- Jo Earlam

- August 19, 2022

- 7:55 pm

- 10 min read

Wild week for Cotton as traders try to decide where prices head to next?

By the sea all worries wash away!

CTZ22 116.01 (+3.31)

CTH23 112.84 (+3.08)

CTK23 109.89 (+3.00)

CTN23 105.20 (+3.31)

CTZ23 90.31 (+2.80)

Zhengzhou CF301 – 15,035 (+200)

Cotlook “A” Index – 131.00 (-0.65)

Daily volume – 24,304

AWP – 101.90

Open interest – 198,716

Certificated stock – 4,552

Z22/H23 spread – (+3.17)

Z22/Z23 spread – (+25.70)

December Options Expiry – 11th November 2022

December 1st Notice Day – 23rd November 2022

Introduction

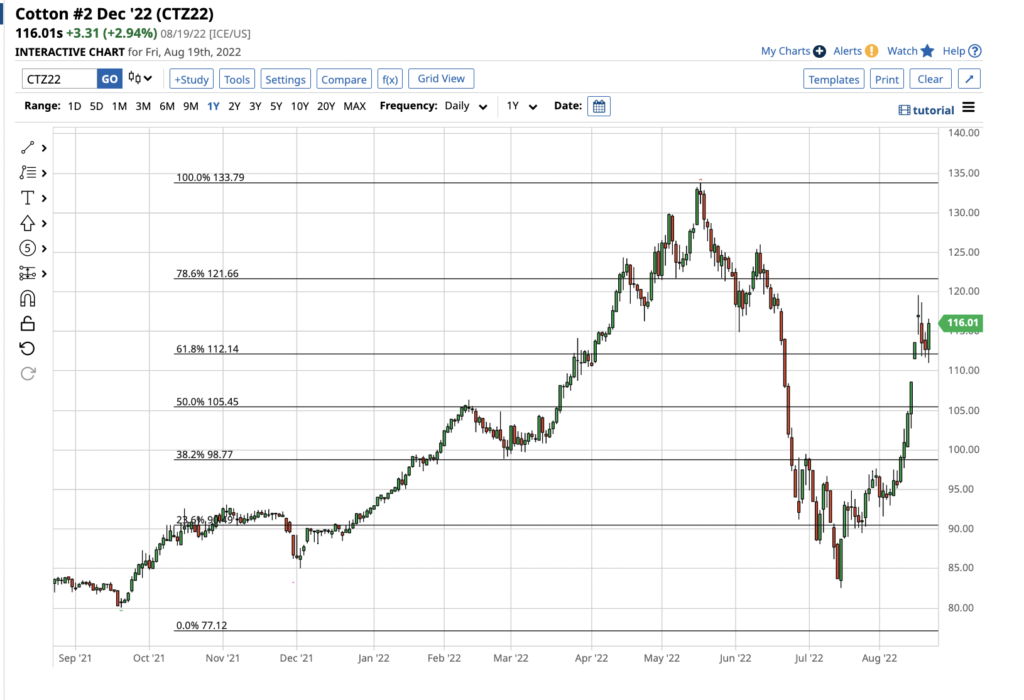

– Z22 traded the week in a wide range of 858 points between 111.01 and 119.59 on average daily futures volume of 43,175. Following the previous Friday’s bullish WASDE, the cotton market had 3 consecutive limit up moves that has seen the price rise over 37c/lb in the space of a month.

– The current upward move followed the previous down move, from 126.00 back on the 15th June, to 82.54 by the 15th July falling a staggering 44.46c/lb and also taking a month! These are huge moves, noting that the average move this century for a cotton season is just under 38c/lb! Taking out the 4 biggest seasons (detailed in the next point) that figure moves to 27c/lb.

– There have been 4 seasons this century which have seen prices in the 100’s and without exception happen in pairs. They are the 10/11 and 11/12 season and the 21/22 and the current 22/23 season. Going further back, we have to go to the 94/95 and 95/96 season. Back then we we also saw two consecutive seasons that saw prices in the 100’s and also happened as a pair. In all cases the 2nd season proved to be an inverse season where seasonal highs occurred early and lows late!

– Option volume averaged a massive 16,695 options daily, being more than double the volume of the previous week with calls once gain outnumbering puts. The open interest in Z22 options is enclosed below and note how volatility remains very high at over 44%.

– Away from the Cotton market, the September Dollar index futures contract rose 2.45% in the last week and was at the 108 level and almost certainly looks to go higher still!

