- Jo Earlam

- July 11, 2022

- 8:40 am

- 10 min read

The pain for the softs and grains is over...for now!!

Commodities are tangible and have value and without them the human race cannot survive! Governments today print money against nothing and we are supposed to trust them! Inflation is rife and your cash is worth less every day!

CTZ22 95.63 – (+3.75)

CTH23 91.81 – (+3.81)

CTK23 89.73 – (+3.79)

CTN23 – 87.62 (+3.76)

Zhengzhou CF209 – 16,670 (+50)

Cotlook “A” Index – 106.20 (-4.75)

Daily volume – 47,664

AWP – 113.37

Open interest – 172,485

Certificated stock – 17,716

Dec/March spread – (+3.82)

September Options Expiry – 19th August 2022

December Options Expiry – 11th November 2022

December 1st Notice Day – 23rd November 2022

Introduction

– In an independence day holiday shortened week, it was once again a volatile week for the Cotton market. Z22 traded in a wide 937 point range between 88.10 and 97.47 to finish 185 points down for the week.

– Prices were boosted on Friday when China has announced a state reserve purchase of between 300 and 500,000 MT which will be active whilst the market trades below 18,600 RMB/MT (CC-Index Friday 17,703 RMB/MT). Whilst this is drawing cotton out of free supply there remains between 2 and 2.5 MMT of unsold Xinjiang cotton in China with consumption falling and new crop progressing well. This reserve purchase will simply serve to move unwanted domestic stocks from one warehouse to another. Supply in China is still ample and we are highly unlikely to see fresh import demand to “replace” the cotton taken into the reserve.

– Volume was once again robust at 40,109 futures daily and traders will have been encouraged by the fact that despite breaking the recent 91.20 low on Thursday, prices held the 88 c/lb level mentioned in our previous weekend report, thereby confirming it as a strong area of support.

– In options, prices for protection remain extremely costly with Z22 implied at the option volatility at 43.59%. Bets for protection to the downside have noticeably increased as traders become aware that prices in Cotton can come back to their historical mean and a point made in these reports for literally years.

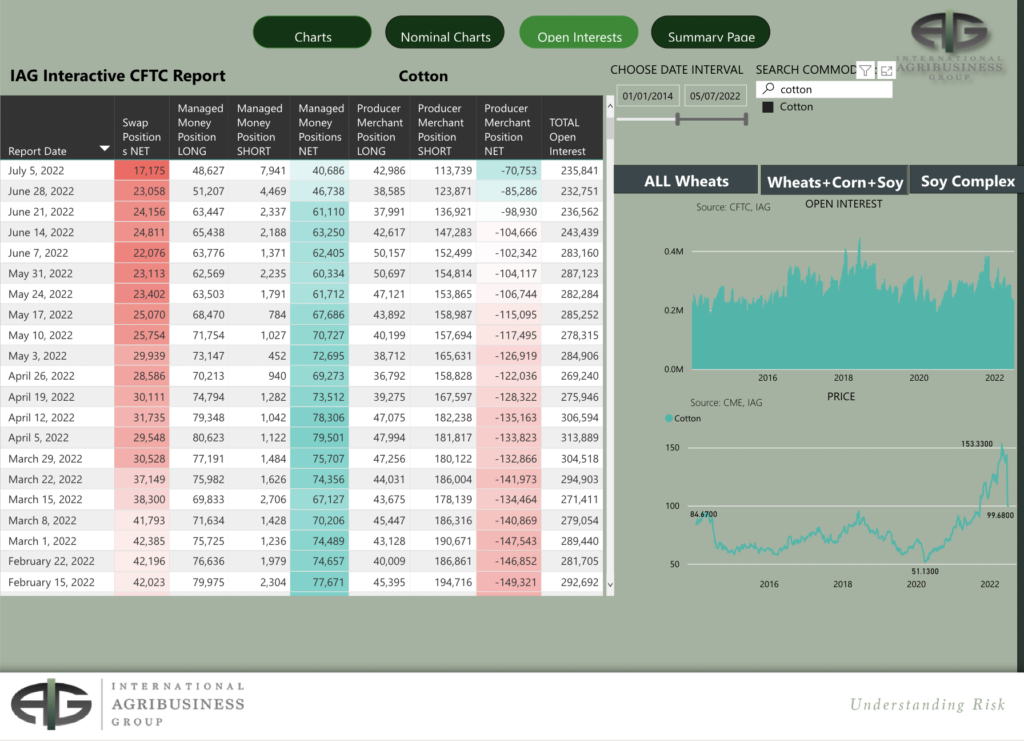

– The CFTC COT report after the close showed funds to be sellers once again. Managed Money (MM) sold a net 6,052 contracts in the week ending last Tuesday. Between MM, OR and NR their net long is down to 53,578 contracts. Oddly enough this position is not too dissimilar to the amount of net unfixed “on call” sales for the 22/23 season against Z, H, K and N23 of 60,637 of contracts. The pressure for fixations is considerably reduced than it was 2 or 3 months ago!

– Technically we think we can be relatively sure of what is likely to happen for Cotton in the event we believe the wave 3 low of 88.10 occurred on Friday.

– The below chart shows a wave 1 down, a countertrend wave 2 up that failed at 126c/lb and an impulsive wave 3 down that we think has ended at 88.10. Note how the 200 day moving average lies at 102.76 which also coincides with the 38.2% retrace of the wave 3. This would be a very natural place for the suggested counter trend wave 4 to fail.

