- Jo Earlam

- August 14, 2022

- 9:33 am

- 10 min read

August WASDE surprises everyone as USA production cut to 12.57mb!

Life has so many surprises that the only real surprise in life is when nothing surprising happens.

CTZ22 – 108.59 – (+4.00)

CTH23 – 105.64 – (+4.00)

CTK23 – 103.87 – (+4.00)

CTN23 – 101.15 – (+4.00)

CTZ23 – 90.45 – (+3.93)

Zhengzhou CF301 – 14,845 – (+280)

Cotlook “A” Index – 122.75 (+3.35)

Daily volume – 33,154

AWP – 88.15

Open interest – 188,209

Certificated stock – 4,552

Z22/H23 spread – (+2.95)

Z22/Z23 spread – (+18.14)

September Options Expiry – 19th August 2022

December Options Expiry – 11th November 2022

December 1st Notice Day – 23rd November 2022

Introduction

– Z22 traded in a wide range of 1345 points between 95.14 and 108.59 on average daily futures volume of 28,290, being an increase of nearly 50% over the previous week. It was guesstimated that Cotton traded synthetically on Friday between 110 and 111c/lb in what is a quiet time of the year because most of the trade are on summer vacations! Monday’s Cotton price limit will be expanded to 5c from 4c following Friday’s limit up move!

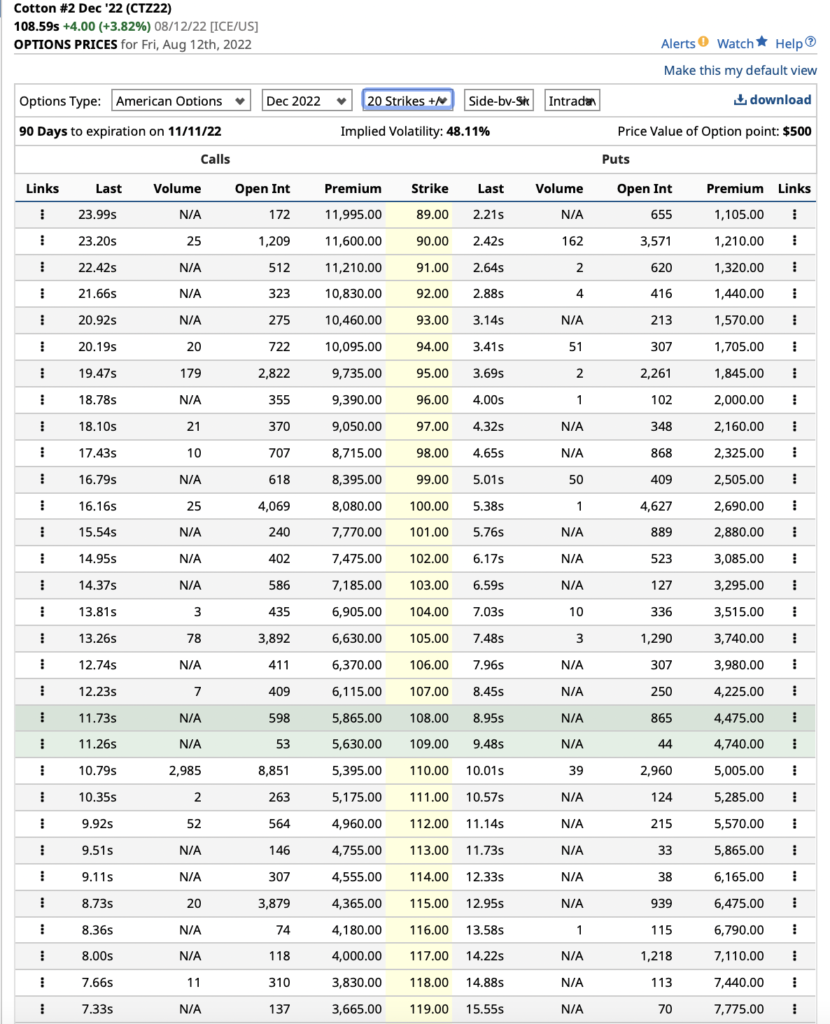

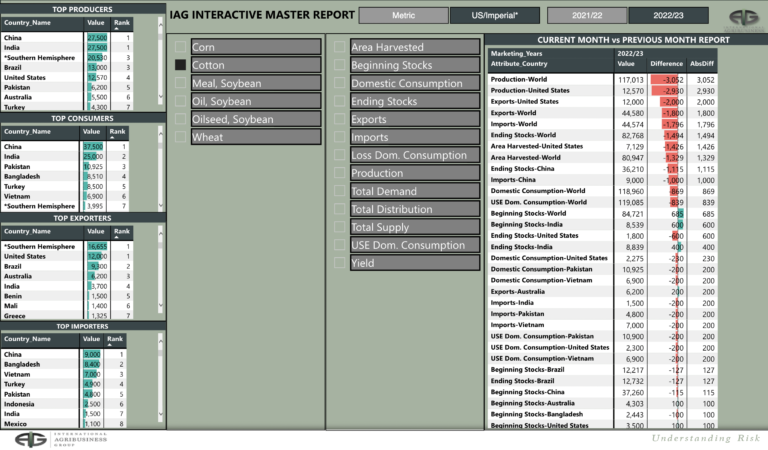

– Option volume averaged 7,767 daily, with calls nearly 3x as active as their comparative puts. Volatility exploded higher following the impulsive move and now lies at 48.11%. The open interest in Z22 options is included below and the September options which trade against Z22 expire next Friday!

