- Jo Earlam

- February 19, 2023

- 3:44 pm

- 10 min read

Cotton breaks out to the downside whilst US $ surges!

Do not fear to be eccentric in opinion, for every opinion now accepted was once eccentric.

CTH23 80.25 (-1.00)

CTK23 81.50 (-0.50)

CTN23 82.35 (-0.41)

CTZ23 82.25 (-0.21)

Zhengzhou WQK23 – 14,240 (-90)

Cotlook “A” Index – 98.25 (-2.60) – From the 16th February

Daily volume – 37,544

AWP – 74.05

Open interest – 203,257

Certificated stock – 1,147

H23 / K23 spread – (-1.25)

K23 / N23 spread – (-0.85)

N23 / Z23 spread – (+0.10)

March 1st Notice Day – 22nd February 2023

May Options Expiry – 14th April 2023

May 1st Notice Day – 24th April 2023

Introduction

– It was a nasty week for Cotton with K23 dropping 408 points for the week. Prices traded in a 556 point range between 81.21 and 86.77, following strength for the US$ Index that had most commodities on the back foot. Futures volume was impressive, as is normal during a roll period. Open interest in H23 is down to just 6,780 whilst for K23 it is at 96,198 contracts.

– The market now has carry between K and N23 with the latter closing the week 85 points higher which may be part of the reason long funds chose not to roll (i.e. it costs them money)

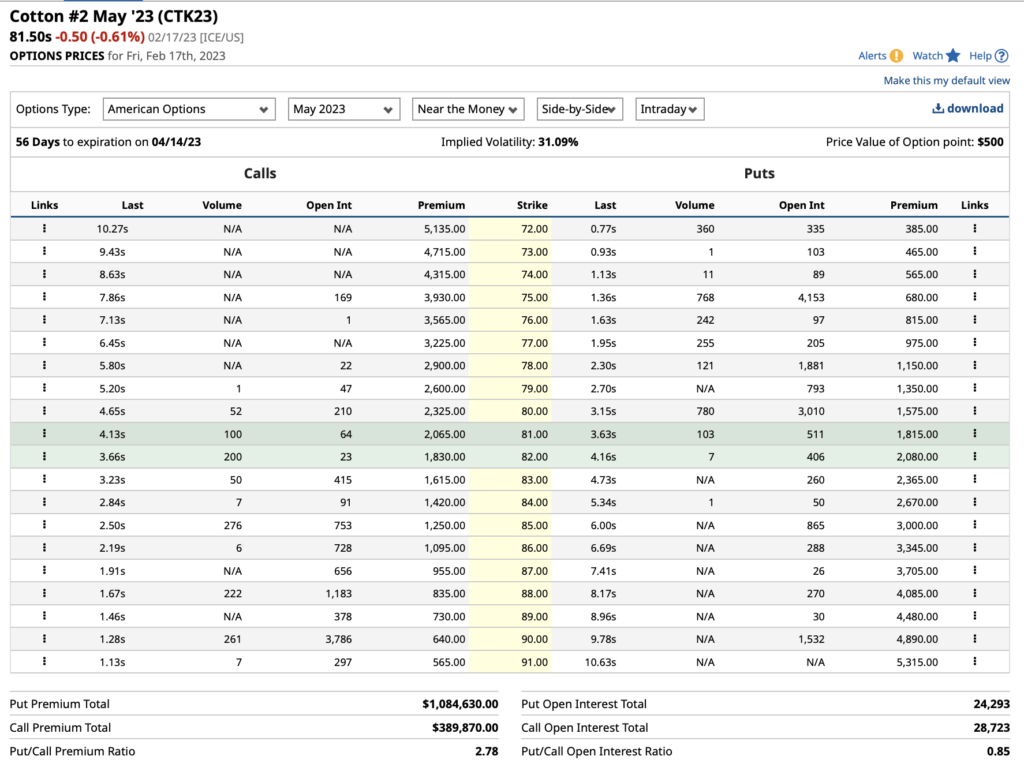

– We have as always included the open interest in K23 options which can be accessed by clicking on the link below but is detailed for the nearby strikes below. All we would opine is that we expect a similar action for the market as we have seen for the H23 contract in the days and weeks ahead i.e. sideways. 1st notice day for H23 is next Wednesday and for all intents and purposes this contract is history!

