CTZ22 84.79 (-0.13)

CTH23 83.49 (+0.02)

CTK23 82.34 (+0.02)

CTN23 80.69 (+0.02)

CTZ23 76.09 (+0.10)

Zhengzhou WQF23 – 13,820 (+15)

Cotlook “A” Index – 106.65 (+0.50) – 5th October

Daily volume – 36,709

AWP – 77.19

Open interest – 232,292

Certificated stock – 880

Z22 / H23 spread – (+1.30)

Z22 / Z23 spread – (+8.70)

December Options Expiry – 11th November 2022

December 1st Notice Day – 23rd November 2022

Introduction

– US CPI data released today showed consumer prices rose faster than expected with the current figure at 8.2% for the year to September, however this was expected to come in at 8.1%. This has put further pressure on the Fed to reign in rising prices with further rate hikes.

– Cotton, along with many markets (see the 15-minute chart of S&P 500 below), took this news badly, before rallying through the remainder of the session. Cotton Dec ’22 fell as low as 82.00 and, following on yesterday’s bearish WASDE (which saw the market close just above limit down), the outlook seemed pretty bleak. In light of this, the recovery to close at 84.79 down 13 pts for the day, can be viewed relatively positively.

– In Vietnam spinning conditions are going from bad to worse. Chinese yarn buying interest has almost completely dried up, leaving spinners receiving high priced, late shipped cotton against an empty order book. Stories of defaults are building and there are many reports of cotton arriving at port after non-performance which the merchant has no other option but to put into bonded warehouse.

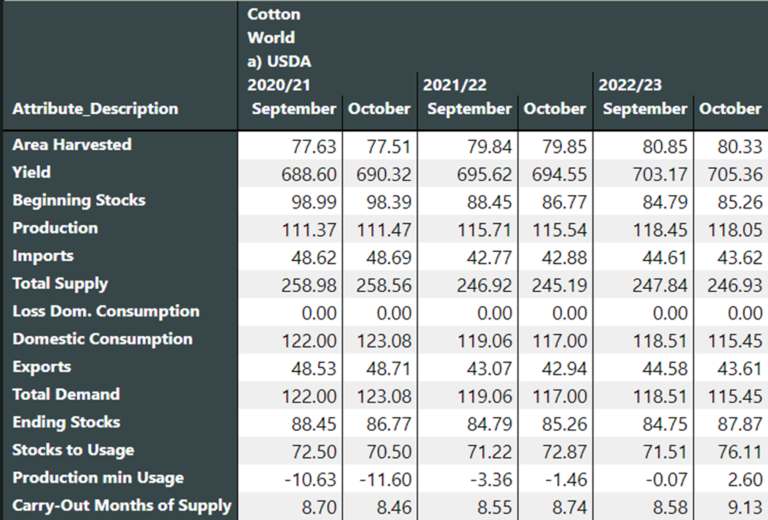

– The USDA released their October WASDE yesterday. Earlier in the week we produced a limited distribution special report on our SnD numbers for the season, it was encouraging yesterday to see the USDA take a step in our direction on global consumption – although we still remain around 5 million bales below them!! We expect further reductions in future reports.

– Consumption was cut across most major consuming markets with the puzzling exceptions of Bangladesh and Indonesia. China bore the brunt of the cuts with 1 million bales reduced this year and 2 million bales last year, though this was offset by 2 million bales of increases in previous years. India also took a hefty cut of 1 million bales. Vietnam was cut 100,000 bales to 6.7 million bales but, in line with the above reports, we believe this is still far too high.

– Pakistan’s crop was cut, taking into account the recent flooding, but we believe the number still reflects too much caution on behalf of the USDA as it still stands above 6 ½ million local bales, whilst most local commentators are below 6 million bales.

– The changes in China were the most peculiar, as mentioned above, the cuts to recent consumption brought the USDA much more in line with our own numbers. However, the increases to historic consumption along with some rather baffling historical changes to production, seemed to be mainly about book balancing. In fact, the outcome of this was China’s ending stocks actually increased!! We have long held that the USDA are far too high on Chinese stocks and we had often considered their reluctance to address this as a timidity on their part around the impact it may have on the market. Last night’s action leads us to another, more concerning, conclusion – they might actually believe their China stock numbers!!!!!

– The USDA export sales report will be released tomorrow.

– CFTC cotton on call report, based positions for the week ending 7th October showed further mill fixations for the Dec ’22 in what is quietly starting to look like an orderly draw down of positions. Over the last 10 weeks the Dec ’22 net on call sales position has reduced 45% and now stands at 20,854 contracts. Whilst the Dec ’22 has reduced 16,831 contracts in this period, the March ’23 has increased 9,104 contracts, suggesting that some of the Dec ’22 positions have been rolled. Overall, the current crop position stands at 58,347 contracts, the fifth highest for this week of the year and a mere 52% of the level of this time last season.

Conclusion

EAP believe that Cotton rallies into the late 80’s and early 90’s will be sold but Cotton in the low 80’s represents short term value. If we are wrong, then a move to 77c/lb can occur! A move back into the 100’s would be surprising, unless end user demand returns in earnest, which we seriously doubt! EAP remain of the belief that the 22/23 season will prove to be an inverted one, with the final low at the end of the season.

Useful links

*Please note that we only share CFTC CTO on weekend reports.

Written by:

Jo Earlam

Copyright statement

No image or information display on this site may be reproduced, transmitted or copied (other than for the purposes of fair dealing, as defined in the Copyright Act 1968) without the express written permission of Earlam & Partners Ltd. Contravention is an infrigement of Copyright Act and its amendments and may be subject to legal action.

Disclaimer

The risk of loss associated with futures and options trading can be substantial. Opinions set forth herein should not be viewed as an offer or solicitation to buy, sell or otherwise trade futures, options or securities. All opinions and information contained in this email constitute EAP’s judgment as of the date of this document and are subject to change without notice. EAP and their respective directors and employees may effect or have effected a transaction for their own account in the investments referred to in the material contained herein before or after the material is published to any customer of a Group Company or may give advice to customers which may differ from or be inconsistent with the information and opinions contained herein. While the information contained herein was obtained from sources believed to be reliable, no Group Company accepts any liability whatsoever for any loss arising from any inaccuracy herein or from any use of this document or its contents. This document may not be reproduced, distributed or published in electronic, paper or other form for any purpose without the prior written consent of EAP. This email has been prepared without regard to the specific investment objectives, financial situation and needs of any particular recipient. For the customers of EAP, this email is produced exclusively for our business and expert clients, it is not for general distribution and our services are not available to private clients. Past performance is not indicative of future results.