- Jo Earlam

- February 5, 2023

- 5:56 pm

- 10 min read

Cotton prices stair step sideways as March expiry looms!

“In times of joy, all of us wished we possessed a tail we could wag”.

CTH23 85.43 (-0.96)

CTK23 86.11 (-0.99)

CTN23 86.72 (-1.00)

CTZ23 85.15 (-0.85)

Zhengzhou WQK23 – 15,080 (+80)

Cotlook “A” Index – 100.95 (-0.40) – From the 2nd February

Daily volume – 45,732

AWP – 75.24

Open interest – 211,702

Certificated stock – 8,900

H23 / K23 spread – (-0.68)

K23 / N23 spread – (-0.61)

N23 / Z23 spread – (+1.57)

March Options Expiry – 10th February 2023

March 1st Notice Day – 22nd February 2023

Introduction

– March Cotton is rapidly losing open interest in favour of the soon to be front month May (75,781 v 59,904) with the start of the GSCI roll beginning on Tuesday next week and ending on the following Monday. Prices of March weakened on Friday following a surprising USA Non Farm Payrolls report that saw many markets on the defensive! More on that later!

– H23 traded the week in another tight 290 point trading range between 84.50 and 87.40 that was all seen in Monday’s trade with the rest of the week spent trading within that range. H23 finished the week down 146 points lower than the previous Friday.

– Volume was unsurprisingly good, averaging 42,001 futures and 6,070 options daily, noting we are in the H/K roll period and H23 options expire next Friday. A look at the H23 open interest in options (which can be seen by clicking the link below) will show that most of the soon to be expiring “calls” are from the 85 strike and higher and for the “puts” at the 85 strike and lower. We therefore guesstimate a futures close for H23 at circa 85c is on the cards for next Friday and especially if one is of the belief most pain occurs for holders of options where most of the bets expire at zero i.e. the 85 strike! Time will tell if we are proven correct or otherwise!

– The CFTC COT report will be delayed by up to 5 days because of a hack on “ION cleared derivatives” which basically means accurate data detailing traders positions cannot be submitted. The attached link explains it in a little more detail. https://crypto.news/cftc-comments-on-hack-with-possible-russian-link/

– We are of the opinion that there will have been little change to fund positions over the week ending last Tuesday, noting the price action of cotton which has seen an average daily range for H23 down to 194 points from 213 points the previous week. This is the lowest in many many months and if this continues as we believe, expect implied volatility to drop below 25 in the coming weeks. For those not as familiar with the meaning of volatility it is the effective cost of buying protection using options.

– The USA jobs report is widely recognised as one of the most keenly watched reports of the month, as it can cause some crazy moves for all markets. The latest one mentioned earlier in our report did not disappoint!

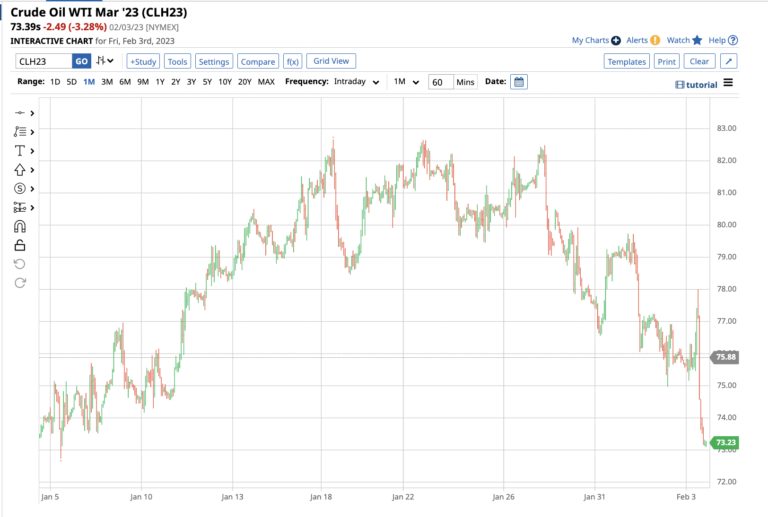

– 517k more jobs were created in January in the USA against a consensus of just 185k and a revised 260k from the previous report. It caused a knee jerk move upwards for the US$ Index and a walloping for many commodity markets including gold and crude oil in particular. The unemployment rate fell to 3.4% and the lowest since May 1969. The jobs data supports more USA interest rate hikes and was why the dollar rallied.

