- Jo Earlam

- May 14, 2023

- 7:11 pm

- 10 min read

The market action suggests it does not believe the May WASDE!

Plan your trade and trade your plan and you will know what to do as the scenario plays out!

CTN23 80.53 (+0.91)

CTZ23 80.15 (+0.55)

CTH24 80.22 (+0.47)

Zhengzhou WQU23 – 15,480 (-165)

Cotlook “A” Index – 91.85 (-1.35)

Daily volume – 29,104

AWP – 67.97

Open interest – 180,872

Certificated stock – 75

N23/Z23 spread – (+38)

Z23/H24 spread – (-0.07)

H24/K24 – (-0.05)

K24/N24– (-0.03)

July Options Expiry – 9th June 2023

July 1st Notice Day – 26th June 2023

Introduction

– CTN23 had a busy week trading in a 535 point range between 79.52 and 84.87 before closing the week down 337 points at 80.53. Futures volume averaged a reasonable 30,701 contracts and options were similar to the previous week at 6,787 contracts daily with calls outnumbering put activity by nearly 2 to 1!

– New crop Z23 was less volatile trading in a 443 point range between 79.49 and 83.92 before closing the week down 309 points at 80.15. Open interest increased in Z23 by 5,511 contracts to 70,702 contracts and will continue to rise against N23 as we reach the Rogers roll period when funds roll from N to Z23 in just over 2 weeks time.

– The highlight of the week was undoubtedly the May WASDE and included a first look at a country by country balance sheet for the 23/24 season.

– The headline figure for the report was tighter USA ending stocks figures for current crop from 4.1mb to 3.5mb that caused a knee-jerk 150-180 point rally on publication of the report.

– The USDA gave a slightly revised lower estimate for 22/23 world consumption at 109.63mb with a rise for 23/24 to 116.23mb. The 109.63mb estimate for 22/23 is so far off the mark that perhaps one could question if the USDA is understaffed to get this figure so wrong! However 100/- people work for the USDA and it would seem none of them have any clue what is going on in the rest of the world (ROW). Traders in the know estimate the true world 22/23 consumption figure to be somewhere between 103 to 105mb…recent conversations last week with agents and spinners in the likes of Bangladesh, Vietnam and Turkey (being huge import markets) would suggest between 100-103mb is a more likely guesstimate and is where EAP’s lies!

