- Jo Earlam

- June 2, 2023

- 3:32 pm

- 10 min read

N23 once again provides plenty of pain for last minute fixations and merchant hedges!

You can have brilliant ideas but if you cannot get them across your ideas won't get you anywhere!

CTN23 86.05 (-0.37)

CTZ23 81.85 (+0.27)

CTH24 81.65 (+0.16)

CTK24 81.59 (+0.07)

CTN24 81.42 (-0.05)

Zhengzhou WQU23 – 16,375 (+350)

Cotlook “A” Index – 96.65 (+2.90)

Daily volume – 41,276

AWP – 66.91

Open interest – 199,536

Certificated stock – 5,802

N23/Z23 spread – (+420)

Z23/H24 spread – (+0.20)

H24/K24 – (+0.06)

K24/N24 – (+0.17)

July Options Expiry – 9th June 2023

July 1st Notice Day – 26th June 2023

Introduction

– N23 continued its volatile ways over the last week having traded in a 440 point range between 82.76 and 87.16, before closing the week up 270 points at 86.05! Volume was once again good at 48,850 contracts daily with new crop December open interest now about 23k over July with the GSCI roll period beginning next Thursday 8th June and lasting for 5 consecutive days.

– Z23 was less volatile trading in a 353 point range between 78.96 and 82.49 before closing up 131 points at 81.85. The N/Z spread continued to be something we always prefer to avoid (especially at this time of the year) closing the week 420 points N over Z. The widow maker N/Z spread may yet have some more pain for those left in it!

– Last year N/Z 22 saw a similar squeeze into July expiry which punished anyone waiting to the last minute to fix. In truth, it meant buyers were forced to fix at levels that bore no relation to what the cotton could be spun profitably at, only to see prices collapse post July 1st notice day. Some of these sales were fixed in the 160’s cost and freight which subsequently proved to be the worst purchases of the year.

– For the time being, the rains in Texas seem to have been largely ignored with Z23 toying with recent highs at 84c/lb.

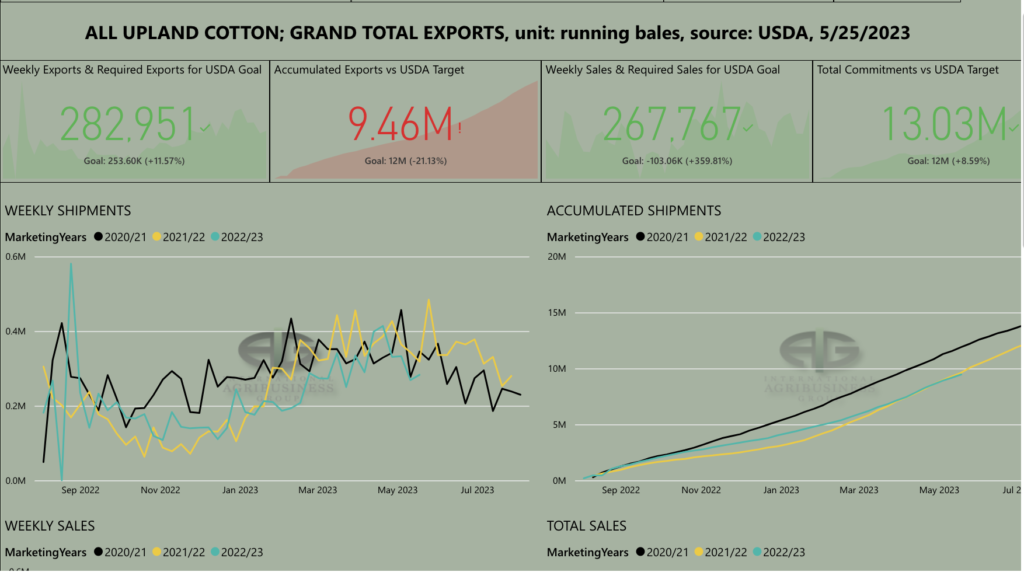

– The one day holiday delayed USA Export sales report was a good one with sales of 267,800RB of which 83% were to China with Turkey a very distant 2nd! Sceptically we believe these sales may be being reported a couple of weeks late because not many sales are being seen in the traditional Far East markets where it remains very quiet! The bullish sentiment we read about on twitter appears largely USA based and with no disrespect meant, the tweets seem to have little clue as to what is happening in the ROW!