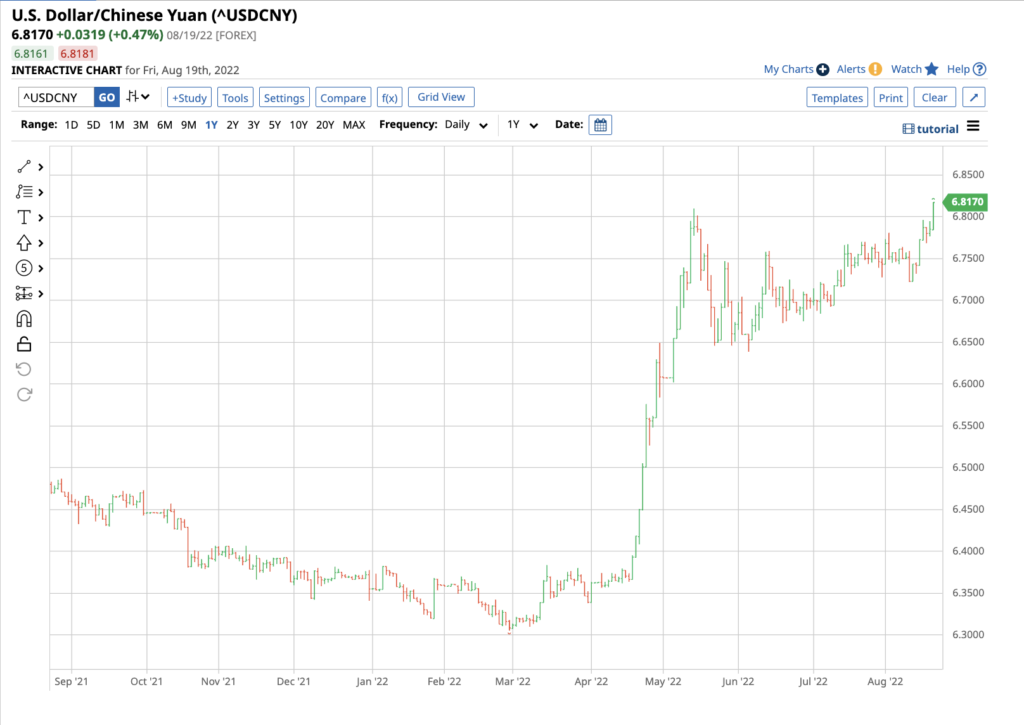

– On the other hand, China’s yuan slipped to its lowest since September 2020 and the € closed at its lowest level in over a month, with more weakness expected. Dollar strength is unlikely to be positive for Commodities!

– On the other hand Natural Gas which is a hugely volatile commodity having had its all-time high in 2005, with a lower high in 2008. In 2022, the potential for even higher highs in the nearby NYMEX natural gas futures contract looks likely. There is plenty of time for more implosive moves before the winter season, but the path of least resistance remains higher for the natural gas futures market as the summer season ends over the coming weeks. The next upside target is the $10 level, which could be a gateway to a new all-time high.

– This point is highly relevant for what we hear in Bangladesh and other large spinning markets where energy costs are so high that demand rationing for Cotton is inevitable!

0- The CFTC cotton on call report showed little change on the week, with a reduction of the current crop net position of only 578 contracts. With so little change we can only repeat our thoughts of last week: the Dec position is the highest for this week of the year, but the March position is, remarkably, the 21st highest! As we commented a week ago, many of the contracts based on Dec can and will be rolled out to March rather than being fixed by Dec FND.

– The USDA export sales report as of 11th August reported net sales of 49,500 bales for the week. The US crop is the most sold at this point in twenty years which can be seen in merchants’ reluctant offerings. Approaching a quarter of the commitments are, however, to China and, given the disparity between local prices and imports, one would expect to see China as an absent buyer going forward for anything other than political reasons.

