- olly

- August 6, 2023

- 8:13 am

- 10 min read

Speculators continue buying Cotton

Learn every day, but especially from the experiences of others. Its cheaper!

CTZ23 84.29 (-0.41)

CTH24 84.40 (-0.41)

CTK24 84.50 (-0.38)

CTN24 84.19 (-0.34)

CTZ24 79.50 (+0.09)

Zhengzhou WQF24 – 17,120 (-185)

Cotlook “A” Index – 95.60 (unch)

Daily volume – 20,985

AWP – 70.19

Open interest – 211,349

Certificated stock – 560

Z23/H24 spread – (-0.11)

H24/K24 spread – (-0.10)

K24/N24 spread – (+0.31)

September Options Expiry – 18th August 2023

December Options Expiry – 10th November 2023

December 1st Notice Day – 24th November 2023

Introduction

– It was a quieter week for Cotton, which finished the week up just 3 points from the previous Friday at 84.29. Prices traded in a relatively tight 303 point range between 83.25 and 86.28.

– Futures volume was lower, averaging 29,565 over the week and options were much quieter too, averaging under 4k daily and less than half the volume of the previous week.

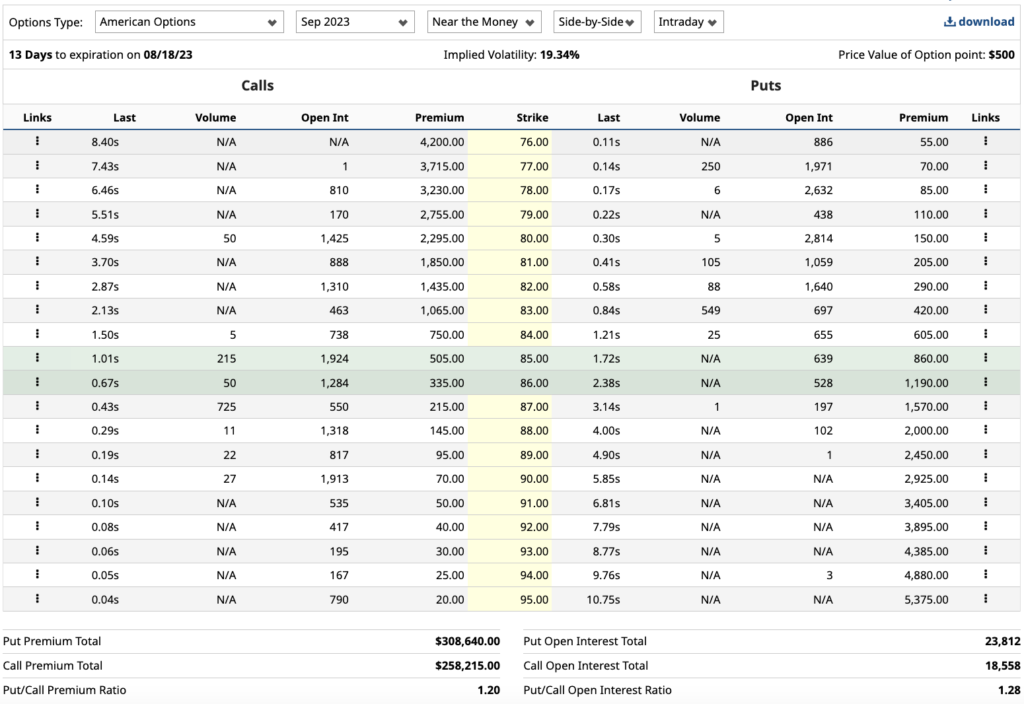

– September Options, which trade against the December contract, expire a week next Friday and nothing has changed our viewpoint that the Z23 contract will close somewhere between 82 and 85c/lb on that date, meaning the majority of the open bets will expire worthless.

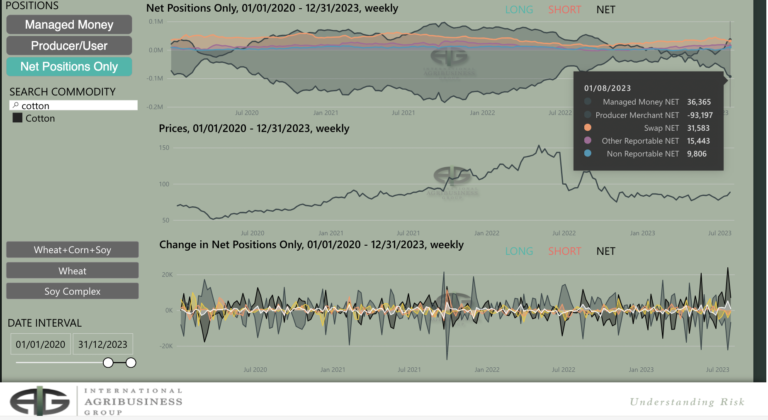

– The weekly CFTC COT report as of last Tuesday showed that Managed Money (MM) had once again been net buyers of the Cotton market for the 5th consecutive week. MM bought a net 7,081 contracts and between MM, OR and NR their overall net long is now 61,614 contracts.