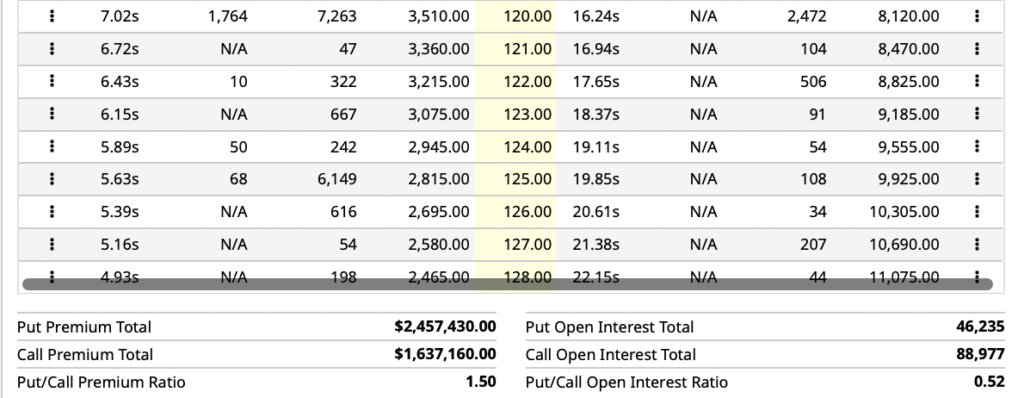

– The USDA set the cat amongst the pigeons in the August WASDE with a near 3 million bale reduction to the US crop. Consensus amongst analysts was for a likely WASDE figure between 13.0 to 14.5mb and never before have we seen such a drastic cut in a WASDE report.

– At EAP we do not profess to be experts on the US crop, but we do happen to know a few people who are. Post the report we spoke to several friends and it seems 12.6 million bales is at the very low end of the range of possibilities. Texas has been rightly cut, but the current estimates for the M/E region are too low.

– Whilst the USDA’s newfound boldness is welcome, it would be beneficial if it were also applied to the consumption side of the equation. For 2022/23 season we believe the USDA are around 3 to 4 million bales too high (perhaps more) and there has really been little move to recognise the worsening global macro outlook of recent months. This is on top of being 2 million bales too high for the 2021/22 season.

– Whilst consumption over the course of a season may be a more subjective viewpoint than a crop estimate based upon recent fieldwork, there are certain tangibles out there that seem to be being ignored. For instance, in Bangladesh the USDA are predicting 2021/22 consumption of 8.4 million bales. Whilst final Bangladesh customs numbers for the 2021/22 season have not been seen yet, based on previous months we are on for around 6.5 million bales. In this case it is hard to see how the USDA can justify maintaining this number!

– Furthermore, reliable information out of India this week advised consumption has been drastically reduced. Back in June this market was consuming 3 million Indian sized bales (170kgs) per month, but is currently thought to be just 1.7 million bales a month or a 43% reduction!

– At the same time, some private estimates say 2022 Indian new crop production could reach as high as 38.0 to 40.0m Indian sized bales being much higher than the current USDA estimate of just over 35.2mb (or 27.5m statistical bales). Eventually the market will account for this in terms of a fair spot price in NY but we may see some wild moves in the coming days!

– The Chinese Reserve bought zero bales for the last three days running as market prices have been above the Reserve basis price. Yarn demand in China has picked up in terms of volume but not necessarily price with mills there making a small margin.

– Chinese mills are benefiting from the cheapest cotton in the world. On a straight conversion the domestic price equates to 107.70 usc/lb, if we take this back to CIF CMP using a 1% import tax imported cotton would need to be 96.60 usc/lb to compete. Whilst the health of the Chinese mill is to be celebrated we should not expect to see Chinese import demand any time soon.

– In fact, the cheap Chinese domestic price is likely to reduce demand for imported yarn from countries such as Vietnam! A week ago, NY Cotton was trading in the mid 90’s) and now it is 110c/lb. This current spot price will hinder or even stop nearby demand for physical Cotton with foreign country hopes for yarn sales to China being non existent!

