- Jo Earlam

- February 12, 2023

- 12:39 pm

- 10 min read

Cotton goes nowhere!

What are the qualities in the people around us that we admire? What makes the greats of history special? What virtues do our friends or family embody that we can take note of and emulate? How can their example show us how to do, and be, better?

CTH23 85.27 (-0.23)

CTK23 85.58 (-0.36)

CTN23 86.07 (-0.38)

CTZ23 84.86 (-0.41)

Zhengzhou WQK23 – 14,620 (-185)

Cotlook “A” Index – 100.75 (-0.20) – From the 9th February

Daily volume – 53,010

AWP – 74.41

Open interest – 203,257

Certificated stock – 1,147

H23 / K23 spread – (-0.31)

K23 / N23 spread – (-0.49)

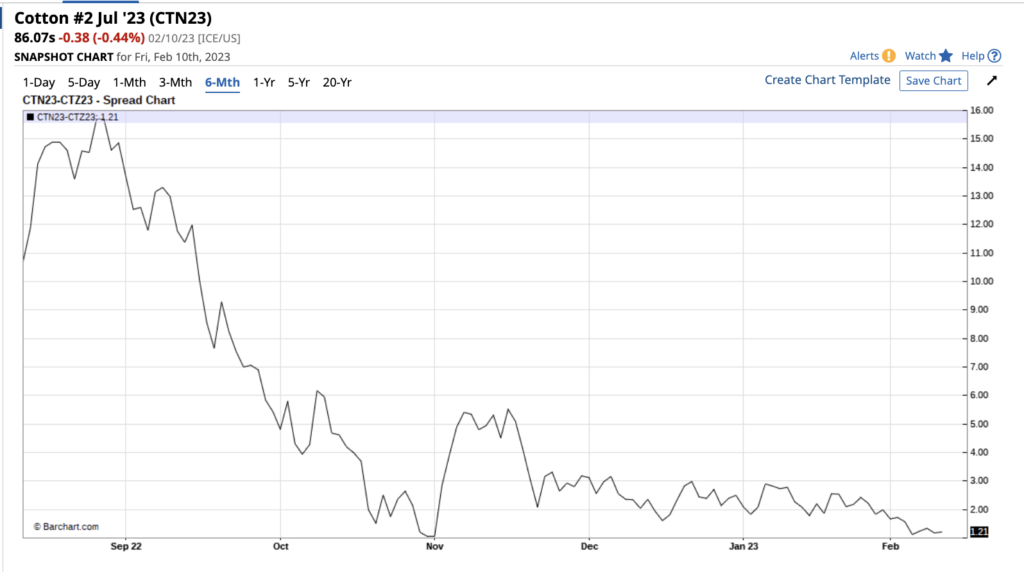

N23 / Z23 spread – (+1.21)

March 1st Notice Day – 22nd February 2023

May Options Expiry – 14th April 2023

May 1st Notice Day – 24th April 2023

Introduction

– March Cotton finished the week down 16 points at 85.27, whilst the now front month May (on account of having the higher open interest) finished down 53 points at 85.58. there is just 1 more day to go before the end of the GSCI roll period!

– In a dull week of trading, prices of H23 meandered in a 392 point range of 83.07 to 86.99 and as suggested in last weekend’s report, H23 option expiry saw H23 expire near to the 85c/lb level where holders of expiring options incurred the most pain.

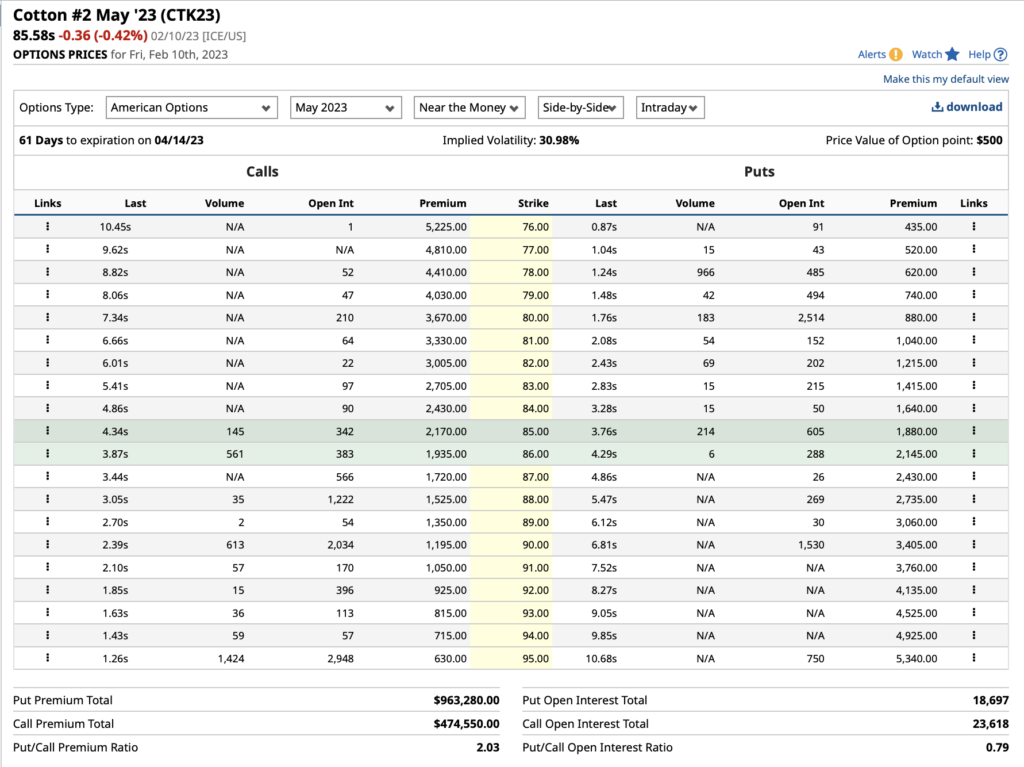

– Volume was understandably impressive, averaging 67,294 futures daily and options at 7,917 daily. Implied option volatility for K23 is now down at 30.98% which remains historically high and allows for some relatively easy money to be made for those of the opinion that the market continues in its sideways range noting we have been bleating the same message for literally months!