– With La Niña winding down this spring, this poses the questions of what is in store for the remainder of the year. Reports suggest that we will not see El Niño until later in the year, with 50% probability of it forming in June/July/August. When it does arrive we can expect precipitation across the Western US as well as parts of South America. In contract, drier and hotter conditions are likely to be seen in Eastern Australia and Southeast Asia.

– 92,3% of 2022/23 Brazilian crop has been planted. According to Conab, this is an 5,1% decrease compared to the same period last year. 60% – 70% of 22/23 crop has been sold. Production is unchanged at 2.9 to 3 million tonnes. In Mato Grosso, the last couple of days have been favourable for crop cultivation. The delay of 20% in planting, compared to same period last year, has improved over the past two weeks and Mato Grosso now is 8,8% behind schedule. This is not a concern considering the high operational capacity of Brazilian farmers. The next element to consider is rain last April, noting this is caused a reduction of 400,000 tonnes in production last crop year.

– Conab estimates domestic consumption to reach 720 thousand tons of cotton in the crop 2022/23 being 2.1% higher than last season (705 thousand tons) and returning to levels of the 2020/21 crop!

– The last CFTC COT report was back in January and to this end the CFTC has issued the following statement https://www.cftc.gov/PressRoom/PressReleases/8662-23

– In our opinion when this matter is finally addressed, we believe that the position of Managed Money (MM) Other and Non Reportables (OR and NR) will show a net position that is either flat or possibly slightly short. If we are correct in our viewpoint this is not bearish regardless of what may be going on in the world of Cotton

– We have often opined that “Money” can often railroad fundamentals for any commodity and it is a fact that rarely do we see funds short of Cotton for any extended period. This time will be no different!

– Below we have included a chart of the March US$ Index. Note how it has found support just above the 100 level. We do not expect this chart to break down anytime soon and will be a drag on all commodities until it does.

– It has been a while since we looked at the charts of Weiqao and Texhong being two of the giants of the textile sector. We like to follow them as they are usually excellent indicators for what is likely to happen to the Cotton price!

– Note how the price of Weiqiao and Texhong bottomed back in November as did the Cotton price! It is almost uncanny how these two companies track the Cotton price!

Conclusion

It is time to tweak our conclusion a little, noting we have not changed it for 3 months which has to be a record in itself! With the market breaking to the downside this week and demand a key factor, we believe value is to be had in the low 80’s basis K23 and EAP would be a scale down buyer of Cotton from this level down to the long standing gap in the mid 70’s dating back to November were prices to reach there. Above we maintain that prices in the high 80’s has Cotton fully valued, with any move in to the 90’s to be considered a selling opportunity. We maintain that anticipated relatively wide trading range of 75 to 95c/lb is likely to prevail to the end of the season ending May 31st.

Useful links

*Please note that we only share CFTC CTO on weekend reports.

Written by:

Jo Earlam

Copyright statement

No image or information display on this site may be reproduced, transmitted or copied (other than for the purposes of fair dealing, as defined in the Copyright Act 1968) without the express written permission of Earlam & Partners Ltd. Contravention is an infrigement of Copyright Act and its amendments and may be subject to legal action.

Disclaimer

The risk of loss associated with futures and options trading can be substantial. Opinions set forth herein should not be viewed as an offer or solicitation to buy, sell or otherwise trade futures, options or securities. All opinions and information contained in this email constitute EAP’s judgment as of the date of this document and are subject to change without notice. EAP and their respective directors and employees may effect or have effected a transaction for their own account in the investments referred to in the material contained herein before or after the material is published to any customer of a Group Company or may give advice to customers which may differ from or be inconsistent with the information and opinions contained herein. While the information contained herein was obtained from sources believed to be reliable, no Group Company accepts any liability whatsoever for any loss arising from any inaccuracy herein or from any use of this document or its contents. This document may not be reproduced, distributed or published in electronic, paper or other form for any purpose without the prior written consent of EAP. This email has been prepared without regard to the specific investment objectives, financial situation and needs of any particular recipient. For the customers of EAP, this email is produced exclusively for our business and expert clients, it is not for general distribution and our services are not available to private clients. Past performance is not indicative of future results.