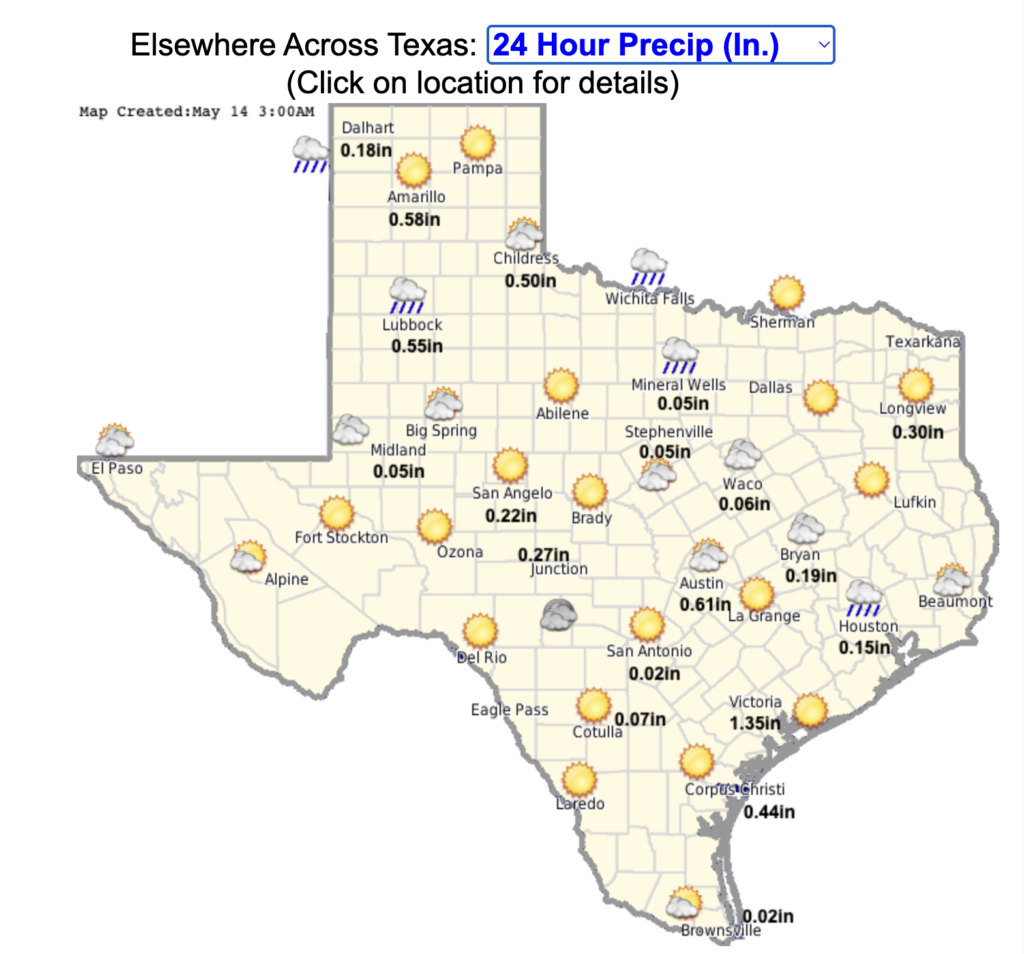

– The market soon headed back down into Friday’s close perhaps rightly focusing more on the weather into next week where much needed rains in Texas could eventually translate into producing a Texas crop that will change the USA production dynamics for the 23/24 season ahead! A 17mb USA crop may be on the cards!

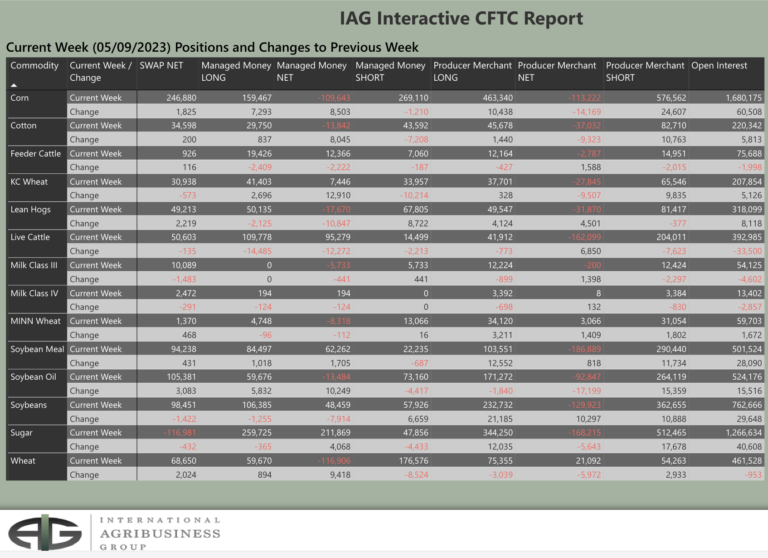

– The CFTC COT report showed Managed Money (MM) to be heavy buyers of 8,046 contracts in the week ending last Tuesday, when NY closed about 1c/lb higher than Friday’s close. This takes MM net short to 13,842 contracts. Other Reportables (OR) bought 1,354 and Non Reportables (NR) sold 287, meaning that between MM, OR and NR their overall net position is 2,433 contracts net long.

– As we opined a few weeks ago, this is an effective zero position that allows funds to take the market either way dependant on which way the wind blows! We suspect that wind will be taking prices down in the days ahead and the funds will be the fuel behind the move!

– We mentioned in Thursday’s report how the CAI had reduced the crop size but “there may be more to this than meets the eye” It is well known to many on the ground that farmers have held back much of their cotton and have tried to feed into the system on price rises.

– Today we see Indian arrivals of 100k bales daily in the middle of May and never before have we seen arrivals happen so late. Word on the street in India has as much as 30% of this year’s crop from two of the main producing states of Maharashtra and Gujurat still in farmers hands (over 5m Indian sized bales).

