- Chris Williams

- October 16, 2022

- 5:29 pm

- 10 min read

Cotton continues on its path of least resistance!

You never realise how long a minute is until you exercise!

CTZ22 – 83.15 – (-1.64)

CTH23 – 81.99 – (-1.50)

CTK23 – 81.08 – (-1.26)

CTN23 – 79.85 – (-0.98)

CTZ23 – 75.65 – (-0.56)

Zhengzhou WQF23 – 13,775 – (-45)

Cotlook “A” Index – 102.60 – (-0.05)

Daily volume – 25,426

AWP – 76.28

Open interest – 233,020

Certificated stock – 880

Z22/H23 spread – (+1.16)

Z22/Z23 spread – (+7.50)

December Options Expiry – 11th November 2022

December 1st Notice Day – 23rd November 2022

Introduction

– Z22 closed the week down 108 points from the previous Friday but not before trading in another wide range of 778 points between 82.00 and 89.78 on average daily futures volume of 34,256.

– In options, it was once again very active averaging 16,370 daily with calls trading twice as actively as puts. Interestingly and as suggested in last weekend’s report, price volatility has started to drop and now lies just under 47% as prices have retreated. Expect more of the same as we approach Z22 option expiration and provided prices stay within the current range of 81.55 to 90.52 trading range of nearly 3 weeks.

– Interestingly and noting we are only about 5 weeks away from Z22 futures expiry the current December futures month is the 5th most volatile since 1970, trading in a 52.24 c/lb trading range since the start of the calendar year between 81.55 and 133.79. The average December range since 1970 is 23.75 against 28.66 for this century alone!

– If history is the guide we should expect things to quieten down a bit next season after the most volatile two seasons since the 10/11 and 11/12 seasons!

– The CFTC COT report showed Managed Money (MM) to be heavy sellers of a net 5,688, as of last Tuesday, which takes their net long to just 26,844 contracts. It is interesting to note this was their 6th consecutive week as net sellers.

– This is their least long position in over 2 years dating back to August 2020

– We remind readers that when the money makes it move, it can simply railroad any bullish fundamentals, as is the case today. Are they finished selling yet? We somehow doubt it, but we are close and usually ends with a puke up move lower by the market with an intraday reversal higher. However, we have not seen that yet but we are on high alert for it!

– Cotton harvesting in Brazil is 99% complete for 21/22 crop whilst 73% has been ginned. According to Abrapa, 84% of 21/22 crop and 50% of 22/23 have been sold.

– It is estimated that 22/23 production will come at 3.17 million tonnes. If this projection is confirmed, this represents an increase of 27% in volume compared to 2.5 million for 21/22. The 5-year average is 2.53 million tonnes.

