- Jo Earlam

- March 19, 2023

- 12:07 am

- 10 min read

New crop December open interest now higher than old crop July with carry between the front 3 months!

When I was a child, I had posters of James Dean in my room. I was a big admirer of his work and was fascinated by him living on the edge. Looking back, my life was kind of the same....Boris Becker

CTK23 77.83 (-1.33)

CTN23 78.44 (-1.26)

CTZ23 79.51 (-1.12)

Zhengzhou WQK23 – 13,845 (-180)

Cotlook “A” Index – 93.55 (Unch)

Daily volume – 36,754

AWP – 68.58

Open interest – 190,998

Certificated stock – 1,661

K23/N23 spread – (-0.61)

N23/Z23 spread – (-1.07)

May Options Expiry – 14th April 2023

May 1st Notice Day – 24th April 2023

Introduction

– One could be forgiven for thinking matters Cotton were rather dull in the last week, noting that the price finished the week down 35 points from the previous Friday close at 77.83 basis the CTK23 front month contract!

– However, it was far from that, with prices traversing in a relatively wide 563 point range between 76.86 and 82.49, on average robust daily futures volume of 45,384. Options were active too with puts and calls trading almost equally and averaging a big 10,478 daily over the week and volatility rising to the low 30s.

– Below we have included the open interest in the WQK23 options that have just 18 days to expiry. It is interesting because of how many open puts lie so close to the futures price, which to us suggests prices are likely to consolidate at current levels meaning most of those bets would thereby expire worthless as so often happens into an option expiry!

– Also included in the 2nd picture is a line chart of New York CTK23 in comparison to the WQK23 future price. As we have opined in recent reports we are sure that current prices offer plenty of interest for end user buying and fixation and is why good two way volume is being seen (read shorting speculators against end user physical buying)

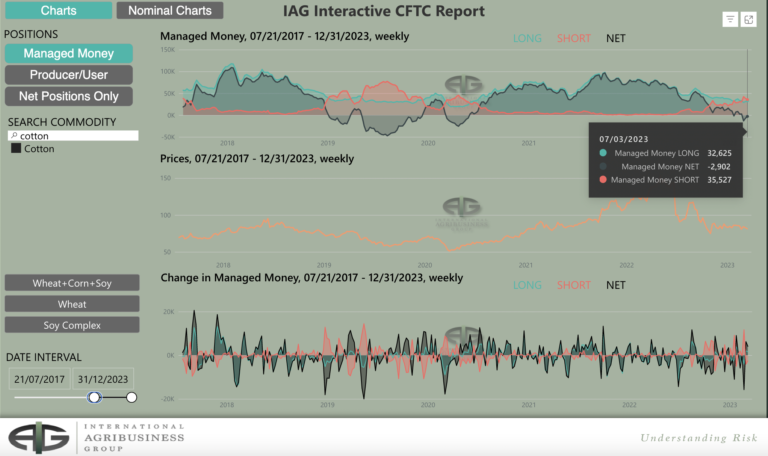

– The COT report is only one week behind schedule with latest positions of traders valid up to the 7th March when CTK23 closed at 82.77 against a closing price of 77.83 on Friday.

– Managed Money hold a net short of 2,902 contracts with Other and Non Reportables (OR and NR) holding a net long of 6,303 and 957 contracts each. Between the three their overall net long was a paltry 4,358 contracts!