– There are just 5 business days until N23 option expiry and volatility remains in the early 30’s for this contract and perhaps reflective of the fact that the average move for July remains high at 268 points daily against 190 points for new crop December where implied at the money volatility is in the mid 20s!

– The share price of Asos has caught our eye this week with the online retailer painting an ugly chart of a company that is facing some very serious issues!

– Asos share price has slumped by more than 90% since peaking over 2 years ago and reaching a 13 year low last month. More than 30% of online purchases end up being returned and Asos has faced the brunt of this. Other online retailers such as Germany’s Zolando and Uk’s Boohoo have faired better. Competition from second hand clothes vendor “Vinted” in particular are a change in attitude from the younger consumer towards buying new clothes and in turn we certainly have our own concerns as to Cotton consumption going forward, even if the USDA is as normal, way off the mark!

– Next week is a busy one with July option expiry and the June WASDE. Somehow we doubt the USDA will be addressing their 23/24 world consumption figure which at 116.23mb published in the May WASDE is not realistic!

– We also heard this week that inventories held by the big retailers are huge and will be addressed in detail in Thursday’s report and following a visit by a spinner friend in Europe last week!

– The CFTC COT report showed Managed Money (MM) to be net sellers in the week ending last Tuesday. MM sold a net 6,470 contracts taking their position to a net long of 1,510 contracts. Other and Non Reportables sold a net 1,377 and 2,217 each meaning between MM, OR and NR their overall net position is 16,810 contracts net long.

Conclusion

N23 has been trading between 76.25 and 89.59, being a range of 13.34c/lb for over 7 months. Last week, we questioned whether the market could retest recent lows, only to see a subsequent strong rebound. Nevertheless N23 remains within it’s nearby range of 79.52 to 87.52. The one certainty in our mind is that this contract month will see continued volatility within this range and and perhaps even the wider range of the highs of 89.59 and chart gap down to 74.85. There are likely to still be some wild moves into expiry of the N23 contract and trading this month should be avoided if at all possible! New crop Z23 has been less volatile, trading between 74.25 and 86.98, being a 1273 point range over the same period. EAP suggest this contract is fully valued in the mid to high 80’s and maintain that end users should only consider a scale down long and/or “on call” fixations from the mid 70’s, to maybe into the 60’s at some point!

Useful links

*Please note that we only share CFTC CTO on weekend reports.

Written by:

Jo Earlam

Copyright statement

No image or information display on this site may be reproduced, transmitted or copied (other than for the purposes of fair dealing, as defined in the Copyright Act 1968) without the express written permission of Earlam & Partners Ltd. Contravention is an infrigement of Copyright Act and its amendments and may be subject to legal action.

Disclaimer

The risk of loss associated with futures and options trading can be substantial. Opinions set forth herein should not be viewed as an offer or solicitation to buy, sell or otherwise trade futures, options or securities. All opinions and information contained in this email constitute EAP’s judgment as of the date of this document and are subject to change without notice. EAP and their respective directors and employees may effect or have effected a transaction for their own account in the investments referred to in the material contained herein before or after the material is published to any customer of a Group Company or may give advice to customers which may differ from or be inconsistent with the information and opinions contained herein. While the information contained herein was obtained from sources believed to be reliable, no Group Company accepts any liability whatsoever for any loss arising from any inaccuracy herein or from any use of this document or its contents. This document may not be reproduced, distributed or published in electronic, paper or other form for any purpose without the prior written consent of EAP. This email has been prepared without regard to the specific investment objectives, financial situation and needs of any particular recipient. For the customers of EAP, this email is produced exclusively for our business and expert clients, it is not for general distribution and our services are not available to private clients. Past performance is not indicative of future results.