– In Brazil, excessive rain at planting, as well as dry and cold periods have hindered plant growth in Mato Grosso causing a loss of 27% in production compared to previous crop with the Sapezal region affected the most. Harvest in the state of Goiás is more than 75% complete and reductions in yield have been confirmed as well as problems with quality after a sequence of climatic problems. Merchants are in some instances having to invoice buyers back as a consequence of producing lower quality cotton.

– The CFTC Cotton on Call report 31 and as of 5th August showed a small draw down in current crop net on call sales of just 147 contracts.

– The total current crop position between Z22 and H, K & N23 stands at a net 62,994 “unfixed” contracts which is the fourth highest for this time of year against a net 98,250 for the same time period last year. Of this position the net unfixed position for Z22 is 37,670 contracts which is the highest for this week of the year but very similar to last year’s figure for this time of year (a net 35,079 contracts on Z21).

– Many unfixed mills will be looking at the week’s price action with concern despite having over 3 months to get fixed! As always a considered plan for fixations should be in place to safeguard against adverse market moves or last minute and costly fixations!

– We would add that this is the main reason that we can see prices shoot higher than are justified by what a mill can sell yarn at, as “end users” get squeezed by the “money”. The story and market move usually ends in a big spike and drop intraday, but the question is when and how far prices can go? What we can be fairly sure of is the squeeze will not be happening after the Z22 expiry as all the pressure is in the spot month and not in H, K and N23.

– This week’s USDA export sales report was the final one for the 2021/22 season. The final report of the season is always a smorgasbord of numbers, suffice to say that, over the three MYs combined total sales added up to 300,700 bales. 2,387,800 bales were carried over i.e. were sold for 21/22 but will be shipped in 22/23, this should come as no surprise to readers of this report where we have long casted doubt on the honesty of some sales reporting.

– Total shipments for 2021/22 came in at 14 million stat bales, which is about ¾ million short of the USDA estimate. There is an expectation that this will be revised up in line with customs figures, which would be just another reason to question the reliability of the market moving numbers ths USDA churns out on a weekly basis.

– The CFTC COT report as of last Tuesday showed that Managed Money (MM) had been small net buyers of 1,066 contracts to take their overall net long to 33,068 contracts. Between MM, OR and NR their overall net long is 37,670 contracts. Unbelievably this is exactly the position of the unfixed “on call” position of the end user against Z22 detailed above!!

– It will be interesting to see if the speculators continue to drive prices even higher in the days ahead noting that many market participants are away from their desks at the present time and can mean the market can move in any direction extremely quickly on low volume! The fund position can easily be increased and is without question a concern to those short of the cotton market at the present time!

– When we look at the big brothers of Soy, Wheat and Corn since they peaked back in May/June and following impulsive moves lower, their subsequent efforts at a bounce are nowhere near as impressive or as volatile as Cotton has been. Charts of all are enclosed below.

– An insightful statistical report will be sent later today to our clients only, comparing seasons similar to this one. The report makes fascinating reading and backs up the final sentence made in today’s report!

Conclusion

Prices have catapulted above the 200 day moving average on account of a very bullish August WASDE report and speculative buying that has caused prices to move higher than EAP anticipated. Potentially and noting a lack of market participants at this time of year, Z22 could get to the 120’s again in a very short time period. On such occasions, one has no choice but to respect the price action, noting the market is always right, and in the short term EAP ideally prefer a stand aside approach. Longer term, EAP remain of the belief that the 22/23 season will prove to be inverted one with the final low at the end of the season.

Useful links

*Please note that we only share CFTC CTO on weekend reports.

Written by:

Jo Earlam

Copyright statement

No image or information display on this site may be reproduced, transmitted or copied (other than for the purposes of fair dealing, as defined in the Copyright Act 1968) without the express written permission of Earlam & Partners Ltd. Contravention is an infrigement of Copyright Act and its amendments and may be subject to legal action.

Disclaimer

The risk of loss associated with futures and options trading can be substantial. Opinions set forth herein should not be viewed as an offer or solicitation to buy, sell or otherwise trade futures, options or securities. All opinions and information contained in this email constitute EAP’s judgment as of the date of this document and are subject to change without notice. EAP and their respective directors and employees may effect or have effected a transaction for their own account in the investments referred to in the material contained herein before or after the material is published to any customer of a Group Company or may give advice to customers which may differ from or be inconsistent with the information and opinions contained herein. While the information contained herein was obtained from sources believed to be reliable, no Group Company accepts any liability whatsoever for any loss arising from any inaccuracy herein or from any use of this document or its contents. This document may not be reproduced, distributed or published in electronic, paper or other form for any purpose without the prior written consent of EAP. This email has been prepared without regard to the specific investment objectives, financial situation and needs of any particular recipient. For the customers of EAP, this email is produced exclusively for our business and expert clients, it is not for general distribution and our services are not available to private clients. Past performance is not indicative of future results.