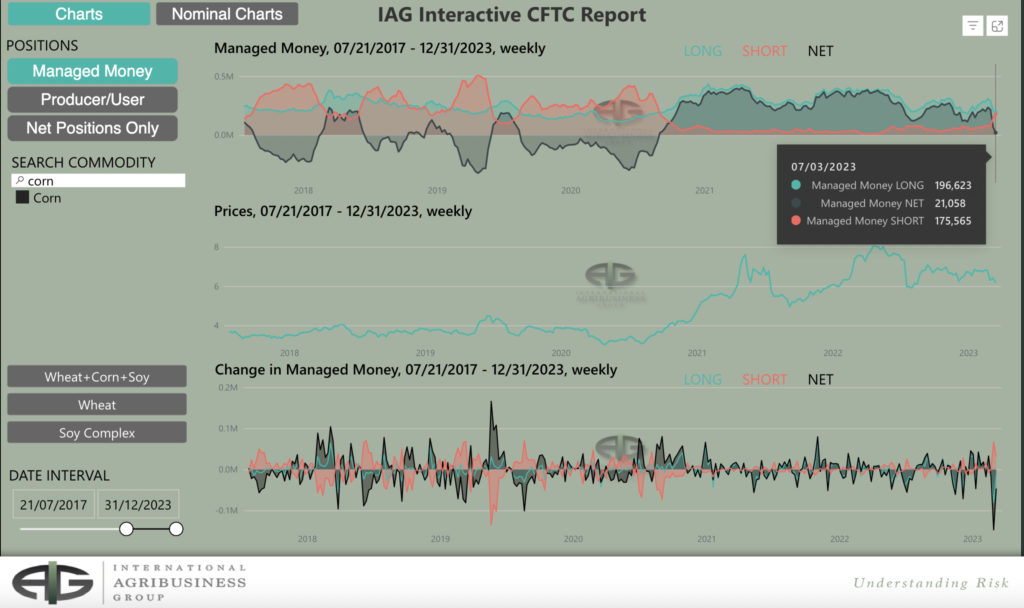

– The action since the 7th March in Cotton has been down, which would suggest that in a couple of weeks we will have confirmation that funds (MM, OR and NR) have increased their short to at least 10k contracts, maybe as much as 20k. Indeed, the big longs held in Corn have now exited in a big way too, as the pictorial evidence provided by our friends at IAG shows below. This is perhaps a reflection of the macro picture over the last week where a risk off mentality in certain commodities has taken hold and in particular, the highly volatile Oil market. Longer term we believe current levels will look good value at under under $67 a barrel!

– For Cotton, we DO NOT see a short position being held by funds as bearish, especially when spot NY prices reflect the fact that Cotton is barely a break even deal for the farmer. Wily end users are almost certainly scale down buyers if they understand anything about the history of Cotton prices!

– Technically, Cotton is in a downward trend but on a closing front month basis is confined within the 77.50 to 90.00 range we have been in for nearly 5 months and despite breaking the 77.02 basis K23 previous low last seen back on the 28th November before eventually managing to close back above it.

– In fairness to Cotton it is currently at the mercy of outside influences such as stock markets and Oil both of which were slaughtered in the last week!

– We have also included the chart of Z23 which has as a result of last week’s action moved into our “Start to consider buying area” when we had previously stated in our report of the 4th March we neither considered Z23 cheap or expensive at a closing price of 84.32 versus 79.51 on Friday.

– On the Oil market we have the following comments to make…..Crude oil has a habit of experiencing wild price volatility with the recent banking crisis causing nearby NYMEX crude oil futures to break below the critical technical support level at the December 2022 $70.08 per barrel low.

– In 2022, the Biden administration sold over 200 million crude oil barrels from the U.S. Strategic Petroleum Reserves to stem the high prices. The average sale is around the $96 per barrel level, and the administration had stated it would repurchase those barrels at the $70 per barrel level or lower. The U.S. could be a significant buyer at the current price level, putting upward pressure on prices. Cotton has a habit of following the oil price so we need to keep a watchful eye!

Conclusion

Cotton broke the 77.50 low – 90.00 high range we have been in since early November but managed to close back above it by Friday’s close. Unfixed end users may choose to be scale down buyers of Cotton down to the long standing gap in the mid 70’s dating back to November. Above, we maintain that prices in the high 80’s has Cotton fully valued, with any move in to the 90’s to be considered a selling opportunity. We maintain that an anticipated relatively wide trading range of 75 to 95c/lb is likely to prevail to the end of the season ending May 31st.

Useful links

*Please note that we only share CFTC CTO on weekend reports.

Written by:

Jo Earlam

Copyright statement

No image or information display on this site may be reproduced, transmitted or copied (other than for the purposes of fair dealing, as defined in the Copyright Act 1968) without the express written permission of Earlam & Partners Ltd. Contravention is an infrigement of Copyright Act and its amendments and may be subject to legal action.

Disclaimer

The risk of loss associated with futures and options trading can be substantial. Opinions set forth herein should not be viewed as an offer or solicitation to buy, sell or otherwise trade futures, options or securities. All opinions and information contained in this email constitute EAP’s judgment as of the date of this document and are subject to change without notice. EAP and their respective directors and employees may effect or have effected a transaction for their own account in the investments referred to in the material contained herein before or after the material is published to any customer of a Group Company or may give advice to customers which may differ from or be inconsistent with the information and opinions contained herein. While the information contained herein was obtained from sources believed to be reliable, no Group Company accepts any liability whatsoever for any loss arising from any inaccuracy herein or from any use of this document or its contents. This document may not be reproduced, distributed or published in electronic, paper or other form for any purpose without the prior written consent of EAP. This email has been prepared without regard to the specific investment objectives, financial situation and needs of any particular recipient. For the customers of EAP, this email is produced exclusively for our business and expert clients, it is not for general distribution and our services are not available to private clients. Past performance is not indicative of future results.