- Jo Earlam

- October 27, 2022

- 10:36 pm

- 10 min read

A new seasonal low for Cotton as December expiry looms!

CTZ22 75.11 (-2.71)

CTH23 74.81 (-2.57)

CTK23 74.53 (-2.22)

CTN23 73.78 (-1.91)

CTZ23 71.63 (-1.42)

Zhengzhou WQF23 – 13,095 (-145)

Cotlook “A” Index – 95.95 (+2.20) – From the 26th October

Daily volume – 38,046

AWP – 76.76

Open interest – 247,373

Certificated stock – 880

Z22/H23 spread – (+0.30)

Z22/Z23 spread – (+3.48)

December Options Expiry – 11th November 2022

December 1st Notice Day – 23rd November 2022

Introduction

– Cotton has remained under pressure in the last week, with prices moving to a new seasonal low today at 74.82, as we approach the start of the Rogers Roll period. This is when funds roll from Z22 to H23 beginning tomorrow, lasting for 3 days and ending next Tuesday.

– Already we are starting to see H23 open interest gain on favour of Z22 where the difference is down to 30 points Z22 over H23 with H23 just 27,601 contracts under that of Z22. Option expiry for Z22 is two weeks on Friday and the scale of the large amount of losing out of the money calls, most of which are undoubtedly going to expire worthless, is a costly reminder to the once “uber bullish” that Cotton and all commodities eventually come back to their “mean price” despite all the hype we have been subject to in recent months. Take a look at Z23 which closed tonight at 71.63!

– It is a sad truth that many farmers never seem to learn their lesson and take advantage of prices in the 100’s, that occur as a rarity. This has never been more relevant than in Greece where we have 1st hand knowledge and can report that probably only 2-5% of them priced their crop in the 100’s, despite continued efforts on our part to get them to do so! Most Greek farmers will have to price by mid December and just like in Z11, their waiting to the last minute, meant pricing Z at seasonal lows, just as it is likely to happen this season!

– The Greek crop is the best quality crop this century and yet no more than 1/3rd of it is sold and basis pressure continues as the the normally active Turkish market stays away. The Turks remain horribly long of yarn stock, with a domestic crop that is struggling to find buyers both at home and abroad, despite being the cheapest basis in the world right now.