– It is thought that the potential of a higher MSP on the 1st October could be incentivising them to mix the old with the new crop and therefore why deliver at current prices?

– Delving deeper we hear mills are now losing money in India, top grade S6 lands Bangladesh at about 1800 on against Brasilian 31-4-36 circa 10c cheaper into the same market. No wonder, no more than 1.1mb of Indian has been exported this season! It is simply priced far far too high!

– Yarn inventories are building in India whilst prices continue to drop searching for a home. We are reliably informed traders/ginners are sitting on at least a month of stock also looking for a home in a largely uninterested buying market!

– Imports of Cotton from less developed countries such as Africa only recently attract (last 2 weeks) a 5.5% duty into India but African FOB basis is high, meaning we see this as a non event until basis prices drop!

– In short summary, none of this is friendly to cotton prices and the stale bulls are still long boringly bleating of higher prices to come….good luck with that one with hope surely doomed to turn into despair!!

– We like to think of a counter argument and of course the bulls will rightly point out the recent excellent USA sales and the USDA estimates of world consumption this and even higher next year! We would counter argue there are numerous cheaper and alternative growths of cotton available to a Bangladesh, Vietnam or Turkish spinner held by merchants. Most merchants will be slightly long or flat in our opinion and want to be short. In truth, they are probably longer than they think, concerned about not receiving a high priced and late L/C, they are almost certainly basis long into a collapsing basis and therefore in a very tricky situation. Late and perhaps not to be ever opened, or soon to be renegotiated, high priced L/C’s by merchants wanting to close out old crop positions into a bearish new crop scenario has ALL the hallmarks for a potential collapse in prices….read July 2012 all over again and mentioned in last week’s report!

– Apart from what we have already mentioned regarding India, Turkey and Greece are both countries that will be carrying a 400k mt and 35k mt inventory of old crop into new crop. That has not happened for literally years!

– Away from India, most spinning mills are operating at 50-80% capacity at best, hold 1-2 months of expensive stocks of Cotton, 1-2 months of unsold and overpriced yarn inventory with soon to arrive expensive cotton! Yarn inventories are rising and struggling to find a willing home, borne out by the retail sector that give them few if any orders with share prices of online retailers plummetting to 52 week lows! Oh dear!

– A break of the 70.50 Z23 life of contract low is entirely possible!

Conclusion

EAP cannot rule out N23 making another attempt to fully fill the gap down to 74.85 and unfixed end users may choose to be scale down buyers of this contract from the high 70’s, down to the low 70’s were prices to get there. EAP expect a 75c to 85c/lb trading range to the end of the season ending 31st May with any moves outside of this range expected to be extremely short lived. For new crop, we would consider a scale down long from the mid 70’s only!

Useful links

*Please note that we only share CFTC CTO on weekend reports.

Written by:

Jo Earlam

Copyright statement

No image or information display on this site may be reproduced, transmitted or copied (other than for the purposes of fair dealing, as defined in the Copyright Act 1968) without the express written permission of Earlam & Partners Ltd. Contravention is an infrigement of Copyright Act and its amendments and may be subject to legal action.

Disclaimer

The risk of loss associated with futures and options trading can be substantial. Opinions set forth herein should not be viewed as an offer or solicitation to buy, sell or otherwise trade futures, options or securities. All opinions and information contained in this email constitute EAP’s judgment as of the date of this document and are subject to change without notice. EAP and their respective directors and employees may effect or have effected a transaction for their own account in the investments referred to in the material contained herein before or after the material is published to any customer of a Group Company or may give advice to customers which may differ from or be inconsistent with the information and opinions contained herein. While the information contained herein was obtained from sources believed to be reliable, no Group Company accepts any liability whatsoever for any loss arising from any inaccuracy herein or from any use of this document or its contents. This document may not be reproduced, distributed or published in electronic, paper or other form for any purpose without the prior written consent of EAP. This email has been prepared without regard to the specific investment objectives, financial situation and needs of any particular recipient. For the customers of EAP, this email is produced exclusively for our business and expert clients, it is not for general distribution and our services are not available to private clients. Past performance is not indicative of future results.