– An 80 by 90c K23 strangle where one sells the 80 put and 90 call simultaneously (effectively underwriting the market at the aforementioned levels) pays out 415 points for 61 days of exposure to be either long K23 at 80c or short at 90c! This is certainly not a recommendation to deal but merely demonstrates that options remain historically expensive and where margins in the physical business are hard to come by, there are other ways to make money!

– It is interesting to note that AP Moller-Maersk (the 2nd largest shipping company in the world) has forecast a plunge in profits this year and a probable contraction in global trade as the pandemic driven boom in container shipping comes to an abrupt end.

– For the Cotton business, this likely means that our end user can expect freight rates to continue to reduce and should eventually mean basis levels by offering merchants to reduce in the coming months!

– China has returned from the New Year holidays and continues on the path of reopening. Traders have been encouraged by solid sales to China in the recent export reports. Nevertheless, a feeling of caution persists in the country and mills are reluctant to overcommit to imports, with the aforementioned sales being primarily to SoE’s. Furthermore, the local prices remain at a par with imported cotton and we are yet to see additional quota issuance beyond the annual 894,000 MT TRQ. China’s reopening remains a bright spot in the market, but it is likely to be a little while longer before we see the Chinese buyer exert himself on the international market.

– No news on the COT report meaning we may need to wait a while longer before determining traders positions!

– We have included the charts of the front month K23 and new crop Z23 below. There is little difference in price between the two and in recent weeks the spread between N23 and Z23 has narrowed.

– This weekend’s NCC USA crop estimate will highlight the likelihood of a smaller USA crop for next year with commentators potentially stating how Z23 is potentially undervalued.

– We have the following comments to make in that regard on a purely statistical point of view! This century the average difference between the high and low for December including Z23 so far is “72.23”, since 2010 to Z23 that average goes up to “86.52”, noting that 14 year period includes the 4 most volatile years of the century so far being Z10, Z11, Z21 & Z22. Those 4 years saw Z trade in a huge hi/lo average range of 64c against the recent 14 year average of nearly half that figure.

– Previous analysis has shown that after 2 very volatile years as we saw in 10/11, 11/12 and 20/21 and 21/22 the cotton market should revert back to a more normal range of just over 20c/lb for the Z contract.

– In summary, we would argue that Z23 on a statistical point of view is a little overvalued at just under 85c and would not want to get long unless we saw it trading under 80.79 down to 76.63 highlighted on the below chart. Below this level we believe it will prove to be excellent value! Interestingly when prices collapsed back in July and again in October (double bottom) one could have bought Z23 at 70c/lb! In other words you got two chances to get in cheap…there could be a third!

– With 9 months to go until Z23 expiry lots can and will likely happen but we would certainly not be betting all our chips now noting seasonal highs and lows are on average 7 months apart and the contract is trading far above its century average!

Conclusion

The cotton market has found resistance just under 90c/lb basis H23. We maintain that for H23 we see prices in the high 80’s as fully valued and, for now, see any move for this contract into the low 90’s as a selling opportunity. The market remains plagued by a lack of demand though pockets of improvement are to be found in certain parts of the world such as India. A relatively wide trading range of say 75 to 95c/lb is likely to prevail to the end of the season ending May 31st.

Useful links

*Please note that we only share CFTC CTO on weekend reports.

Written by:

Jo Earlam

Copyright statement

No image or information display on this site may be reproduced, transmitted or copied (other than for the purposes of fair dealing, as defined in the Copyright Act 1968) without the express written permission of Earlam & Partners Ltd. Contravention is an infrigement of Copyright Act and its amendments and may be subject to legal action.

Disclaimer

The risk of loss associated with futures and options trading can be substantial. Opinions set forth herein should not be viewed as an offer or solicitation to buy, sell or otherwise trade futures, options or securities. All opinions and information contained in this email constitute EAP’s judgment as of the date of this document and are subject to change without notice. EAP and their respective directors and employees may effect or have effected a transaction for their own account in the investments referred to in the material contained herein before or after the material is published to any customer of a Group Company or may give advice to customers which may differ from or be inconsistent with the information and opinions contained herein. While the information contained herein was obtained from sources believed to be reliable, no Group Company accepts any liability whatsoever for any loss arising from any inaccuracy herein or from any use of this document or its contents. This document may not be reproduced, distributed or published in electronic, paper or other form for any purpose without the prior written consent of EAP. This email has been prepared without regard to the specific investment objectives, financial situation and needs of any particular recipient. For the customers of EAP, this email is produced exclusively for our business and expert clients, it is not for general distribution and our services are not available to private clients. Past performance is not indicative of future results.