– More importantly and noting the impulsiveness of the wave 3 down, one can be more assured that whatever bounce we get is likely to fail. Quite often in such bearish situations, the traders that need or have to get short, just never get on the train! Their frustration often leads to even more exaggerated moves as they are simply forced to get out of longs or try to put on a short position. A failure at the 23.6% retrace should not be a surprise either!

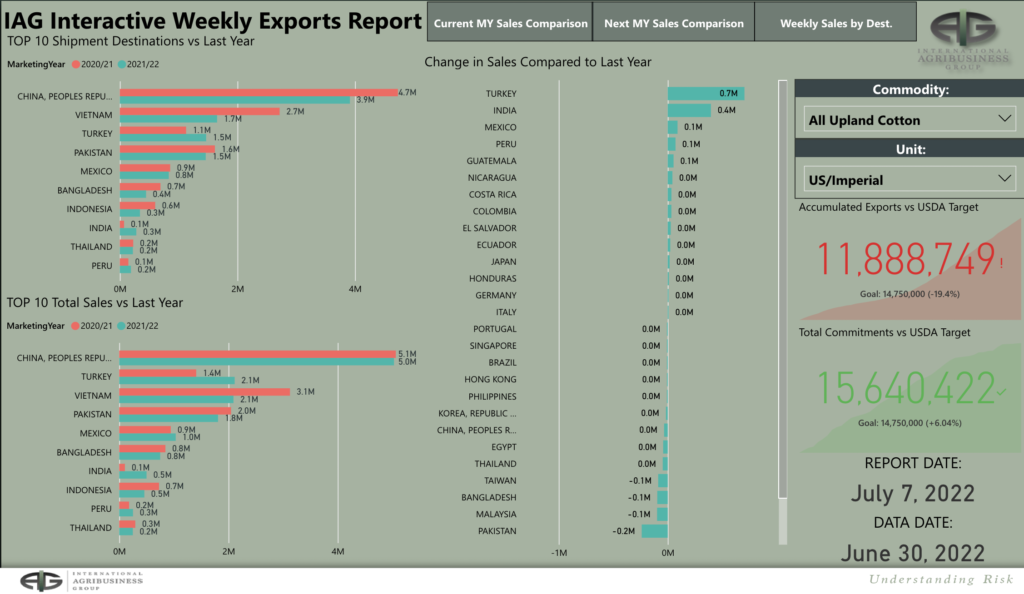

– The 1 day delayed USDA export sales report based the week ending 30th June reported 37,400 bales of sales for the soon to be over 2021/22 crop year and 381,900 bales for new crop 2022/23. The largest buyers were Pakistan with 98,700 bales and Turkey with 95,500 bales.

– Whilst we can not rule out more strategic buying in Pakistan, we have good friends in Turkey whose opinion we hold on great trust, they assure us that little to no buying has taken place recently. To regular readers we are perhaps a stuck record on this matter, but in our eyes the consistent false reporting has stripped this report of all credibility.

– Thanks as always to our friends at IAG for pictorial evidence of the current sales!

– We like statistics at EAP and a look at the average price for Z over a period of more than 50 years against its high/low for each season shows the average price to be just over 66 c/lb. Even during the inflationary period between the early 70’s and early 80’s, Z averaged just over 71c/lb. Since the 10/11 season and including the 22/23 season so far, noting we have been to the 100’s no less than 4x over that time, the average is still much lower than one would think at just under 84c/lb.

– Today the price of Z22 is 95c/lb. On a purely statistical viewpoint, today’s price of Z22 remains far above its average and whilst the remaining bulls out there will say it’s different this time, we flatly disagree and suggest history and hard work will eventually prove our point that Cotton and all commodities always come back to their mean price!

Conclusion

We believe the market has found a short term bottom at 88.10 and will make a move towards the late 90’s/early 100’s before the bear reasserts itself. EAP maintain our viewpoint this will be an inverse season and we have already seen the seasonal high at 133.79c/lb on the 17th May and now think a move to the mid 70’s and possibly lower is likely with timing towards the end of May before the current bear market is over!

Useful links

*Please note that we only share CFTC CTO on weekend reports.

Written by:

Jo Earlam

Copyright statement

No image or information display on this site may be reproduced, transmitted or copied (other than for the purposes of fair dealing, as defined in the Copyright Act 1968) without the express written permission of Earlam & Partners Ltd. Contravention is an infrigement of Copyright Act and its amendments and may be subject to legal action.

Disclaimer

The risk of loss associated with futures and options trading can be substantial. Opinions set forth herein should not be viewed as an offer or solicitation to buy, sell or otherwise trade futures, options or securities. All opinions and information contained in this email constitute EAP’s judgment as of the date of this document and are subject to change without notice. EAP and their respective directors and employees may effect or have effected a transaction for their own account in the investments referred to in the material contained herein before or after the material is published to any customer of a Group Company or may give advice to customers which may differ from or be inconsistent with the information and opinions contained herein. While the information contained herein was obtained from sources believed to be reliable, no Group Company accepts any liability whatsoever for any loss arising from any inaccuracy herein or from any use of this document or its contents. This document may not be reproduced, distributed or published in electronic, paper or other form for any purpose without the prior written consent of EAP. This email has been prepared without regard to the specific investment objectives, financial situation and needs of any particular recipient. For the customers of EAP, this email is produced exclusively for our business and expert clients, it is not for general distribution and our services are not available to private clients. Past performance is not indicative of future results.