– The US$ index had made a false break earlier this week and below its 50% retrace detailed in the chart below, which had some traders poised for a potential surge in commodity prices if the weakness continued and the psychological 100 level were to be breached. In short summary this did not happen and with the reversal in the US$, we suspect some recently acquired commodity longs were promptly exited on publication of the report, causing exacerbated moves and plenty of red on traders screens for the metal, energy and most raw material markets!

– In Brazil, 64.4% of 2022/23 crop has been planted. This is an 14.4% decrease compared to the same period last year. Mato Grosso is 20% behind last year’s planted figure, but this is not an issue considering the high operational capacity of farmers.

– According to latest Abrapa figures, 89% of 21/22 crop has been sold by farmers and 57% of 22/23 has been sold by farmers.

– Brazil export sales for both December 2022 and January 2023 are down 35% compared to 5-year average. A weaker US$ in Brazil favours domestic sales, which indicated 102 – 104 US$c/ lbs ex-warehouse this past week.

– In India, spinning mills are almost back to 85-90% capacity and is without doubt the only market that seems to be bucking the trend and where some degree of enthusiasm can be found. Whilst arrivals are far below last year so far we still believe that when all is said and done a crop of 33m Indian sized bales will prevail.

– In Greece, in the last week we hear that almost all farmers have finally fixed their Cotton. Basis levels there remain weaker than one might have expected in view their Turkish neighbours are not as active as they have been in previous years. As much as 100k mt which is 1/3rd of the crop is still thought to be available in what remains the best quality produced in a generation.

– Next week will be active for Cotton with the GSCI roll beginning, the February WASDE on Wednesday and H23 option expiry on Friday

Conclusion

The cotton market has found resistance just under 90c/lb basis H23. We maintain that for H23 we see prices in the high 80’s as fully valued and, for now, see any move for this contract into the low 90’s as a selling opportunity. The market remains plagued by a lack of demand though pockets of improvement are to be found in certain parts of the world such as India. A relatively wide trading range of say 75 to 95c/lb is likely to prevail to the end of the season ending May 31st.

Useful links

*Please note that we only share CFTC CTO on weekend reports.

Written by:

Jo Earlam

Copyright statement

No image or information display on this site may be reproduced, transmitted or copied (other than for the purposes of fair dealing, as defined in the Copyright Act 1968) without the express written permission of Earlam & Partners Ltd. Contravention is an infrigement of Copyright Act and its amendments and may be subject to legal action.

Disclaimer

The risk of loss associated with futures and options trading can be substantial. Opinions set forth herein should not be viewed as an offer or solicitation to buy, sell or otherwise trade futures, options or securities. All opinions and information contained in this email constitute EAP’s judgment as of the date of this document and are subject to change without notice. EAP and their respective directors and employees may effect or have effected a transaction for their own account in the investments referred to in the material contained herein before or after the material is published to any customer of a Group Company or may give advice to customers which may differ from or be inconsistent with the information and opinions contained herein. While the information contained herein was obtained from sources believed to be reliable, no Group Company accepts any liability whatsoever for any loss arising from any inaccuracy herein or from any use of this document or its contents. This document may not be reproduced, distributed or published in electronic, paper or other form for any purpose without the prior written consent of EAP. This email has been prepared without regard to the specific investment objectives, financial situation and needs of any particular recipient. For the customers of EAP, this email is produced exclusively for our business and expert clients, it is not for general distribution and our services are not available to private clients. Past performance is not indicative of future results.