– Looking closer, we note that between MM, OR and NR they have bought a net 60,953 contracts over the last 5 weeks during which time they took Z23 from a close of 77.06 on the 27th June to a close of 86.22 on the 1st August, being the date of the latest report. Over this period funds have pushed the market up over 9c/lb. By our calculation, they used 6,654 contracts of buying to move the market up by 1c/lb on average and we guesstimate that their average long price noting most of the big buying took place over the last 2 weeks is approximately 83-84c/lb.

– Funds do not like losing money and most will have strict rules as to exposure to losses. If prices were to head South later in the season as we believe could happen, the fuel for a move lower lies in the long positions now held by the funds!

– Thanks as always to our friends at IAG for the pictorial evidence of the aforementioned points.

– Spinning mills with commitments for July/August shipment which are unfixed will be forced to fix these positions prior to the cottons arrival which is certainly offering some support to the market at the present time. Next week we have the August WASDE which could also have bullish connotation for the Cotton market, not forgetting potential crop damaging hurricanes at this time of the year. All of this could provide some short term support to the market, but we suggest that any spikes higher will be short lived with lots of hedging pressure between 88.00 – 92.00 usc/lb.

– The Credit rating of the United States was downgraded this week from AAA to AA+ by Fitch. The ratings agency had warned of the downgrade since May’23 linked in part by the massive debt burden and severe political mismanagement. The last time an AA+ rating was issued was August 2011, and global markets got hit hard. Political Governance is under pressure with the Biden administration seemingly ignoring all warning signs and continuing their frivolous spending.

– Basis levels remain under pressure, not surprising when the the freight rates from Santos to Chattogram stands at just 272pts/lb. Shipping giant Maersk is now predicting a long and deep contraction in global container demand. Acting as a proxy for trade, it is now estimated demand will contract from -1% to -4% vs the -0.5 – 2.5% previously predicted. The COVID boom meant lines enjoyed monster profits, ramping up capacity which will now bare stark pressure on pricing moving through the remainder of 2023.

– Although we remain long term bearish of this market and expect the next season to be inverse, we believe the scenario for the next 4-5 weeks could see a retest of the recent December 23 high of 88.39 and possibly a shade higher to 90-92 c/lb.

– We are ahead of probably the best hedging opportunity of the season due to the recent change in managed money (specs) buying into this market.

– Since 1960 we have seen 4 August / September highs for cotton, meaning they occur just 6.5% of the time.

– The Dollar Index has rallied over 2% during the past 2 weeks and is currently trading around 101.89 (Chart Below). The market has found strong resistance at the 100 day MA and has capitalised on the ECB rate decision last Thursday who hiked interest rates by another 25pts and now looks to push above the higher trend line at 102.72 (Coinciding with the 50% retrace).

Conclusion

We maintain that the 2023/24 season will prove to be an inverse season, that cotton is fully valued in the mid to high 80s and that we would be a scale up seller at these levels. While the funds can drive the market direction, we think the upside move will be limited given the underlying fundamentals.

Useful links

*Please note that we only share CFTC CTO on weekend reports.

Written by:

olly

Copyright statement

No image or information display on this site may be reproduced, transmitted or copied (other than for the purposes of fair dealing, as defined in the Copyright Act 1968) without the express written permission of Earlam & Partners Ltd. Contravention is an infrigement of Copyright Act and its amendments and may be subject to legal action.

Disclaimer

The risk of loss associated with futures and options trading can be substantial. Opinions set forth herein should not be viewed as an offer or solicitation to buy, sell or otherwise trade futures, options or securities. All opinions and information contained in this email constitute EAP’s judgment as of the date of this document and are subject to change without notice. EAP and their respective directors and employees may effect or have effected a transaction for their own account in the investments referred to in the material contained herein before or after the material is published to any customer of a Group Company or may give advice to customers which may differ from or be inconsistent with the information and opinions contained herein. While the information contained herein was obtained from sources believed to be reliable, no Group Company accepts any liability whatsoever for any loss arising from any inaccuracy herein or from any use of this document or its contents. This document may not be reproduced, distributed or published in electronic, paper or other form for any purpose without the prior written consent of EAP. This email has been prepared without regard to the specific investment objectives, financial situation and needs of any particular recipient. For the customers of EAP, this email is produced exclusively for our business and expert clients, it is not for general distribution and our services are not available to private clients. Past performance is not indicative of future results.