CTZ22 96.13 (+1.51)

CTH23 93.80 (+1.47)

CTK23 92.35 (+1.51)

Zhengzhou CF301 – 13,730 (-160)

Cotlook “A” Index – 113.10 (+0.24)

Daily volume – 15,669

AWP – 89.44

Open interest – 187,179

Certificated stock – 4,552

Z22/H23 spread – (+2.33)

Z22/Z23 spread – (+13.16)

September Options Expiry – 19th August 2022

December Options Expiry – 11th November 2022

December 1st Notice Day – 23rd November 2022

Introduction

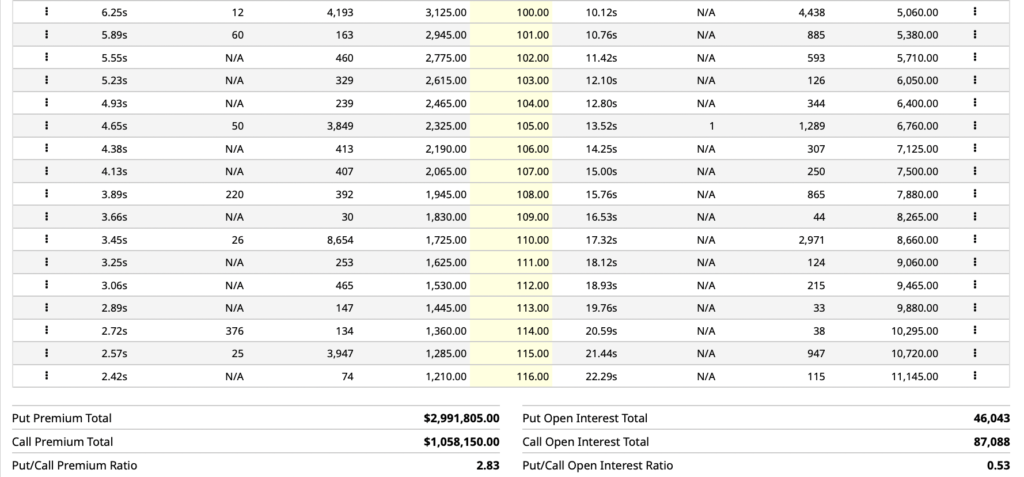

– The 592 point trading range of the week was an inside week, meaning it was within the range of the previous week with a low of 91.60 and high of 97.52 basis CTZ22. Volume was typically low for this time of the year, averaging 19,202 daily and options averaged just 4,552 with call buying outnumbering puts by nearly 2 to 1.

– Option implied at the money volatility in Z22 continues to drift lower and at 39.49%, is a 2.5% lower over the week. Another week like the one past and we can expect volatility to fall to the mid 30’s rather quickly!

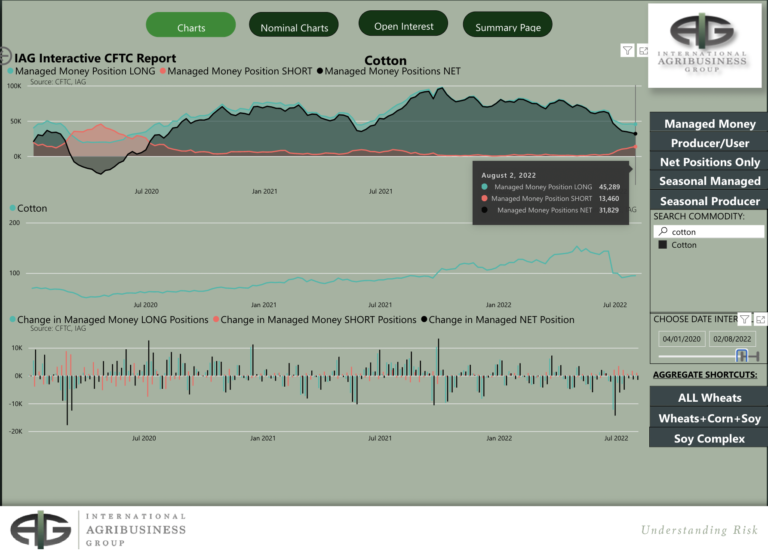

– The CFTC COT report after the close and showing traders positions as of last Tuesday showed that Managed Money (MM) were sellers for the 7th consecutive week. Other and Non Reportables were also small net sellers and between MM, OR and NR their overall net position is down to 36,641 net long.

– Shipping giant AP Moller-Maersk this week lifted their profit guidance and predicted that the global supply chain disruption would take longer than expected to return to normal. Maersk predicted that a gradual normalisation of freight rates would begin in the fourth quarter of the year. Merchants will, of course, seek to pass this cost on via an elevated basis as they have done to date. However, given the poor demand outlook we expect the basis to come under pressure and merchants will be at risk of continuing high freight costs eating into their margins.

– Oil’s strength (despite recent consolidation) has been much publicised over recent months. Oil is, of course, the raw material for most of cotton’s competing fibres. Whilst there is no perfect indicator market for man made fibres, the CZCE PTA market is perhaps the best proxy. The below monthly PTA chart shows that, whilst prices enjoyed something of a bounce on the back of oil strength they still remain at a historically competitive level. Cotton on the other hand, though down from recent highs, still remains towards the high end of what one would consider “normal” prices.

–

We have spoken at length in our reports to the current poor demand situation for cotton which, we believe, is ultimately driven by a worsening macro economic situation. Cotton is, in general, a preferred fibre, when the consumer is confident they will look to cotton ahead of man made fibres as a fibre of choice (athleisure being a notable exception), but when times are tough price will take over as a driving factor. The continuing price disparity between cotton and MMFs is a further concern for current cotton demand.

Conclusion

Prices have held the recent 82.54 low and a counter trend bounce has occurred which could take prices as high as the low 100’s but is expected by EAP to fail. Potentially, a test of the 200 day moving average is possible fuelled by some courageous end user physical buying and/or a hurricane inspired series of events. However, EAP maintain our longer term viewpoint that a final move to the 70’s will eventually play out by next May and the 22/23 season will prove to be an inverted season.

Useful links

*Please note that we only share CFTC CTO on weekend reports.

Written by:

Jo Earlam

Copyright statement

No image or information display on this site may be reproduced, transmitted or copied (other than for the purposes of fair dealing, as defined in the Copyright Act 1968) without the express written permission of Earlam & Partners Ltd. Contravention is an infrigement of Copyright Act and its amendments and may be subject to legal action.

Disclaimer

The risk of loss associated with futures and options trading can be substantial. Opinions set forth herein should not be viewed as an offer or solicitation to buy, sell or otherwise trade futures, options or securities. All opinions and information contained in this email constitute EAP’s judgment as of the date of this document and are subject to change without notice. EAP and their respective directors and employees may effect or have effected a transaction for their own account in the investments referred to in the material contained herein before or after the material is published to any customer of a Group Company or may give advice to customers which may differ from or be inconsistent with the information and opinions contained herein. While the information contained herein was obtained from sources believed to be reliable, no Group Company accepts any liability whatsoever for any loss arising from any inaccuracy herein or from any use of this document or its contents. This document may not be reproduced, distributed or published in electronic, paper or other form for any purpose without the prior written consent of EAP. This email has been prepared without regard to the specific investment objectives, financial situation and needs of any particular recipient. For the customers of EAP, this email is produced exclusively for our business and expert clients, it is not for general distribution and our services are not available to private clients. Past performance is not indicative of future results.