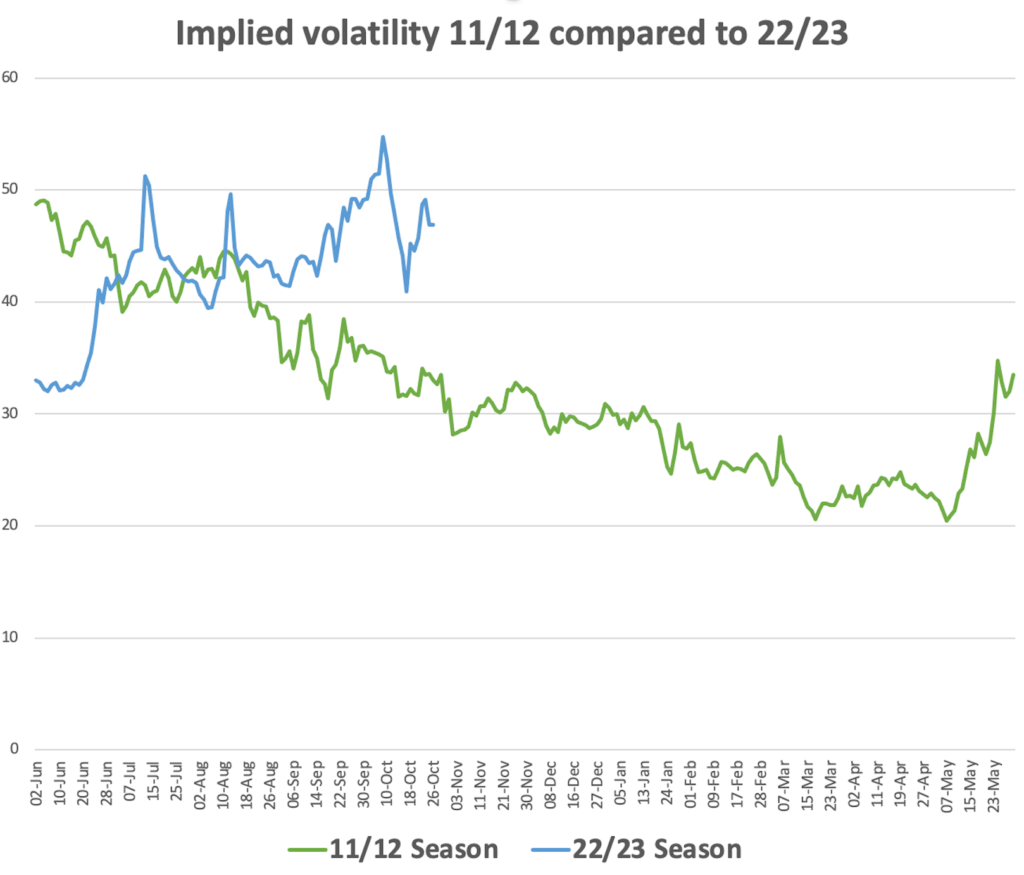

– Implied volatility reached a high of 54.77% on October 7th this season having averaged in the mid 30’s for over a year. If history is to be repeated, we should expect volatility to come down to its historical average of 22% and probably by the 1st quarter of 2023 if prices calm down as we expect.

– The weekly CFTC “Cotton on Call” report as of week 42 held few surprises and compared to the 22 previous years of data and looking at Z22/H, K and N23 it is clear that in terms of overall unfixed “on call” sales is nothing at all out of the ordinary and ranking 7th out of 22 years, we see it as having little bearing on market direction in the weeks ahead!

– Technically and as expected, prices are under pressure and as opined in the weekend report we see further downside ahead. The chart of Z22 look likely to test 70c and will probably get there much faster than the majority believe possible!

– The weekly USA Export sales report was disappointing to be fair with Pakistan unsurprisingly leading the list of buyers. Full details can be seen by clicking on the link below!

Conclusion

With prices still under pressure we expect Cotton to possibly test the 68-70c/lb area before any sort of meaningful bounce and almost certainly before the expiry of Z22. Longer term, we expect the weakness to continue into the new calendar year with a final low towards the end of the season probably in the mid 60’s and maintain a sell the rallies approach is likely to be fruitful!

Useful links

*Please note that we only share CFTC CTO on weekend reports.

Written by:

Jo Earlam

Copyright statement

No image or information display on this site may be reproduced, transmitted or copied (other than for the purposes of fair dealing, as defined in the Copyright Act 1968) without the express written permission of Earlam & Partners Ltd. Contravention is an infrigement of Copyright Act and its amendments and may be subject to legal action.

Disclaimer

The risk of loss associated with futures and options trading can be substantial. Opinions set forth herein should not be viewed as an offer or solicitation to buy, sell or otherwise trade futures, options or securities. All opinions and information contained in this email constitute EAP’s judgment as of the date of this document and are subject to change without notice. EAP and their respective directors and employees may effect or have effected a transaction for their own account in the investments referred to in the material contained herein before or after the material is published to any customer of a Group Company or may give advice to customers which may differ from or be inconsistent with the information and opinions contained herein. While the information contained herein was obtained from sources believed to be reliable, no Group Company accepts any liability whatsoever for any loss arising from any inaccuracy herein or from any use of this document or its contents. This document may not be reproduced, distributed or published in electronic, paper or other form for any purpose without the prior written consent of EAP. This email has been prepared without regard to the specific investment objectives, financial situation and needs of any particular recipient. For the customers of EAP, this email is produced exclusively for our business and expert clients, it is not for general distribution and our services are not available to private clients. Past performance is not indicative of future results.