- Jo Earlam

- October 9, 2022

- 3:59 pm

- 10 min read

Cotton ignores the plight of the S&P500....for once!

Life is defined by your choices and your discipline. In time, this will determine your destiny!

CTZ22 – 84.23 – (+1.33)

CTH23 – 82.66 – (+1.22)

CTK23 – 81.51 – (+1.21)

CTN23 – 79.94 – (+1.19)

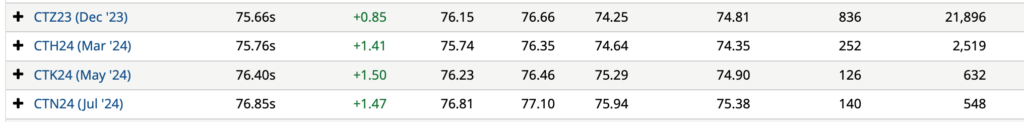

CTZ23 – 75.66 – (+0.85)

Zhengzhou WQF23 – 13,515- (+155)

Cotlook “A” Index – 101.30 – (-0.40)

Daily volume – 31,071

AWP – 77.19

Open interest – 228,954

Certificated stock – 2,109

Z22/H23 spread – (+1.57)

Z22/Z23 spread – (+8.57)

December Options Expiry – 11th November 2022

December 1st Notice Day – 23rd November 2022

Introduction

– CTZ22 finished the week down just 111 points at 84.23 after a volatile 897 point week that saw prices trade between 81.55 and 90.52.

– Volume was once again good averaging 36,043 contracts daily. In options, it was also very busy with call activity outnumbering puts by more than 2 to 1! Implied “at the money” option volatility is at almost extreme highs at 51.46%. It reached over 70% back in March 2011 when prices briefly reached the 200’s. In fairness, volatility has averaged more than 36 % dating back to the start of the 21/22 season but averaged 22.5% over the previous 5 years!

– High volatility simply means that protection using options is extremely expensive. There are only 34 days to go until the expiry of the December options. The Z22 contract reached as high as 108.10 just 1 month ago and closed on Friday nearly 24c lower. This is a massive drop in a very short time, noting the normal seasonal range this century is about 38c/lb!

– For those readers rather unfamiliar with volatility, we enclose the following example. If one was sure that the market will not close above 95c/lb or below 75c/lb, before the expiry of the December options on 11th November, then one could sell each of the aforementioned strikes at the same time. The “75 put” closed at 1.73c and the “95 call” closed at 2.05c and by selling both simultaneously, one would receive 3.78c. Assuming spreads and dealing costs of as much as 20 points this would still amount to receipt of 3.58c for the risk of being long Z22 at 75c or short Z22 at 95c. Provided Z22 futures closed between 75 and 95c at Z22 option expiry, the strategy pays out 4.25% for underwriting the aforementioned levels for just 34 days.

N.B. this is NOT a recommendation to deal and merely illustrates how expensive options are at the present time

