to why these two particular commodities have held up so well in recent months!

– The US$ Index had a good week (like Cotton) and we note our previous weekend comments that value was to be had in Cotton in the low 80’s despite a strengthening US$!

– The cash chart of the US$ index is attached and we would argue that stiff resistance lies ahead at the 38.2% retrace of the recent counter trend move by the US$ suggesting a further and potential 1% move higher but might be all we get in the short term! Please see chart below!

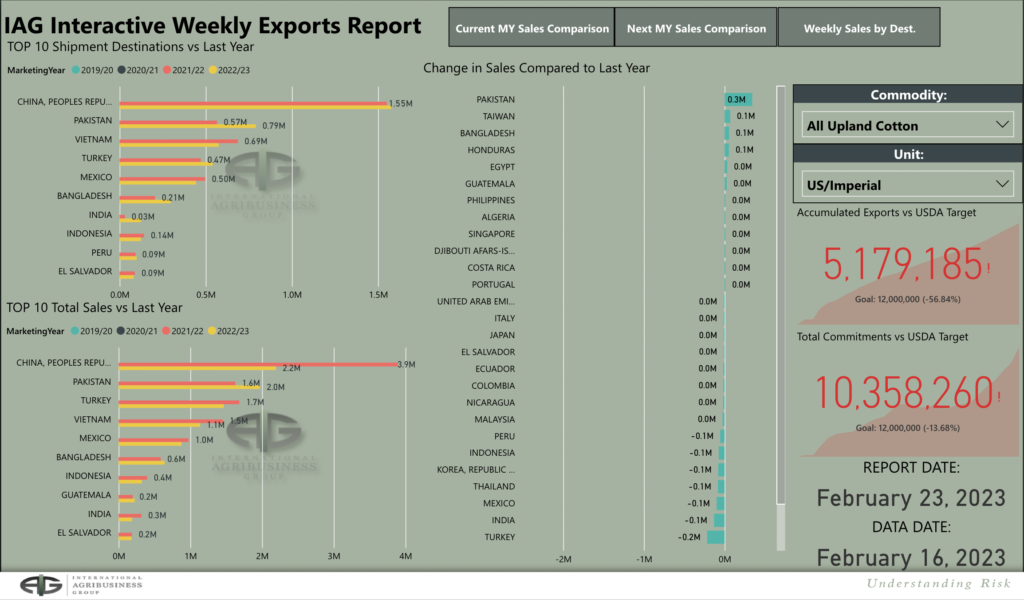

– The one day delayed USA Export sales report of 425,300 RB for 2022/2023 was a marketing-year high and 96 percent up from the previous week and 97 percent from the prior 4-week average and were to a wide 16 destinations. Vietnam (131,200 RB), Pakistan (95,600 RB), Turkey (79,600 RB) & China (46,200 RB) topped the sales markets! The report was impressive to say the least and perhaps indicative of the lack of forward coverage by so many mills across the globe!

– The IAG pictorial evidence of sales tells the story of the year so far and probably better than we can write, for which we remain most thankful!

– It was a good performance by Cotton this week and recent speculative shorts will likely be rueing their decision to sell Cotton in the low 80’s!

– We would not be surprised to see additional strength early next week and maybe even a test of the top end of the range in the high 80’s. However, we are fairy sure that farmer fixations will cap any rally with a continuation of the 80 to 90c/lb range we have been accustomed to this calendar year!

Conclusion

We believe value is to be had in the low 80’s basis K23 and EAP would be a scale down buyer of Cotton from this level down to the long standing gap in the mid 70’s dating back to November, were prices to reach there. Above, we maintain that prices in the high 80’s has Cotton fully valued, with any move in to the 90’s to be considered a selling opportunity. We maintain that an anticipated relatively wide trading range of 75 to 95c/lb is likely to prevail to the end of the season ending May 31st.

Useful links

*Please note that we only share CFTC CTO on weekend reports.

Written by:

Jo Earlam

Copyright statement

No image or information display on this site may be reproduced, transmitted or copied (other than for the purposes of fair dealing, as defined in the Copyright Act 1968) without the express written permission of Earlam & Partners Ltd. Contravention is an infrigement of Copyright Act and its amendments and may be subject to legal action.

Disclaimer

The risk of loss associated with futures and options trading can be substantial. Opinions set forth herein should not be viewed as an offer or solicitation to buy, sell or otherwise trade futures, options or securities. All opinions and information contained in this email constitute EAP’s judgment as of the date of this document and are subject to change without notice. EAP and their respective directors and employees may effect or have effected a transaction for their own account in the investments referred to in the material contained herein before or after the material is published to any customer of a Group Company or may give advice to customers which may differ from or be inconsistent with the information and opinions contained herein. While the information contained herein was obtained from sources believed to be reliable, no Group Company accepts any liability whatsoever for any loss arising from any inaccuracy herein or from any use of this document or its contents. This document may not be reproduced, distributed or published in electronic, paper or other form for any purpose without the prior written consent of EAP. This email has been prepared without regard to the specific investment objectives, financial situation and needs of any particular recipient. For the customers of EAP, this email is produced exclusively for our business and expert clients, it is not for general distribution and our services are not available to private clients. Past performance is not indicative of future results.