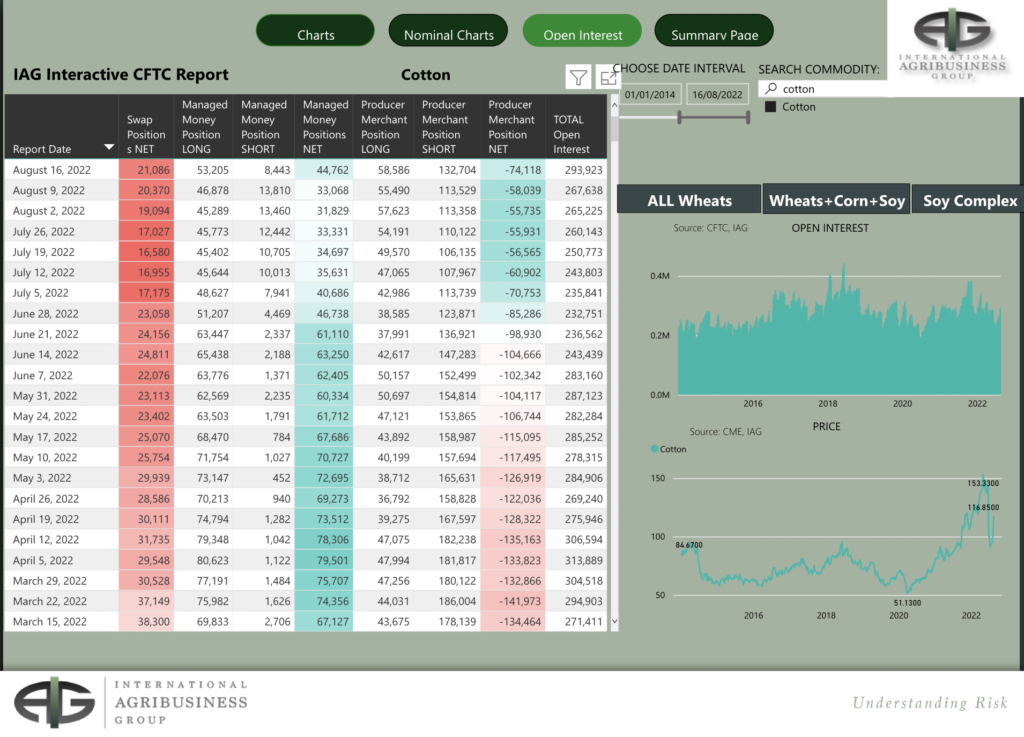

– As expected the CFTC COT report showed a big increase week on week in Managed Money long positions. MM bought a net 11,694 contracts in the week ending last Tuesday. Other and Non Reportables (OR and NR) were also in buying mode adding a net 333 and 3,336 each and between MM, OR and NR they bought a net 15,363 contracts in a week to take their overall net long back up to 53,033 contracts.

– We strongly suspect they may be even longer than this noting the price action and rise in open interest of over 8k contracts over the last 3 days of last week.

– The big brothers have not made any sort of move higher compared to Cotton since topping out a couple of months ago. Indeed, Wheat is actually lower than when the war in the Ukraine began.

– In other words, Cotton seems to have disengaged itself from its big brothers and history tells us this is unlikely to continue for an extended period.

– However, with hurricane season upon us, we simply cannot rule out some additional storm inspired rises in the Cotton market that could potentially see a test of prices in the mid 120’s or possibly even higher. Nevertheless, EAP maintain that by the end of September reality and demand rationing for Cotton will set in and prices will start to drop again.

– We do not expect the same sort of impulsive collapse seen back in the middle of June but expect a more orderly drop and test of the low 100’s after the middle to end of September and into the Z22 expiry in the 3rd week of November.

– In addition, EAP believe current elevated basis offering levels by merchants will eventually weaken in the months ahead, noting the recent weakness of the Baltic Dry Index and the likelihood of faltering end user demand in the face of negative yarn margins versus replacement Cotton costs.

Conclusion

EAP do not rule out a potential retest of the low to mid 120’s over the next 4-5 weeks on fund buying and/or a hurricane inspired rally following the very bullish August WASDE report and last week’s speculative buying that may well continue a little longer. This is a period of extreme volatility and EAP ideally prefer a stand aside approach for the next week or two, until prices calm down somewhat. Longer term, EAP remain of the belief that the 22/23 season will prove to be an inverted one, with the final low at the end of the season and scale up selling into strength over the next 4/5 weeks will likely prove to be prudent.

Useful links

*Please note that we only share CFTC CTO on weekend reports.

Written by:

Jo Earlam

Copyright statement

No image or information display on this site may be reproduced, transmitted or copied (other than for the purposes of fair dealing, as defined in the Copyright Act 1968) without the express written permission of Earlam & Partners Ltd. Contravention is an infrigement of Copyright Act and its amendments and may be subject to legal action.

Disclaimer

The risk of loss associated with futures and options trading can be substantial. Opinions set forth herein should not be viewed as an offer or solicitation to buy, sell or otherwise trade futures, options or securities. All opinions and information contained in this email constitute EAP’s judgment as of the date of this document and are subject to change without notice. EAP and their respective directors and employees may effect or have effected a transaction for their own account in the investments referred to in the material contained herein before or after the material is published to any customer of a Group Company or may give advice to customers which may differ from or be inconsistent with the information and opinions contained herein. While the information contained herein was obtained from sources believed to be reliable, no Group Company accepts any liability whatsoever for any loss arising from any inaccuracy herein or from any use of this document or its contents. This document may not be reproduced, distributed or published in electronic, paper or other form for any purpose without the prior written consent of EAP. This email has been prepared without regard to the specific investment objectives, financial situation and needs of any particular recipient. For the customers of EAP, this email is produced exclusively for our business and expert clients, it is not for general distribution and our services are not available to private clients. Past performance is not indicative of future results.