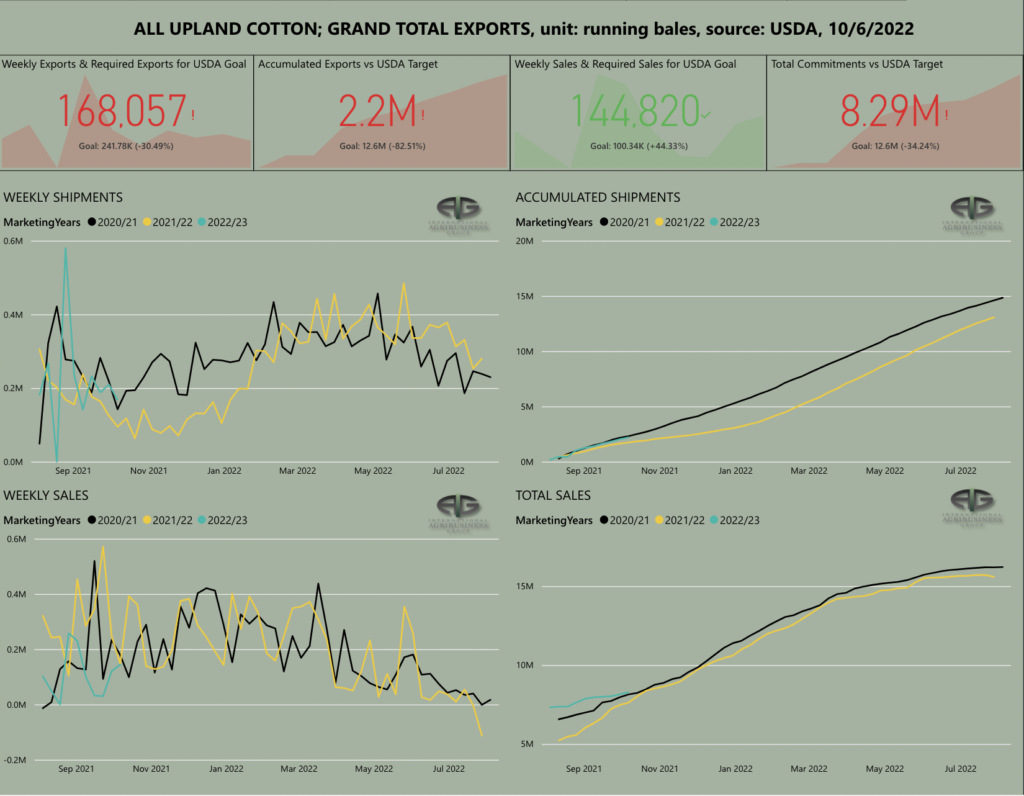

– The weekly USA Export sales report was actually better than expected for this time in the season. Net Upland Sales were 144,800 RB with 16 different destinations noted and Pakistan as the largest buyer. Next Marketing Year Sales were 34,800 RB with Mexico as the major buyer.

– Technically, Cotton looks set to move lower and with funds in selling mode, we will need to see end user demand pick up, which is sporadic at best!

– The writer has been India the last few days in preparation for the CAI’s Centenary Year celebrations on Tuesday, 18th October in Mumbai. Nobody so far spoken to is friendly to the market and demand is simply woeful. This is perhaps no wonder with the Indian basis far and away above most foreign growths and looks set to weaken as harvest pressure builds up! The attached article from an Indian newspaper says it all!

Conclusion

EAP believe that Cotton rallies into the mid 80’s and high 80’s will be sold but Cotton in the low 80’s represents short term value, but we are now of the opinion a move to 77c/lb is likely! A move back into the 100’s would be surprising, unless end user demand returns in earnest, which we seriously doubt! EAP remain of the belief that the 22/23 season will prove to be an inverted one, with the final low at the end of the season. Scale up selling from 90c/lb or higher over the coming days (were we to see it) is likely to prove prudent.

Useful links

*Please note that we only share CFTC CTO on weekend reports.

Written by:

Chris Williams

Copyright statement

No image or information display on this site may be reproduced, transmitted or copied (other than for the purposes of fair dealing, as defined in the Copyright Act 1968) without the express written permission of Earlam & Partners Ltd. Contravention is an infrigement of Copyright Act and its amendments and may be subject to legal action.

Disclaimer

The risk of loss associated with futures and options trading can be substantial. Opinions set forth herein should not be viewed as an offer or solicitation to buy, sell or otherwise trade futures, options or securities. All opinions and information contained in this email constitute EAP’s judgment as of the date of this document and are subject to change without notice. EAP and their respective directors and employees may effect or have effected a transaction for their own account in the investments referred to in the material contained herein before or after the material is published to any customer of a Group Company or may give advice to customers which may differ from or be inconsistent with the information and opinions contained herein. While the information contained herein was obtained from sources believed to be reliable, no Group Company accepts any liability whatsoever for any loss arising from any inaccuracy herein or from any use of this document or its contents. This document may not be reproduced, distributed or published in electronic, paper or other form for any purpose without the prior written consent of EAP. This email has been prepared without regard to the specific investment objectives, financial situation and needs of any particular recipient. For the customers of EAP, this email is produced exclusively for our business and expert clients, it is not for general distribution and our services are not available to private clients. Past performance is not indicative of future results.