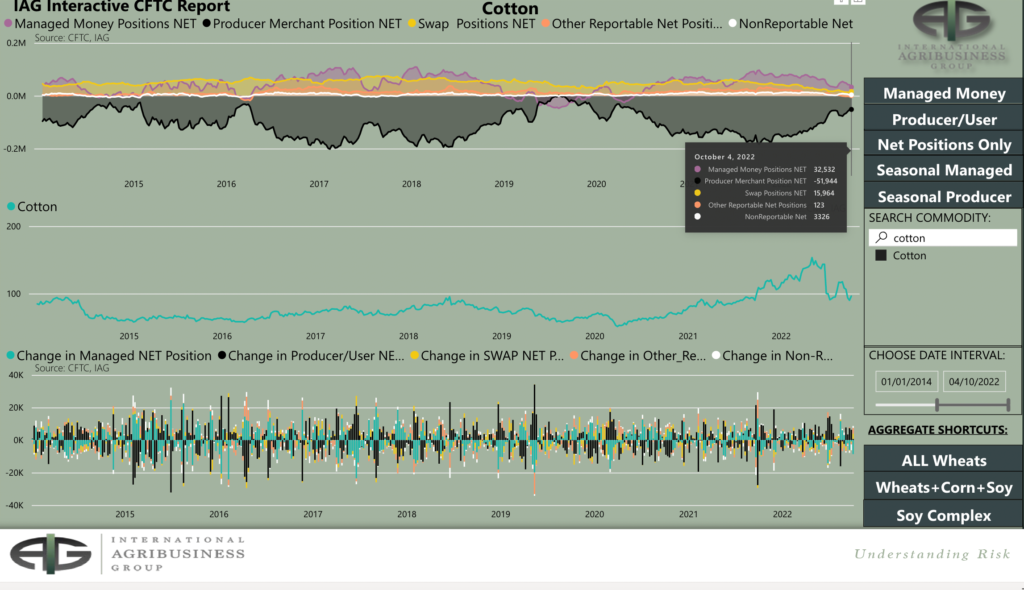

– The CFTC COT report once again saw a reduction of the net long held by Managed Money (MM) who sold 8,651 contracts, mostly as new shorts rather than a liquidation of existing longs. The best buyers were Other Reportables (OR) who bought a net 3,427, whilst Non Reportables (NR) were net buyers of 1,248 contracts. Between MM, OR and NR their overall net long is 35,981.

Whilst there are many open options bets in the market against the Z22 contract, the actual net futures position is really quite small against the historic fund long or short position!

– In the last week we were fortunate enough to be guests at one of our favourite conferences of the Cotton calendar year hosted by Afcot in the delightful town of Deauville.

– The sentiment from almost all there surprised us! EAP have been quite forthright in our own bearish viewpoint since prices peaked back in May, but even we were startled by the negativity that was going around

– We freely admit that we are often contrarian thinkers and whilst demand is awful and the economy dire, we had not expected such a downbeat feeling!

However, we believe that some buying will start to come back in the days and weeks ahead and value is to be had near last weeks lows! A chart of the Z22 contract is shown below!

– As a final thought, take a look at the picture below! It shows the forward contract months of the 23/24 season. Note how there is a tiny amount of carry between each month stated. For 10-15 years the Western world have been treated to ultra low interest rates, but this is certainly not the case today. The days of cheap money are over!

– We fully expect that carry to increase in the 23/24 season and will keeping a watchful eye on these futures months to see if we are proven right!

Conclusion

EAP believe that Cotton rallies into the late 80’s and early 90’s will be sold but Cotton in the low 80’s represents short term value. If we are wrong, then a move to 77c/lb can occur! A move back into the 100’s would be surprising, unless end user demand returns in earnest, which we seriously doubt! EAP remain of the belief that the 22/23 season will prove to be an inverted one, with the final low at the end of the season. Scale up selling from 90c/lb or higher over the coming days (were we to see it) is likely to prove prudent.

Useful links

*Please note that we only share CFTC CTO on weekend reports.

Written by:

Jo Earlam

Copyright statement

No image or information display on this site may be reproduced, transmitted or copied (other than for the purposes of fair dealing, as defined in the Copyright Act 1968) without the express written permission of Earlam & Partners Ltd. Contravention is an infrigement of Copyright Act and its amendments and may be subject to legal action.

Disclaimer

The risk of loss associated with futures and options trading can be substantial. Opinions set forth herein should not be viewed as an offer or solicitation to buy, sell or otherwise trade futures, options or securities. All opinions and information contained in this email constitute EAP’s judgment as of the date of this document and are subject to change without notice. EAP and their respective directors and employees may effect or have effected a transaction for their own account in the investments referred to in the material contained herein before or after the material is published to any customer of a Group Company or may give advice to customers which may differ from or be inconsistent with the information and opinions contained herein. While the information contained herein was obtained from sources believed to be reliable, no Group Company accepts any liability whatsoever for any loss arising from any inaccuracy herein or from any use of this document or its contents. This document may not be reproduced, distributed or published in electronic, paper or other form for any purpose without the prior written consent of EAP. This email has been prepared without regard to the specific investment objectives, financial situation and needs of any particular recipient. For the customers of EAP, this email is produced exclusively for our business and expert clients, it is not for general distribution and our services are not available to private clients. Past performance is not indicative of future results.